Musk's X Debt: A Financial Deep Dive Into The Company's Transformation

Table of Contents

The Acquisition Debt: A Mountain to Climb

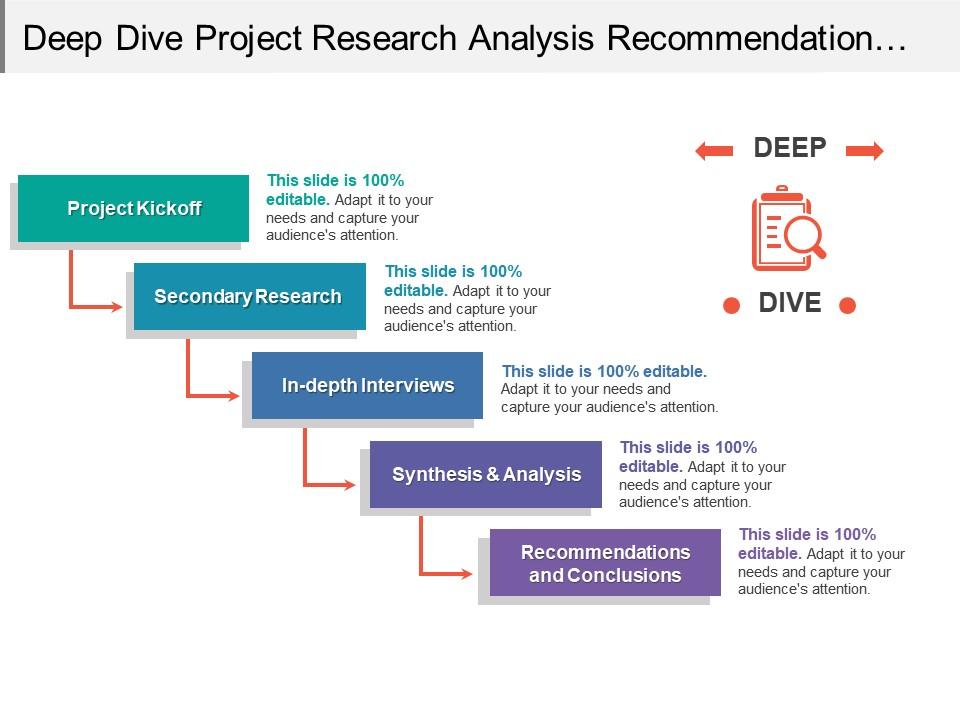

The acquisition of Twitter by Elon Musk was a leveraged buyout, resulting in a massive accumulation of acquisition debt. The deal, finalized in late 2022, saddled X with a significant financial burden, impacting its financial health immediately. The financing relied heavily on a mix of loans and equity, creating a complex and potentially precarious financial structure.

- Loan Amounts and Interest Rates: While precise figures aren't publicly available for all loan components, estimates suggest billions of dollars in high-yield debt, carrying potentially high interest rates. The exact terms remain largely opaque, adding to the uncertainty surrounding X's financial future.

- Key Lenders: A consortium of banks and financial institutions participated in providing the loans necessary for the acquisition. The identities of these lenders and the specifics of their agreements remain partially undisclosed, limiting public scrutiny of the debt structure.

- Loan Maturity Dates: The maturity dates of these loans are crucial. If a significant portion of the debt comes due within a short timeframe, X will face an immense refinancing challenge, potentially exacerbating its financial difficulties.

This leveraged buyout strategy, while enabling the acquisition, immediately placed an immense strain on X's cash flow and its ability to invest in growth initiatives or weather economic downturns. The high-yield debt associated with the Twitter acquisition cost represents a considerable risk factor for the platform's long-term financial stability.

X's Revenue Streams and Debt Servicing Challenges

X's current revenue streams primarily consist of advertising revenue and, to a lesser extent, subscription revenue from its premium service, X Blue. However, generating sufficient revenue to service its substantial debt obligations presents a significant challenge.

- Advertising Revenue Trends: The advertising market is notoriously volatile. Economic downturns can significantly impact advertising spending, directly affecting X's ability to generate the cash flow necessary for debt servicing. Competition from other social media platforms also puts pressure on advertising rates.

- Subscription Model Performance: While X Blue offers a new revenue stream, its contribution to overall revenue is still relatively small compared to advertising. The success of this subscription model is crucial for X's long-term financial health.

- Potential New Revenue Streams: Exploring and implementing new revenue streams beyond advertising and subscriptions is critical for X's financial stability. This could include features like enhanced API access for developers or partnerships with other businesses.

The economic climate plays a significant role. A prolonged economic downturn could severely impair X's capacity to meet its debt payments, potentially leading to default or requiring drastic financial restructuring.

Musk's Strategies for Managing X's Debt

To manage X's substantial debt burden, Elon Musk might employ several strategies, each with its own set of challenges and potential risks.

- Cost-Cutting Measures: X has already implemented significant cost-cutting measures, including layoffs and reductions in operational expenses. Further cost reductions are possible, but they could negatively impact product development and user experience.

- Asset Sales: Selling off non-core assets could generate cash to help reduce the debt. However, identifying and selling such assets without significantly disrupting X's operations is a complex task.

- Equity Financing: Raising additional capital through equity financing (selling shares) would dilute existing shareholders' ownership but could provide much-needed liquidity. Attracting investors in the current economic climate might be difficult.

- Debt Restructuring: Negotiating with lenders to restructure the debt – potentially extending repayment terms or lowering interest rates – could offer some relief. However, this requires cooperation from lenders and may still leave X with a substantial debt burden.

Specific examples of cost-cutting include the reduction of its workforce and renegotiation of various contracts. Potential assets for sale could include real estate holdings or less critical aspects of the platform's infrastructure. The challenges associated with each strategy involve both internal operational disruption and the external financial climate.

The Long-Term Outlook: Navigating Financial Uncertainty

The long-term financial outlook for X remains uncertain. The considerable debt load and the competitive landscape of social media present significant headwinds. Musk's overall business strategy will significantly influence X's financial stability.

- Potential Scenarios: Several scenarios are possible, ranging from successful debt management and sustained revenue growth to default and potential bankruptcy. The outcome will depend on many factors, including economic conditions, competitive pressures, and Musk's strategic choices.

- Competition: Intense competition from established social media platforms like Facebook, Instagram, and TikTok poses a significant threat to X's user base and advertising revenue.

- Regulatory Risks: Regulatory scrutiny and potential legal challenges could also negatively affect X's financial performance.

The overall risk assessment indicates a complex situation. The interplay of debt levels, revenue generation, and external factors creates significant uncertainty regarding X's long-term viability.

Conclusion: The Future of Musk's X Debt – A Path Forward

The analysis reveals a significant debt burden weighing heavily on X. Musk's approach to managing this debt will significantly influence the platform's future. Cost-cutting, asset sales, equity financing, and debt restructuring are potential strategies, each with its own set of challenges and risks. The long-term consequences depend on the success of these strategies in conjunction with market conditions and competitive pressures. Musk's leadership will be critical in determining X's long-term financial health. What are your thoughts on Musk's approach to Musk's X debt and the platform's future? Share your opinions in the comments below! Read more on this topic in our related articles on navigating business debt and financial strategies for tech companies.

Featured Posts

-

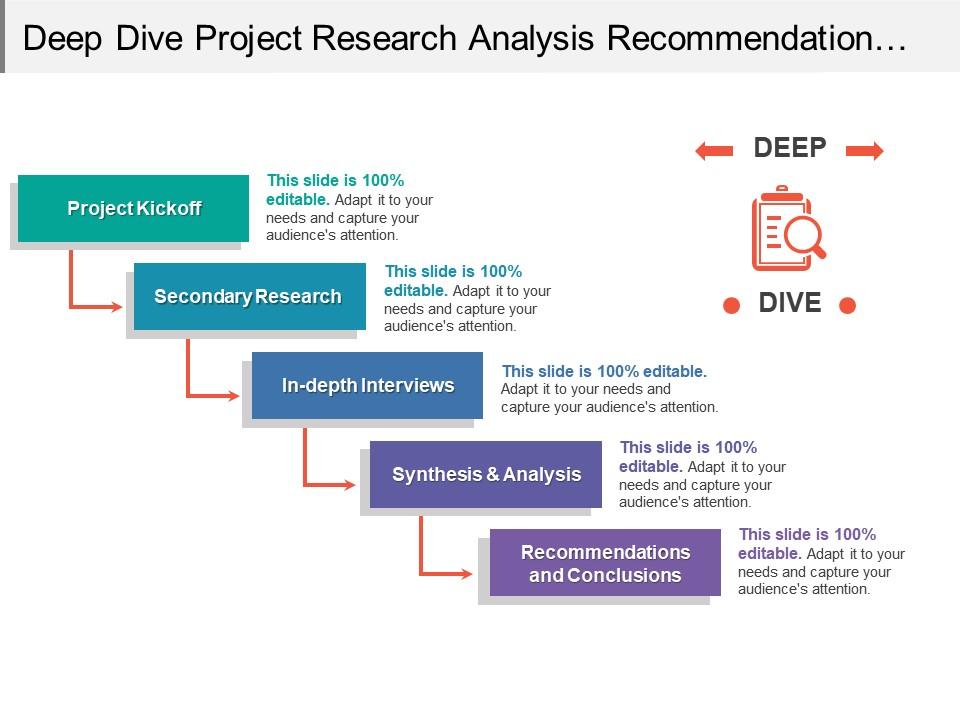

Upcoming Memoir From Cassidy Hutchinson Insights From A Key January 6th Witness

Apr 28, 2025

Upcoming Memoir From Cassidy Hutchinson Insights From A Key January 6th Witness

Apr 28, 2025 -

Could Aaron Judge Play In The 2026 World Baseball Classic

Apr 28, 2025

Could Aaron Judge Play In The 2026 World Baseball Classic

Apr 28, 2025 -

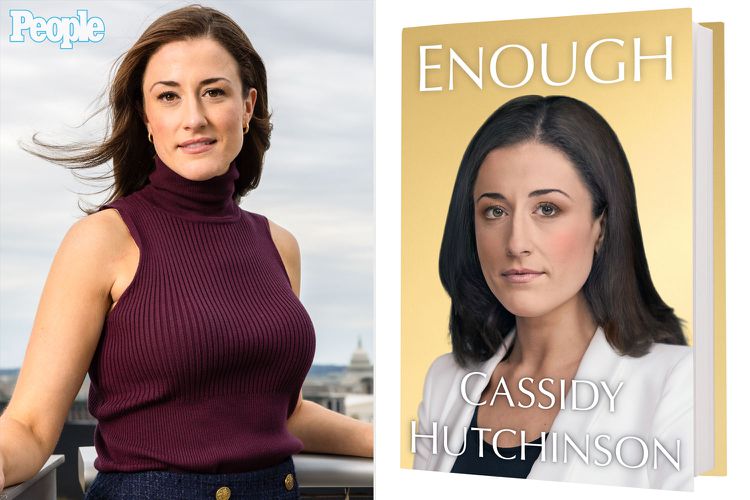

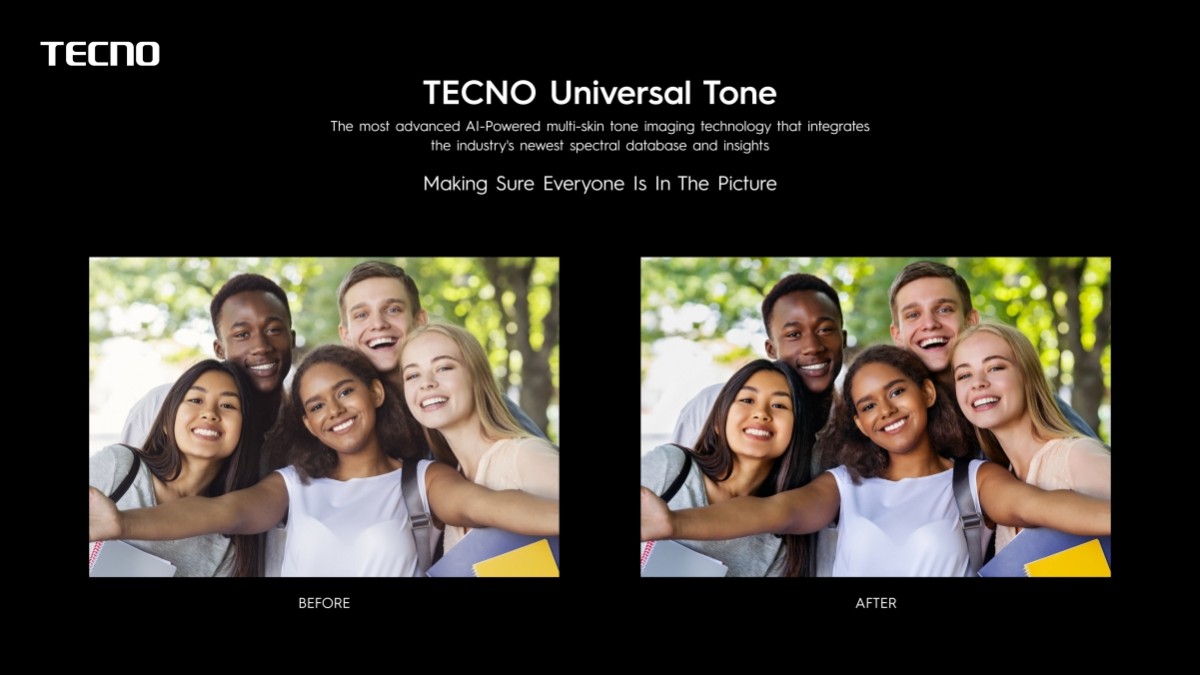

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Exploring The Florida Keys From Railroad To Overwater Highway

Apr 28, 2025

Exploring The Florida Keys From Railroad To Overwater Highway

Apr 28, 2025 -

Contempt Motion Looms Over Yukon Mine Managers Refusal To Testify

Apr 28, 2025

Contempt Motion Looms Over Yukon Mine Managers Refusal To Testify

Apr 28, 2025

Latest Posts

-

Mc Ilroy And Lowrys Zurich Classic Defense A Six Shot Climb

May 12, 2025

Mc Ilroy And Lowrys Zurich Classic Defense A Six Shot Climb

May 12, 2025 -

Zurich Classic Mc Ilroy Lowry Face Six Shot Deficit In Title Defense

May 12, 2025

Zurich Classic Mc Ilroy Lowry Face Six Shot Deficit In Title Defense

May 12, 2025 -

Mirniy Plan Trampa Ta Reaktsiya Borisa Dzhonsona Na Nogo

May 12, 2025

Mirniy Plan Trampa Ta Reaktsiya Borisa Dzhonsona Na Nogo

May 12, 2025 -

Analiz Mirnogo Planu Trampa Kritika Vid Borisa Dzhonsona

May 12, 2025

Analiz Mirnogo Planu Trampa Kritika Vid Borisa Dzhonsona

May 12, 2025 -

Dzhonson Vs Tramp Rizni Pidkhodi Do Mirnogo Vregulyuvannya V Ukrayini

May 12, 2025

Dzhonson Vs Tramp Rizni Pidkhodi Do Mirnogo Vregulyuvannya V Ukrayini

May 12, 2025