Navigating Student Loans: A Financial Planner's Perspective

Table of Contents

Understanding Your Student Loan Debt

Before you can create a successful repayment strategy, you need a clear understanding of your student loan debt. This involves identifying the types of loans you have and understanding their specific terms.

Types of Student Loans

The landscape of student loans is diverse, primarily categorized as federal and private loans. Each type has distinct characteristics impacting your repayment journey.

- Federal Student Loans: These loans are offered by the U.S. government and generally offer more favorable terms and repayment options than private loans. They include subsidized and unsubsidized loans.

- Subsidized Loans: The government pays the interest while you're in school (under certain conditions).

- Unsubsidized Loans: Interest accrues while you're in school, leading to a larger overall debt.

- Private Student Loans: These loans are offered by banks, credit unions, and other private lenders. Interest rates tend to be higher, and repayment options are less flexible than federal loans. They often require a creditworthy co-signer.

Understanding the nuances of these loan types – their interest rates, repayment terms, and eligibility requirements – is crucial for effective student loan management.

Consolidating Your Loans

Student loan consolidation involves combining multiple loans into a single loan. This can simplify repayment by reducing the number of monthly payments and potentially lowering your monthly payment amount. However, it's not always the best solution.

- Benefits: Simplified repayment, potentially lower monthly payments (though not always lower overall interest).

- Drawbacks: Potential for a higher overall interest rate over the life of the loan if you refinance into a higher rate, loss of certain benefits associated with specific loan types (e.g., income-driven repayment plans).

Before consolidating, carefully compare the interest rates and terms of the new loan with your existing loans to ensure it aligns with your financial goals.

Creating a Realistic Repayment Plan

A successful student loan repayment strategy begins with a realistic budget and a well-defined debt repayment plan.

Budgeting and Prioritizing Debt

Creating a comprehensive budget is paramount. This involves meticulously tracking your income and expenses to identify areas for savings.

- Strategies for Budgeting: Use budgeting apps, spreadsheets, or traditional budgeting methods to monitor income and expenses.

- Prioritizing Debt: Consider strategies like the debt snowball or debt avalanche methods to prioritize high-interest loans. Allocate as much as possible to student loan payments within your budget.

By carefully managing expenses and prioritizing debt repayment, you can accelerate your progress toward becoming debt-free.

Exploring Repayment Options

The federal government offers various repayment plans for federal student loans to tailor repayment to individual circumstances.

- Standard Repayment: Fixed monthly payments over 10 years.

- Extended Repayment: Longer repayment periods (up to 25 years), leading to lower monthly payments but higher overall interest.

- Income-Driven Repayment (IDR): Monthly payments are based on your income and family size. This plan offers the potential for loan forgiveness after a certain number of years (this varies depending on plan and income).

Private student loans usually offer standard repayment plans. Understanding the pros and cons of each repayment option is critical in choosing the best fit for your financial situation.

Seeking Professional Financial Guidance

Navigating the complexities of student loans can be overwhelming. Seeking professional financial guidance can significantly improve your outcomes.

The Value of a Financial Advisor

A financial advisor specializing in student loan debt management can provide personalized guidance and strategies.

- Personalized Financial Planning: They'll help you create a comprehensive financial plan that addresses your specific needs and goals.

- Debt Reduction Strategies: They can help you develop effective strategies to reduce your debt burden and accelerate repayment.

- Long-Term Financial Goals: They'll guide you towards achieving your long-term financial aspirations, such as buying a home or investing.

Working with a financial advisor can provide peace of mind and help you make informed decisions regarding your student loan debt.

Finding Reputable Advisors

Choosing the right financial advisor is crucial. Ensure they have the necessary qualifications and experience.

- Verify Credentials: Check for certifications like Certified Financial Planner (CFP®).

- Ask Questions: Inquire about their experience with student loan debt management, fees, and approach to financial planning.

- Beware of Red Flags: Avoid advisors who make unrealistic promises or pressure you into making quick decisions.

Finding a reputable financial advisor can be a game-changer in your journey towards managing your student loans effectively.

Conclusion

Effectively navigating student loans requires a multifaceted approach. Understanding your loan types, creating a realistic budget and repayment plan, and seeking professional financial guidance are crucial steps in managing student loan debt effectively. Remember, proactive planning is key to achieving long-term financial wellness. Don't let student loan debt overwhelm you. Take control of your financial future by seeking professional guidance and developing a personalized student loan repayment plan. For more information on student loan management and to connect with a financial advisor, [link to resources/contact form].

Featured Posts

-

I Megaloprepis Teleti I Ypodoxi Toy Tramp Stin Saoydiki Aravia

May 17, 2025

I Megaloprepis Teleti I Ypodoxi Toy Tramp Stin Saoydiki Aravia

May 17, 2025 -

Djokovic Gap Alcaraz O Ban Ket Miami Open 2025 Phan Tich Cap Dau Hua Hen

May 17, 2025

Djokovic Gap Alcaraz O Ban Ket Miami Open 2025 Phan Tich Cap Dau Hua Hen

May 17, 2025 -

37 Point Loss Prompts Thibodeau To Call For More Knicks Determination

May 17, 2025

37 Point Loss Prompts Thibodeau To Call For More Knicks Determination

May 17, 2025 -

Knicks Vs Celtics Feb 23 Josh Harts Injury And Game Status

May 17, 2025

Knicks Vs Celtics Feb 23 Josh Harts Injury And Game Status

May 17, 2025 -

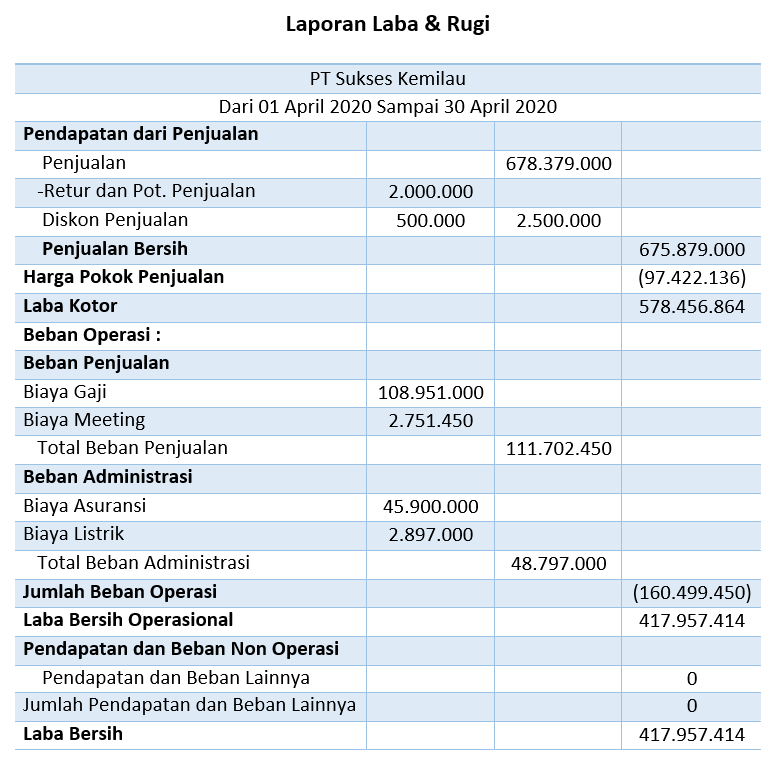

Memahami Laporan Keuangan Panduan Lengkap Untuk Pengusaha

May 17, 2025

Memahami Laporan Keuangan Panduan Lengkap Untuk Pengusaha

May 17, 2025