Millions Could Be Owed HMRC Refunds: Check Your Payslip Now

Table of Contents

Millions of UK taxpayers could be entitled to significant HMRC tax refunds, and you might be one of them! Don't let potentially thousands of pounds go unclaimed. This article explains how to check your payslips to identify potential overpayments and guides you through the process of claiming your HMRC tax refund. Let's find out if you're eligible for a refund.

<h2>Common Reasons for HMRC Tax Refunds</h2>

Several factors can lead to underpayment of tax and subsequent eligibility for an HMRC tax refund. Carefully reviewing your payslips can reveal if you've been underpaid due to various reasons.

-

Underpaid Tax Credits: Many people aren't fully aware of their tax credit entitlements. A thorough review of your payslips is crucial.

- Child Tax Credit Discrepancies: Check if your payslips accurately reflect your child tax credit entitlement based on your circumstances. Incorrect calculations are a common cause of underpayment.

- Working Tax Credit Accuracy: Verify that your working tax credit claims were processed correctly and that all qualifying conditions were considered.

- Qualifying Circumstances: Ensure your payslips correctly account for circumstances impacting your tax credits, such as disability, childcare costs, or severe disability premium. Missing or incorrectly reported information can lead to underpayment.

-

Payroll Errors: Mistakes by employers during payroll processing can result in underpayment of tax and National Insurance (NI) contributions. Careful scrutiny of your payslips is essential.

- Tax Code Inconsistencies: Look for discrepancies or changes in your tax code across different pay periods. Inconsistent tax codes may signal an error requiring correction.

- Tax and NI Deduction Anomalies: Examine your tax and NI deductions for any unusual patterns or inconsistencies. Unexpected fluctuations could indicate a payroll error.

- Income and Benefits Reporting: Ensure your payslips accurately reflect your income and any benefits received. Incorrect reporting can significantly affect your tax calculations.

-

Changes in Circumstances: Life events impact your tax liability. Failing to update HMRC with changes can result in overpayment or underpayment of tax.

- Updating HMRC Records: It's crucial to inform HMRC promptly about significant life changes such as marriage, divorce, childbirth, job changes, or moving house. These changes often necessitate adjustments to your tax code and allowances.

- Review Payslips Around Life Events: Specifically review payslips from the periods surrounding major life changes to check for any inaccuracies in tax calculations.

- Accurate Reporting is Key: Ensuring that HMRC has accurate and up-to-date information about your circumstances is vital for correct tax calculations and preventing underpayment.

<h2>How to Check Your Payslips for Potential HMRC Refunds</h2>

To check for potential HMRC tax refunds, follow these steps:

- Gather Your Payslips: Collect all your payslips from the past four tax years (or longer if necessary). HMRC typically allows claims within this timeframe, but exceptions might apply, so check their guidance for specifics.

- Review Key Information: Pay close attention to your tax code, tax deductions, National Insurance contributions, and any allowances or deductions. Look for inconsistencies or anomalies.

- Compare with HMRC Records: Access your online HMRC account to compare your reported income and deductions with the information on your payslips. Discrepancies could indicate a potential refund.

- Use Online Tax Calculators (with Caution): Online tax calculators can provide estimates of potential refunds. However, these tools should be used as supplementary checks only. For complex situations, seek professional advice from a tax advisor.

<h2>Claiming Your HMRC Tax Refund</h2>

Once you've identified a potential underpayment, follow these steps to claim your refund:

- Gather Necessary Documentation: Collect all relevant payslips, P60s, P45s, and any supporting evidence related to changes in circumstances.

- Complete the Correct Forms: Download the appropriate HMRC forms from the government website (gov.uk) and fill them out carefully and accurately.

- Submit Your Claim: Submit your claim online through your HMRC account, by post, or through a tax advisor. The best method depends on your preference and the complexity of your claim.

- Be Patient: HMRC processing times can vary. Allow sufficient time for your claim to be processed and don't hesitate to contact them for updates if necessary.

<h2>Conclusion</h2>

Millions could be owed HMRC refunds, and by diligently checking your payslips, you could be among them. Don't delay – take action today! Review your payslips carefully, compare them to your HMRC records, and if you find discrepancies, initiate the claim process immediately. Don't miss out on your potential HMRC tax refund! Check your payslips now and reclaim what's rightfully yours!

Featured Posts

-

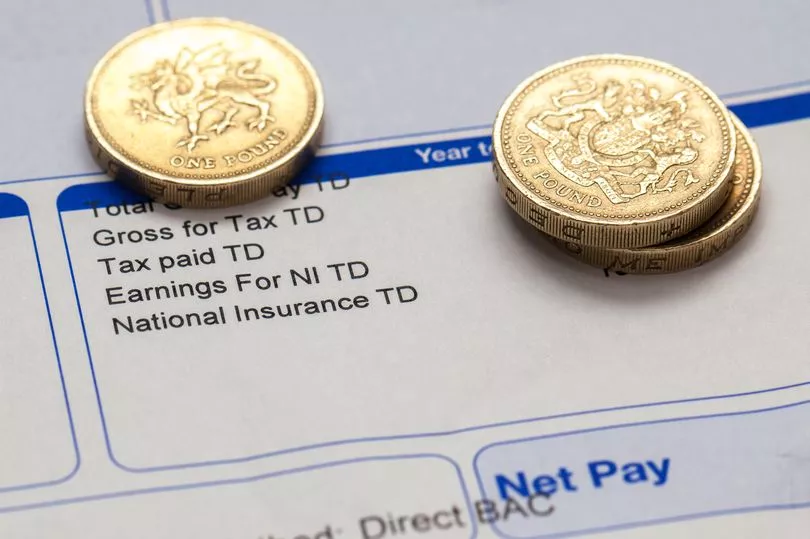

Agatha Christies Poirot A Detectives Enduring Appeal

May 20, 2025

Agatha Christies Poirot A Detectives Enduring Appeal

May 20, 2025 -

Hmrc Nudge Letters E Bay Vinted And Depop Sellers Beware

May 20, 2025

Hmrc Nudge Letters E Bay Vinted And Depop Sellers Beware

May 20, 2025 -

Unraveling The Mysteries A Deep Dive Into Agatha Christies Poirot Stories

May 20, 2025

Unraveling The Mysteries A Deep Dive Into Agatha Christies Poirot Stories

May 20, 2025 -

Femicide A Deep Dive Into The Problem And Its Growing Prevalence

May 20, 2025

Femicide A Deep Dive Into The Problem And Its Growing Prevalence

May 20, 2025 -

Quantum Leap In Drug Discovery D Waves Ai And Quantum Computing Collaboration

May 20, 2025

Quantum Leap In Drug Discovery D Waves Ai And Quantum Computing Collaboration

May 20, 2025