Navigate The Private Credit Boom: 5 Key Do's And Don'ts

Table of Contents

Do Your Due Diligence: Understanding Private Credit Investments

Entering the world of private credit requires a thorough understanding of the investment landscape. Rushing into investments without proper research can lead to significant financial setbacks. Due diligence is paramount.

Thoroughly Research Potential Investments:

Don't rush into private credit investments. Due diligence is crucial. A comprehensive assessment is necessary before committing any capital. This involves:

- Independently verify financial statements and projections: Don't rely solely on the information provided by the borrower. Engage independent experts to verify the accuracy and reliability of financial data. This includes scrutinizing cash flow projections and assessing their reasonableness.

- Assess the borrower's management team and their track record: The quality of the management team is a critical factor in determining the success of a private credit investment. Investigate their experience, expertise, and past performance. Look for evidence of strong leadership and a history of successful business ventures.

- Analyze the underlying collateral and its valuation: Understanding the collateral securing the loan is crucial, especially in the event of default. Obtain independent valuations to ensure the collateral accurately reflects its market value. Consider potential risks to the collateral's value, such as obsolescence or market fluctuations.

- Understand the terms of the loan agreement completely: Carefully review all aspects of the loan agreement, including interest rates, fees, covenants, and repayment schedules. Seek professional legal advice to ensure you fully understand the terms and conditions.

- Seek professional advice from financial advisors specializing in private credit: Navigating the complexities of private credit requires specialized knowledge. Engaging a financial advisor with experience in this area can provide invaluable insights and guidance.

Diversify Your Private Credit Portfolio:

Don't put all your eggs in one basket. Diversification is a cornerstone of effective risk management in private credit. Spreading investments across various assets reduces your exposure to any single borrower or sector. This includes:

- Invest across different sectors and geographies: Diversification across sectors mitigates the impact of industry-specific downturns. Similarly, geographic diversification reduces exposure to regional economic shocks.

- Consider varying levels of seniority in your debt investments: Senior debt generally carries less risk than subordinated debt. Diversifying across seniority levels helps balance risk and return.

- Spread investments across multiple borrowers to reduce concentration risk: Concentrating investments in a few borrowers increases your exposure to the risk of default by a single entity. A well-diversified portfolio limits this risk.

- Explore different private credit strategies, such as direct lending or fund investments: Direct lending provides more control but requires greater expertise. Fund investments offer diversification but less control.

Don't Neglect Risk Management in the Private Credit Market

Private credit investments carry inherent risks. A robust risk management strategy is essential to mitigate potential losses.

Assess Credit Risk Appropriately:

Private credit carries inherent risks. Accurate assessment is essential. A thorough credit risk assessment should consider:

- Use robust credit scoring models and qualitative analysis: Quantitative credit scoring models provide a numerical assessment of creditworthiness. Qualitative analysis incorporates subjective factors, such as management quality and industry trends.

- Consider macroeconomic factors and their potential impact: Economic downturns can significantly impact borrowers' ability to repay loans. Analyzing macroeconomic factors helps anticipate potential risks.

- Evaluate the borrower’s ability to repay the loan under various scenarios (stress testing): Stress testing involves simulating different economic scenarios to assess the borrower's resilience under adverse conditions.

- Account for potential illiquidity risks associated with private credit: Private credit investments are often illiquid, making it difficult to quickly sell them if needed.

Understand Liquidity and Exit Strategies:

Private credit investments are often illiquid. Planning for liquidity is crucial. Before investing, you should have a clear understanding of:

- Factor in the longer-term nature of private credit investments when making decisions: Private credit investments typically have longer holding periods than publicly traded securities. Your investment strategy should reflect this longer-term horizon.

- Consider the potential for secondary market sales or refinancing options: While illiquid, some opportunities exist for selling private credit investments in secondary markets or refinancing them.

- Develop a clear exit strategy before investing: Having a pre-defined exit strategy helps ensure you can liquidate your investments when needed, minimizing potential losses.

Do Leverage Professional Expertise in Private Credit

Navigating the private credit market effectively requires specialized knowledge and expertise.

Seek Advice from Experienced Professionals:

Navigating the private credit market requires specialized knowledge. This includes:

- Consult with financial advisors experienced in private credit: Financial advisors specializing in private credit can provide valuable guidance on investment strategy, risk management, and due diligence.

- Utilize legal counsel specializing in private debt transactions: Legal counsel can help ensure compliance with relevant regulations and protect your interests in loan agreements.

- Engage with experienced investment managers in the private credit space: Experienced investment managers can provide insights into market trends, potential investment opportunities, and risk mitigation strategies.

Understand Legal and Regulatory Compliance:

Private credit investments are subject to various regulations. Understanding and adhering to these regulations is crucial:

- Stay abreast of relevant legal and regulatory changes: Regulations in the private credit market are subject to change. Staying informed about these changes is essential for compliance.

- Ensure all transactions comply with applicable laws and regulations: Non-compliance can lead to significant legal and financial consequences.

- Seek legal guidance to avoid potential legal pitfalls: Engaging legal counsel can help prevent costly mistakes and ensure your transactions are compliant.

Don't Overlook the Importance of Transparency and Communication

Effective communication and thorough documentation are essential for successful private credit investments.

Maintain Open Communication with Borrowers:

Effective communication is critical for success. This involves:

- Establish clear communication channels with borrowers: Regular communication allows for early detection of potential problems and proactive mitigation strategies.

- Regularly monitor the borrower's financial performance: Monitoring key financial metrics helps assess the borrower's ability to repay the loan.

- Proactively address any concerns or potential issues: Addressing problems early can prevent them from escalating into major issues.

Document Everything Thoroughly:

Meticulous record-keeping is essential in private credit transactions. This includes:

- Maintain detailed records of all transactions and communications: Thorough documentation provides a clear audit trail and helps ensure accountability.

- Securely store all important documents related to your private credit investments: Secure storage protects sensitive information and ensures easy access when needed.

- Use a standardized system for tracking and managing your investments: A well-organized system simplifies portfolio management and facilitates performance monitoring.

Do Regularly Review and Rebalance Your Private Credit Portfolio

Regular monitoring and adaptation are critical for long-term success in private credit.

Monitor Portfolio Performance Closely:

Regular monitoring helps identify potential problems early. This includes:

- Track key performance indicators (KPIs) related to your private credit portfolio: Key performance indicators provide insights into the overall performance of your investments.

- Regularly review your investment strategy and make adjustments as needed: Market conditions and your risk tolerance may change over time, requiring adjustments to your investment strategy.

- Stay informed about market trends and their potential impact on your investments: Keeping abreast of market trends helps you anticipate potential risks and opportunities.

Adapt Your Strategy Based on Market Conditions:

The private credit market is dynamic. Adaptability is key. This means:

- Adjust your investment strategy in response to changing market conditions: Market conditions can shift rapidly, requiring adjustments to your investment approach.

- Be prepared to rebalance your portfolio to manage risk: Rebalancing your portfolio helps maintain your desired level of risk exposure.

- Consider diversifying further or consolidating your holdings depending on market situations: Market conditions may dictate whether to diversify further or consolidate holdings to optimize returns and minimize risk.

Conclusion:

The private credit boom presents both significant opportunities and inherent risks. By following these five key do's and don'ts, investors and borrowers can navigate the complexities of this dynamic market more effectively. Remember that thorough due diligence, robust risk management, professional expertise, and consistent portfolio monitoring are crucial for success in the world of private credit. Don't hesitate to seek professional guidance when navigating the intricacies of private credit investments. Start planning your approach to private credit today!

Featured Posts

-

Liams Strange Behavior And Bridgets Stunning Discovery The Bold And The Beautiful April 16 Recap

Apr 24, 2025

Liams Strange Behavior And Bridgets Stunning Discovery The Bold And The Beautiful April 16 Recap

Apr 24, 2025 -

The Bold And The Beautiful Thursday April 3rd Recap Liams Collapse And Hopes New Living Situation

Apr 24, 2025

The Bold And The Beautiful Thursday April 3rd Recap Liams Collapse And Hopes New Living Situation

Apr 24, 2025 -

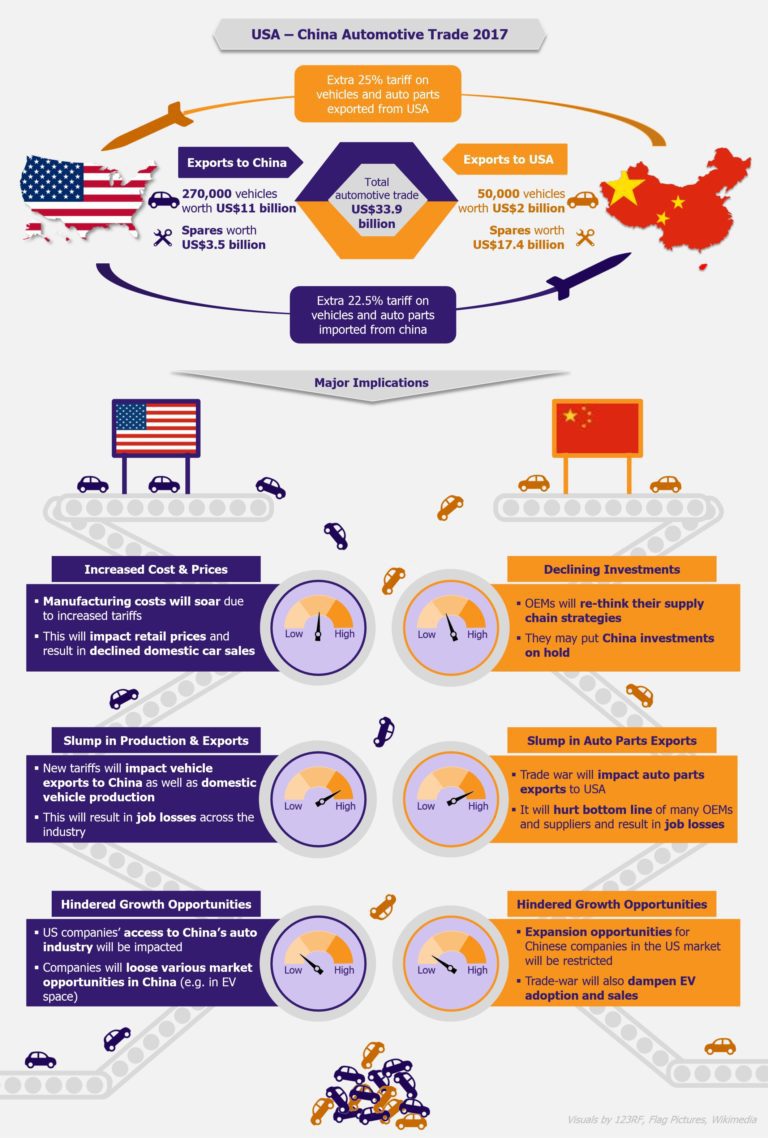

Facing Us Trade War Canadian Auto Dealers Release Crucial Five Point Plan

Apr 24, 2025

Facing Us Trade War Canadian Auto Dealers Release Crucial Five Point Plan

Apr 24, 2025 -

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue

Apr 24, 2025

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue

Apr 24, 2025 -

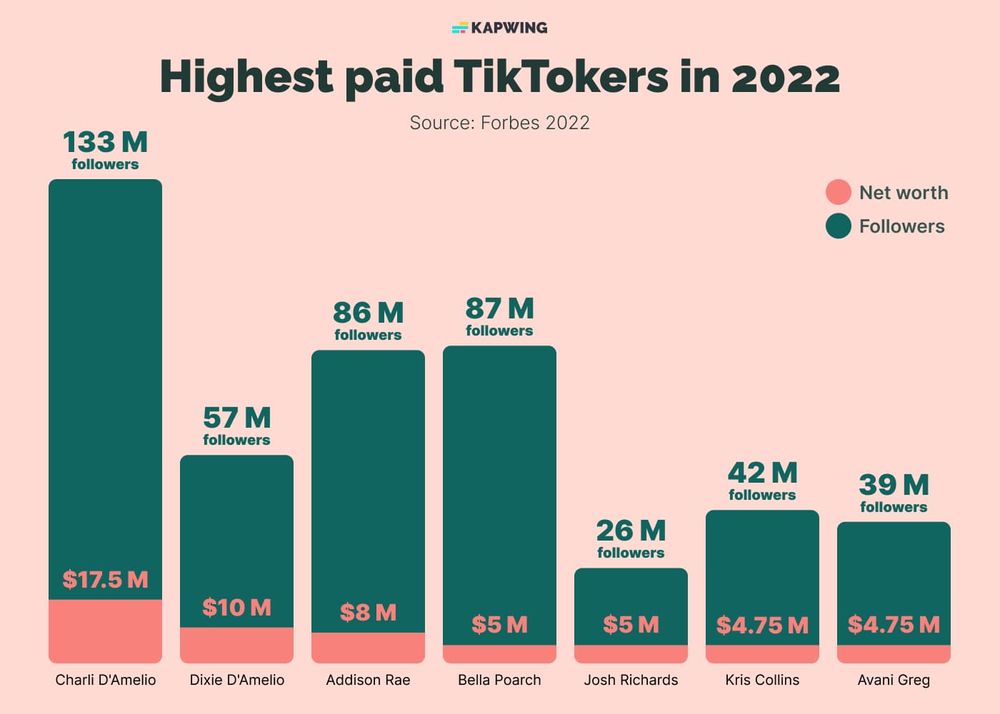

Instagrams Bid For Tik Tok Creators A Dedicated Video Editor

Apr 24, 2025

Instagrams Bid For Tik Tok Creators A Dedicated Video Editor

Apr 24, 2025

Latest Posts

-

Beyonces Cowboy Carter Double The Streams Post Tour Debut

May 10, 2025

Beyonces Cowboy Carter Double The Streams Post Tour Debut

May 10, 2025 -

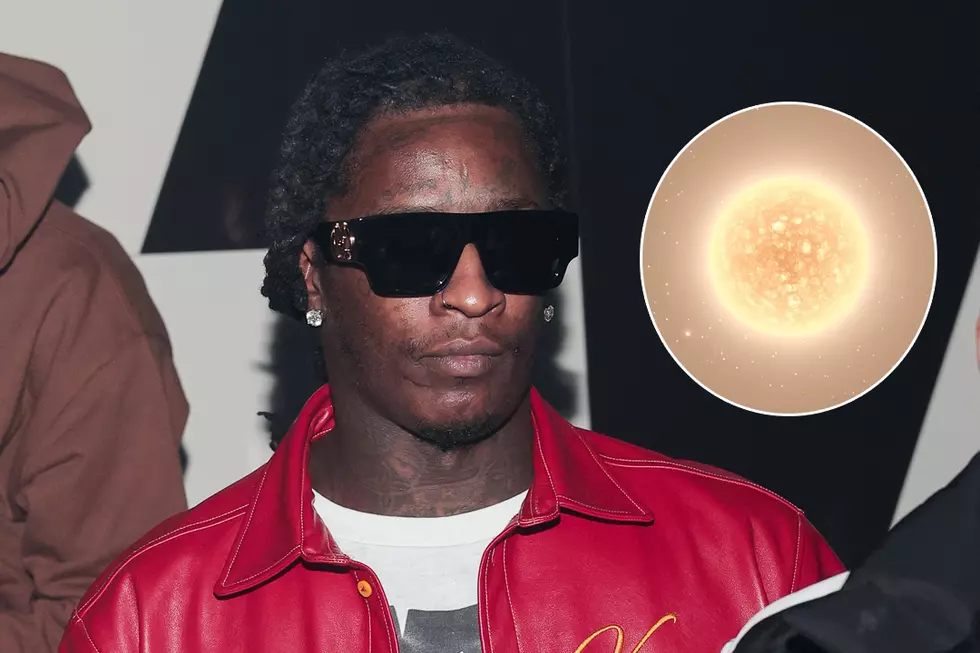

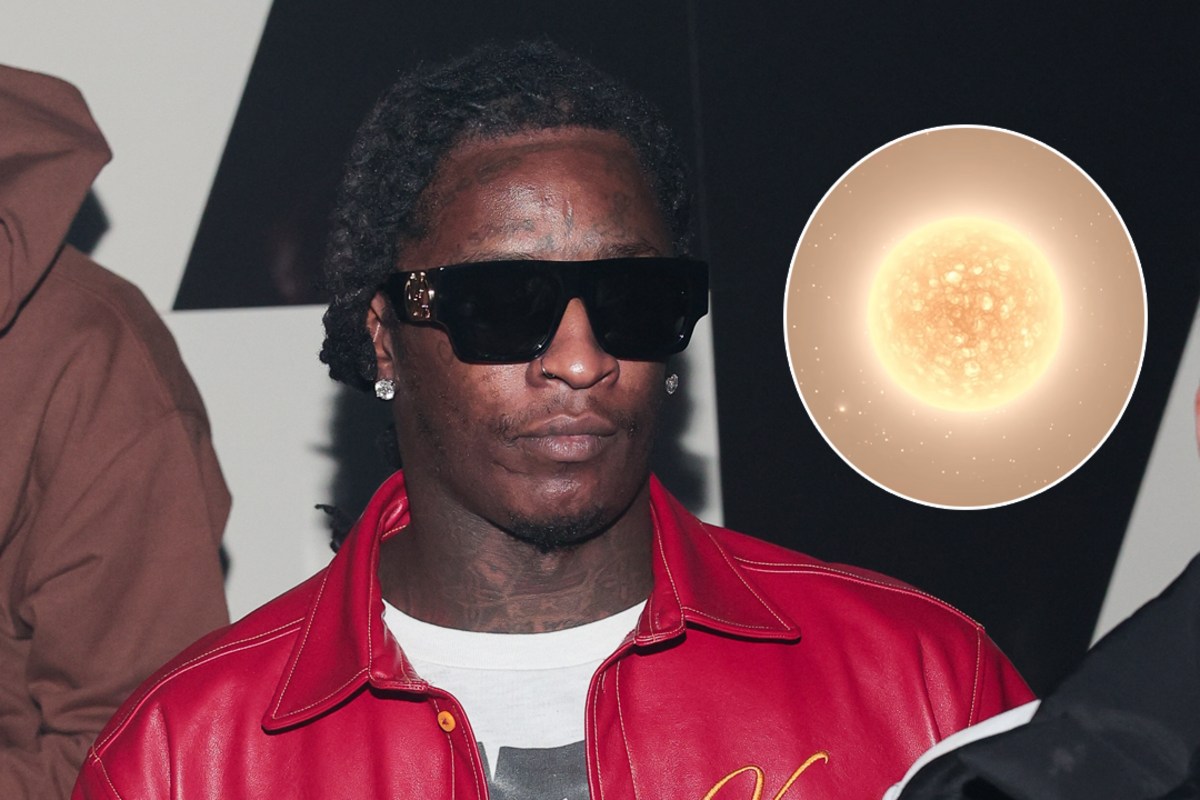

Young Thugs Upcoming Album Uy Scuti Whens The Release

May 10, 2025

Young Thugs Upcoming Album Uy Scuti Whens The Release

May 10, 2025 -

Uy Scuti Release Date Teased By Young Thug

May 10, 2025

Uy Scuti Release Date Teased By Young Thug

May 10, 2025 -

Is Young Thugs Uy Scuti Album Coming Soon Release Date Speculation

May 10, 2025

Is Young Thugs Uy Scuti Album Coming Soon Release Date Speculation

May 10, 2025 -

Uy Scuti Young Thugs New Album Release Date Teased

May 10, 2025

Uy Scuti Young Thugs New Album Release Date Teased

May 10, 2025