Musk's X Debt Sale: New Financials Reveal A Transforming Company

Table of Contents

The Details of the X Debt Sale

X's debt sale involved a significant capital raise, the specifics of which are crucial to understanding the company's financial strategy. While precise figures may vary depending on the reporting source, the sale likely involved billions of dollars in new debt. The terms of the sale, including interest rates and maturity dates, will significantly influence X's future financial obligations and its ability to meet those obligations. Understanding these terms is key to assessing the risk associated with this financing strategy.

- Specific amount of debt raised: While exact figures remain somewhat fluid depending on final closings, reports suggest a multi-billion dollar debt issuance.

- Type of debt: The debt likely consists of a combination of high-yield bonds and potentially syndicated bank loans. The specific mix will affect the overall cost of capital.

- Key terms of the debt agreement: The terms – including interest rates, covenants, and maturity dates – will influence X's financial flexibility and future debt servicing capacity. These terms will be scrutinized by credit rating agencies and investors alike.

- Credit rating agencies' assessment of the debt: Agencies like Moody's and S&P will assess the creditworthiness of X and assign a rating to the new debt. This rating will impact the interest rate X pays and the attractiveness of the debt to investors.

- How the funds will be used: The proceeds from the debt sale are expected to be used for several purposes, including refinancing existing debt, investing in artificial intelligence (AI) technologies, and upgrading the platform's infrastructure.

The impact of this debt on X's long-term financial health is a critical consideration. The debt-to-equity ratio will likely increase, potentially leading to higher financial risk. The increased interest expense will also impact profitability, requiring X to generate sufficient revenue to cover these payments. The chosen financing method, while providing immediate capital, introduces a degree of risk associated with high-yield debt.

X's Shifting Financial Landscape

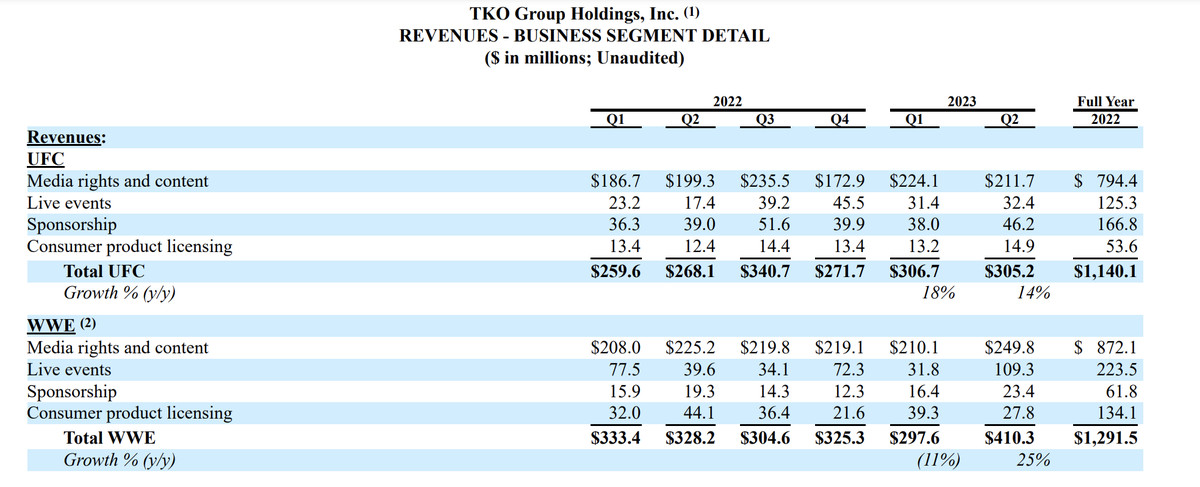

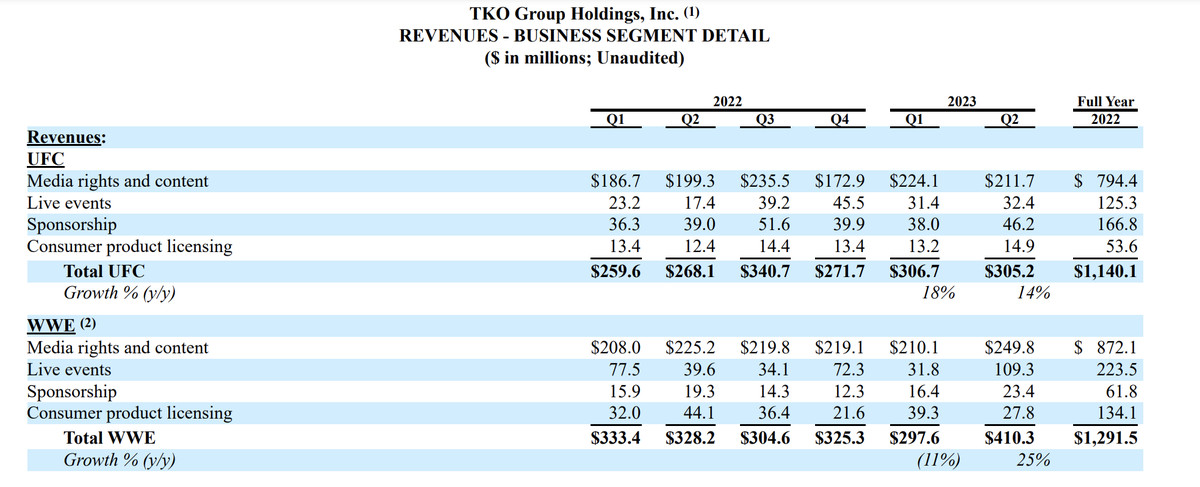

X's recent financial performance reveals a company undergoing significant change. Analyzing key metrics provides insight into the challenges and opportunities facing the platform. Comparing current financials to previous periods – both under previous ownership and Musk's leadership – offers a clearer picture of the company's trajectory.

- Revenue growth (or decline): Revenue growth (or lack thereof) compared to prior years will showcase the impact of Musk's changes on the company's revenue generation capacity.

- Key cost drivers: Employee salaries, infrastructure upgrades, and content moderation costs are all significant cost drivers that impact X's profitability. Understanding these costs is crucial for evaluating the financial health of the company.

- Profitability metrics (e.g., net income, EBITDA): Analyzing profitability metrics will highlight the effectiveness of Musk's strategies in driving profitability. The interplay between revenue and expense management will determine X's overall financial success.

- User growth and engagement metrics: User growth and engagement are critical metrics for a social media platform. Decreases in user activity could negatively impact advertising revenue and overall valuation.

- Comparison with competitors' financial performance: Benchmarking against competitors like Meta (Facebook) and Alphabet (Google) will provide context to X's financial performance and identify areas for improvement.

Challenges facing X include increased competition from other social media platforms, regulatory scrutiny related to content moderation and data privacy, and maintaining user retention in a crowded market. Musk's strategic decisions and their impact on the company's financial performance require careful scrutiny.

Strategic Implications of the Debt Sale

Musk's stated goals for X – often described as transforming it into an "everything app" – have major implications for the company's future. The debt sale aligns with these ambitious objectives by providing the capital necessary to pursue various strategic initiatives.

- Musk's vision for X's future: This vision encompasses broader integration of various services and features beyond its core social media function.

- How the raised capital will support these objectives: Funds may be used for acquisitions of complementary companies, development of new features, and expansion into new markets.

- Potential acquisitions or investments: Strategic acquisitions or investments in areas like payments, e-commerce, or AI could significantly shape X's future trajectory.

- The role of AI integration in X's future: AI is likely to play a central role in X's future, impacting everything from content moderation to personalized user experiences.

- Expected impact on user experience: Changes driven by the debt-fueled initiatives could significantly impact the user experience, potentially increasing user engagement or causing dissatisfaction.

The debt sale could influence X's competitive position significantly, either enhancing it through strategic acquisitions and technological advancements or weakening it through an increased debt burden. The long-term impact on X's market valuation depends on the successful implementation of Musk's vision and the company's ability to manage its financial obligations.

Investor and User Reactions to the Debt Sale

The market's response to the X debt sale offers valuable insight into investor sentiment. The reactions of users are equally important, as they directly influence the platform's long-term success.

- Stock price reaction (if applicable): Stock price movements reflect investor confidence in the company's future prospects in light of the debt sale.

- Analyst opinions and ratings: Financial analysts will provide their assessment of the debt sale's impact on X's financial health and long-term value.

- User sentiment on social media and other platforms: User feedback on social media platforms offers a valuable gauge of their opinion on the debt sale and Musk's strategy.

- Potential implications for advertisers and content creators: Changes related to the debt sale may affect advertising revenue and the platform's overall attractiveness to content creators.

- Impact on X's long-term sustainability: The debt sale's long-term impact hinges on X's capacity to effectively manage its financial risks and continue to grow and innovate.

Investors should consider the risks and rewards associated with X, considering the company's significant debt burden and the volatile nature of the social media landscape. The current financial climate and X's recent developments should all factor into any investment decision.

Conclusion

The debt sale by X marks a significant turning point in the company's history. While the financial details reveal a company navigating challenges, the strategic implications suggest an ambitious vision for the future. The success of this transformation hinges on X's ability to execute its plans effectively and navigate the complexities of a competitive market. Further analysis of Musk's X and its evolving financial situation will be crucial in understanding the long-term impact of this debt sale. Stay informed about future developments and follow the ongoing story of Musk's X debt sale to understand this transforming company's future.

Featured Posts

-

Justin Herbert Chargers 2025 Brazil Season Opener Confirmed

Apr 29, 2025

Justin Herbert Chargers 2025 Brazil Season Opener Confirmed

Apr 29, 2025 -

Parole Hearing Approaches For Ohio Doctor Convicted Of Wifes Murder 36 Years Ago

Apr 29, 2025

Parole Hearing Approaches For Ohio Doctor Convicted Of Wifes Murder 36 Years Ago

Apr 29, 2025 -

Winners Of Minnesota Snow Plow Naming Competition Announced

Apr 29, 2025

Winners Of Minnesota Snow Plow Naming Competition Announced

Apr 29, 2025 -

Capital Summertime Ball 2025 Everything You Need To Know About Tickets

Apr 29, 2025

Capital Summertime Ball 2025 Everything You Need To Know About Tickets

Apr 29, 2025 -

Missing Person British Paralympian Last Seen In Las Vegas

Apr 29, 2025

Missing Person British Paralympian Last Seen In Las Vegas

Apr 29, 2025