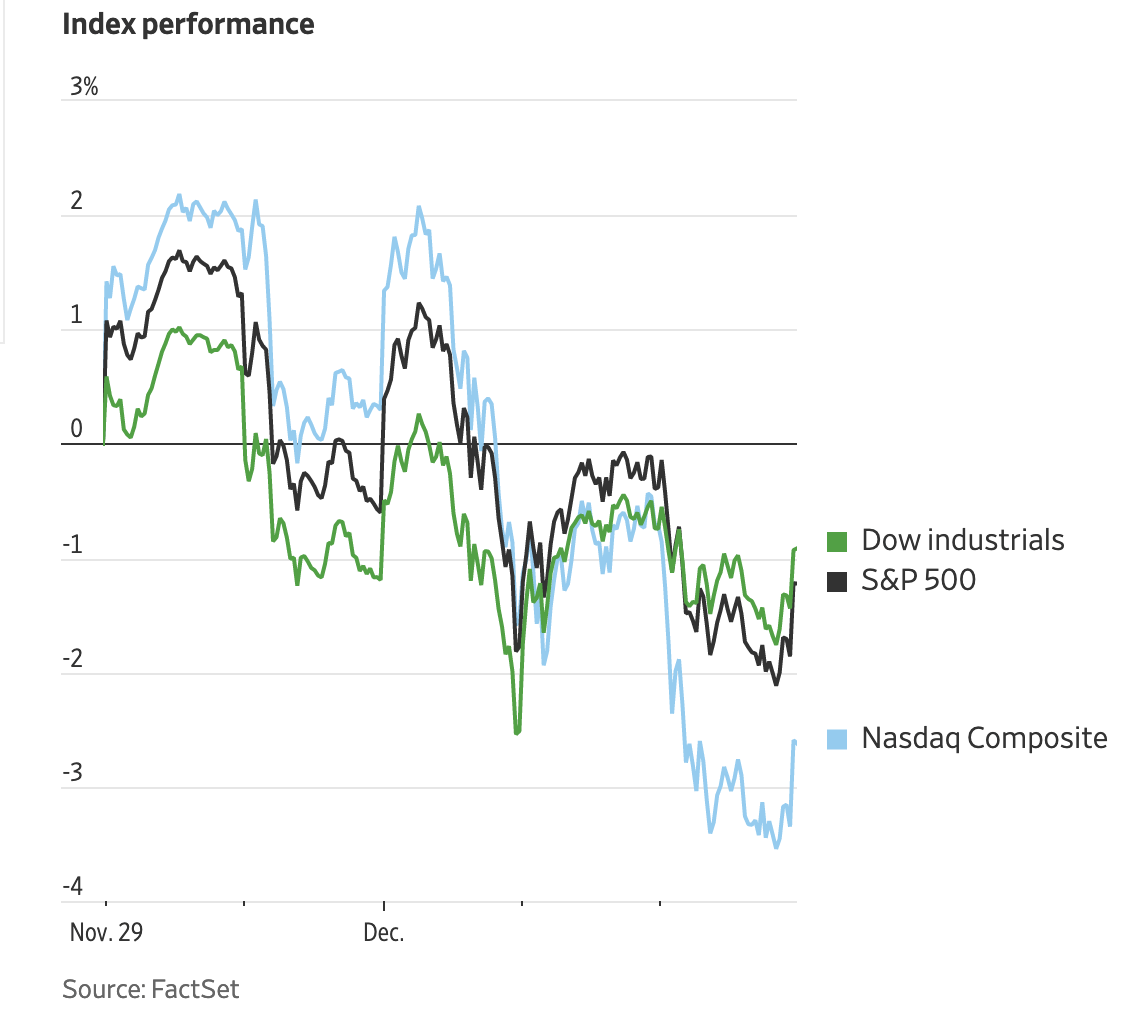

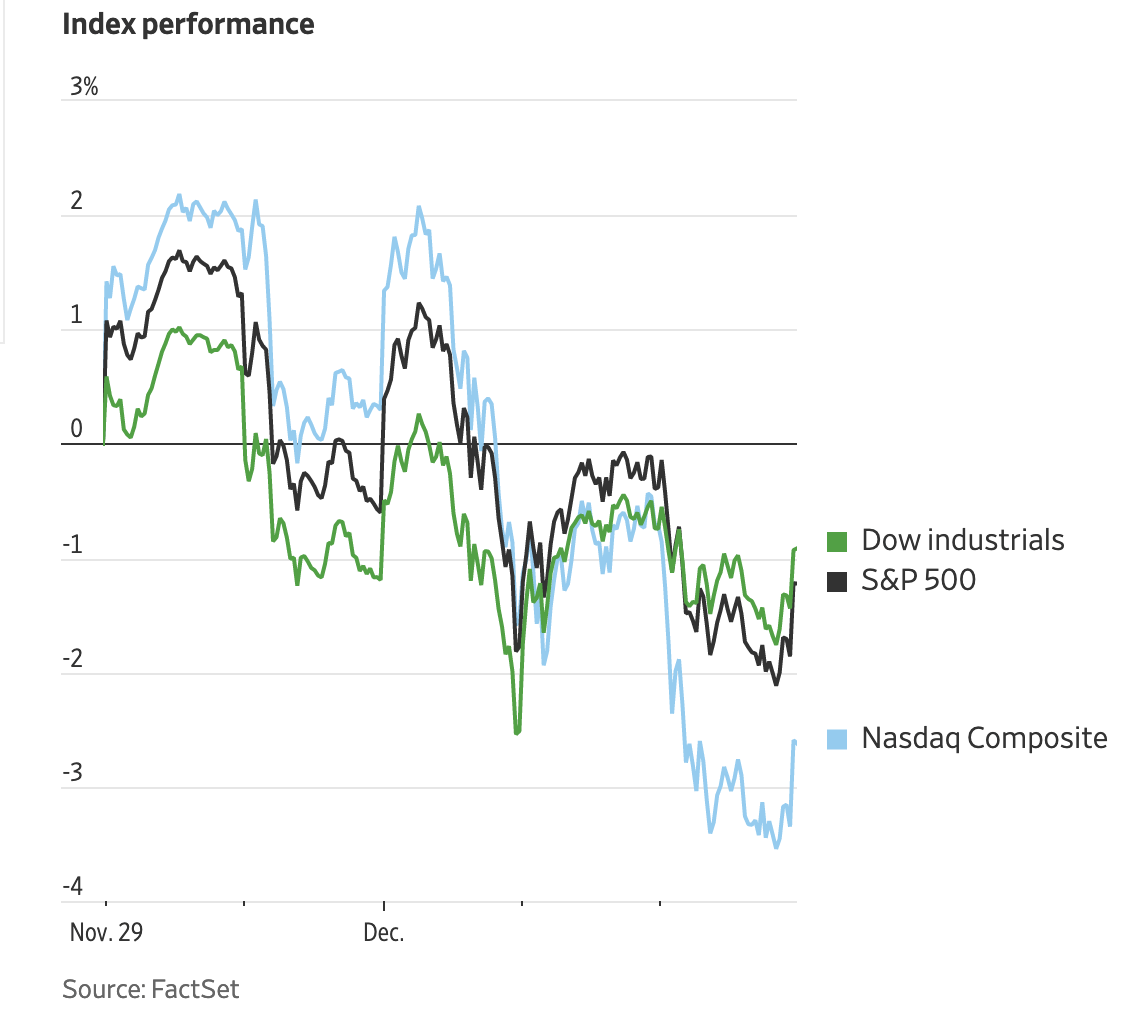

Market Uncertainty? ETF Investments Hit Record Highs

Table of Contents

First, let's define what ETFs are. Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges, much like individual stocks. They offer investors diversified exposure to a basket of assets, such as stocks, bonds, or commodities, at a relatively low cost. This ease of access and diversification is a key factor driving their current popularity.

The Appeal of Diversification in Uncertain Markets

One of the primary reasons for the rise in ETF investments is their inherent ability to diversify portfolios, a crucial strategy in uncertain markets.

Reducing Portfolio Volatility

ETFs offer diversification across various asset classes, mitigating the risk associated with individual stock performance. A well-diversified ETF portfolio can significantly reduce the impact of market downturns.

- Examples of diversified ETFs:

- Broad market ETFs: These track major market indices like the S&P 500 (e.g., SPY, IVV) offering broad exposure to large-cap US equities.

- Sector-specific ETFs: These focus on particular sectors of the economy (e.g., technology, healthcare, energy), allowing for targeted investments.

- International ETFs: These provide exposure to international markets, reducing dependence on a single country's economy.

Diversification is key to mitigating risk. If one sector underperforms, the others might offset those losses, resulting in a more stable portfolio value. This is particularly beneficial during periods of market uncertainty, when individual stocks can experience significant volatility.

Hedging Against Inflation

Certain ETFs can act as a hedge against inflation, offering protection from the erosion of purchasing power.

- Examples of inflation-hedging ETFs:

- Commodity ETFs: These track the prices of commodities like gold, oil, and agricultural products, which often rise during inflationary periods.

- Inflation-protected securities ETFs (TIPS ETFs): These invest in Treasury Inflation-Protected Securities (TIPS), whose principal adjusts with inflation.

These ETFs work by investing in assets whose value tends to increase with inflation. For example, the price of gold often rises during inflationary periods as investors seek a safe haven for their assets. TIPS, on the other hand, directly adjust their principal to account for inflation, protecting the investor's purchasing power.

The Simplicity and Accessibility of ETF Investing

Beyond diversification, the simplicity and accessibility of ETF investing contribute to their increasing popularity.

Low Costs and Transparency

ETFs generally have lower expense ratios than actively managed mutual funds, meaning investors keep a larger portion of their returns.

- Comparison of expense ratios: While mutual funds can have expense ratios of 1% or more, many ETFs boast expense ratios of 0.1% or less.

Lower costs translate directly to higher returns over the long term, making ETFs a cost-effective investment option. The transparency of ETFs, with their clearly defined holdings, further enhances their appeal.

Easy Trading and Accessibility

ETFs trade just like stocks, offering ease of buying and selling through various brokerage accounts.

- Brokerage platforms: ETFs can be traded on platforms like Fidelity, Schwab, Vanguard, and TD Ameritrade.

This ease of trading, combined with high liquidity, allows investors to quickly adjust their portfolios according to market conditions. This flexibility is particularly valuable in uncertain markets, where swift adjustments may be necessary.

ETF Strategies for Navigating Market Uncertainty

Investors employ various ETF strategies to navigate market uncertainty.

Defensive ETF Strategies

Defensive strategies focus on preserving capital during downturns.

- Examples of defensive ETFs:

- Low-volatility ETFs: These focus on stocks with historically lower price volatility.

- Bond ETFs: Bonds are generally considered less volatile than stocks, offering a degree of stability during market downturns.

These defensive ETFs aim to minimize losses during periods of market stress. They are not designed for high growth but rather to provide a cushion against significant declines.

Opportunistic ETF Strategies

Opportunistic strategies aim to capitalize on market volatility.

- Examples of ETFs suitable for opportunistic strategies:

- Sector-specific ETFs: Investors might rotate into sectors expected to outperform during recovery periods.

- Tactical asset allocation ETFs: These dynamically adjust their asset allocation based on market conditions.

These strategies require a more active approach, aiming to profit from market corrections and subsequent rebounds. However, they involve higher risk compared to defensive strategies.

Conclusion

The surge in ETF investments reflects their ability to offer diversification, simplicity, and accessibility, all especially valuable during market uncertainty. Investing in ETFs provides a way to reduce risk, lower costs, and easily manage portfolios. Whether employing defensive or opportunistic ETF strategies, investors can navigate the complexities of volatile markets effectively. Are you ready to navigate market uncertainty with confidence? Explore the world of ETF investments and find the right strategy for your ETF portfolio today! Learn more about investing in ETFs and different ETF strategies to build a robust and resilient investment plan.

Featured Posts

-

Beyond Canada Post Systemic Issues Requiring Reform In Federal Agencies

May 28, 2025

Beyond Canada Post Systemic Issues Requiring Reform In Federal Agencies

May 28, 2025 -

American Music Awards 2025 Jennifer Lopezs Hosting Gig

May 28, 2025

American Music Awards 2025 Jennifer Lopezs Hosting Gig

May 28, 2025 -

Winning Lotto Ticket Sold Here Claim Your Prize

May 28, 2025

Winning Lotto Ticket Sold Here Claim Your Prize

May 28, 2025 -

Rent Freeze Negative Impact On Tenant Housing And Housing Corporation Responsibilities

May 28, 2025

Rent Freeze Negative Impact On Tenant Housing And Housing Corporation Responsibilities

May 28, 2025 -

Pirates Announce Skenes As Opening Day Pitcher

May 28, 2025

Pirates Announce Skenes As Opening Day Pitcher

May 28, 2025