Microsoft Stock: A Safe Haven Amidst Trade Wars

Table of Contents

Microsoft's Diversified Revenue Streams: A Buffer Against Trade Impacts

Global trade conflicts create ripple effects throughout the economy. However, some companies are better positioned to weather these storms than others. Microsoft's diversified business model is a key factor in its resilience.

Reduced Reliance on International Trade:

- Software dominance: Microsoft's core business revolves around software licenses and subscriptions, significantly reducing its reliance on physical goods manufacturing and the associated tariffs and trade barriers. This is in stark contrast to companies heavily dependent on global supply chains.

- Cloud computing power: Microsoft Azure, its cloud computing platform, operates globally, benefiting from a distributed infrastructure less directly impacted by localized trade disputes. Azure's revenue is increasingly significant, further diversifying Microsoft's income streams.

- Revenue diversification statistics: While precise breakdowns vary quarterly, a significant portion of Microsoft's revenue comes from its cloud services (Azure, Microsoft 365), software licenses, and enterprise solutions, all relatively less susceptible to international trade friction compared to hardware manufacturers.

The shift towards digital services and subscription models has proven to be a significant advantage for Microsoft, minimizing the disruption caused by physical trade limitations.

Strong Domestic Market Presence:

- US market leadership: Microsoft holds a commanding market share in the United States for operating systems (Windows), productivity software (Microsoft 365), and enterprise solutions. This strong domestic presence provides a stable revenue base.

- Key products driving dominance: Windows, Office 365, and Azure all contribute significantly to Microsoft's domestic market strength, providing a buffer against external economic shocks.

- Government and enterprise contracts: Large government contracts and enterprise agreements with corporations across various sectors provide a consistent and reliable revenue stream, further solidifying Microsoft's financial stability.

The combination of robust domestic market share and significant government and enterprise contracts creates a stable foundation for Microsoft's financial performance, even amidst global uncertainties.

Microsoft's Robust Financial Performance & Future Growth Prospects

Beyond its immediate resilience, Microsoft's long-term growth prospects also contribute to its appeal as a safe haven investment.

Consistent Profitability and Dividend Growth:

- Steady Earnings Per Share (EPS) growth: Microsoft has demonstrated a consistent history of EPS growth, indicating strong profitability and financial health.

- Reliable dividend payments: Microsoft consistently pays dividends, with a track record of increasing those dividends over time. This provides a stable income stream for investors.

- Financial data highlights: Investors should review Microsoft's financial statements (available on their investor relations website and through financial news sources) for precise data on EPS growth, revenue growth, and dividend yield to inform their investment decisions.

This consistent profitability and commitment to dividend growth instill investor confidence, making Microsoft a relatively safe bet even during market volatility.

Growth in Cloud Computing (Azure) and AI:

- Leading cloud provider: Microsoft Azure is a leading cloud computing platform, competing directly with AWS and Google Cloud. This sector is experiencing rapid growth, offering significant future potential for Microsoft.

- AI investments and innovation: Microsoft's substantial investments in artificial intelligence position it at the forefront of this rapidly evolving technology, further enhancing its growth potential.

- Market share comparisons: While AWS currently holds a larger market share in cloud computing, Microsoft Azure is aggressively expanding its presence and capturing significant market share, showcasing its competitive advantage.

These high-growth sectors provide Microsoft with substantial avenues for future expansion, mitigating risks associated with potentially slower-growing segments of its business.

Microsoft Stock's Historical Performance During Economic Uncertainty:

Examining Microsoft's past performance during periods of economic downturn offers valuable insight into its resilience.

Analyzing Past Market Downturns:

- Historical data comparison: Analyzing Microsoft's stock performance during previous recessions and periods of geopolitical uncertainty, compared to broader market indices like the S&P 500, reveals its relative stability. (Note: Consult reputable financial sources for historical data).

- Relative resilience: While no stock is immune to market fluctuations, Microsoft's historical performance often shows relative resilience during periods of economic downturn compared to other sectors.

Analyzing past performance against market benchmarks provides crucial context for assessing Microsoft stock's potential to serve as a safe haven investment.

Investor Sentiment and Risk Tolerance:

- Strong brand reputation: Microsoft's strong brand recognition and market leadership contribute to positive investor sentiment and confidence in the company's long-term prospects.

- Appeal to risk-averse investors: The combination of consistent profitability, dividend growth, and relative stability during economic downturns makes Microsoft stock attractive to risk-averse investors seeking a safer investment option.

This perception of safety translates into consistent demand for Microsoft stock, further bolstering its price stability, even during periods of market uncertainty.

Conclusion:

In conclusion, Microsoft stock presents a compelling case as a safe haven investment amidst global trade tensions. Its diversified revenue streams, robust financial performance, growth prospects in cloud computing and AI, and historically resilient performance during market downturns all contribute to its appeal. While no investment is entirely risk-free, Microsoft's position offers a degree of stability that may be attractive to investors seeking shelter from trade war uncertainty. Consider adding Microsoft stock to your diversified portfolio as part of your overall investment strategy to potentially mitigate risk and ensure long-term growth. Begin your research into Microsoft stock today to see if it's a good fit for your investment goals. Remember to conduct thorough due diligence and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Everything You Need To Remember Before Andor Season 2 Starts

May 15, 2025

Everything You Need To Remember Before Andor Season 2 Starts

May 15, 2025 -

Comparing Trump And Biden Economic Policies And Their Impact

May 15, 2025

Comparing Trump And Biden Economic Policies And Their Impact

May 15, 2025 -

Anesthetic Gas And Everest A Controversial Speed Climbing Attempt

May 15, 2025

Anesthetic Gas And Everest A Controversial Speed Climbing Attempt

May 15, 2025 -

Dpr Dukung Pembangunan Giant Sea Wall Solusi Lindungi Warga Pesisir Dari Bencana

May 15, 2025

Dpr Dukung Pembangunan Giant Sea Wall Solusi Lindungi Warga Pesisir Dari Bencana

May 15, 2025 -

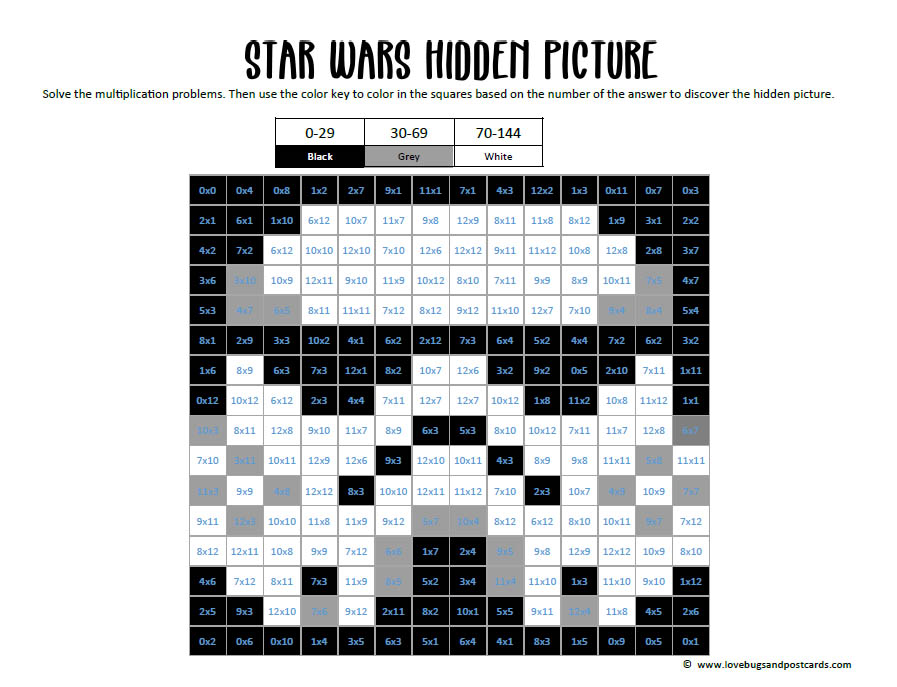

48 Years In The Making Star Wars Hidden Planet Unveiled

May 15, 2025

48 Years In The Making Star Wars Hidden Planet Unveiled

May 15, 2025