Markets Respond To Trump's Auto Tariff Statements; LVMH Suffers Losses

Table of Contents

The Immediate Market Reaction to Trump's Auto Tariff Threats

The threat of Trump's auto tariffs triggered immediate market volatility. The uncertainty surrounding the implementation and scope of these tariffs created a climate of fear among investors. This uncertainty led to a significant shift in market sentiment. Major stock market indices felt the impact. The Dow Jones Industrial Average and the S&P 500 experienced noticeable dips following the announcements, reflecting the widespread concern about the potential for economic disruption.

- Sharp decline in automotive sector stocks: Companies directly involved in automobile manufacturing and related industries suffered the most significant losses, as they faced the immediate prospect of increased production costs and reduced competitiveness.

- Increased uncertainty among investors: The unpredictability surrounding the tariffs made it difficult for investors to make informed decisions, leading to a period of heightened market uncertainty and decreased investment.

- Flight to safety in government bonds: Investors sought refuge in safer assets like government bonds, as these were perceived as less risky during this period of economic uncertainty fueled by Trump's auto tariff pronouncements.

- Weakening of the US dollar: The threat of trade wars and economic instability often leads to a weakening of the US dollar, as investors move their capital to other currencies perceived as safer havens.

LVMH's Vulnerability and Subsequent Losses

LVMH, despite its luxury positioning, proved surprisingly vulnerable to the threat of Trump's auto tariffs. While not directly involved in auto manufacturing, its extensive global operations and reliance on international supply chains made it susceptible to the broader economic consequences. The potential for retaliatory tariffs and the increased cost of imported goods significantly impacted its profitability.

- Dependence on global supply chains: LVMH's production and distribution networks span the globe. Disruptions to these supply chains, caused by tariffs or trade disputes, directly affected its ability to produce and deliver goods efficiently.

- Increased production costs due to tariffs: Even indirectly, the tariffs increased the cost of raw materials, components, and transportation for LVMH, squeezing profit margins.

- Impact on consumer spending due to economic uncertainty: The uncertainty created by Trump's auto tariffs negatively impacted consumer confidence and spending, particularly in luxury goods, leading to reduced demand for LVMH products.

- Currency fluctuations affecting profitability: Fluctuations in exchange rates, often exacerbated by trade tensions, impacted LVMH's profitability, as a significant portion of its revenue is generated in currencies other than the US dollar.

Analysis of LVMH's Stock Performance

LVMH's stock price experienced a significant downturn following the announcements of Trump's auto tariffs. [Insert chart or graph illustrating LVMH stock performance around the time of the tariff announcements]. The decline reflected investor concerns about the company's future profitability in a climate of heightened trade uncertainty. Analyst predictions following the event were mixed, with some forecasting a short-term recovery and others expressing more long-term concerns about the impact of protectionist policies. Investor sentiment was understandably negative, reflecting the general apprehension surrounding the implications of these trade policies.

Wider Economic Implications of Protectionist Trade Policies

Trump's auto tariffs exemplify the broader consequences of protectionist trade policies. Such policies go beyond affecting individual companies; they disrupt global trade and international cooperation. The threat of retaliatory tariffs from other countries adds another layer of complexity, further destabilizing global markets.

- Retaliatory tariffs from other countries: Protectionist measures often invite retaliatory actions from other nations, escalating trade disputes and harming global economic growth.

- Disruption of global supply chains: Tariffs and trade wars disrupt established supply chains, leading to increased production costs and delays, impacting businesses worldwide.

- Increased prices for consumers: Protectionist policies frequently lead to higher prices for consumers, as import costs increase and competition is reduced.

- Slowdown in economic growth: The uncertainty and disruptions caused by protectionist trade policies can significantly slow down global economic growth, potentially leading to recessionary pressures.

Conclusion

The announcement of Trump's auto tariffs triggered significant market volatility, with LVMH experiencing substantial losses due to its exposure to global trade. This incident highlights the far-reaching consequences of protectionist trade policies, impacting not only specific companies like LVMH but also the global economy as a whole. The interconnectedness of global markets underscores the need for careful consideration of the ramifications of such policies.

Call to Action: Understanding the impact of events like Trump's auto tariff statements is crucial for investors and businesses alike. Stay informed about the latest developments in international trade and the effects of protectionist measures on global markets. Further research into the long-term implications of Trump's auto tariffs and similar policies is essential for navigating the increasingly complex landscape of international trade and mitigating potential risks.

Featured Posts

-

Repetitive Documents Ai Creates A Profound Poop Podcast

May 25, 2025

Repetitive Documents Ai Creates A Profound Poop Podcast

May 25, 2025 -

From 0 6 To Victory Swiateks Resilience Sets Up Madrid Semifinal With Gauff

May 25, 2025

From 0 6 To Victory Swiateks Resilience Sets Up Madrid Semifinal With Gauff

May 25, 2025 -

The Nvidia Rtx 5060 Fiasco Understanding The Fallout And Moving Forward

May 25, 2025

The Nvidia Rtx 5060 Fiasco Understanding The Fallout And Moving Forward

May 25, 2025 -

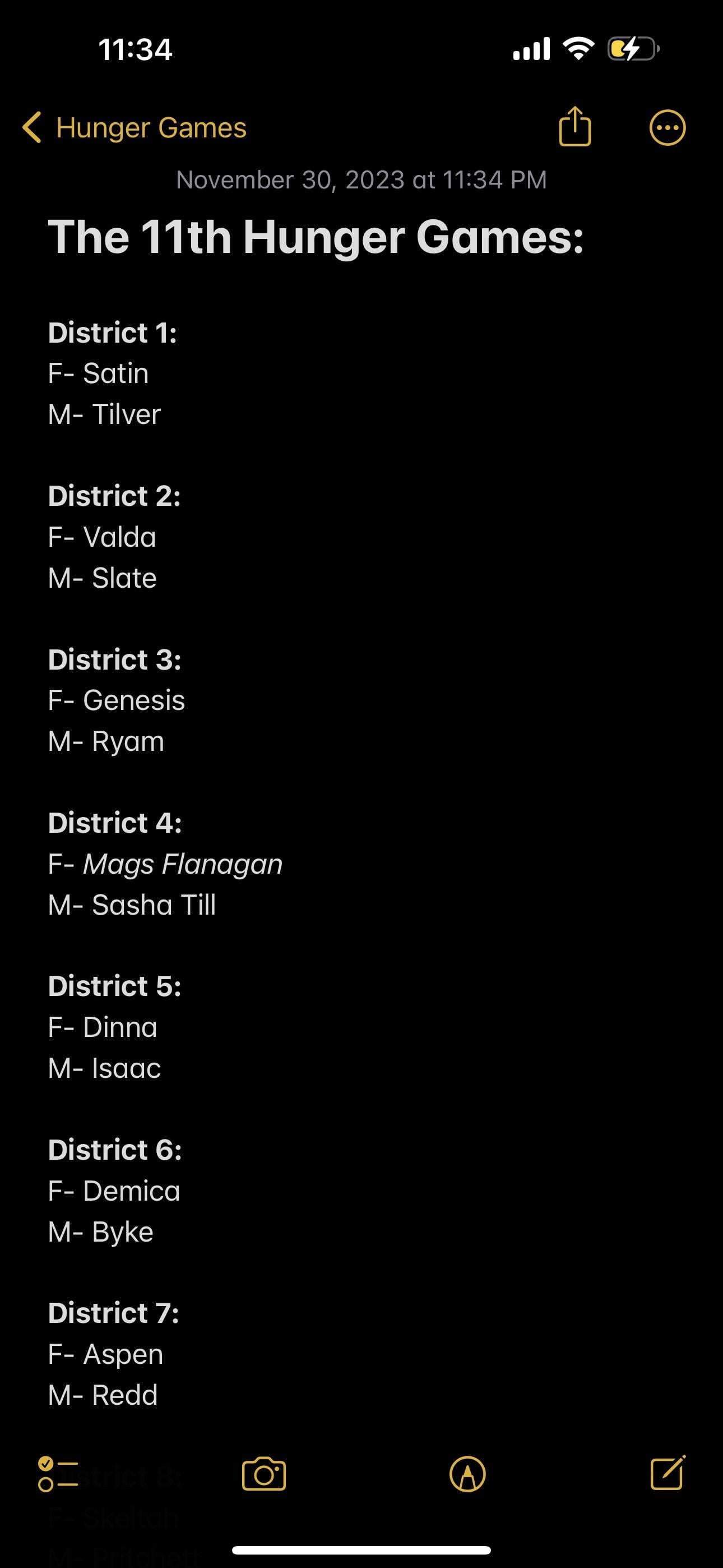

Finding The Hunger Games Fanfiction On Ohnotheydidnt Live Journal

May 25, 2025

Finding The Hunger Games Fanfiction On Ohnotheydidnt Live Journal

May 25, 2025 -

Is Naomi Campbell Banned From The 2025 Met Gala A Look At The Wintour Feud Speculation

May 25, 2025

Is Naomi Campbell Banned From The 2025 Met Gala A Look At The Wintour Feud Speculation

May 25, 2025