Musk's SpaceX Holdings: A $43 Billion Increase Over Tesla Investment

Table of Contents

SpaceX's Meteoric Rise: From Private Company to Multi-Billion Dollar Enterprise

SpaceX's journey from a fledgling private company to a multi-billion dollar enterprise is nothing short of extraordinary. Its innovative approach to space travel, coupled with significant technological breakthroughs, has redefined the landscape of the rocket industry. Key achievements, such as the development of reusable rockets like the Falcon 9, the Dragon capsule for cargo and crew transport to the International Space Station, and the ambitious Starlink satellite internet constellation, have fueled its rapid expansion.

Several factors contribute to SpaceX's meteoric rise:

- SpaceX technology: The company's relentless focus on innovation, particularly the reusability of the Falcon 9, drastically reduced launch costs, making space travel more accessible and economically viable.

- SpaceX contracts: Securing lucrative contracts with NASA and other government agencies, alongside commercial contracts for satellite launches, provided crucial funding and validated SpaceX's capabilities.

- SpaceX innovation: The Starlink project, aiming to provide global broadband internet access through a vast network of satellites, represents a groundbreaking undertaking with massive growth potential. This exemplifies SpaceX's commitment to disruptive innovation within the space industry.

Bullet Points:

- Successful Falcon 9 launches and reusability: The Falcon 9's reusability significantly lowered launch costs, a key factor in SpaceX's competitive advantage.

- Securing lucrative NASA and other government contracts: These contracts provided critical funding and demonstrated SpaceX's technological prowess and reliability.

- The rapid expansion of Starlink satellite internet: Starlink's potential to generate substantial revenue streams is a major driver of SpaceX's overall valuation.

- Strategic partnerships and collaborations: SpaceX has forged strategic partnerships, leveraging external expertise and resources to further its ambitions.

Comparing SpaceX and Tesla Investments: A Tale of Two Titans

Musk's investments in both SpaceX and Tesla represent distinct yet interconnected ventures. While precise figures regarding his initial investments in SpaceX remain undisclosed, the current valuation clearly surpasses his original stake in Tesla. This highlights the immense potential and returns associated with the space exploration sector.

Comparing these investments reveals differing risk profiles:

- Musk's investments: While both ventures carried inherent risks, Tesla operated within a more established market (automotive), while SpaceX ventured into a relatively nascent space (private space exploration).

- Tesla valuation: Tesla's valuation, though considerable, has experienced its own fluctuations. SpaceX's recent surge indicates a robust trajectory, further emphasizing the potential of private space ventures.

- SpaceX vs Tesla: The contrast underscores Musk's strategic diversification across various high-growth sectors. His success in both demonstrates his exceptional foresight and entrepreneurial acumen.

- Investment strategy: Musk’s investment strategy highlights the importance of diversification across different sectors with high growth potential.

Bullet Points:

- Direct comparison of initial investment amounts in both companies: While precise figures for SpaceX are unavailable, the significant increase in SpaceX's valuation compared to Tesla’s highlights the remarkable growth.

- Analysis of return on investment (ROI) for both: SpaceX's ROI significantly surpasses Tesla's based on current valuations.

- Discussion of the differing risk factors associated with each venture: SpaceX’s higher risk translated into substantially higher potential returns.

- Comparison of market capitalization and growth trajectories: SpaceX's growth trajectory, particularly in recent years, has outpaced that of Tesla.

The Implications of SpaceX's Valuation: Future of Space Exploration and Musk's Influence

SpaceX's soaring valuation has profound implications for the broader space exploration industry. It signifies a significant shift towards increased private sector involvement and the potential for accelerated technological advancement. The influx of private investment, spurred by SpaceX's success, will likely fuel competition and innovation, leading to further breakthroughs in space technology.

Bullet Points:

- Increased private investment in space exploration: SpaceX's success is inspiring other private companies to enter the space exploration market.

- Potential for further technological advancements due to competition: Increased competition will drive innovation and push technological boundaries.

- The impact on government space programs: Government space programs may adapt their strategies in response to the growing influence of the private sector.

- Musk's influence as a visionary entrepreneur: Musk's vision and leadership have significantly shaped the trajectory of the space industry.

Conclusion: Investing in the Future with SpaceX and Elon Musk

SpaceX's remarkable $43 billion valuation increase underscores the immense potential of private space exploration. Its success, when compared to even the significant growth of Tesla, highlights the transformative impact of innovative technologies and bold entrepreneurial vision. This surge signals a new era in space travel, promising increased accessibility and advancements previously deemed unimaginable. Learn more about SpaceX and the exciting future of the space industry to understand the opportunities that await. Understanding the explosive growth of SpaceX holdings offers valuable insights into the dynamic world of private space exploration and investment.

Featured Posts

-

Outcry Over Xs Blocking Of Turkish Mayors Account

May 10, 2025

Outcry Over Xs Blocking Of Turkish Mayors Account

May 10, 2025 -

5 Notable Disputes Stephen King And His Celebrity Rivals

May 10, 2025

5 Notable Disputes Stephen King And His Celebrity Rivals

May 10, 2025 -

Wow High Potentials Finale Proves Its Potential

May 10, 2025

Wow High Potentials Finale Proves Its Potential

May 10, 2025 -

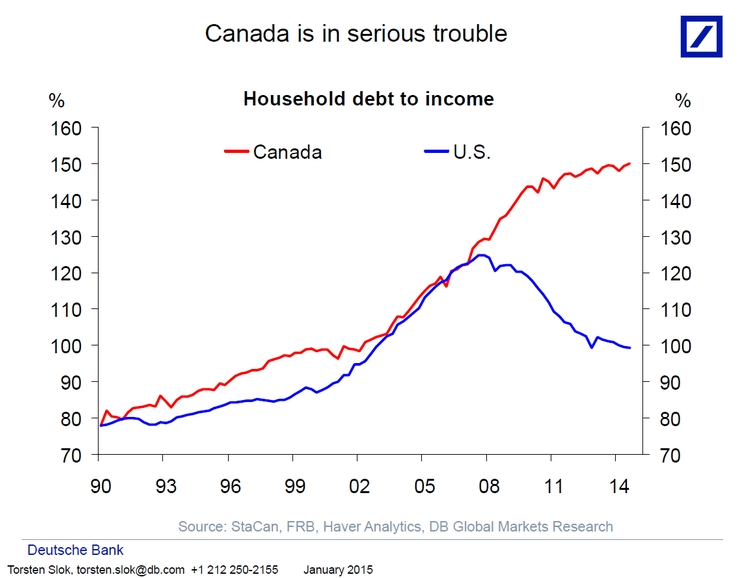

The Impact Of Large Down Payments On Canadian Homebuyers

May 10, 2025

The Impact Of Large Down Payments On Canadian Homebuyers

May 10, 2025 -

Vegas Golden Knights Defeat Minnesota Wild In Overtime Barbashev Scores Series Tied

May 10, 2025

Vegas Golden Knights Defeat Minnesota Wild In Overtime Barbashev Scores Series Tied

May 10, 2025