Musk's Focus Under Scrutiny: State Treasurers Challenge Tesla's Board

Table of Contents

The State Treasurers' Concerns

Several state treasurers, responsible for managing public pension funds often invested in Tesla stock, have voiced serious concerns about Elon Musk's leadership and the Tesla board's effectiveness. Their primary objections center around potential conflicts of interest stemming from Musk's involvement in other significant ventures like SpaceX and X (formerly Twitter). These treasurers argue that Musk's divided attention and extensive commitments elsewhere detract from his focus on Tesla, potentially jeopardizing the company's long-term success and the value of their investments.

- Specific examples of conflicts of interest: Critics point to instances where Musk's decisions regarding Tesla appear to benefit his other companies, potentially at the expense of Tesla shareholders. For example, the use of Tesla resources or personnel for projects related to SpaceX or X has raised eyebrows.

- Concerns about Tesla's board effectiveness: The state treasurers question the board's ability to effectively oversee Musk, given his dominant influence and the breadth of his other business interests. They suggest a lack of robust oversight mechanisms to prevent conflicts of interest from arising and impacting Tesla's performance.

- Impact on Tesla's stock price and investor confidence: The ongoing scrutiny surrounding Musk's leadership and the concerns raised by state treasurers have undeniably impacted Tesla's stock price and investor confidence. Volatility in the stock market reflects the uncertainty surrounding the company's future direction.

- Specific proposals or demands: While the exact demands vary, many treasurers have called for increased board independence, improved corporate governance practices, and a greater focus on mitigating potential conflicts of interest to protect Tesla's long-term value.

Musk's Response and Tesla's Defense

Musk has yet to directly address many of the specific concerns raised by the state treasurers in a comprehensive manner. Tesla's official response has largely focused on highlighting the company's achievements and defending Musk's leadership as integral to its success.

- Direct quotes from Musk or Tesla representatives: While there haven't been direct public responses to every criticism, Tesla's communications frequently emphasize Musk's visionary leadership and innovative contributions to the electric vehicle industry.

- Arguments presented by Tesla in defense of its board and Musk's leadership: Tesla's defense generally points to its continued growth, market leadership in electric vehicles, and Musk's role as a driving force behind its innovations. The company emphasizes its commitment to shareholder value and ongoing efforts to maintain sound corporate governance.

- Actions taken by Tesla in response to the criticism: So far, Tesla hasn't announced significant structural changes in response to the criticism, focusing instead on continued growth and development within its existing framework. However, increased transparency regarding Musk's time allocation and involvement in various projects could be a future development.

The Broader Implications for Corporate Governance

The challenge to Tesla's board raises critical questions about corporate governance best practices, particularly concerning the oversight of CEOs with extensive business portfolios. This situation underscores the need for stronger mechanisms to prevent and manage potential conflicts of interest.

- Discussion of best practices in corporate governance: The situation highlights the need for independent boards with robust oversight mechanisms, clear conflict of interest policies, and transparent reporting processes.

- Analysis of the potential impact on other companies with similar leadership structures: The Tesla case serves as a cautionary tale for other companies with CEOs involved in multiple large ventures. It emphasizes the importance of effective board oversight and robust corporate governance to mitigate risks associated with such structures.

- The role of shareholder activism in holding companies accountable: The actions of the state treasurers demonstrate the power of shareholder activism in holding corporations accountable for their governance practices and protecting investor interests. This case highlights the influence of large institutional investors in driving positive change.

The Future of Tesla Under Scrutiny

The long-term consequences of this challenge remain uncertain. Several potential scenarios exist, each carrying significant implications for Tesla.

- Potential scenarios for Tesla's future: Potential outcomes range from minor adjustments to corporate governance practices to more significant changes, including potential leadership changes or alterations in the company's strategic direction.

- Expert opinions on the situation: Experts in corporate governance and the automotive industry offer varied opinions, with some believing the situation necessitates significant reforms, while others remain confident in Tesla's ability to navigate the challenges.

- Prediction of the impact on Tesla's stock price and investor sentiment: The ongoing scrutiny is expected to continue influencing Tesla's stock performance and investor confidence, leading to further volatility in the short to medium term. The eventual resolution of these concerns will significantly shape investor sentiment.

Conclusion

This challenge to Tesla's board by state treasurers underscores the increasing scrutiny of Elon Musk's leadership and the complexities of corporate governance in the face of multifaceted business ventures. The outcome of this conflict will have significant implications for Tesla's future, impacting not only its stock performance but also setting precedents for corporate responsibility and shareholder activism. The debate highlights the crucial role of effective board oversight in preventing and managing conflicts of interest, a lesson applicable to numerous companies beyond Tesla.

Call to Action: Stay informed about the evolving situation surrounding Musk's leadership and the challenges facing Tesla's board. Continue to follow the latest developments in the ongoing scrutiny of Tesla's corporate governance and the impact on its future. Further research into the implications of this case on corporate governance best practices is vital to understanding how to effectively manage conflicts of interest within large companies, ensuring both ethical conduct and shareholder value.

Featured Posts

-

Updated Sanctions Switzerland Targets Russian Media In Line With Eu

Apr 23, 2025

Updated Sanctions Switzerland Targets Russian Media In Line With Eu

Apr 23, 2025 -

Chainalysis And Alterya Merge The Future Of Blockchain Investigations

Apr 23, 2025

Chainalysis And Alterya Merge The Future Of Blockchain Investigations

Apr 23, 2025 -

Artfae Am Ankhfad Thlyl Ser Aldhhb Alywm Balsaght

Apr 23, 2025

Artfae Am Ankhfad Thlyl Ser Aldhhb Alywm Balsaght

Apr 23, 2025 -

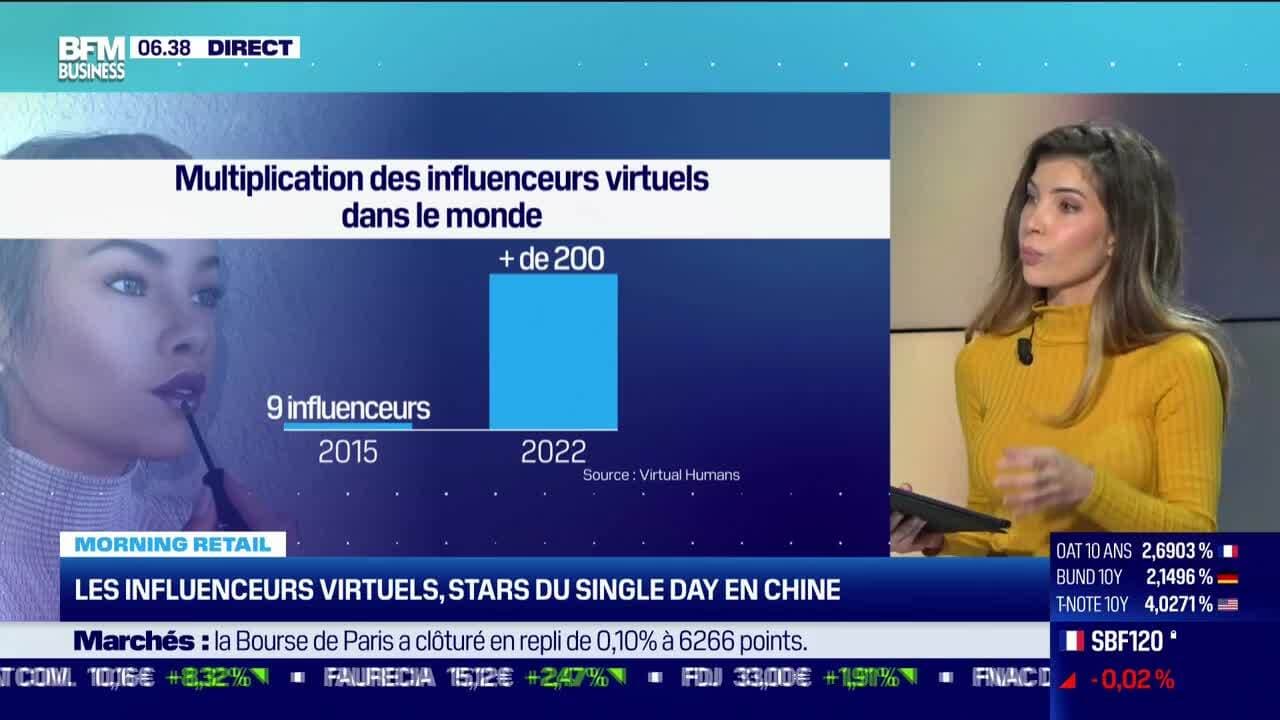

Nutriscore Dans Le Morning Retail Les Meilleures Options Pour Un Petit Dejeuner Sain

Apr 23, 2025

Nutriscore Dans Le Morning Retail Les Meilleures Options Pour Un Petit Dejeuner Sain

Apr 23, 2025 -

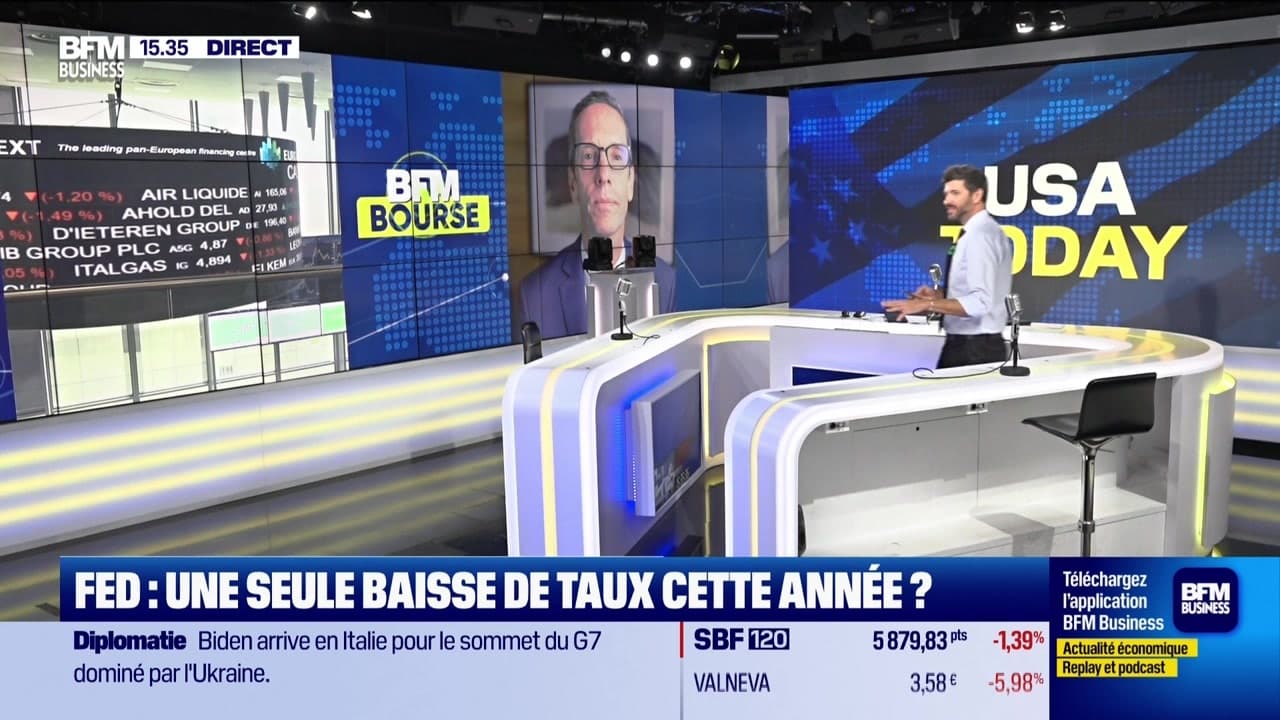

Depenses Militaires Usa Russie L Analyse De John Plassard Usa Today

Apr 23, 2025

Depenses Militaires Usa Russie L Analyse De John Plassard Usa Today

Apr 23, 2025