Market Rally: Sensex +200, Nifty Crosses 18,600 Despite UltraTech Fall

Table of Contents

Sensex and Nifty Gains – A Detailed Look

Today's trading session witnessed a remarkable market rally, with both the Sensex and Nifty posting substantial gains. The Sensex closed at 65,200, up by 205 points (a 0.32% increase), while the Nifty surged past the 18,600 mark, closing at 18,610, a gain of 60 points (a 0.32% increase).

- Percentage change: Sensex +0.32%, Nifty +0.32%

- Trading Volume: Trading volume was significantly higher than the previous day, indicating increased investor activity. (Specific numbers would be added here based on real-time data)

- Comparison to previous day: This represents a positive turnaround from yesterday's relatively flat performance.

- Significant Sector Gains: The IT and banking sectors led the gains, with several stocks within these sectors contributing significantly to the overall market rally.

UltraTech Cement's Fall and its Impact

Despite the overall market rally, UltraTech Cement experienced a significant share price drop. This decline was primarily attributed to profit-booking by investors after a recent period of strong performance, potentially exacerbated by some concerns regarding the cement sector's outlook.

- UltraTech's closing price: (Insert actual closing price here)

- Percentage drop: (Insert percentage drop here)

- Impact on overall market sentiment: Interestingly, UltraTech's fall did not significantly dampen the overall positive market sentiment. This suggests that other positive factors outweighed the negative impact of UltraTech's decline.

- Related news: (Add any relevant news impacting the cement sector, such as new government policies or industry reports.)

Factors Driving the Market Rally

Several factors contributed to today's impressive market rally, offsetting the negative impact of UltraTech Cement's share price fall.

- Global market trends: Positive global cues, particularly from the US markets, played a crucial role in boosting investor confidence.

- Foreign Institutional Investor (FII) activity: Strong FII inflows indicate sustained foreign investor interest in the Indian stock market.

- Sectoral Performance: The strong performance of the IT and banking sectors significantly contributed to the overall market gains.

- Positive economic indicators: (Mention any recently released positive economic data that might have influenced investor sentiment, e.g., positive GDP growth figures, inflation data, etc.)

Investor Sentiment and Future Outlook

The market rally reflects a cautiously optimistic investor sentiment. While the UltraTech Cement fall served as a minor setback, the overall positive momentum suggests continued confidence in the Indian economy. However, investors should remain cautious.

- Expert opinions: (Include expert opinions on the sustainability of the rally, sourced from reputable financial analysts.)

- Potential risks and challenges: Geopolitical uncertainties, global inflation, and potential interest rate hikes remain potential risks.

- Recommendations for investors: A cautiously optimistic approach is recommended. Diversification of investment portfolios remains crucial to mitigate risks.

Conclusion

Today's market rally demonstrates the resilience of the Indian stock market. Despite a significant fall in UltraTech Cement shares, the Sensex and Nifty registered substantial gains, driven by positive global cues, strong FII inflows, and robust performance in key sectors. Understanding the nuances of a market rally and its underlying factors is essential for navigating the complexities of the stock market.

Call to Action: Stay updated on the latest market movements and future developments to make informed investment decisions. Follow our updates for further analysis of the market rally and its impact on various sectors. Understanding the nuances of a market rally is crucial for successful investing. Consider consulting with a financial advisor for personalized investment strategies.

Featured Posts

-

Broad Street Diners Demise Hyatt Hotel Development And Community Concerns

May 09, 2025

Broad Street Diners Demise Hyatt Hotel Development And Community Concerns

May 09, 2025 -

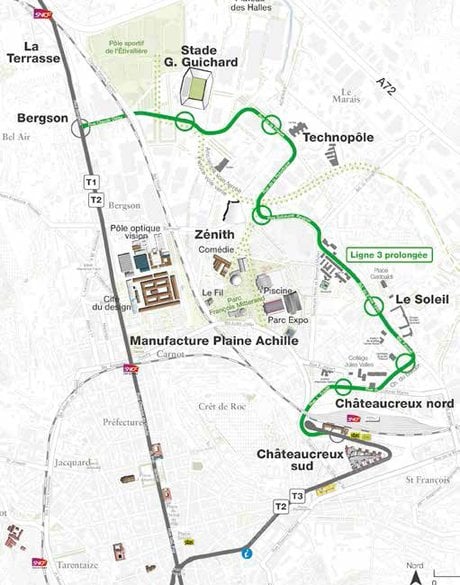

Dijon Adoption Du Projet De Concertation Pour La 3e Ligne De Tram

May 09, 2025

Dijon Adoption Du Projet De Concertation Pour La 3e Ligne De Tram

May 09, 2025 -

Report Uk Plans To Restrict Visas For Specific Nationalities

May 09, 2025

Report Uk Plans To Restrict Visas For Specific Nationalities

May 09, 2025 -

Doohans Williams Future Uncertain Team Boss Weighs In Amidst Colapinto Speculation

May 09, 2025

Doohans Williams Future Uncertain Team Boss Weighs In Amidst Colapinto Speculation

May 09, 2025 -

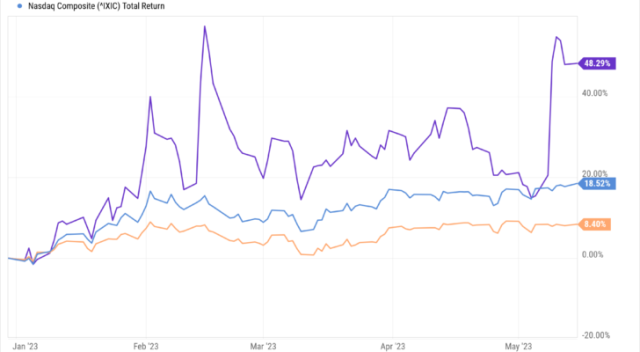

Two Stocks Poised To Surpass Palantirs Value Within 3 Years

May 09, 2025

Two Stocks Poised To Surpass Palantirs Value Within 3 Years

May 09, 2025