MicroStrategy Competitor: A Deep Dive Into The Latest SPAC Investment

Table of Contents

Understanding the SPAC Investment Landscape

SPACs, or Special Purpose Acquisition Companies, are shell corporations formed to raise capital through an initial public offering (IPO) with the sole purpose of acquiring a private company. They've become increasingly popular, particularly in the tech sector, offering a faster and potentially less expensive route to going public compared to a traditional IPO. This surge in SPAC mergers is especially noticeable within the business intelligence and data analytics sector, disrupting the established order and bringing new players into the arena.

- Definition of SPACs and their advantages for acquiring companies: SPACs provide a quicker path to public markets, bypassing the complexities and time constraints of a traditional IPO. This is attractive to private companies seeking rapid growth capital.

- Examples of successful SPAC mergers in the tech industry: Several successful tech companies have leveraged SPAC mergers to achieve rapid growth and access to capital markets. These examples demonstrate the potential, but also the risks, involved.

- Risks associated with SPAC investments: SPACs are not without risk. The target company might not be as well-vetted as in a traditional IPO, and the management team of the SPAC may lack experience in successfully integrating acquired businesses.

- Discuss recent regulatory scrutiny of SPACs: Increased regulatory scrutiny of SPACs is a key consideration. Regulators are focusing on transparency and ensuring adequate due diligence is performed.

Profiling the New MicroStrategy Competitor: Hypothetical Example - "DataWise Analytics"

For the purpose of this analysis, let's consider a hypothetical example: DataWise Analytics, a rapidly growing business intelligence company specializing in cloud-based data visualization and predictive analytics, recently went public via a SPAC merger.

- Company overview and history: DataWise Analytics was founded in 2015 and quickly gained traction with its innovative approach to data visualization. Its strong growth trajectory made it an attractive target for a SPAC.

- Key products and services offered: DataWise offers a suite of cloud-based business intelligence tools, including data integration, data visualization dashboards, and predictive modeling capabilities. Their focus is on ease of use and accessibility.

- Target customer demographics: DataWise targets small and medium-sized businesses (SMBs) as well as larger enterprises seeking scalable and cost-effective solutions.

- Technological strengths and weaknesses: DataWise's strength lies in its user-friendly interface and robust cloud infrastructure. A potential weakness could be a less mature enterprise-level security infrastructure compared to MicroStrategy.

- Management team expertise: DataWise possesses a strong management team with extensive experience in software development, data analytics, and business growth.

- Funding secured through SPAC merger: The SPAC merger provided DataWise with significant funding to accelerate product development, expand its sales and marketing efforts, and potentially pursue acquisitions.

Market Share Implications and Analysis

The entry of DataWise Analytics (or any similar competitor) significantly impacts MicroStrategy's market position. While MicroStrategy holds a substantial market share, DataWise’s focus on SMBs and its cloud-based platform could attract a significant portion of the market that MicroStrategy might not fully address.

- Market share projections for both companies: Predicting exact market share is difficult, but DataWise's entry could lead to a slight erosion of MicroStrategy's market dominance, particularly in the fast-growing cloud-based BI segment.

- Analysis of competitive pricing strategies: DataWise might adopt a more aggressive pricing strategy, targeting price-sensitive SMBs.

- Potential for partnerships or collaborations: Both companies could explore strategic partnerships to expand their reach and offerings.

- Impact on innovation and technological advancements in the sector: Increased competition will likely fuel innovation and accelerate the development of new technologies within the business intelligence sector.

- Long-term forecast for market dynamics: The long-term market dynamics will depend on the success of DataWise and other emerging competitors in capturing market share and innovating within the business intelligence space.

Investment Opportunities and Risks

Investing in either MicroStrategy or its new competitors like DataWise presents both opportunities and risks.

- Stock price analysis for both companies: Careful analysis of both companies' stock performance, including valuation metrics and growth prospects, is essential.

- Valuation metrics and comparisons: Comparing valuation metrics like price-to-earnings ratios (P/E) and revenue growth rates is crucial for assessing investment potential.

- Potential return on investment (ROI): The potential ROI will depend on various factors, including market growth, competitive dynamics, and the companies' ability to execute their strategies.

- Risks associated with market volatility: The tech sector is known for its volatility, so investors must be prepared for potential price fluctuations.

- Impact of macroeconomic factors: Broader economic factors like interest rates and inflation can significantly impact both companies' performance.

Conclusion

The recent SPAC investment in a new competitor like DataWise Analytics presents both opportunities and challenges for MicroStrategy and the broader business intelligence market. While MicroStrategy maintains a strong market position, the emergence of this new player signals increased competition and necessitates strategic adjustments. Understanding the competitive dynamics and assessing the risks and rewards are crucial for investors navigating this evolving landscape.

Call to Action: Stay informed about the latest developments in the business intelligence market and the ongoing competition between MicroStrategy and its emerging rivals. Continue researching MicroStrategy competitors and the impact of SPAC investments to make informed investment decisions.

Featured Posts

-

The 25m Question West Hams Financial Future

May 09, 2025

The 25m Question West Hams Financial Future

May 09, 2025 -

Nyt Strands Today April 1 2025 Clues And Solutions

May 09, 2025

Nyt Strands Today April 1 2025 Clues And Solutions

May 09, 2025 -

Mange Skisentre Stenger Tidligere Enn Vanlig Pa Grunn Av Mild Vinter

May 09, 2025

Mange Skisentre Stenger Tidligere Enn Vanlig Pa Grunn Av Mild Vinter

May 09, 2025 -

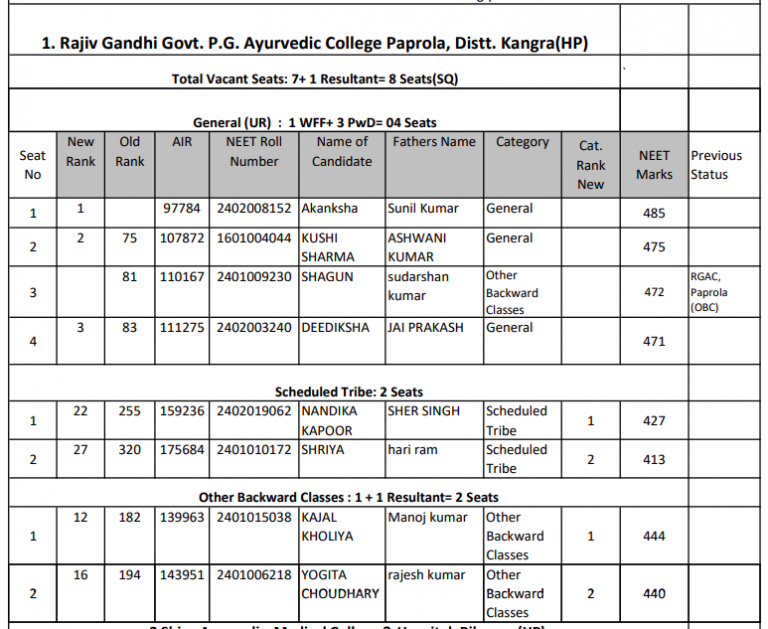

Madhyamik 2025 Result How To Check Your Merit Rank

May 09, 2025

Madhyamik 2025 Result How To Check Your Merit Rank

May 09, 2025 -

Putins Victory Day Ceasefire A Temporary Halt In Fighting

May 09, 2025

Putins Victory Day Ceasefire A Temporary Halt In Fighting

May 09, 2025