May 16 Oil Market Report: Prices, Trends, And Forecasts

Table of Contents

Crude Oil Price Analysis for May 16

Benchmark Prices (WTI & Brent)

The following data represents the benchmark prices for West Texas Intermediate (WTI) and Brent crude oil for May 16th. This analysis compares these figures to the previous day and the previous week, providing a clearer picture of recent price movements. (Note: Actual price data would be inserted here for a real-time report. For this example, we will use placeholder data.)

[Insert Chart Here: A line chart showing WTI and Brent prices for the past week, highlighting May 16th's data.]

- WTI:

- Opening Price: $75.50

- High: $76.20

- Low: $74.80

- Closing Price: $75.90

- Change from Previous Day: +$0.80 (+1.07%)

- Change from Previous Week: +$1.50 (+2.02%)

- Brent:

- Opening Price: $78.00

- High: $78.70

- Low: $77.30

- Closing Price: $78.40

- Change from Previous Day: +$0.90 (+1.16%)

- Change from Previous Week: +$1.80 (+2.34%)

Significant price volatility was observed throughout the day, particularly in response to [mention specific news event affecting prices].

Factors Influencing Prices

Several key factors influenced oil prices on May 16th:

- Geopolitical Tensions: The ongoing conflict in [mention specific region] continues to create uncertainty in the global oil market, potentially impacting supply chains and production levels. Increased sanctions on [mention country] also contributed to price fluctuations.

- OPEC+ Production Decisions: The OPEC+ alliance's decision to [mention their decision regarding production levels] significantly affected the market’s supply outlook. This decision reflects their assessment of global demand and their strategy for influencing prices.

- Global Economic Growth Forecasts: Positive economic growth forecasts from major economies like the US and China boosted demand for oil, putting upward pressure on prices. However, concerns about [mention economic concern, e.g., inflation] created some countervailing pressure.

- US Dollar Strength: The strengthening US dollar made oil more expensive for buyers using other currencies, impacting global demand and potentially influencing prices.

- Inventory Levels: Current crude oil inventories in [mention key storage locations] are [mention levels – high, low, or stable], influencing the market's perception of supply tightness.

- Seasonal Demand: Increased seasonal demand for gasoline and other petroleum products in [mention relevant region/season] added to the upward pressure on prices.

- Unexpected Disruptions: A temporary pipeline closure in [mention location] led to a brief spike in prices before the issue was resolved.

Key Trends Shaping the Oil Market

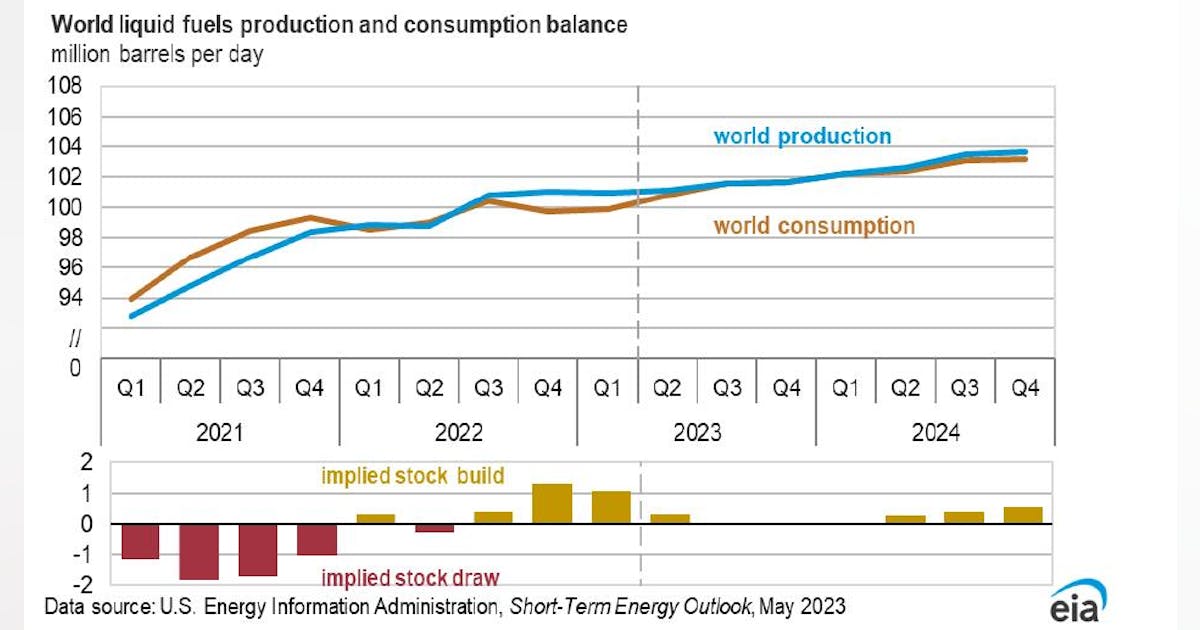

Supply and Demand Dynamics

The global oil market is currently experiencing [mention whether it is a surplus or deficit]. This balance is largely influenced by:

- Production Levels: Major oil-producing countries like Saudi Arabia, Russia, and the US are producing at [mention production levels and any changes].

- Global Oil Consumption: Global oil consumption is [mention current trend – increasing, decreasing, or stable], driven by factors such as economic growth in developing countries and the transportation sector's reliance on oil.

- Renewable Energy Growth: The increasing adoption of renewable energy sources like solar and wind power is gradually impacting oil demand, although its effect remains relatively moderate in the short term.

- Storage Levels: High storage levels can suggest a potential surplus, while low levels indicate potential supply constraints. Currently, storage levels are [mention current status and implications].

Geopolitical Risks and Uncertainties

Several geopolitical risks pose significant challenges to the stability of the oil market:

- Ongoing Conflicts: The ongoing conflict in [mention specific region] remains a major source of uncertainty, potentially disrupting oil production and transportation.

- Political Instability: Political instability in key oil-producing regions can lead to production disruptions and price volatility.

- Supply Chain Disruptions: Geopolitical tensions and other unforeseen events can lead to supply chain disruptions, further influencing prices.

- Sanctions and Embargoes: International sanctions and embargoes can significantly impact the availability of oil from certain countries, leading to supply shortages and price spikes.

Oil Market Forecasts and Predictions

Short-Term Outlook (Next Few Weeks)

Considering current trends, we predict that WTI and Brent crude oil prices will remain relatively stable in the next few weeks, trading within the following ranges:

- WTI: $74 - $78 per barrel

- Brent: $77 - $81 per barrel

Key factors influencing this short-term outlook include [mention specific factors, e.g., OPEC+ meeting outcomes, economic data releases, geopolitical developments]. Potential catalysts for price changes include [mention potential catalysts].

Long-Term Outlook (Next 6-12 Months)

Over the next 6-12 months, we anticipate a more moderate price trajectory, with potential for both upside and downside risks.

- WTI: Projected range of $70 - $85 per barrel.

- Brent: Projected range of $75 - $90 per barrel.

The long-term outlook is heavily influenced by:

- Energy Transition: The ongoing energy transition towards renewable energy sources will exert a long-term downward pressure on oil demand.

- Global Economic Growth: Continued global economic growth will likely support oil demand, although the pace of growth will be crucial.

- Technological Advancements: Technological advancements in oil exploration and extraction could influence supply levels and potentially impact prices.

Conclusion

This May 16 Oil Market Report has analyzed the current state of the oil market, providing insights into price movements, influencing factors, and future predictions. The interplay of geopolitical events, supply and demand dynamics, and economic indicators continues to shape the oil market landscape. While short-term volatility is expected, understanding these underlying trends is essential for navigating the complexities of the oil market. To stay updated on the latest oil market trends and receive future reports like this May 16 Oil Market Report, subscribe to our newsletter or follow us on social media. Regularly reviewing oil market reports will allow you to make informed decisions based on the latest data and analysis related to the volatile oil market.

Featured Posts

-

How Student Loan Delinquency Affects Your Credit Rating

May 17, 2025

How Student Loan Delinquency Affects Your Credit Rating

May 17, 2025 -

Cancelled Too Soon 10 Tv Shows We Miss

May 17, 2025

Cancelled Too Soon 10 Tv Shows We Miss

May 17, 2025 -

Kevin Durant Reignites Angel Reese Dating Rumors What Did He Say

May 17, 2025

Kevin Durant Reignites Angel Reese Dating Rumors What Did He Say

May 17, 2025 -

Japans Q1 Economic Performance Assessing The Pre Tariff Slowdown

May 17, 2025

Japans Q1 Economic Performance Assessing The Pre Tariff Slowdown

May 17, 2025 -

Ubers New Pet Policy In Mumbai How To Book A Ride With Your Furry Friend

May 17, 2025

Ubers New Pet Policy In Mumbai How To Book A Ride With Your Furry Friend

May 17, 2025