Navigating Crypto Exchange Regulations In India: A Practical Guide For 2025

Table of Contents

The Current Legal Status of Cryptocurrency in India

The legal status of cryptocurrencies in India remains ambiguous. While there's no outright ban, the government's stance has been cautious, leading to uncertainty among investors and businesses. The Reserve Bank of India (RBI) initially attempted to ban cryptocurrency transactions through a 2018 circular, but this was overturned by the Supreme Court in 2020. This landmark ruling clarified that cryptocurrencies are not illegal per se, but it didn't provide a definitive legal framework. The government is currently working on a comprehensive cryptocurrency bill, potentially impacting how Indian Crypto Laws will shape the future of the industry.

Keywords: Cryptocurrency Legal Status India, Indian Crypto Laws, Supreme Court Crypto India

- Existing Laws and Guidelines: Current regulations primarily focus on indirect measures like taxation and anti-money laundering provisions.

- Potential Future Legislation: The upcoming bill is expected to provide clarity on the regulatory framework, potentially including licensing requirements for exchanges and stipulations for investor protection.

- Self-Regulatory Efforts: Industry bodies are actively working on self-regulatory frameworks to promote responsible crypto trading and improve compliance.

Understanding KYC/AML Compliance for Crypto Exchanges in India

KYC Crypto India and AML Crypto India compliance are paramount for crypto exchanges operating within India. These regulations aim to prevent money laundering and terrorist financing, requiring exchanges to verify the identities of their users and monitor transactions for suspicious activity. Non-compliance can lead to severe penalties, including hefty fines and legal action. Understanding and adhering to these Crypto Exchange Compliance India requirements is crucial for both exchanges and their users.

Keywords: KYC Crypto India, AML Crypto India, Crypto Exchange Compliance India, Crypto KYC Regulations

- KYC/AML Compliance Guide: Exchanges typically require users to submit identification documents (passport, Aadhaar card, etc.), proof of address, and potentially other supporting documentation.

- Required Documents: The specific documents needed vary between exchanges but generally include government-issued identification and proof of residence.

- AML Procedures: Exchanges must implement robust transaction monitoring systems to identify and report suspicious activity to the relevant authorities.

Taxation of Cryptocurrency in India

Understanding Crypto Tax India is critical for all crypto investors and traders. Currently, cryptocurrency transactions are taxed as capital gains, meaning profits from trading are subject to tax. The tax rate depends on the holding period – short-term capital gains (STCG) are taxed at a higher rate than long-term capital gains (LTCG). This complex Cryptocurrency Taxation India system requires careful tracking of transactions and accurate reporting.

Keywords: Crypto Tax India, Cryptocurrency Taxation India, Capital Gains Tax Crypto India, Tax on Crypto Trading

- Applicable Tax Rates: STCG tax rates are higher than LTCG rates, reflecting the holding period of the asset.

- Reporting to Tax Authorities: Accurate record-keeping and timely filing of tax returns are crucial to avoid penalties.

- Future Changes: The government may introduce changes to the cryptocurrency tax regime in the coming years, making it essential to stay updated.

Choosing a Reputable and Compliant Crypto Exchange in India

Selecting a secure and regulated Crypto Exchange in India is crucial for protecting your investments. When choosing a platform, prioritize those with robust security measures, clear KYC/AML compliance procedures, and a proven track record. Comparing different exchanges based on fees, features, and user reviews will help you make an informed decision.

Keywords: Best Crypto Exchanges India, Secure Crypto Exchanges India, Regulated Crypto Exchanges India, Top Crypto Platforms India

- Security Checklist: Look for exchanges that utilize multi-factor authentication, cold storage for user funds, and transparent security practices.

- Exchange Comparison: Consider factors such as trading fees, available cryptocurrencies, user interface, and customer support.

- Reputable Exchanges: Research and select exchanges that are transparent about their operations and have a positive reputation within the industry.

Future Outlook of Crypto Exchange Regulations in India

The future of Crypto Exchange Regulations in India is dynamic. The upcoming cryptocurrency bill will likely provide much-needed clarity, potentially introducing licensing requirements, investor protection measures, and a clearer legal definition for crypto assets. The potential introduction of a Central Bank Digital Currency (CBDC) could also significantly impact the landscape.

Keywords: Future of Crypto in India, India Crypto Regulation 2025, Cryptocurrency Future India, Crypto Market Predictions India

- Government Initiatives: Keep an eye on government announcements and policy changes related to cryptocurrencies.

- CBDC Impact: The introduction of a CBDC could influence the adoption and regulation of other cryptocurrencies.

- Future Regulatory Landscape: Expect ongoing evolution in the regulatory framework, requiring continuous monitoring and adaptation.

Conclusion

Navigating Crypto Exchange Regulations in India in 2025 requires a proactive and informed approach. Understanding the legal status of cryptocurrencies, complying with KYC/AML regulations, and choosing a reputable exchange are crucial steps for all crypto investors and traders. Staying updated on the latest developments and prioritizing legal compliance is paramount to ensuring safe and successful participation in the Indian cryptocurrency market. Stay ahead of the curve by regularly reviewing the latest updates on Navigating Crypto Exchange Regulations in India and ensure your crypto investments remain compliant.

Featured Posts

-

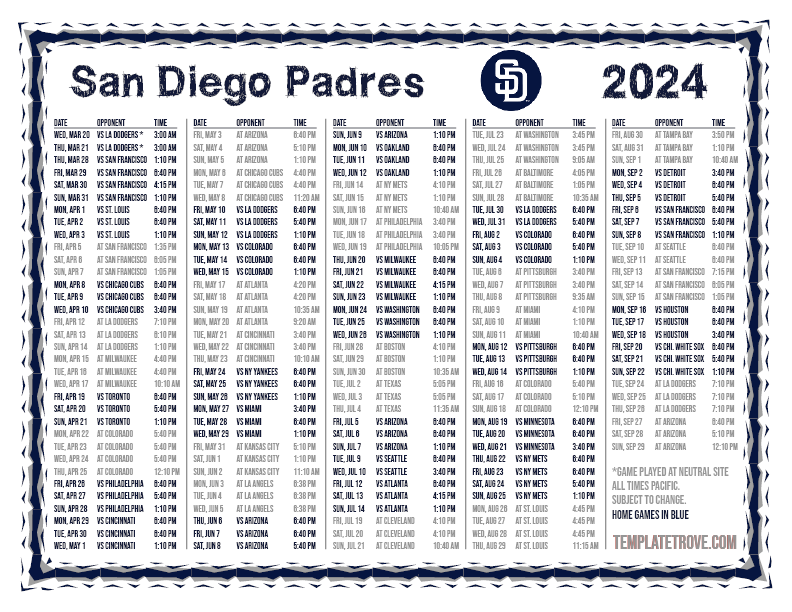

Padres Daily News Fernando Tatis Jr S Challenges And The Teams Response

May 15, 2025

Padres Daily News Fernando Tatis Jr S Challenges And The Teams Response

May 15, 2025 -

San Diego Padres Preparing For A Successful 2025 Season Starting At Home

May 15, 2025

San Diego Padres Preparing For A Successful 2025 Season Starting At Home

May 15, 2025 -

Ndukwes Record Breaking Performance Secures Pbc Tournament Mvp Award

May 15, 2025

Ndukwes Record Breaking Performance Secures Pbc Tournament Mvp Award

May 15, 2025 -

Judge Rules Erik And Lyle Menendez Could Face Resentencing

May 15, 2025

Judge Rules Erik And Lyle Menendez Could Face Resentencing

May 15, 2025 -

Follow The La Lakers Season With Vavel United States

May 15, 2025

Follow The La Lakers Season With Vavel United States

May 15, 2025