Monday Morning Stock Market Update: Live Music Sector Recovers

Table of Contents

Live Music Venue Stocks Surge After Pandemic Slump

Live music venue stocks are experiencing a significant rebound, reflecting the industry's robust comeback. Several factors contribute to this surge in concert venue investment opportunities:

- Increased Concert Attendance: Venues are reporting significantly higher attendance numbers compared to pre-pandemic levels, indicating a pent-up demand for live experiences.

- Strong Ticket Sales: Ticket sales are booming, reflecting not only increased attendance but also higher ticket prices in some cases, boosting revenue streams.

- Successful Safety Protocols: The successful implementation of safety measures and protocols has instilled confidence in concertgoers, contributing to higher attendance rates. Venues that effectively addressed public health concerns have seen particularly strong rebounds.

- Government Support (where applicable): Government aid and stimulus packages in some regions provided crucial support to struggling venues, enabling them to survive the downturn and rebuild. This financial assistance played a vital role in the recovery of many.

- Examples of Strong Performers: [Insert examples of specific venues showing strong performance and their stock ticker symbols here. For example: "Live Nation Entertainment (LYV) has seen a significant increase in its stock price, reflecting the company's strong performance."].

Streaming and Recorded Music Revenue Continues to Support the Sector

While live performances are crucial, streaming and recorded music revenue continue to provide a strong foundation for the live music industry. The interconnection between these sectors is undeniable:

- Impact of Major Streaming Platforms: Platforms like Spotify, Apple Music, and others have become essential revenue sources for artists, fostering a more stable financial environment, even during periods when live performances were limited.

- Growth in Digital Music Consumption: The continued growth in digital music consumption has broadened the audience reach for artists and labels, creating new opportunities for monetization.

- Increased Artist Royalties: While debates continue about the fairness of royalty payments, the increased overall revenue from streaming has resulted in higher payouts for many artists, improving their financial stability and potentially influencing their ability to tour.

- Examples of Publicly Traded Music Streaming Companies: [Insert examples of publicly traded music streaming companies and their recent performance here. For example: "Spotify's consistent growth in subscribers translates to increased revenue for the platform and ultimately, for the artists they represent."]

Challenges Remain for the Live Music Sector

Despite the positive signs, challenges persist for the live music sector. These headwinds could impact future growth:

- Inflationary Pressures and Rising Operational Costs: Rising inflation is impacting operational expenses, from venue rentals and equipment to staffing costs, squeezing profit margins.

- Difficulties in Securing Talent and Managing Artist Contracts: The competition for top artists and the complexities of artist contracts can pose significant challenges for venues and promoters.

- Supply Chain Disruptions: Supply chain issues continue to affect the availability and cost of equipment, potentially delaying projects or increasing expenses.

- Geopolitical Uncertainties: Global events and geopolitical uncertainties can disrupt touring schedules, impacting revenue and artist availability.

Long-Term Outlook and Investment Strategies

The long-term outlook for the live music sector remains positive, driven by the enduring appeal of live experiences. However, investors should adopt a cautious approach:

- Investment Opportunities: While the recovery is encouraging, careful assessment of individual companies and their risk profiles is essential. Diversification across different segments of the industry (venues, streaming platforms, artist management) is recommended.

- Long-Term Growth: The long-term growth potential is substantial, particularly with the continued expansion of digital platforms and the increasing global demand for live entertainment.

- Stock Market Predictions: While predicting the future is impossible, analysts generally hold a positive outlook on the sector’s long-term potential.

- Portfolio Diversification: Integrating live music stocks into a diversified portfolio can help manage risk and capitalize on potential growth.

- Risk Assessment: Thorough due diligence and risk assessment are critical when considering investments in this sector.

Conclusion

This Monday Morning Stock Market Update highlights the remarkable recovery of the live music sector. While challenges remain, the increased concert attendance, strong ticket sales, and continued support from streaming revenue paint a positive picture. Understanding the interplay between live performances, streaming, and recorded music revenue is key to assessing investment opportunities within this dynamic industry. Stay tuned for our next Monday Morning Stock Market Update to track the continued recovery of the live music industry and discover more potential investment opportunities. Consider researching specific companies and sectors to further refine your investment strategy in this exciting and evolving market.

Featured Posts

-

Alcaraz Vs Musetti A 2025 Monte Carlo Masters Final Preview

May 30, 2025

Alcaraz Vs Musetti A 2025 Monte Carlo Masters Final Preview

May 30, 2025 -

Unexpected Prediction Paddy Pimblett On Jones Vs Aspinall Ufc Heavyweight Clash

May 30, 2025

Unexpected Prediction Paddy Pimblett On Jones Vs Aspinall Ufc Heavyweight Clash

May 30, 2025 -

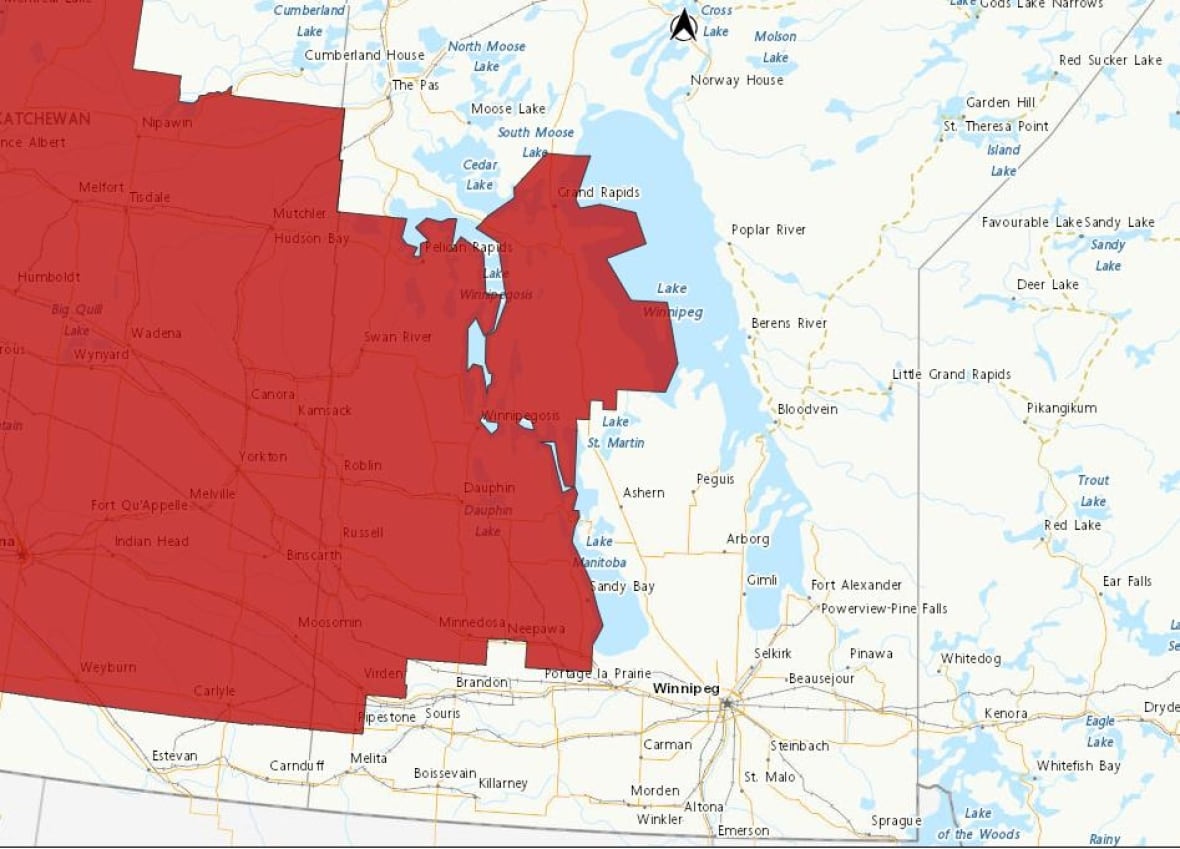

Significant Snowfall Warning For Western Manitoba Up To 20 Cm Tuesday

May 30, 2025

Significant Snowfall Warning For Western Manitoba Up To 20 Cm Tuesday

May 30, 2025 -

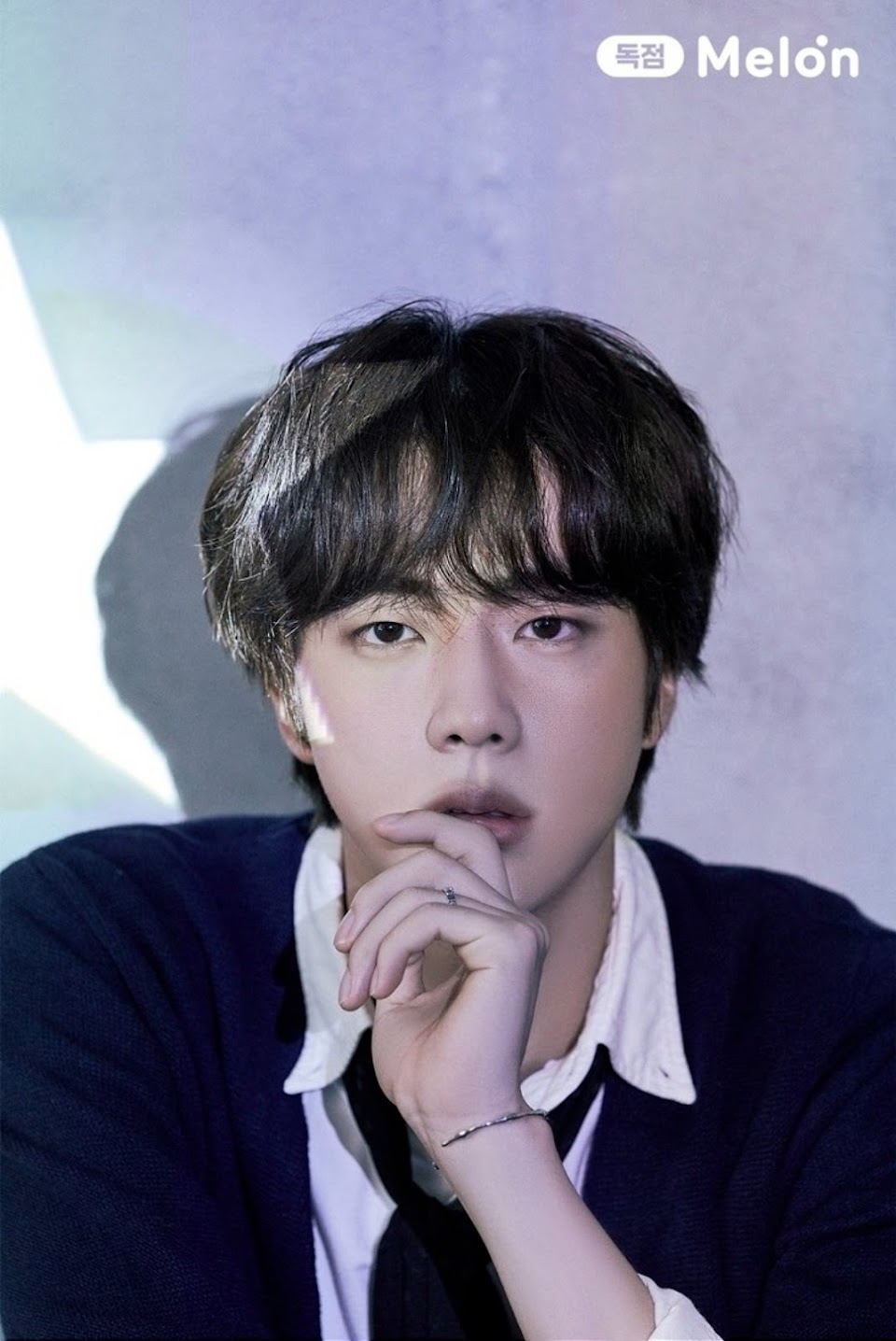

Bts Return On The Horizon Jins Promise At Coldplay Concert

May 30, 2025

Bts Return On The Horizon Jins Promise At Coldplay Concert

May 30, 2025 -

California Coast Suffers The Impact Of Toxic Algae Blooms On Marine Ecosystems

May 30, 2025

California Coast Suffers The Impact Of Toxic Algae Blooms On Marine Ecosystems

May 30, 2025