Microsoft Among Top Software Stocks Weathering Tariff Storms

Table of Contents

Microsoft's Diversified Revenue Streams Mitigate Tariff Risks

Microsoft's success in navigating tariff challenges stems significantly from its incredibly diversified revenue streams. This diversification minimizes the impact of any single sector's vulnerability to tariffs.

Cloud Computing Dominance

Microsoft's Azure cloud platform is a major revenue driver, and its global nature makes it less susceptible to direct tariff impacts compared to businesses heavily reliant on physical hardware manufacturing and shipping.

- Global reach of Azure: Azure's extensive global infrastructure reduces reliance on any single geographic market, mitigating the effects of localized tariff increases.

- Strong enterprise adoption: Large corporations rely on Azure for critical business functions, leading to high and consistent demand.

- Subscription-based model minimizes impact: The subscription model ensures predictable income, buffering against fluctuating tariff costs that might impact pricing strategies for hardware or other products.

Azure's global infrastructure is strategically positioned across numerous data centers worldwide, ensuring business continuity and minimizing disruption from regional trade conflicts. This distributed approach significantly reduces the risk associated with tariffs impacting specific geographic locations.

Productivity and Business Processes Software Strength

Office 365 (now Microsoft 365), Dynamics 365, and other productivity suites generate recurring revenue, providing exceptional stability amidst external economic uncertainties.

- High subscription renewal rates: Customers consistently renew their subscriptions, creating a predictable revenue stream.

- Sticky customer base: Businesses become heavily reliant on Microsoft's productivity tools, creating strong customer loyalty and retention.

- Global demand for productivity software: The need for efficient productivity software remains consistently high regardless of global trade fluctuations.

The subscription model inherent in these products generates consistent, predictable income. This recurring revenue acts as a significant buffer against the volatility of tariffs impacting hardware sales or other one-time purchases.

Gaming and Xbox Revenue Diversification

The gaming division, while facing some supply chain challenges like any hardware-dependent business, contributes significantly to overall revenue diversification, reducing reliance on any single sector.

- Global Xbox market: Xbox enjoys a significant global market share, lessening dependence on any single region.

- Recurring subscription revenue from Xbox Game Pass: The subscription model for Game Pass mirrors the success of Microsoft 365, creating predictable revenue streams.

- Diverse game portfolio: A broad range of games caters to diverse audiences, enhancing market reach and reducing reliance on any single title.

Xbox's global reach and subscription-based revenue models help mitigate potential tariff-related impacts on hardware sales by diversifying income streams and lessening dependence on physical product sales alone.

Strategic Positioning and Competitive Advantage

Microsoft's enduring success is not solely attributable to its diversified revenue; its strategic positioning and competitive advantages further solidify its resilience against market shocks.

Strong Brand Recognition and Loyalty

Microsoft's established brand and loyal customer base offer a substantial buffer against market fluctuations.

- High brand trust: Microsoft enjoys exceptionally high levels of trust amongst consumers and businesses.

- Extensive enterprise partnerships: Long-standing relationships with major corporations solidify ongoing demand for Microsoft's products and services.

- Strong customer retention rates: Customers consistently choose Microsoft solutions, demonstrating high loyalty and repeat business.

The strength of Microsoft's brand translates directly into sustained demand for its products and services, mitigating the impact of external economic pressures, including tariffs.

Continuous Innovation and Adaptation

Microsoft’s ongoing investment in R&D allows it to remain at the forefront of technological advancements, enabling it to adapt quickly to changing market dynamics, including evolving trade policies.

- Investment in AI, cloud computing, and other emerging technologies: Continuous investment ensures Microsoft remains competitive and resilient to market shifts.

- Continuous product updates: Regular updates ensure product relevance and competitiveness, maintaining high customer satisfaction and retention.

- Proactive risk management strategies: Microsoft proactively identifies and mitigates risks, including those stemming from trade policy changes.

This proactive approach to innovation allows Microsoft to consistently evolve and adapt, maintaining a strong competitive edge even in the face of external uncertainties.

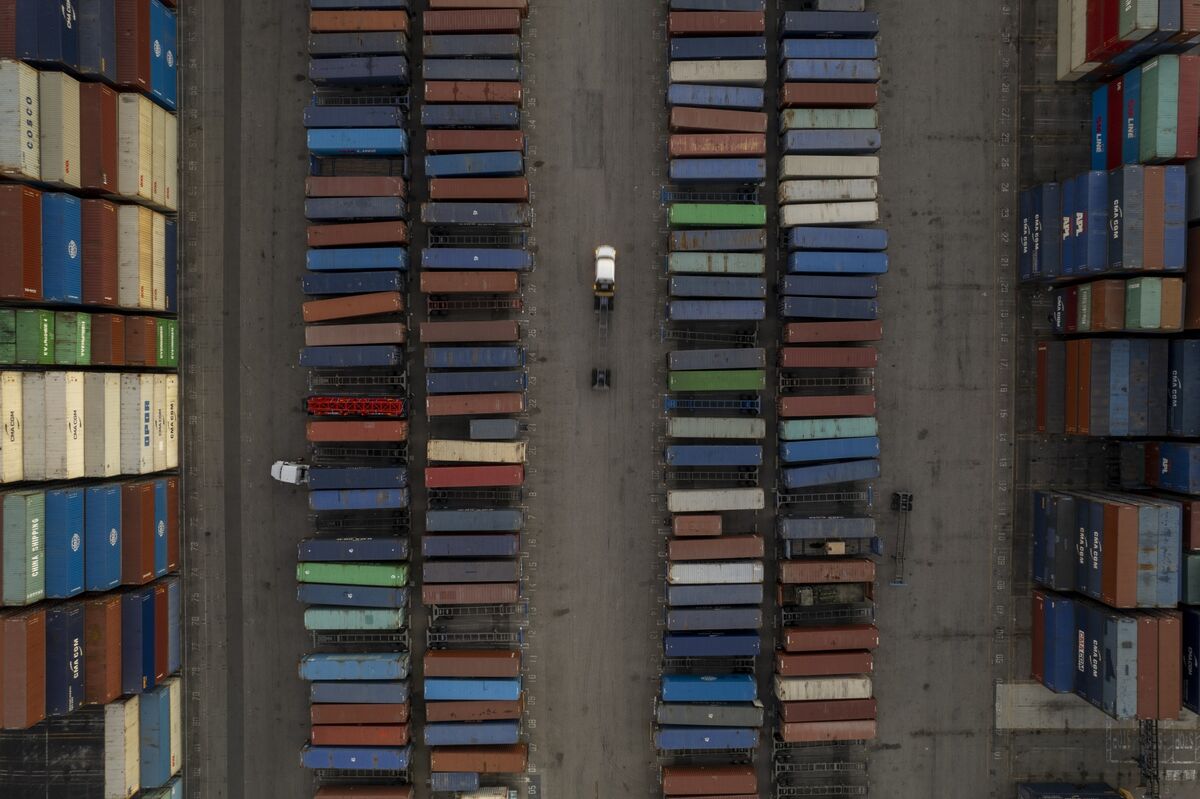

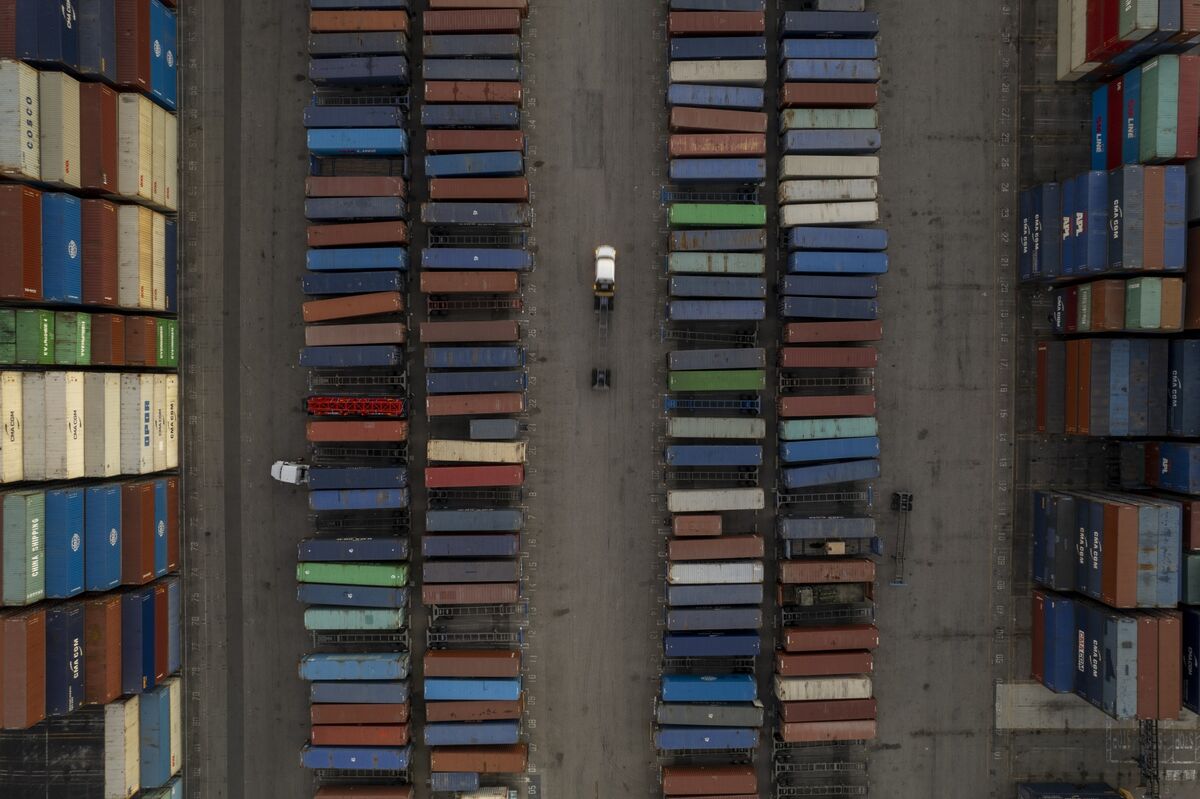

Global Infrastructure and Supply Chain Resilience

Microsoft's globally distributed infrastructure and diversified supply chains significantly contribute to its ability to withstand tariff disruptions.

- Multiple data centers worldwide: This geographically diverse infrastructure reduces dependence on any single location.

- Strategic sourcing of components: Microsoft strategically sources components from multiple vendors globally, reducing vulnerability to disruptions in any one region.

- Robust supply chain management: Efficient and resilient supply chain management ensures the continuous flow of goods and services, minimizing disruptions caused by tariffs.

Microsoft's global reach and strategically diversified supply chains minimize its exposure to the risks of tariffs impacting any single geographic region or supplier.

Financial Performance and Investor Confidence

Microsoft's resilience to tariff challenges is clearly reflected in its robust and consistent financial performance, further boosting investor confidence.

Consistent Financial Growth and Profitability

Microsoft consistently demonstrates strong financial growth and impressive profit margins, showcasing its ability to navigate challenging economic conditions. (Note: Insert relevant financial data here, sourced from reputable financial news sites such as Yahoo Finance, Google Finance, or Bloomberg. Include figures for revenue growth, profit margins, etc., over a relevant time period.)

This consistent financial performance directly reflects Microsoft's ability to not only withstand but thrive amidst economic uncertainty.

Investor Sentiment and Stock Performance

Despite global trade tensions, investor sentiment towards Microsoft stock remains largely positive, reflecting confidence in the company’s long-term prospects. (Note: Insert data on stock price performance, analyst ratings, and investor confidence indicators here, sourced from reputable financial websites.)

The sustained investor confidence demonstrates the market’s belief in Microsoft’s ability to overcome tariff challenges and continue its trajectory of growth and profitability.

Conclusion

Microsoft's success in navigating the complexities of global trade disputes underscores its robust business model and strategic foresight. Its diversified revenue streams, strong brand, and continuous innovation position it as a leader among software stocks weathering tariff storms. Investing in top software stocks like Microsoft can be a strategic move in times of economic uncertainty. Consider diversifying your portfolio with resilient companies like Microsoft to mitigate risk and potentially benefit from long-term growth in the tech sector. Learn more about how to navigate the complexities of the market and find the best software stocks to invest in.

Featured Posts

-

Celtics In Orlando Game 3 Playoff Showdown

May 16, 2025

Celtics In Orlando Game 3 Playoff Showdown

May 16, 2025 -

Riscuri Apa De Robinet Ghid Pentru Consumatori Din Romania

May 16, 2025

Riscuri Apa De Robinet Ghid Pentru Consumatori Din Romania

May 16, 2025 -

Draymond Green On Jimmy Butler Post Game Honesty After Warriors Kings Matchup

May 16, 2025

Draymond Green On Jimmy Butler Post Game Honesty After Warriors Kings Matchup

May 16, 2025 -

Is This Little Known App The Next Big Threat To Meta

May 16, 2025

Is This Little Known App The Next Big Threat To Meta

May 16, 2025 -

Ukrainskie Goroda Pod Obstrelom Rossiya Vypustila Bolee 200 Raket I Dronov

May 16, 2025

Ukrainskie Goroda Pod Obstrelom Rossiya Vypustila Bolee 200 Raket I Dronov

May 16, 2025