Navigate The Private Credit Boom: 5 Do's And Don'ts To Secure Your Next Role

Table of Contents

Do's: Maximizing Your Chances in the Private Credit Job Market

Successfully navigating the private credit job market requires proactive and strategic actions. Here are five key "do's" to boost your chances of landing your dream role.

Do #1: Network Strategically within Private Credit Circles

Networking is paramount in the private credit industry. Don't rely solely on online job boards.

- Attend industry events: Conferences, seminars, and workshops offer excellent opportunities to meet professionals and learn about current market trends.

- Leverage LinkedIn: Join relevant LinkedIn groups, participate in discussions, and connect with individuals working in private credit. Actively engage, share insightful comments, and build relationships.

- Conduct informational interviews: Reach out to professionals in private credit for informational interviews. These conversations can provide valuable insights, advice, and potential job leads. Remember to express your gratitude and follow up.

- Target specific firms: Research firms known for their expertise in areas that align with your skills and interests (e.g., leveraged buyouts, distressed debt, mezzanine financing). Tailor your approach to each firm's unique investment strategy.

Remember to highlight your network's impact on your job search in your resume and cover letter. Quantify your connections and the value they've brought to your career development.

Do #2: Tailor Your Resume and Cover Letter for Private Credit Roles

Generic applications rarely succeed in a competitive market like private credit.

- Quantify your accomplishments: Instead of simply stating your responsibilities, use numbers to demonstrate the impact of your work. For example, instead of "Managed a portfolio of assets," write "Managed a $50 million portfolio of assets, resulting in a 15% increase in ROI."

- Incorporate relevant keywords: Use keywords commonly found in private credit job descriptions, such as leveraged buyouts, distressed debt, credit analysis, financial modeling, valuation, covenant compliance, and due diligence.

- Showcase your understanding: Demonstrate your knowledge of private credit investment strategies, market trends, and regulatory frameworks. Mention any relevant coursework, certifications, or projects.

Do #3: Develop In-Demand Private Credit Skills

The private credit industry demands a specific skillset. Continuously upgrade your capabilities.

- Master financial modeling: Proficiency in Excel and financial modeling software is crucial. Practice building complex models and interpreting financial statements.

- Refine valuation techniques: Understand different valuation methodologies and their applications in private credit transactions.

- Hone credit analysis skills: Develop expertise in assessing credit risk, structuring debt, and analyzing financial statements.

- Obtain relevant certifications: Consider pursuing certifications such as the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) to enhance your credibility.

- Highlight alternative investment experience: If you have experience in other alternative investment strategies (e.g., hedge funds, private equity), showcase this experience to highlight your transferable skills.

Do #4: Prepare for Behavioral and Technical Private Credit Interviews

Private credit interviews are rigorous and demand thorough preparation.

- Practice common interview questions: Prepare answers to behavioral questions (e.g., "Tell me about a time you failed," "Describe your leadership style") and technical questions related to financial modeling, valuation, and credit analysis.

- Prepare case studies: Practice analyzing case studies that involve private credit investments. Be prepared to discuss your approach, assumptions, and conclusions.

- Research the firm: Thoroughly research the firm's investment strategy, recent transactions, and team culture. Demonstrate your knowledge during the interview.

Do #5: Follow Up Effectively After Private Credit Interviews

Following up demonstrates your continued interest and professionalism.

- Send thank-you notes: Send personalized thank-you notes within 24 hours of each interview, reiterating your interest and highlighting key discussion points.

- Follow up strategically: After a reasonable timeframe (e.g., a week after the interview), follow up with a brief email checking on the status of the hiring process. Avoid excessive follow-up.

- Maintain contact: Even if you don't receive an offer, maintain professional contact with interviewers. This can lead to future opportunities.

Don'ts: Common Mistakes to Avoid in Your Private Credit Job Search

Avoiding common pitfalls is just as important as actively pursuing opportunities. Here are five critical "don'ts" to keep in mind.

Don't #1: Apply for Every Private Credit Role Without Targeting

Applying indiscriminately is inefficient and ineffective.

- Focus on relevant roles: Target roles that align with your skills, experience, and career goals.

- Research the company: Understand the firm's culture, investment philosophy, and team dynamics before applying.

- Tailor each application: Don't use a generic cover letter and resume. Customize your application materials to each specific role and company.

Don't #2: Neglect the Importance of Networking

Networking is not merely optional; it's essential.

- Don't underestimate its power: Personal connections significantly increase your chances of securing a role in the private credit industry.

- Actively engage: Attend industry events, participate in online discussions, and connect with professionals on LinkedIn.

Don't #3: Underestimate the Importance of Due Diligence

Thorough research is crucial before applying to any firm.

- Research thoroughly: Understand the firm's investment strategies, recent deals, and team dynamics.

- Assess firm culture: Research the company's culture and values to ensure a good fit.

Don't #4: Fail to Prepare for Technical Questions

Technical proficiency is a cornerstone of success in private credit.

- Brush up on skills: Strengthen your financial modeling, valuation, and credit analysis skills.

- Practice case studies: Practice answering case study questions related to private credit investments.

Don't #5: Neglect Follow-up Communication

Following up demonstrates your persistence and professionalism.

- Follow up promptly: Send timely and thoughtful follow-up communications.

- Maintain professional contact: Don't disappear after the interview; maintain professional contact to stay top-of-mind.

Securing Your Place in the Thriving Private Credit Sector

Securing a role in the competitive private credit market requires a strategic approach. By diligently following the "do's" and carefully avoiding the "don'ts" outlined above, you can significantly increase your chances of landing your dream role. Remember to network strategically, tailor your applications, develop in-demand skills, prepare thoroughly for interviews, and follow up effectively. By implementing these strategies, you can successfully navigate your private credit job search and secure a rewarding career in this dynamic and growing sector. Start your strategic job search today!

Featured Posts

-

Judge Orders Release Of Detained Tufts Student Rumeysa Ozturk

May 10, 2025

Judge Orders Release Of Detained Tufts Student Rumeysa Ozturk

May 10, 2025 -

Show Of Support For Wynne Evans As He Addresses Accusations

May 10, 2025

Show Of Support For Wynne Evans As He Addresses Accusations

May 10, 2025 -

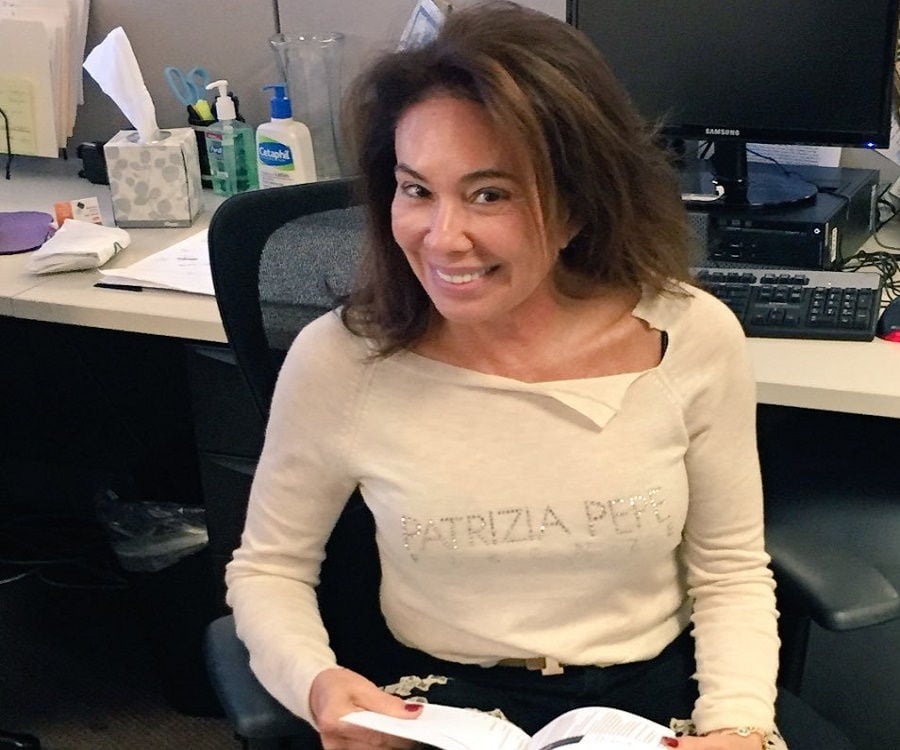

Behind The Scenes With Judge Jeanine Pirro Fears And A Personal Confession

May 10, 2025

Behind The Scenes With Judge Jeanine Pirro Fears And A Personal Confession

May 10, 2025 -

Psgs Winning Formula Luis Enriques Impact On The French Champions

May 10, 2025

Psgs Winning Formula Luis Enriques Impact On The French Champions

May 10, 2025 -

Senate Democrats Accusation Pam Bondi And Hidden Epstein Records

May 10, 2025

Senate Democrats Accusation Pam Bondi And Hidden Epstein Records

May 10, 2025