Market Volatility And Portal Issues: Analyzing The Current State Of The Pakistan Stock Exchange

Table of Contents

Understanding the Current Market Volatility in the PSX

Macroeconomic Factors Influencing Volatility

Political instability in Pakistan has significantly impacted investor confidence. Frequent changes in government policies and economic uncertainty create an environment of risk aversion, leading to price fluctuations.

- Political Instability: Recent political events, including changes in leadership and policy shifts, have created considerable uncertainty, causing investors to withdraw or adopt a wait-and-see approach.

- Currency Fluctuations: The fluctuating value of the Pakistani Rupee (PKR) against major currencies like the US dollar introduces significant volatility. Imports become more expensive, impacting businesses and investor sentiment.

- Inflation: High inflation erodes purchasing power and reduces investor confidence. Rising inflation rates often lead to increased interest rates, further dampening market enthusiasm.

- Global Economic Factors: Global economic slowdowns or crises, such as the recent global inflation and energy crises, invariably impact the PSX through reduced foreign investment and decreased demand for Pakistani exports.

Data from the State Bank of Pakistan and the PSX itself can be used to illustrate the correlation between these macroeconomic factors and observed market volatility.

Sector-Specific Volatility

Certain sectors within the PSX are more susceptible to volatility than others.

- Energy Sector: Fluctuations in global oil prices and government regulations directly impact the profitability of energy companies, creating price swings in their stocks.

- Banking Sector: Interest rate changes and economic downturns significantly affect the performance of banks, leading to increased volatility in this sector.

- Technology Sector: This sector is particularly sensitive to global market trends and technological disruptions, often exhibiting higher volatility.

For example, companies heavily reliant on imports have faced significant price fluctuations due to the PKR's depreciation.

Investor Sentiment and Speculation

Investor psychology plays a crucial role in driving market volatility.

- Herd Behavior: Investors often mimic the actions of others, leading to amplified price movements, both upwards and downwards.

- News and Rumors: Market sentiment can be heavily influenced by news reports, social media trends, and unsubstantiated rumors, leading to sudden price swings.

- Short-Selling and Margin Calls: Short-selling and margin calls can exacerbate volatility, especially during periods of market decline. When investors are forced to liquidate assets to meet margin calls, it can trigger further selling pressure.

Analyzing Portal Issues Affecting PSX Accessibility

Website Functionality and User Experience

The PSX website's functionality has been a source of concern for many investors.

- Navigation Issues: Reports indicate difficulties in navigating the website, finding specific information, and accessing crucial data efficiently.

- Data Accuracy: Concerns have been raised regarding the accuracy and reliability of the data presented on the website. Inaccurate data can lead to flawed investment decisions.

- Website Speed: Slow loading times and frequent downtime hinder efficient trading activities and frustrate investors.

The PSX has implemented certain upgrades, but further improvements are necessary.

Data Delays and Information Gaps

Delays in disseminating critical market information exacerbate market uncertainty.

- Delayed Announcements: Delays in announcing financial results, regulatory changes, or corporate actions can lead to information asymmetry and erratic trading patterns.

- Incomplete Data: Incomplete or missing data creates uncertainty, forcing investors to rely on incomplete information, potentially leading to poor investment choices.

These delays and gaps undermine investor confidence and contribute to market volatility.

Security Concerns and Data Breaches

Protecting investor data is paramount. Any security breaches can have severe consequences.

- Cybersecurity Threats: The PSX website is vulnerable to cyberattacks, which could compromise sensitive investor data, leading to financial losses and reputational damage.

- Data Breaches: A data breach could result in the theft of personal and financial information, leading to identity theft and other serious consequences.

Strengthening security measures is vital to maintaining investor trust.

The Interplay Between Market Volatility and Portal Issues

How Portal Problems Exacerbate Volatility

The PSX portal's shortcomings can directly contribute to heightened market volatility.

- Unreliable Data: Access to unreliable or delayed data can cause panic selling and amplified price swings, particularly in already volatile markets.

- Limited Access: Difficulties accessing the portal, due to technical glitches or slow loading times, can further panic investors and contribute to volatility.

These issues erode confidence in the market's transparency and efficiency.

The Need for Improved Infrastructure and Technology

Upgrading the PSX's technological infrastructure is crucial.

- Enhanced Data Security: Investing in robust cybersecurity measures is critical to protect investor data and maintain market integrity.

- Efficient Information Dissemination: Implementing systems for timely and accurate information dissemination is essential to reduce uncertainty and improve transparency.

- Improved Website Functionality: Improvements to website design, navigation, and speed are essential to improve user experience and facilitate efficient trading activities.

Conclusion: Market Volatility and Portal Issues: Recommendations for the Future of the PSX

The PSX faces significant challenges related to market volatility and portal issues. These challenges are interconnected, with portal deficiencies exacerbating existing market volatility and undermining investor confidence. Addressing these issues requires a multi-pronged approach. This includes strengthening macroeconomic stability, improving regulatory oversight, enhancing the PSX portal's functionality and security, and implementing robust investor education programs.

Addressing market volatility and portal issues is crucial for the future of the Pakistan Stock Exchange. Let's work together to build a more stable and accessible market for all. Investors, regulators, and the PSX itself must collaborate to implement the necessary changes to create a more robust and trustworthy investment environment.

Featured Posts

-

Office365 Breach Nets Millions Insider Reveals Criminals Tactics

May 10, 2025

Office365 Breach Nets Millions Insider Reveals Criminals Tactics

May 10, 2025 -

Ihsaas Transgender Athlete Ban A Post Trump Order Analysis

May 10, 2025

Ihsaas Transgender Athlete Ban A Post Trump Order Analysis

May 10, 2025 -

Postponed Bbc Meeting Wynne Evans Spends Quality Time With Girlfriend Liz

May 10, 2025

Postponed Bbc Meeting Wynne Evans Spends Quality Time With Girlfriend Liz

May 10, 2025 -

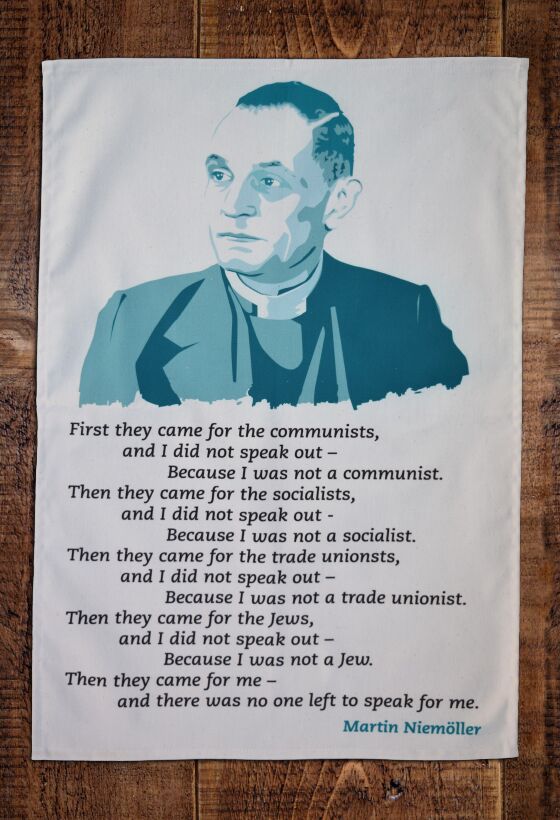

Lais Ve Day Address A Warning On The Rise Of Totalitarianism In Taiwan

May 10, 2025

Lais Ve Day Address A Warning On The Rise Of Totalitarianism In Taiwan

May 10, 2025 -

Family Support For Dakota Johnson At Materialist Film Screening

May 10, 2025

Family Support For Dakota Johnson At Materialist Film Screening

May 10, 2025