Navigating Economic Uncertainty: Inflation And Unemployment Risks

Table of Contents

Understanding Inflation's Impact

Defining Inflation and its Causes

Inflation, simply put, is a general increase in the prices of goods and services in an economy over a period of time. When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. There are several types of inflation, with two prominent ones being demand-pull and cost-push inflation.

- Demand-pull inflation: Occurs when aggregate demand outpaces aggregate supply. Increased consumer spending, government spending, or investment can drive up prices as demand exceeds the available goods and services.

- Cost-push inflation: Happens when the cost of producing goods and services increases, leading businesses to raise prices to maintain profit margins. This can be caused by factors like rising wages, increased raw material costs (e.g., energy prices), or supply chain disruptions.

Several factors contribute to inflationary pressures:

- Increased demand: Strong economic growth can lead to increased demand for goods and services, outpacing supply and driving up prices.

- Supply chain disruptions: Global events, such as pandemics or geopolitical instability, can disrupt supply chains, leading to shortages and higher prices.

- Rising wages: Wage increases, while beneficial for workers, can contribute to cost-push inflation if businesses pass these increased labor costs onto consumers.

- Energy price increases: Fluctuations in global energy markets significantly impact the price of many goods and services.

- Food price increases: Similar to energy, agricultural production and supply chain issues can significantly impact food prices, directly affecting the cost of living.

The impact of inflation on purchasing power is significant. As prices rise, the same amount of money buys fewer goods and services, eroding the real value of savings and wages.

Inflation's Effects on Individuals and Businesses

Inflation has far-reaching consequences for individuals and businesses alike. For individuals, the primary impact is a reduction in purchasing power. This means that your money buys less than it did before, impacting your standard of living. Furthermore:

- Impact on savings: The real return on savings decreases as inflation erodes the value of accumulated wealth.

- Impact on investment strategies: Inflation necessitates adjustments to investment strategies to protect against the loss of purchasing power. Investors may shift towards assets that offer inflation protection, such as real estate or inflation-linked bonds.

- Challenges for businesses in pricing and planning: Businesses face the challenge of setting prices that cover rising costs while remaining competitive in the market. Uncertainty about future inflation makes long-term planning difficult.

The ongoing inflationary pressures contribute to an overall economic downturn, impacting financial planning and increasing investment risk.

The Threat of Unemployment

Defining Unemployment and its Types

Unemployment refers to the state of being without a job while actively seeking employment. Different types of unemployment exist:

- Frictional unemployment: Temporary unemployment between jobs.

- Structural unemployment: Unemployment resulting from a mismatch between worker skills and available jobs.

- Cyclical unemployment: Unemployment tied to the business cycle, rising during recessions and falling during periods of economic expansion.

Economic uncertainty exacerbates unemployment. During periods of economic instability, businesses often reduce hiring or even lay off employees due to decreased demand or uncertainty about the future.

- Statistics on unemployment rates: Monitoring unemployment rates is critical for understanding the health of the economy. High unemployment rates indicate a weakening economy.

- Sectors most affected by job losses: Certain sectors, such as manufacturing or hospitality, are often more vulnerable to job losses during economic downturns.

The fear of job losses and the possibility of a recession significantly impact workforce participation.

Mitigating Unemployment Risks

Individuals and governments can employ strategies to mitigate unemployment risks:

- Skills development: Investing in education and training is crucial for adapting to changing labor market demands and increasing employability. This improves career development and enhances job security.

- Diversification of income streams: Creating multiple income streams, such as through entrepreneurship or investments, can provide a safety net in case of job loss. This fosters economic independence and reduces reliance on a single source of income.

- Government support programs: Government unemployment benefits and job training programs provide a crucial safety net for unemployed individuals, helping them transition back into the workforce and contributing to economic recovery.

Investing in these areas increases the resilience of the workforce and facilitates a smoother transition during periods of economic uncertainty.

The Interplay Between Inflation and Unemployment

The Phillips Curve

The Phillips Curve traditionally suggests an inverse relationship between inflation and unemployment. Lower unemployment is associated with higher inflation, and vice versa. However, this relationship has become more complex in recent years.

- Historical examples of the Phillips Curve in action: Historical data has shown periods where this inverse relationship held true.

- Current deviations from the traditional model: The recent experience of stagflation (high inflation and high unemployment simultaneously) demonstrates limitations in the traditional Phillips Curve model.

Policy Responses to Economic Uncertainty

Governments and central banks use monetary and fiscal policies to manage inflation and unemployment:

- Monetary policy: Central banks control the money supply and interest rates to influence inflation. Monetary tightening (raising interest rates) can combat inflation but may increase unemployment.

- Fiscal policy: Governments use government spending and taxation to influence aggregate demand. Fiscal stimulus (increased government spending) can boost demand and reduce unemployment, but it may also fuel inflation.

These policies aim for economic stabilization, but finding the right balance is crucial and requires careful consideration of potential impacts. Effective policy responses require careful monitoring of economic indicators and adaptability to changing conditions.

Conclusion

Navigating the current period of economic uncertainty, characterized by inflation and unemployment risks, requires a multifaceted approach. Understanding the causes and consequences of inflation, the factors contributing to unemployment, and the complex interplay between these two forces is crucial for informed decision-making. By proactively addressing these challenges through careful financial planning, skill development, and a close watch on government policies related to economic uncertainty, individuals and businesses can better position themselves to weather this economic storm. Stay informed about changes in the economic landscape and adapt your strategies accordingly to effectively navigate future periods of economic uncertainty and mitigate associated risks.

Featured Posts

-

Justica Para Bruno Fernandes Uma Analise Detalhada

May 30, 2025

Justica Para Bruno Fernandes Uma Analise Detalhada

May 30, 2025 -

Endgame Fallout Popular Avenger Left Out Of Future Mcu Plans

May 30, 2025

Endgame Fallout Popular Avenger Left Out Of Future Mcu Plans

May 30, 2025 -

Carlos Alcaraz Triumphs In Monte Carlo Musettis Injury Complicates Final

May 30, 2025

Carlos Alcaraz Triumphs In Monte Carlo Musettis Injury Complicates Final

May 30, 2025 -

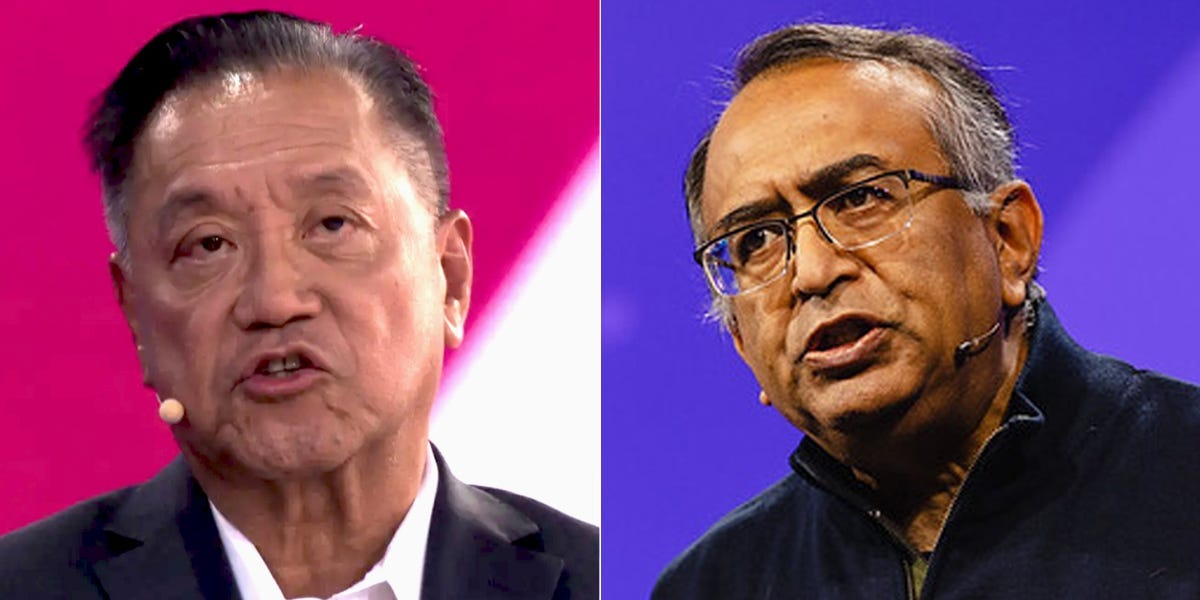

Broadcoms V Mware Deal A 1050 Price Hike Sparks Outrage From At And T

May 30, 2025

Broadcoms V Mware Deal A 1050 Price Hike Sparks Outrage From At And T

May 30, 2025 -

Planlegg Badeturen Sjekk Vaer Og Temperaturer For Du Drar

May 30, 2025

Planlegg Badeturen Sjekk Vaer Og Temperaturer For Du Drar

May 30, 2025