Microsoft Leads Software Stocks In Tariff-Proof Performance

Table of Contents

Microsoft's Intrinsic Tariff-Proof Advantages

Microsoft's success in navigating turbulent economic waters stems from its inherent strengths, making it a prime example of a tariff-proof investment. This resilience isn't accidental; it's built into the very nature of its business.

Reduced Dependence on Physical Goods

- Intangible Assets: Unlike manufacturers reliant on physical goods subject to tariffs and supply chain disruptions, Microsoft's core offerings are largely intangible. Software licenses, cloud services like Azure, and online subscriptions are easily distributed globally, bypassing many of the logistical hurdles and tariff barriers faced by companies dealing in physical products.

- Global Digital Distribution: Microsoft's digital distribution model allows for seamless delivery of its products and services worldwide, irrespective of geographical boundaries or trade restrictions. This eliminates the complexities and costs associated with importing and exporting physical goods.

- Agility and Adaptability: The digital nature of Microsoft’s business allows for quick adaptation to changing market conditions and regulatory environments. This agility is a key factor in its tariff-proof performance.

Strong Recurring Revenue Streams

- Subscription Model Dominance: Microsoft's transition to subscription-based models for key products like Office 365 and Azure subscriptions has created highly predictable and stable revenue streams. These recurring revenues cushion the company against short-term market fluctuations.

- SaaS Advantage: As a leader in Software as a Service (SaaS), Microsoft benefits from long-term contracts and predictable income flows, unlike companies dependent on one-time sales. This provides significant financial stability.

- Reduced Volatility: This recurring revenue model significantly reduces the volatility often associated with businesses reliant on cyclical sales patterns. It provides a consistent financial foundation, making it less vulnerable to economic downturns.

Diversified Product Portfolio

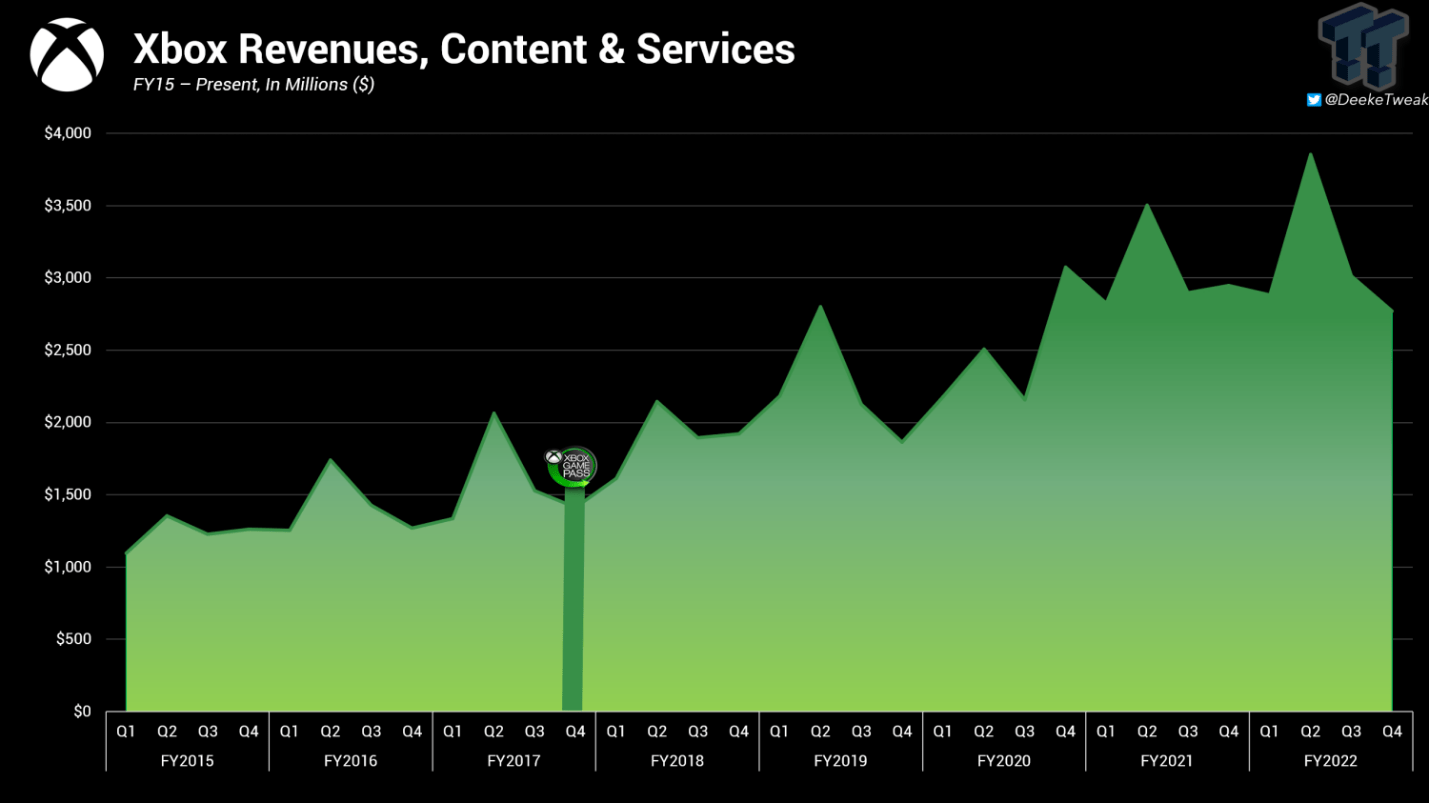

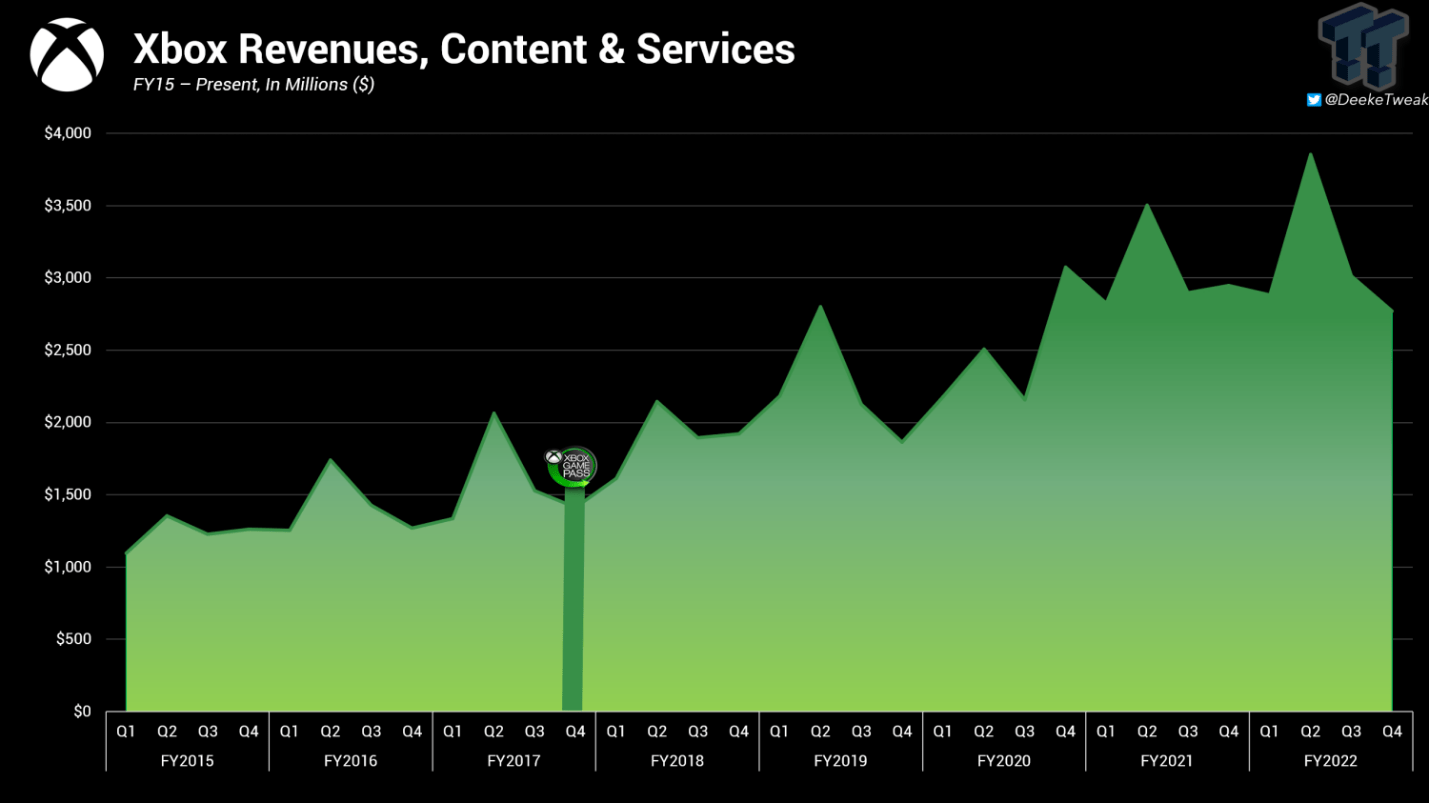

- Broad Market Reach: Microsoft's diverse product portfolio, encompassing Windows, Office, Azure, gaming (Xbox), LinkedIn, and more, minimizes its reliance on any single product or market segment. This diversification is crucial to its overall resilience.

- Risk Mitigation: The breadth of its offerings acts as a strong hedge against potential risks associated with specific market downturns or technological shifts within individual sectors.

- Competitive Advantage: This diversification creates a powerful competitive advantage, enabling Microsoft to adapt to evolving market demands and maintain a robust market share.

Outperforming the Market: Microsoft's Financial Performance Indicators

Microsoft's consistent outperformance isn't just anecdotal; it's reflected in its strong financial performance indicators.

Consistent Revenue and Earnings Growth

- Year-Over-Year Performance: Microsoft has demonstrated consistent revenue and earnings growth year over year, even during periods of heightened economic uncertainty, showcasing its resilience in challenging markets. (Insert chart/graph illustrating revenue and earnings growth).

- Market Comparison: Comparing Microsoft's performance to other tech giants and the broader market reveals its superior growth trajectory and stability. (Insert chart/graph comparing Microsoft's performance to competitors and market indices).

- Financial Stability: This consistent growth demonstrates a robust financial foundation and operational efficiency, making it a stable and reliable investment.

Strong Investor Confidence

- Stock Price Trends: Microsoft's stock price trends reflect strong investor confidence, demonstrating a sustained upward trajectory even amidst broader market volatility. (Insert chart showing stock price trends).

- Analyst Ratings: Consistent positive analyst ratings further underscore investor confidence in Microsoft's future growth prospects and long-term stability.

- Market Capitalization: Its substantial market capitalization reflects its established position as a market leader and the confidence investors have in its long-term value.

Future Outlook and Investment Implications

Microsoft's position of strength suggests a promising future.

Continued Growth Potential in Cloud Computing

- Azure Growth: The cloud computing market continues to expand rapidly, and Microsoft's Azure platform is positioned for significant growth, driving future revenue streams.

- Market Share Expansion: Microsoft is actively working to expand its market share in the cloud, capturing a significant portion of the growing market demand.

- Future Projections: Future projections for the cloud computing market indicate sustained growth, presenting substantial opportunities for Microsoft and its investors.

Strategic Acquisitions and Innovation

- Strategic Growth: Microsoft's history of strategic acquisitions and commitment to research and development (R&D) drives innovation and solidifies its market leadership.

- Technological Leadership: Continued investment in innovation ensures Microsoft remains at the forefront of technological advancements, further strengthening its competitive advantage.

- Future Technologies: Microsoft's focus on emerging technologies positions it for future growth and leadership in new markets.

Conclusion

Microsoft's tariff-proof business model, consistent financial performance, and strong growth potential make it a compelling investment in uncertain times. Its resilience in the face of global economic challenges is undeniable. Investing in Microsoft offers a path to diversification and protection against economic volatility. Consider adding Microsoft and other tariff-proof software stocks to your portfolio to mitigate risk and benefit from the stability of this sector. Research further to deepen your understanding of Microsoft’s performance and its future in the evolving tech landscape. Explore alternative investment strategies that leverage the resilience of the software sector. Remember to consult with a financial advisor before making any investment decisions. Invest in Microsoft and build a robust, tariff-proof investment strategy today.

Featured Posts

-

Knicks Bench Steps Up Jalen Brunson Injury Highlights Team Depth

May 15, 2025

Knicks Bench Steps Up Jalen Brunson Injury Highlights Team Depth

May 15, 2025 -

Ovechkin Oboshel Grettski I Leme Novye Rekordy N Kh L

May 15, 2025

Ovechkin Oboshel Grettski I Leme Novye Rekordy N Kh L

May 15, 2025 -

Ensuring Crypto Exchange Compliance In India Key Requirements For 2025

May 15, 2025

Ensuring Crypto Exchange Compliance In India Key Requirements For 2025

May 15, 2025 -

David Pastrnak Och Tjeckiens Vm Chanser

May 15, 2025

David Pastrnak Och Tjeckiens Vm Chanser

May 15, 2025 -

Smart Mlb Dfs Picks For May 8th Sleepers And Value Plays

May 15, 2025

Smart Mlb Dfs Picks For May 8th Sleepers And Value Plays

May 15, 2025