Missed Student Loan Payments: Impact On Your Credit Score

Table of Contents

Credit scores are crucial; they're the numerical representation of your creditworthiness, influencing your ability to secure loans, rent an apartment, even get certain jobs. A poor credit score, often resulting from missed payments, can severely limit your access to favorable interest rates on mortgages, car loans, and other essential financial products. This article aims to provide you with the knowledge and tools to navigate the complexities of student loan repayment and protect your credit score.

How Missed Student Loan Payments Affect Your Credit Score

When you miss a student loan payment, your lender reports this delinquency to the three major credit bureaus: Equifax, Experian, and TransUnion. This negative information significantly impacts your credit score, leading to a substantial point drop. The severity of the drop depends on several factors, including the number of missed payments and the length of the delinquency. This negative mark typically remains on your credit report for seven years from the date of the missed payment.

- Score Reductions: A single missed payment can drop your score by 30-50 points or more, depending on your existing credit history and the credit scoring model used. Multiple missed payments will result in even more substantial drops, potentially exceeding 100 points.

- Credit Scoring Models: FICO and VantageScore, the two most prevalent credit scoring models, both penalize late payments. While the specific algorithms differ, both consider the frequency and severity of late payments when calculating your score.

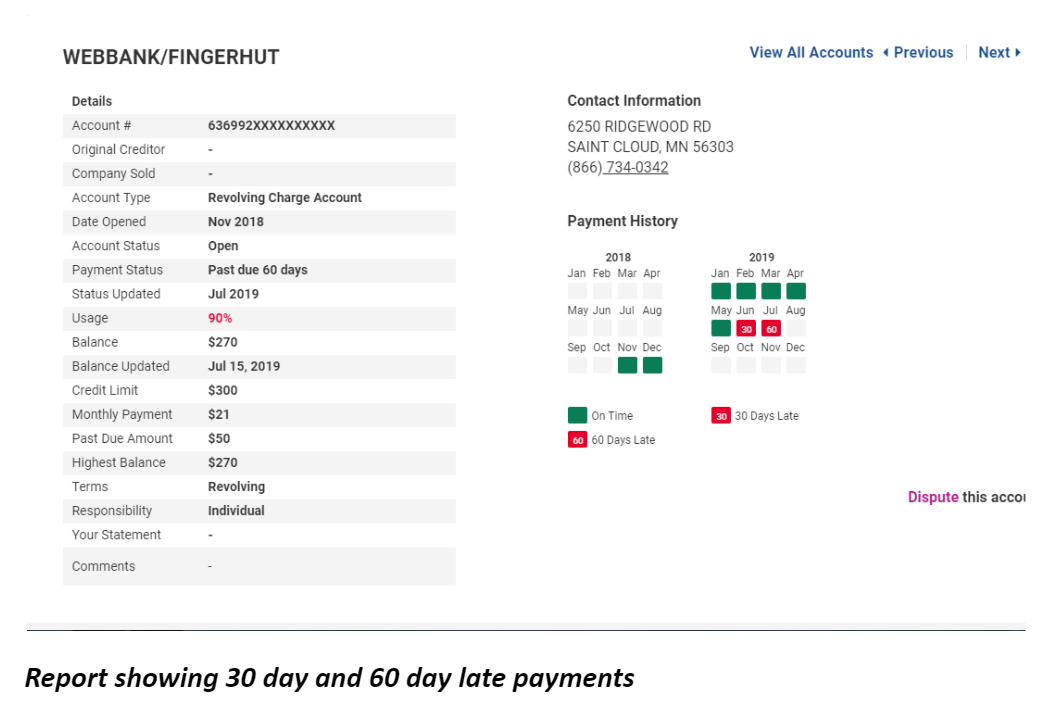

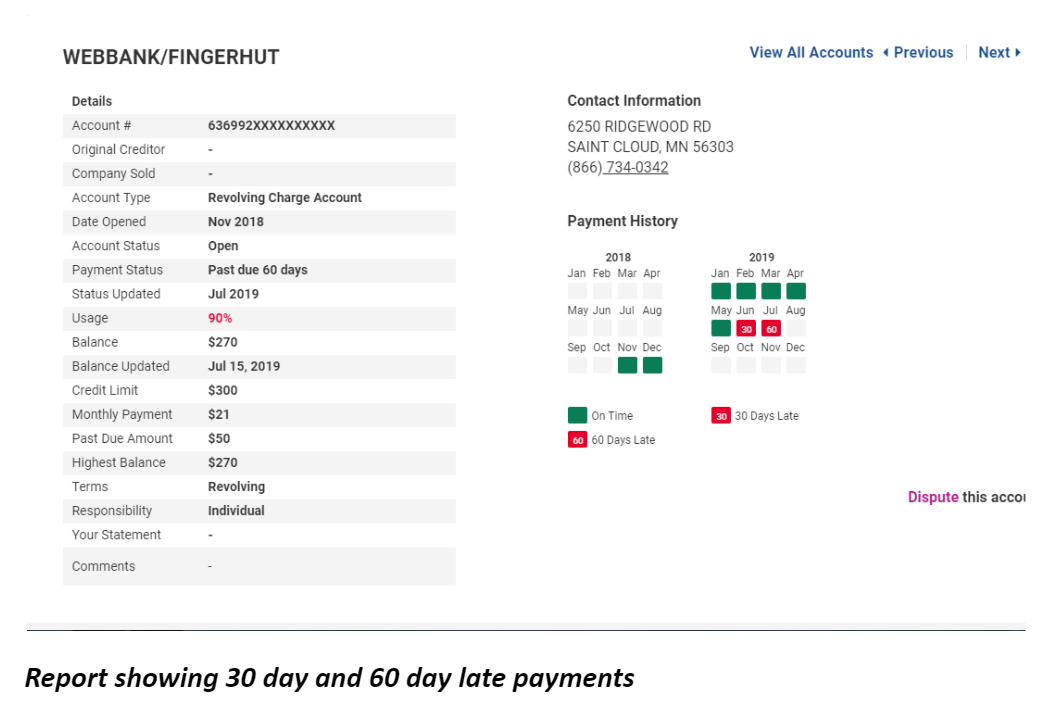

- Delinquency Status: The impact worsens with the length of delinquency. A 30-day late payment is less damaging than a 60-day or 90+ day delinquency, which can severely impact your creditworthiness and potentially lead to loan default.

Understanding the Different Types of Student Loans and Their Impact

The type of student loan you have – federal or private – significantly impacts how missed payments affect your credit and the potential consequences.

Federal student loans are backed by the government, offering various repayment plans and protections. However, persistent non-payment leads to default, triggering serious consequences like wage garnishment and tax refund offset. Private student loans, on the other hand, are issued by banks and other private lenders. Defaulting on a private student loan often results in being sent to collections, negatively impacting your credit score and potentially leading to legal action.

- Federal Loan Default: Wage garnishment, tax refund offset, inability to obtain federal financial aid in the future.

- Private Loan Default: Collection agency involvement, potential lawsuits, significant damage to credit score.

- Loan Type Variations: Subsidized and unsubsidized federal loans, as well as parent PLUS loans, all have different implications regarding interest accrual and repayment, all impacting credit score if payments are missed.

Strategies to Avoid Missed Student Loan Payments

Proactive financial planning is crucial for avoiding missed student loan payments. Creating a realistic budget that allocates funds for student loan repayment is paramount. Explore different repayment options offered by your loan servicer. Income-driven repayment plans, extended repayment plans, and deferment/forbearance options (although these should be used cautiously as interest may continue to accrue) can provide flexibility. Don't hesitate to contact your loan servicer; they might offer solutions to prevent delinquency.

- Budgeting Tips: Track your income and expenses meticulously. Allocate a specific amount for student loan repayment each month.

- Repayment Plan Options: Research income-driven repayment (IDR) plans like ICR, PAYE, REPAYE, andIBR; these base your monthly payments on your income and family size. Consider extended repayment plans for a longer repayment period with lower monthly payments.

- Loan Servicer Contact: Contact your loan servicer immediately if you anticipate difficulties making payments. They might offer temporary solutions such as deferment or forbearance.

- Deferment/Forbearance: These offer temporary pauses in payments but often accrue interest. They should be used strategically and sparingly.

Recovering from Missed Student Loan Payments

Repairing your credit after missed student loan payments requires time and consistent effort. The most effective strategy is to establish a consistent history of on-time payments on all your accounts. Consider credit counseling to learn better financial management techniques. While credit repair services exist, be wary of their costs and claims. Always monitor your credit reports regularly to ensure accuracy and identify any potential problems early.

- Dispute Inaccurate Information: If you find inaccuracies on your credit report, dispute them immediately with the credit bureaus.

- Positive Payment History: Building a positive payment history demonstrates your commitment to responsible financial management.

- Free Credit Reports: Obtain your free credit reports annually from AnnualCreditReport.com to monitor your credit health.

- Credit Counseling Agencies: Seek guidance from reputable non-profit credit counseling agencies.

Protecting Your Credit Score from Missed Student Loan Payments

Missed student loan payments inflict serious damage on your credit score, limiting your future financial prospects. Proactive financial planning, responsible budgeting, and exploring available repayment options are key to preventing this. If you're struggling, don't wait; reach out to your loan servicer for assistance. Don't let missed student loan payments negatively affect your credit score. Take control of your finances today by exploring repayment options and seeking help if needed. Learn more about managing your student loans and protecting your credit.

Featured Posts

-

Tam Krwz Ky Dytng Layf Halyh Apdyts

May 17, 2025

Tam Krwz Ky Dytng Layf Halyh Apdyts

May 17, 2025 -

Valerio Therapeutics S A Postponement Of 2024 Financial Report And Statement Approval

May 17, 2025

Valerio Therapeutics S A Postponement Of 2024 Financial Report And Statement Approval

May 17, 2025 -

Tom Thibodeau And Mikal Bridges Resolving The Post Game Tension

May 17, 2025

Tom Thibodeau And Mikal Bridges Resolving The Post Game Tension

May 17, 2025 -

Iga Svjontek Dominira Pobjeda Nad Ukrajinkom I Povezane Vijesti

May 17, 2025

Iga Svjontek Dominira Pobjeda Nad Ukrajinkom I Povezane Vijesti

May 17, 2025 -

Best Online Casinos Canada 2025 A Comprehensive Comparison Including 7 Bit Casino

May 17, 2025

Best Online Casinos Canada 2025 A Comprehensive Comparison Including 7 Bit Casino

May 17, 2025