Markets To Decide If Words Are Enough: Assessing The US-China Trade Talks

Table of Contents

Analyzing the Current State of US-China Trade Relations

The relationship between the US and China has been defined by escalating trade tensions for years. This began with accusations of unfair trade practices, intellectual property theft, and forced technology transfer by China. The ensuing trade war, marked by the imposition of significant tariffs on billions of dollars worth of goods, created significant uncertainty and disruption.

-

Key sticking points: The current negotiations remain bogged down over several crucial issues. These include persistent concerns about intellectual property rights protection, forced technology transfer demands, and substantial agricultural subsidies provided by the Chinese government. The US also seeks a more balanced trade relationship and reduced trade deficits.

-

Recent announcements and statements: While both sides have issued statements expressing a desire for a resolution, concrete agreements remain elusive. Recent announcements often lack specifics and are subject to varying interpretations, highlighting the complexity of the negotiations.

-

Impact of geopolitical factors: The trade dispute is intricately intertwined with broader geopolitical factors, including the competition for technological dominance and differing views on global governance. These geopolitical tensions significantly influence the negotiation dynamics and potential outcomes.

Market Reactions as a Barometer of Success

Stock markets, currency exchange rates, and commodity futures serve as powerful indicators of investor sentiment and confidence regarding the US-China trade talks. Positive developments tend to boost market optimism, while setbacks trigger sell-offs and increased volatility.

-

Examples of market fluctuations: For instance, positive news regarding a potential “Phase One” deal in 2019 led to a temporary rally in global stock markets. Conversely, escalations in trade tensions have historically resulted in significant drops in equity prices and increased volatility in the currency markets.

-

Market segment sensitivity: Different market segments exhibit varying degrees of sensitivity to the trade talks’ outcomes. Technology companies heavily reliant on Chinese markets or supply chains are particularly vulnerable, while agricultural commodities directly impacted by tariffs also show considerable sensitivity.

-

Investor behavior and risk assessment: Investors constantly reassess risks associated with US-China trade relations. Uncertainty surrounding the talks contributes to market volatility, as investors adjust their portfolios based on perceived risks and potential rewards. A lack of clarity often leads to risk aversion and capital flight.

Beyond the Rhetoric: Assessing the Practical Impacts of Agreements

The true measure of success in the US-China trade talks lies in their tangible consequences. Any agreement, or lack thereof, will have significant repercussions across various sectors.

-

Impact on specific industries: The technology sector, particularly companies involved in semiconductors and telecommunications, will feel a profound impact. The agricultural sector remains significantly affected by tariffs and trade restrictions. Manufacturing industries dependent on global supply chains will also be significantly influenced.

-

Effects on global supply chains and consumer prices: Disruptions to global supply chains due to tariffs and trade restrictions can lead to increased production costs and higher consumer prices. This impact propagates throughout the global economy.

-

Consequences for economic growth: The outcome of the negotiations will have a direct bearing on economic growth prospects in both the US and China, impacting global GDP and potentially triggering ripple effects in other nations.

The Role of Geopolitical Factors

The US-China trade talks are not isolated events; they occur within a broader geopolitical context. Technological rivalry, differing ideological approaches, and the shifting global power balance all play critical roles.

-

Influence of other nations and international organizations: The actions and stances of other nations and international organizations, such as the WTO, significantly impact the dynamics of the negotiations. Alliances and counter-alliances influence both the bargaining power of each side and the potential outcomes.

-

Potential for unintended consequences: The complex interplay of geopolitical factors can lead to unintended consequences, potentially exacerbating existing tensions and creating new challenges.

-

Long-term implications for the global economic order: The ultimate resolution (or lack thereof) of the US-China trade dispute will significantly influence the structure and functioning of the global economic order for years to come.

Market Verdict on US-China Trade Talks

In conclusion, while diplomatic pronouncements provide a narrative of the US-China trade talks, the true assessment of progress hinges on observable market reactions. Stock market performance, currency fluctuations, and commodity pricing offer a more objective evaluation of the impact of agreements (or the lack thereof) than official statements alone. Market sentiment, as reflected in these various economic indicators, provides a more accurate assessment of progress than mere statements from negotiating parties. Keep an eye on the markets to gauge the true impact of the ongoing US-China trade talks – the markets ultimately decide if words are enough.

Featured Posts

-

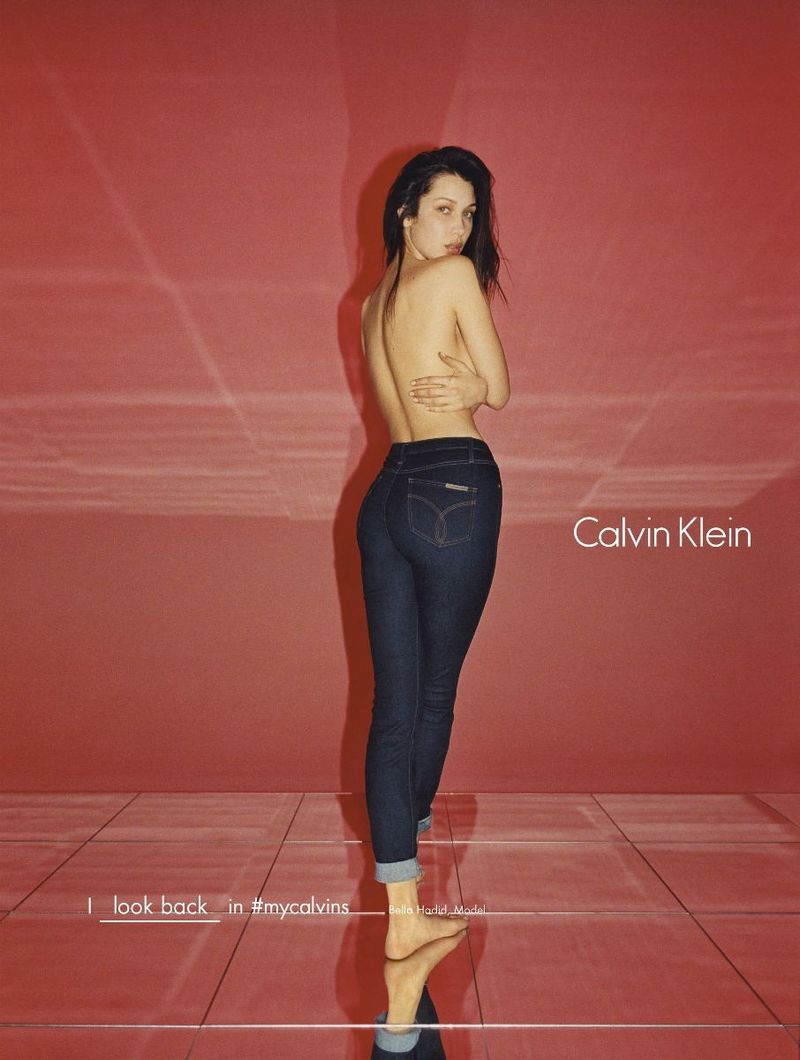

New Calvin Klein Campaign Featuring Lily Collins

May 12, 2025

New Calvin Klein Campaign Featuring Lily Collins

May 12, 2025 -

Next Stellantis Ceo Us Head A Top Contender For The Role

May 12, 2025

Next Stellantis Ceo Us Head A Top Contender For The Role

May 12, 2025 -

Blue Origins New Shepard Launch Delayed Subsystem Issue Reported

May 12, 2025

Blue Origins New Shepard Launch Delayed Subsystem Issue Reported

May 12, 2025 -

Selena Gomezs Edgy Leather Dress Get The Look

May 12, 2025

Selena Gomezs Edgy Leather Dress Get The Look

May 12, 2025 -

Ufc 315 In Depth Analysis And Predictions For Shevchenko Vs Fiorot

May 12, 2025

Ufc 315 In Depth Analysis And Predictions For Shevchenko Vs Fiorot

May 12, 2025