Navigate The Private Credit Boom: 5 Do's And Don'ts To Get Hired

Table of Contents

Do's: Maximize Your Chances in the Private Credit Job Market

1. Network Strategically

Building a strong network is paramount in the private credit industry. Don't underestimate the power of connections.

- LinkedIn Optimization: Craft a compelling LinkedIn profile highlighting your skills and experience in areas relevant to private credit, such as financial modeling, credit analysis, and due diligence. Actively engage with industry professionals and join relevant groups.

- Industry Events: Attend conferences, workshops, and seminars related to private credit, alternative lending, and investment management. These events provide invaluable networking opportunities with potential employers and peers. Look for events focused on private debt, mezzanine financing, or distressed debt, depending on your area of interest.

- Informational Interviews: Reach out to professionals working in private credit firms for informational interviews. This is a fantastic way to learn about their experiences, gain insights into the industry, and make valuable connections.

- Targeted Networking: Don't cast a wide net. Identify specific private credit firms whose investment strategies align with your interests and target your networking efforts accordingly.

2. Highlight Relevant Skills & Experience

Your resume and cover letter are your first impression. Make them count.

- Tailored Applications: Never submit a generic application. Carefully tailor your resume and cover letter to each specific job description, emphasizing the skills and experience most relevant to the role. Highlight keywords from the job posting.

- Quantifiable Achievements: Quantify your accomplishments whenever possible. Instead of saying "improved portfolio performance," say "increased portfolio returns by 15% through strategic investment decisions in leveraged lending."

- Showcase Expertise: Demonstrate your knowledge of various private credit strategies, including leveraged lending, distressed debt, mezzanine financing, and real estate debt. Mention specific software proficiency (e.g., Bloomberg Terminal, Argus).

- Build Your Online Presence: Create a strong online presence showcasing your expertise. Consider writing articles, blog posts, or LinkedIn posts on relevant topics within the private credit or alternative credit space.

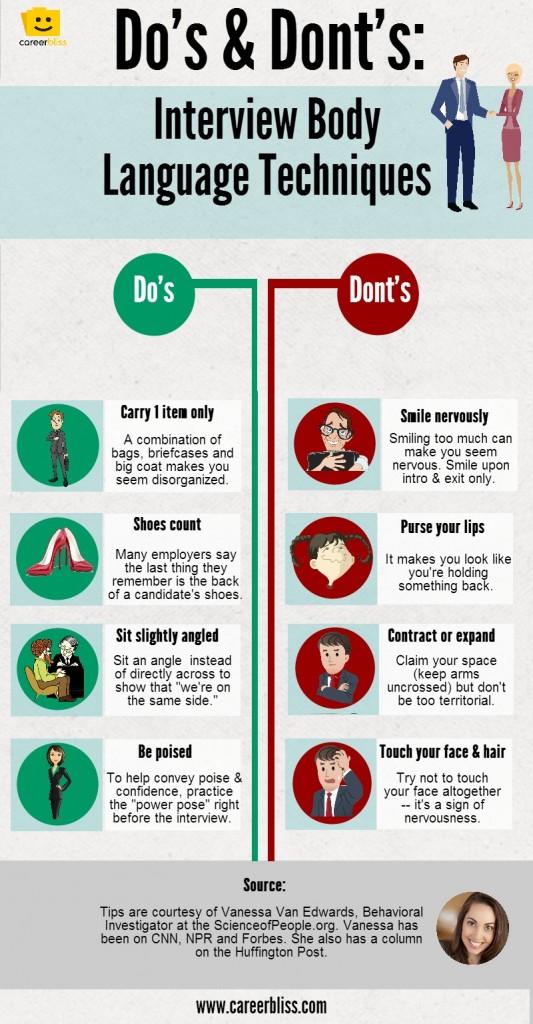

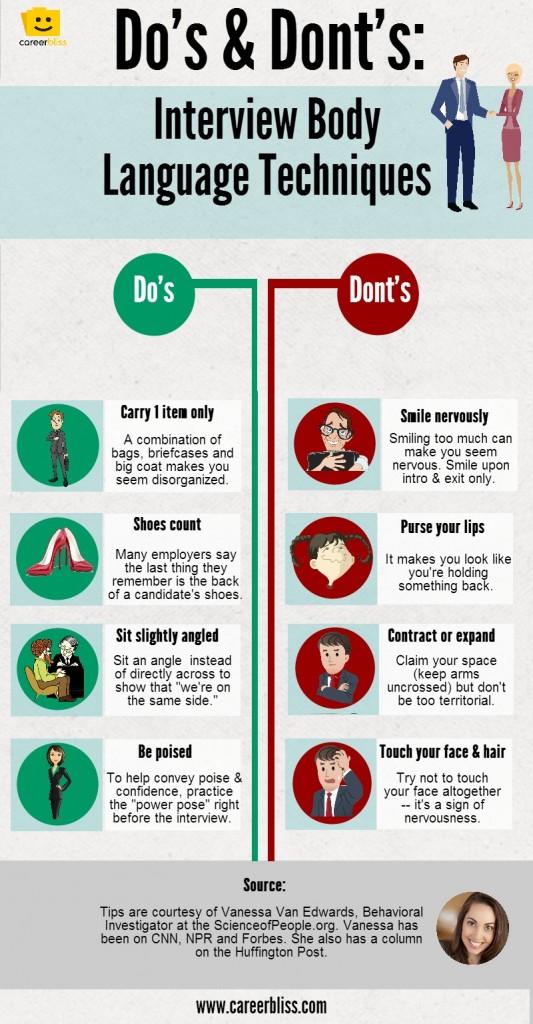

3. Master the Interview Process

The interview is your chance to shine. Preparation is key.

- Practice Makes Perfect: Practice your responses to common private credit interview questions, focusing on behavioral questions ("Tell me about a time you failed") and technical questions related to financial modeling, valuation, and credit analysis.

- Thorough Research: Research the firm, its investment strategy, its portfolio companies, and the interviewer. Demonstrate your understanding of their approach to private debt or alternative credit investments.

- Market Awareness: Stay informed about market trends, regulatory changes like Dodd-Frank, and current events impacting the private credit industry. Demonstrate this knowledge during the interview.

- Ask Thoughtful Questions: Prepare insightful questions to ask the interviewer, demonstrating your genuine interest and understanding of the role and the firm.

Don'ts: Avoid These Common Pitfalls in Your Private Credit Job Search

1. Submit Generic Applications

Avoid this common mistake. Private credit firms seek highly specialized skills.

- Tailored Approach: Never send the same resume and cover letter to multiple firms. Each application should be meticulously tailored to the specific job description and the firm's investment strategy.

- Research the Firm: Thoroughly research the firm's investment thesis, portfolio companies, and recent transactions before applying. This shows genuine interest and understanding.

2. Underestimate the Importance of Networking

Networking is not optional; it's essential in the private credit world.

- Beyond Job Boards: Don't rely solely on online job boards. Networking events, informational interviews, and building relationships on platforms like LinkedIn are crucial.

- Informational Interviews are Valuable: Don't underestimate the power of informational interviews. They provide unparalleled insights into the industry and can lead to unexpected opportunities.

3. Lack Preparation for Technical Questions

Private credit interviews are rigorous. Technical prowess is expected.

- Master the Fundamentals: Be prepared to answer in-depth technical questions regarding financial modeling, valuation, credit analysis, and accounting principles (IFRS, GAAP).

- Practice Your Skills: Brush up on your financial modeling skills, and practice common valuation techniques and credit analysis methodologies before your interviews.

Conclusion

Landing a job in the booming private credit sector requires a strategic and proactive approach. By diligently following these do's and don'ts—mastering your networking skills, showcasing your relevant expertise, and acing the interview process—you significantly increase your chances of securing your dream private credit job. Don't delay—start navigating the private credit boom today and leverage these strategies to land your ideal role in this dynamic and rewarding industry. Begin your private credit job search now!

Featured Posts

-

Olivia Rodrigo Stays True To Her Signature Style At The 2025 Grammys

Apr 25, 2025

Olivia Rodrigo Stays True To Her Signature Style At The 2025 Grammys

Apr 25, 2025 -

Zelenskiy Faces Pressure From Trump For War Deal As Russia Launches Missile Attacks On Ukraine

Apr 25, 2025

Zelenskiy Faces Pressure From Trump For War Deal As Russia Launches Missile Attacks On Ukraine

Apr 25, 2025 -

The Dark Side Of Betting Exploiting The Los Angeles Wildfires

Apr 25, 2025

The Dark Side Of Betting Exploiting The Los Angeles Wildfires

Apr 25, 2025 -

Pozitsiya Trampa Schodo Viyni V Ukrayini Analiz Ritoriki

Apr 25, 2025

Pozitsiya Trampa Schodo Viyni V Ukrayini Analiz Ritoriki

Apr 25, 2025 -

The Trump Auto Tariff Effect Renaults Scrapped Us Sports Car Venture

Apr 25, 2025

The Trump Auto Tariff Effect Renaults Scrapped Us Sports Car Venture

Apr 25, 2025