Microsoft Stock: A Safe Haven Amidst Tariff Turmoil?

Table of Contents

Microsoft's Diversified Revenue Streams

One key reason why Microsoft stock might be considered a safe haven is its remarkably diversified revenue streams. Unlike companies heavily reliant on a single sector, Microsoft's portfolio spans multiple high-growth areas, effectively mitigating the risk associated with any one sector's underperformance due to tariffs or other economic shocks. This diversification makes it a more resilient investment compared to companies with concentrated revenue sources.

-

Azure Cloud Dominance: Microsoft's Azure cloud platform is a leading competitor in the cloud computing market, consistently demonstrating strong growth. The cloud's inherent scalability and global reach make it relatively less susceptible to localized trade disruptions.

-

Office 365 Subscription Strength: The subscription model of Office 365 provides predictable recurring revenue, further stabilizing Microsoft's financial performance and reducing vulnerability to market fluctuations.

-

Gaming Growth (Xbox): The gaming sector, while subject to its own trends, contributes a substantial and growing portion of Microsoft's overall revenue, adding another layer of diversification.

-

Geographic Diversification: Microsoft generates revenue from numerous countries worldwide. This geographical spread mitigates the impact of trade restrictions imposed by a single nation or region.

Recent financial reports show [Insert relevant statistic on revenue distribution across segments – e.g., percentage breakdown of revenue from Azure, Office 365, Gaming, etc.]. This diversification clearly demonstrates Microsoft's ability to withstand economic headwinds.

Microsoft's Strong Financial Position

Beyond diversification, Microsoft boasts a robust financial foundation that adds to its "safe haven" appeal. The company's strong balance sheet, high cash reserves, and consistent profitability contribute significantly to its resilience during uncertain economic times.

-

Cash Flow and Debt Levels: Microsoft consistently demonstrates strong positive cash flow and maintains manageable debt levels. [Insert relevant statistics on cash flow and debt-to-equity ratio]. This healthy financial position allows the company to weather economic storms and continue investing in future growth.

-

Credit Ratings and Investor Confidence: Microsoft's high credit ratings from major agencies reflect investor confidence in its financial strength and long-term prospects. This confidence further strengthens its position as a relatively low-risk investment.

-

History of Weathering Downturns: Microsoft has a proven track record of navigating past economic downturns, demonstrating its capacity to adapt and maintain profitability even during challenging market conditions. Its history provides a strong argument for its ability to endure current and future economic uncertainties.

This solid financial footing enables Microsoft to continue investing in research and development and strategic acquisitions, even amidst global economic headwinds, ensuring its continued competitiveness and innovation.

Microsoft's Competitive Advantage

Microsoft's enduring success is underpinned by a significant competitive advantage. Its market leadership, strong brand recognition, and established network effects contribute to its ability to withstand external shocks.

-

Enterprise Software Dominance: Microsoft holds a dominant position in the enterprise software market, with its products deeply integrated into businesses globally. This entrenched position creates high switching costs for customers, making it difficult for competitors to gain significant market share.

-

Network Effects and High Switching Costs: The widespread adoption of Microsoft products creates powerful network effects. The more users a product has, the more valuable it becomes, further cementing Microsoft's competitive edge.

-

Continuous Innovation and Product Development: Microsoft consistently invests in research and development, releasing innovative products and services that maintain its leading position in various markets.

-

Strong Intellectual Property Portfolio: A robust portfolio of patents and trademarks protects Microsoft's innovations and provides a significant barrier to entry for competitors.

These factors create a significant moat around Microsoft's business, protecting it from the disruptive effects of external factors, including tariff-related market volatility.

Risks to Consider

While Microsoft presents a compelling case as a potential safe haven, it’s crucial to acknowledge potential risks. No investment is entirely without risk, and even a seemingly stable company like Microsoft is subject to certain vulnerabilities.

-

Regulatory Scrutiny: Microsoft faces regulatory scrutiny in various jurisdictions, which could lead to increased costs or limitations on its business operations.

-

Competition from Tech Giants: Intense competition from other tech giants like Amazon, Google, and Apple presents a constant challenge to Microsoft’s market share and growth.

-

Global Economic Slowdown: A broader global economic slowdown could impact demand for Microsoft's products and services, even with its diversified portfolio.

-

Foreign Exchange Market Fluctuations: Fluctuations in currency exchange rates can affect Microsoft's profitability, as a significant portion of its revenue comes from international markets.

Conclusion: Is Microsoft Stock a True Safe Haven?

In conclusion, Microsoft stock (MSFT) presents a compelling case as a potential safe haven during periods of tariff turmoil and economic uncertainty. Its diversified revenue streams, strong financial position, and significant competitive advantages contribute to its resilience. However, investors should acknowledge the inherent risks associated with any investment, including regulatory challenges, competition, global economic slowdowns, and currency fluctuations.

Microsoft's strengths, notably its diversification, financial stability, and competitive dominance in key technology markets, suggest it could be a valuable component of a well-diversified investment portfolio designed to navigate trade uncertainties. However, thorough research and careful consideration of your personal risk tolerance are essential before making any investment decisions. We recommend further research into Microsoft stock investment strategies and risk management techniques to make informed choices. Consider Microsoft stock as part of your broader portfolio strategy for navigating market volatility.

Featured Posts

-

Gear Up For The Celtics Finals Push Find Your Perfect Fan Apparel At Fanatics

May 16, 2025

Gear Up For The Celtics Finals Push Find Your Perfect Fan Apparel At Fanatics

May 16, 2025 -

Republican Tax Plan House Unveils Trumps Economic Vision

May 16, 2025

Republican Tax Plan House Unveils Trumps Economic Vision

May 16, 2025 -

Steams Free Game Offering A Critical Look

May 16, 2025

Steams Free Game Offering A Critical Look

May 16, 2025 -

893 Goals And Closing In Ovechkins Chase For Gretzkys Nhl Goal Record

May 16, 2025

893 Goals And Closing In Ovechkins Chase For Gretzkys Nhl Goal Record

May 16, 2025 -

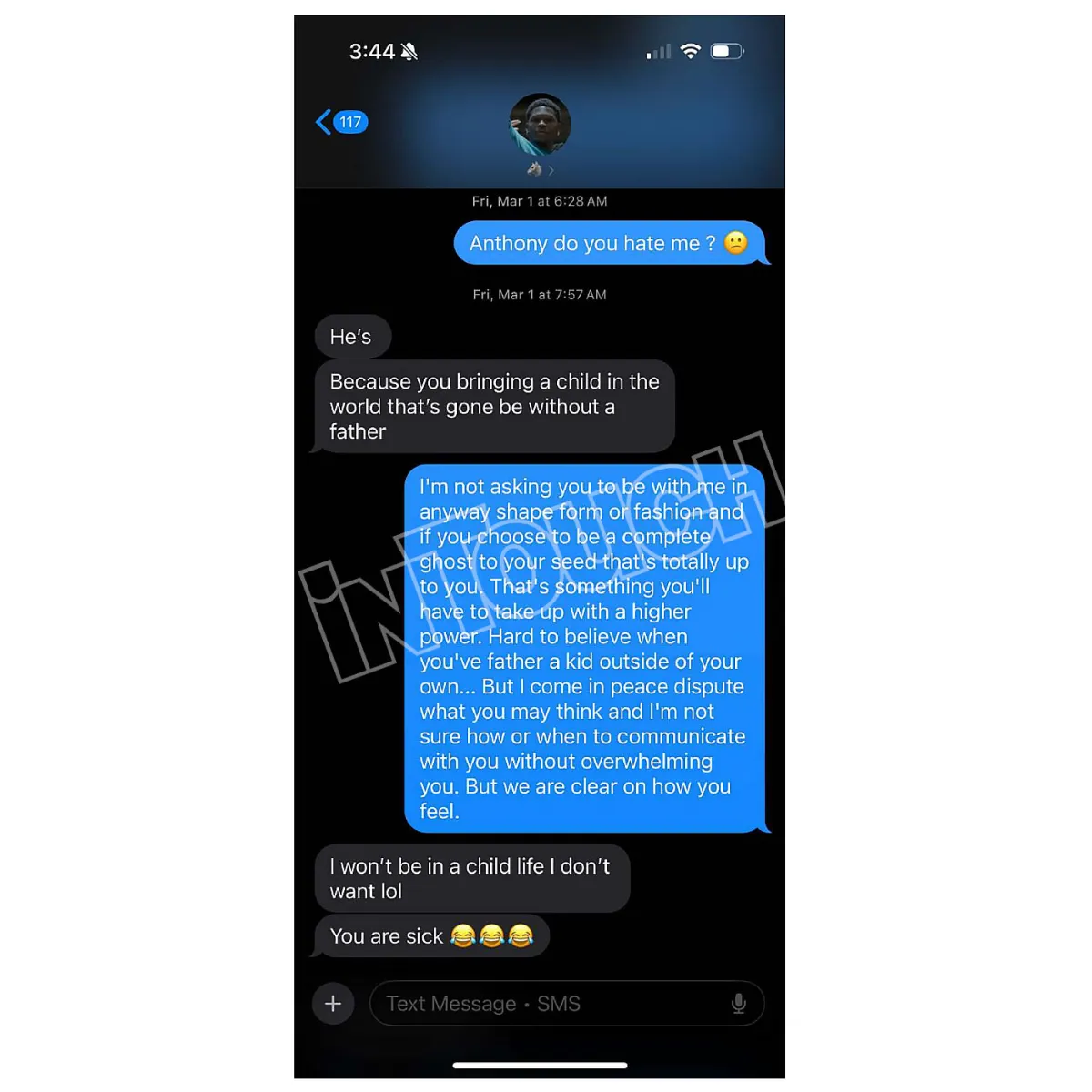

Ayesha Howard And Anthony Edwards Shared Custody Arrangement

May 16, 2025

Ayesha Howard And Anthony Edwards Shared Custody Arrangement

May 16, 2025