Mercer International Inc.: 2024 Financial Results And $0.075 Quarterly Dividend Declaration

Table of Contents

Q2 2024 Financial Highlights of Mercer International Inc.

Revenue and Earnings

Mercer International Inc.'s Q2 2024 results showcased [Insert Actual Total Revenue Figure] in total revenue, a [Insert Percentage Change]% change compared to Q1 2024 and a [Insert Percentage Change]% change year-over-year. This variation can be attributed to [Explain reasons for revenue change, e.g., stronger demand for northern bleached softwood kraft (NBSK) pulp, increased energy production, favorable market conditions].

- Total Revenue: [Insert Actual Total Revenue Figure]

- Net Income/Loss: [Insert Actual Net Income/Loss Figure]

- Earnings Per Share (EPS): [Insert Actual EPS Figure]

- Key Revenue Drivers: NBSK pulp sales, energy production from cogeneration facilities.

The performance was [In line with/Above/Below] analysts' expectations. [Explain whether the results were a positive or negative surprise and why].

Pulp Market Performance and Impact

The global pulp market in Q2 2024 experienced [Describe the overall market conditions, e.g., increased demand, price fluctuations, supply chain challenges]. This impacted Mercer's financial results by [Explain the impact of market conditions on Mercer's profitability, e.g., driving increased sales prices, impacting production costs].

- Global Pulp Prices: [Insert Information on Pulp Price Trends]

- Demand Fluctuations: [Describe Demand Fluctuations]

- Competition: [Discuss Competitive Landscape]

- Supply Chain Disruptions: [Discuss any supply chain issues]

Mercer's profitability was [Positively/Negatively] affected by these market conditions due to [Explain the reasons].

Operational Efficiency and Cost Management

Mercer International Inc. demonstrated [Describe the operational performance, e.g., strong operational efficiency, effective cost management] in Q2 2024. The company implemented several cost-cutting measures and efficiency improvements, leading to [Explain the results of cost management strategies, e.g., reduced operational costs, increased production volumes].

- Production Volumes: [Insert Production Volume Data]

- Operational Costs: [Insert Operational Cost Data]

- Cost-Cutting Measures: [List Implemented Cost-Cutting Measures]

- Efficiency Improvements: [Describe Efficiency Improvements]

The effectiveness of their cost management strategies was [Describe the success of cost management, e.g., significant, moderate, limited], resulting in [Explain the outcome, e.g., improved margins, increased profitability].

$0.075 Quarterly Dividend Declaration by Mercer International Inc.

Dividend Details and Implications

Mercer International Inc. announced a quarterly dividend of $0.075 per share, payable on [Insert Payment Date], to shareholders of record on [Insert Record Date]. The ex-dividend date is [Insert Ex-Dividend Date]. This represents a [Insert Percentage Change]% change compared to the previous quarter's dividend. The dividend payout ratio is [Insert Payout Ratio], indicating [Explain what the payout ratio signifies about the company's financial health].

- Dividend Amount per Share: $0.075

- Payment Date: [Insert Payment Date]

- Ex-Dividend Date: [Insert Ex-Dividend Date]

- Record Date: [Insert Record Date]

- Dividend Yield: [Insert Dividend Yield]

This dividend signals [Explain what the dividend signals about the company's future outlook and financial health, e.g., confidence in future earnings, commitment to shareholder returns].

Shareholder Value and Investor Sentiment

The announcement of the dividend has [Describe the market reaction, e.g., positively impacted, had a neutral effect on] investor sentiment, with the stock price [Describe the stock price reaction, e.g., increasing slightly, remaining stable]. Analyst ratings have [Describe changes in analyst ratings, e.g., remained positive, shown some slight downward revision]. Overall investor confidence appears to be [Describe overall investor confidence, e.g., strong, stable, slightly weakened].

- Stock Price Reaction: [Describe the stock price reaction]

- Analyst Ratings: [Summarize analyst ratings and opinions]

- Investor Confidence: [Describe investor sentiment]

Future Outlook for Mercer International Inc.

Management Guidance and Expectations

Mercer International Inc.'s management expects [Summarize management's guidance for future performance, e.g., continued growth in revenue and earnings, challenges in navigating market volatility]. They anticipate [Mention anticipated challenges or opportunities, e.g., increased competition, potential supply chain disruptions, expansion opportunities].

- Projected Revenue: [Insert Projected Revenue Figures]

- Profitability Expectations: [Insert Profitability Projections]

- Strategic Initiatives: [List Key Strategic Initiatives]

Key factors influencing Mercer's performance in the coming quarters include [Mention key influencing factors, e.g., global pulp market demand, energy prices, operational efficiency].

Long-Term Growth Strategy

Mercer International Inc. is focused on [Describe Mercer's long-term strategic goals, e.g., expanding production capacity, investing in new technologies, exploring new market opportunities]. This includes [Mention specific long-term plans, e.g., investments in new facilities, research and development initiatives, strategic acquisitions].

- Investment in New Facilities: [Mention any planned investments]

- Expansion Plans: [Describe expansion plans]

- Research and Development Initiatives: [Describe R&D initiatives]

Mercer's vision for the future is [Summarize Mercer's overall vision, e.g., to become a leading global producer of pulp, to achieve sustainable growth, to enhance shareholder value].

Conclusion: Mercer International Inc. – Investing in the Future

Mercer International Inc.'s Q2 2024 financial results demonstrate [Summarize key financial highlights, e.g., robust revenue generation, stable earnings, effective cost management]. The declaration of a $0.075 quarterly dividend reinforces the company's commitment to returning value to shareholders. The company's positive outlook and strategic initiatives suggest promising growth prospects for the future. Consider Mercer International Inc. as part of your diversified investment portfolio. Stay informed about future Mercer International Inc. financial reports and dividend announcements by subscribing to their investor relations page.

Featured Posts

-

Cardinal Conclave A Battle For The Churchs Direction

Apr 25, 2025

Cardinal Conclave A Battle For The Churchs Direction

Apr 25, 2025 -

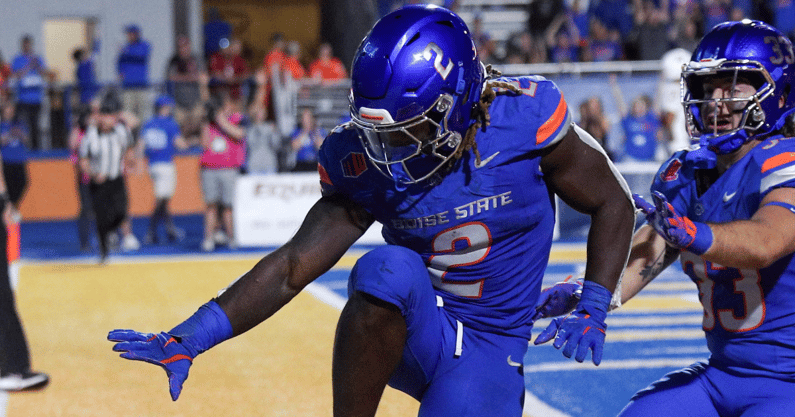

Ashton Jeanty Can He Lead The Denver Broncos To The Super Bowl

Apr 25, 2025

Ashton Jeanty Can He Lead The Denver Broncos To The Super Bowl

Apr 25, 2025 -

Exclusive Meme Coin Investors Dine With President Trump

Apr 25, 2025

Exclusive Meme Coin Investors Dine With President Trump

Apr 25, 2025 -

China To Issue Special Bonds Amidst Us Trade War Pressure

Apr 25, 2025

China To Issue Special Bonds Amidst Us Trade War Pressure

Apr 25, 2025 -

Can China And Canada Forge An Alliance To Challenge Us Policies

Apr 25, 2025

Can China And Canada Forge An Alliance To Challenge Us Policies

Apr 25, 2025