Mortgage Term Length In Canada: The Case Against 10 Years

Table of Contents

The Risk of Predictability: Interest Rate Fluctuations and 10-Year Mortgages

Locking into a 10-year mortgage term means committing to a specific interest rate for a decade. While this offers predictability in monthly payments, it also presents significant risk. Interest rates are notoriously volatile, and committing to a long-term rate could leave you overpaying significantly if rates drop substantially during your term.

- Example Scenario 1: You lock into a 10-year mortgage at 5%. Two years later, interest rates fall to 3%. You're paying considerably more than necessary for the remaining eight years.

- Example Scenario 2: You lock into a 10-year mortgage at a low rate. However, during the term, rates unexpectedly spike, causing financial strain despite initially favorable terms.

- Refinancing a 10-year mortgage before the term ends is possible, but it incurs additional costs, including penalties and legal fees. These fees can negate some or all of the potential savings from a rate decrease.

- While interest rate forecasting can help, it's far from an exact science. Predicting rate movements with certainty over a 10-year period is virtually impossible.

Financial Flexibility: Why Shorter Terms Offer Greater Control

In today's unpredictable economic climate, financial flexibility is paramount. A shorter-term mortgage, such as a 5-year term, provides significantly greater control over your finances.

- Easier Refinancing: Shorter terms allow for more frequent refinancing opportunities. You can renegotiate your interest rate every five years, taking advantage of lower rates when they become available.

- Rate Renegotiation: The ability to renegotiate your interest rate more often provides a significant advantage over a 10-year fixed-rate mortgage.

- Payment Control: Shorter terms give you more control over your monthly payments. If your financial situation changes, you have more flexibility to adjust your mortgage payments more frequently.

Long-Term Planning and Life Changes: The Unexpected Curveballs

Life throws curveballs. Job loss, unexpected medical expenses, family changes – these events can significantly impact your ability to make mortgage payments. A 10-year mortgage leaves you less adaptable to such unforeseen circumstances.

- Job Loss: Losing your job can make a long-term mortgage commitment incredibly difficult to maintain.

- Family Changes: Having a child or experiencing a major life change can significantly alter your budget and ability to manage a long-term mortgage.

- Financial Strain: The financial strain of unexpected events can be amplified with a long-term mortgage commitment. A shorter term provides a safety net by allowing you to re-evaluate and potentially adjust your mortgage strategy every few years.

Alternatives to 10-Year Mortgages in Canada

Canada offers various mortgage terms beyond the standard 10-year option. Consider these alternatives:

- 5-Year Term: Offers a balance between stability and flexibility.

- 1-Year Term: Provides maximum flexibility but requires more frequent rate adjustments.

- Open Mortgage: Allows for increased flexibility in terms of payments but usually carries a higher interest rate.

- Closed Mortgage: Offers fixed payments and interest rates, but less flexibility.

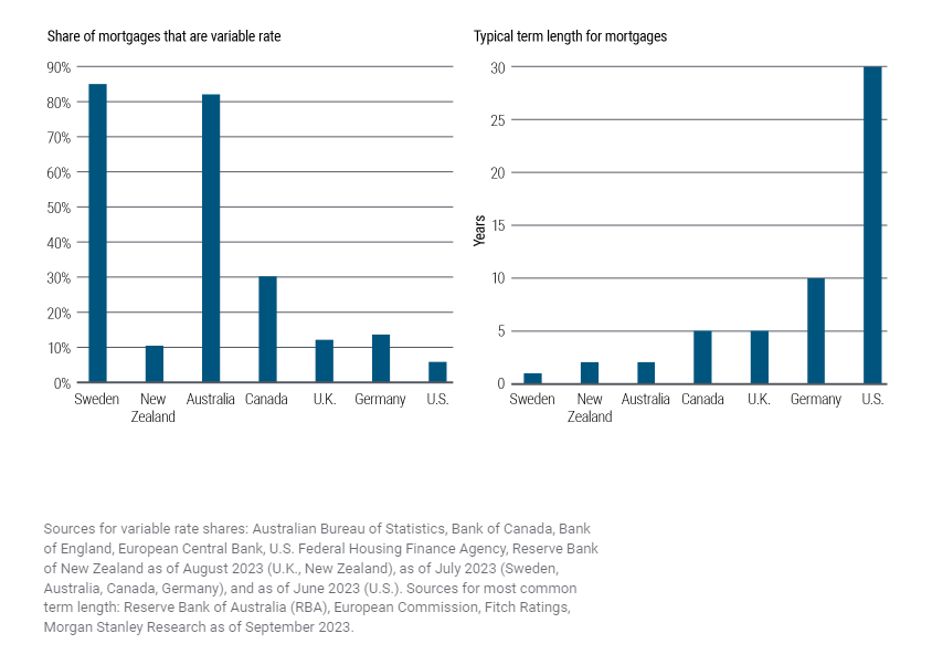

Comparison Chart: (This section would ideally include a table comparing different mortgage terms, interest rates, and features. Due to the dynamic nature of interest rates, this table needs to be populated with current data from a reliable source).

Consult a mortgage broker to discuss which term best suits your needs and risk tolerance.

Conclusion: Choosing the Right Mortgage Term Length for Your Needs

A 10-year mortgage in Canada offers predictability, but this comes at the cost of significant financial risk associated with interest rate fluctuations and a lack of flexibility. Shorter-term mortgages provide greater control over your finances, allowing you to adapt to changing economic conditions and unexpected life events. Don't lock yourself into a potentially costly 10-year mortgage. Explore shorter-term options and regain control of your financial future. Contact a mortgage professional today to discuss your options and find the mortgage term length that best fits your individual needs and financial goals!

Featured Posts

-

Max Verstappen Reveals Babys Name Ahead Of Miami Race

May 04, 2025

Max Verstappen Reveals Babys Name Ahead Of Miami Race

May 04, 2025 -

Le Plus Grand Parc De Batteries De Belgique Ouvert A Au Roeulx Par Eneco

May 04, 2025

Le Plus Grand Parc De Batteries De Belgique Ouvert A Au Roeulx Par Eneco

May 04, 2025 -

La Rental Market Exploited After Fires A Celebritys Accusation

May 04, 2025

La Rental Market Exploited After Fires A Celebritys Accusation

May 04, 2025 -

Gaza Alerte De Macron Sur Une Possible Militarisation De L Aide Humanitaire Par Israel

May 04, 2025

Gaza Alerte De Macron Sur Une Possible Militarisation De L Aide Humanitaire Par Israel

May 04, 2025 -

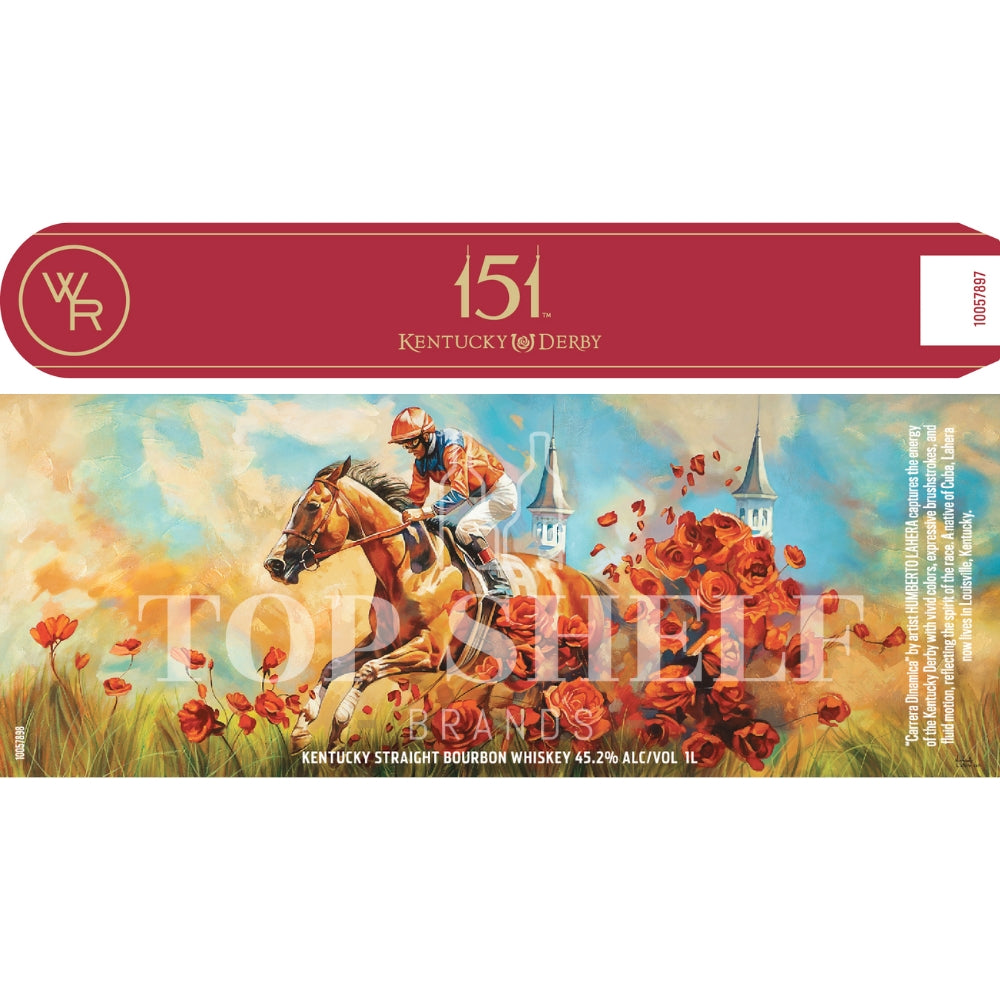

Kentucky Derby 151 A Spectators Pre Race Checklist

May 04, 2025

Kentucky Derby 151 A Spectators Pre Race Checklist

May 04, 2025