MicroStrategy Stock Vs. Bitcoin: A 2025 Investment Comparison

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy Incorporated (MSTR) is a publicly traded company primarily known for its business intelligence, mobile software, and cloud-based services. However, its most significant recent move has been its substantial investment in Bitcoin. The company began accumulating Bitcoin in August 2020, viewing it as a long-term investment and a store of value. This bold strategy has significantly impacted its stock price, creating both opportunities and risks for investors.

- Software Business: MicroStrategy's core business generates revenue through the sale and licensing of its enterprise analytics and mobility software platforms.

- Bitcoin Acquisitions Timeline: The company has consistently added to its Bitcoin holdings over the years, making significant purchases at various price points. This demonstrates a long-term commitment to the cryptocurrency.

- Percentage of Assets in BTC: A significant portion of MicroStrategy's balance sheet is now allocated to Bitcoin, making the company's performance directly tied to Bitcoin's price movements. This represents a high-risk, high-reward strategy.

- Keywords: MicroStrategy stock, Bitcoin investment, MSTR stock price, corporate Bitcoin adoption, Bitcoin holdings.

Risks and Rewards of Investing in MicroStrategy Stock

Investing in MSTR stock presents a unique risk profile. While MicroStrategy’s software business offers a degree of stability, the substantial Bitcoin holdings introduce significant volatility.

- MSTR Stock Volatility: The price of MSTR stock is highly correlated with the price of Bitcoin. Any significant fluctuation in Bitcoin's price will directly impact MSTR's stock price.

- Dependency on Bitcoin Price: The success of MicroStrategy's investment strategy is directly dependent on the future performance of Bitcoin. A downturn in Bitcoin's price could severely impact the company's valuation.

- Potential for Future Growth: MicroStrategy’s software business and its pioneering role in corporate Bitcoin adoption could provide future growth opportunities. However, this growth is contingent upon both its software performance and the success of its Bitcoin strategy.

- Keywords: MSTR stock volatility, Bitcoin price prediction, risk assessment, investment risk, MicroStrategy future.

Bitcoin's Potential in 2025 and Beyond

Bitcoin's Market Position and Adoption Rate

Bitcoin remains the leading cryptocurrency by market capitalization and enjoys widespread recognition globally. Its future potential hinges on several factors.

- Global Adoption Trends: Increasing mainstream adoption by individuals and institutions is crucial for Bitcoin's continued growth. This includes wider acceptance as a payment method and as a store of value.

- Institutional Investment in Bitcoin: Large institutional investors, including corporations and investment funds, are increasingly allocating assets to Bitcoin, boosting its legitimacy and price.

- Regulatory Landscape: The evolving regulatory framework surrounding cryptocurrencies will significantly impact Bitcoin's trajectory. Clearer regulations could lead to increased confidence and adoption.

- Technological Developments Impacting Bitcoin: Advancements in Bitcoin's underlying technology, such as the Lightning Network, could enhance its scalability and usability, driving further adoption.

- Keywords: Bitcoin price prediction 2025, cryptocurrency market cap, Bitcoin adoption rate, Bitcoin regulation, Bitcoin scalability.

Risks Associated with Direct Bitcoin Investment

Direct investment in Bitcoin carries substantial risks.

- Price Volatility: Bitcoin's price is notoriously volatile, subject to significant swings in short periods. This volatility can lead to substantial gains or losses.

- Security Risks: Holding Bitcoin requires secure storage solutions. The risk of theft or hacking from exchanges or personal wallets is a significant concern.

- Regulatory Uncertainty: The lack of clear and consistent regulatory frameworks in many jurisdictions presents challenges for Bitcoin investors.

- Potential for Market Manipulation: The cryptocurrency market is susceptible to manipulation, which can cause significant price fluctuations.

- Keywords: Bitcoin volatility, cryptocurrency security, Bitcoin wallet security, Bitcoin investment risks, Bitcoin exchange security.

MicroStrategy Stock vs. Bitcoin: A Direct Comparison

Comparing Risk Profiles

Investing in MicroStrategy stock versus Bitcoin directly presents different risk profiles.

- Risk Tolerance Levels: Investing in MSTR stock involves a degree of diversification, as it includes the company's software business. Direct Bitcoin investment is a purely cryptocurrency-focused strategy.

- Correlation between Bitcoin Price and MSTR Stock Price: MSTR's stock price is directly linked to Bitcoin's performance. This high correlation increases risk for investors.

- Diversification Strategies: Direct Bitcoin investment offers limited diversification. MSTR stock offers some diversification but still carries significant Bitcoin-related risk.

- Keywords: risk diversification, investment portfolio, asset allocation, risk management.

Potential Returns and Long-Term Outlook

Predicting long-term returns for either investment is inherently challenging.

- Long-term Growth Potential: Both Bitcoin and MicroStrategy stock possess long-term growth potential. However, the extent of that potential depends on numerous factors, including market trends, technological advancements, and regulatory changes.

- Potential Return on Investment (ROI): Past performance is not indicative of future results. Both Bitcoin and MSTR stock have the potential for high ROI but also carry considerable risk.

- Comparison of Historical Performance: Analyzing the historical performance of both Bitcoin and MSTR stock offers some insights, but it's crucial to consider the future factors mentioned above.

- Keywords: long-term investment, ROI calculation, investment strategy comparison, Bitcoin return on investment, MSTR return on investment.

Conclusion

The decision to invest in MicroStrategy stock or Bitcoin directly in 2025 involves carefully weighing the risks and potential rewards of each. MicroStrategy offers a more established company structure but is highly dependent on Bitcoin's performance. Direct Bitcoin investment presents higher volatility but potentially higher rewards. Ultimately, the best investment strategy depends on your individual risk tolerance, financial goals, and investment horizon. Conduct thorough research and consider consulting a financial advisor before making any investment decisions regarding MicroStrategy stock or Bitcoin. Remember to carefully assess your individual risk tolerance before investing in either MicroStrategy stock or Bitcoin.

Featured Posts

-

Arsenal Vs Psg Gary Nevilles Prediction And Potential Outcome

May 08, 2025

Arsenal Vs Psg Gary Nevilles Prediction And Potential Outcome

May 08, 2025 -

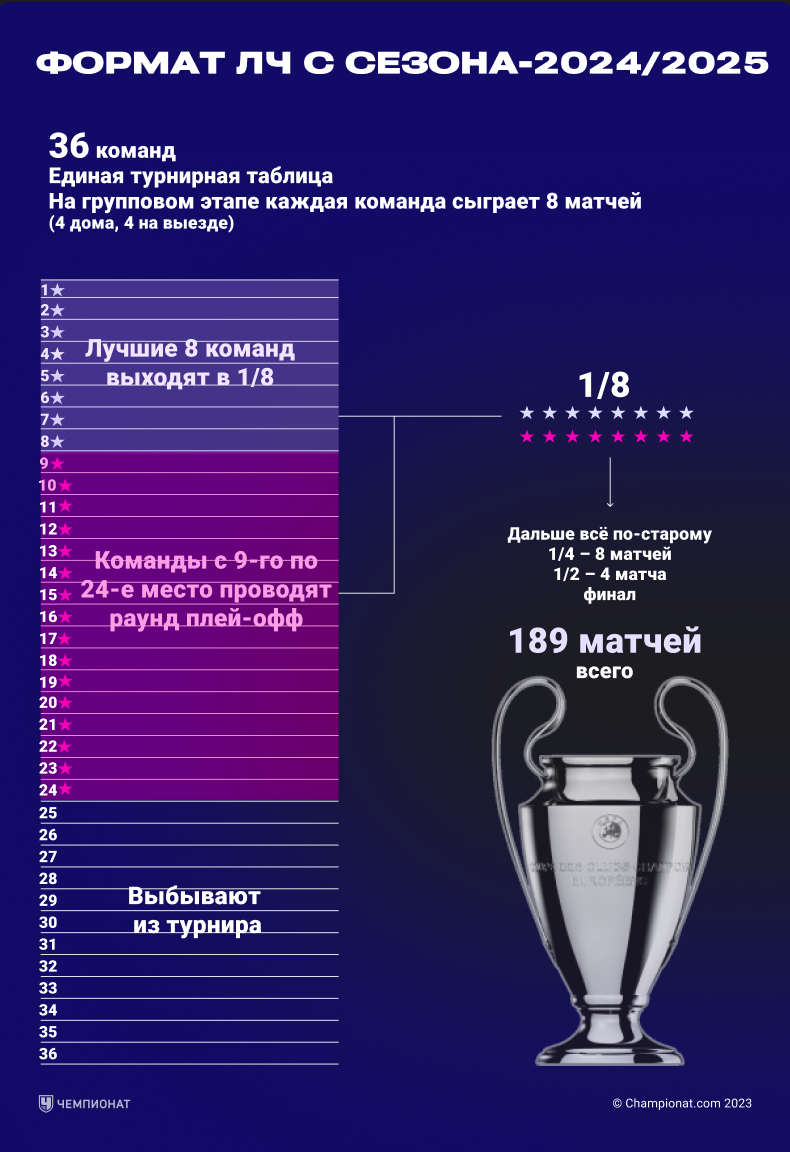

Arsenal Ps Zh Barselona Inter Anons Matchey 1 2 Finala Ligi Chempionov 2024 2025

May 08, 2025

Arsenal Ps Zh Barselona Inter Anons Matchey 1 2 Finala Ligi Chempionov 2024 2025

May 08, 2025 -

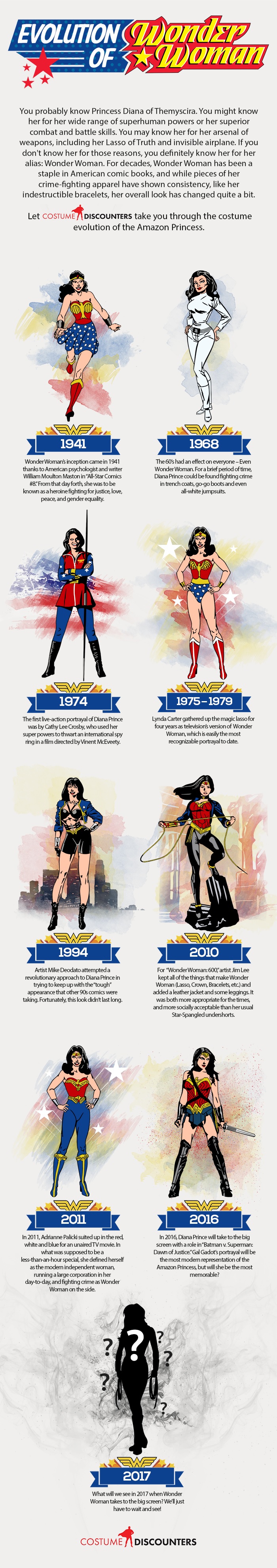

X Men Rogues Costume Evolution A Surprising Shift

May 08, 2025

X Men Rogues Costume Evolution A Surprising Shift

May 08, 2025 -

Taiwan Investors Retreat From Us Bond Etfs A Shift In Investment Strategy

May 08, 2025

Taiwan Investors Retreat From Us Bond Etfs A Shift In Investment Strategy

May 08, 2025 -

Nba Star Jayson Tatum Seemingly Confirms Son With Ella Mai In New Ad

May 08, 2025

Nba Star Jayson Tatum Seemingly Confirms Son With Ella Mai In New Ad

May 08, 2025