Navigating Succession Planning For Multi-Generational Wealth

Table of Contents

Understanding the Unique Challenges of Multi-Generational Wealth Transfer

Transferring wealth across generations presents unique challenges. Family dynamics, differing values, and communication breakdowns can significantly impact the success of your succession plan. Effective wealth preservation requires proactive strategies to address these potential hurdles.

- Addressing differing values and priorities across generations: Each generation may have vastly different financial priorities and risk tolerances. Older generations might prioritize wealth preservation, while younger generations may be more inclined towards growth and investment in innovative ventures. Open communication and understanding these differing perspectives are crucial.

- Managing potential family conflicts over inheritance: Disputes over inheritance are unfortunately common. Clear, well-defined plans, ideally created with legal counsel, minimize the potential for conflict. Transparency and fairness in distribution are key. Consider using neutral third parties for conflict resolution.

- Developing effective communication strategies within the family: Regular family meetings, facilitated by a neutral professional if necessary, can create a space for open dialogue about financial matters and succession plans. Honest and transparent communication is essential to building trust and preventing misunderstandings.

- Considering the unique needs and goals of each generation: A successful succession plan acknowledges the individual circumstances of each generation. This might involve tailored financial strategies, educational support, or philanthropic opportunities designed to align with their individual ambitions.

- Implementing transparent and equitable distribution methods: Establish clear criteria for distributing assets to ensure fairness and prevent future conflict. This might involve setting up trusts, creating detailed wills, or employing other legal mechanisms to allocate assets according to pre-determined guidelines.

Legal and Tax Implications of Multi-Generational Wealth Succession

Navigating the legal and tax complexities of multi-generational wealth transfer is critical. Failing to do so can lead to significant financial losses and protracted legal battles. Engaging expert legal counsel is essential.

- Exploring various estate planning vehicles like trusts and wills: Trusts offer significant advantages in wealth protection and tax minimization. A well-drafted will is essential for distributing assets according to your wishes and avoiding probate delays. The choice between these instruments depends on individual circumstances and financial goals.

- Minimizing estate and inheritance taxes through strategic planning: Tax laws vary significantly across jurisdictions. Strategic planning, often involving sophisticated tax optimization strategies, can help minimize your tax burden during wealth transfer. This often involves working with tax lawyers and financial advisors specialized in estate planning.

- Understanding the complexities of gift tax laws: Gifting assets to younger generations can be a powerful tool for estate planning, but it's subject to gift tax regulations. Understanding the applicable laws and annual gift tax exclusions is crucial for avoiding penalties.

- The importance of working with an experienced estate planning attorney: An experienced estate planning attorney is invaluable in navigating the complexities of tax laws and developing a legally sound and effective succession plan. They can guide you through the process, ensure compliance, and protect your interests.

- Strategies for efficient wealth transfer across state lines (if applicable): If assets are located in multiple states or jurisdictions, additional considerations are necessary to ensure compliance with varying legal and tax regulations. This requires careful planning and legal expertise to mitigate potential complications.

Financial Planning Strategies for Multi-Generational Wealth

A robust financial plan is the cornerstone of successful multi-generational wealth transfer. This plan should account for long-term goals, risk management, and investment strategies tailored to the needs of each generation.

- Developing a long-term investment strategy aligned with family goals: Investment strategies must align with the family's long-term objectives, risk tolerance, and time horizon. Professional financial advice is crucial for developing a diversified portfolio that balances growth and preservation of capital.

- Diversifying investments to mitigate risk and maximize returns: Diversification across different asset classes, such as stocks, bonds, real estate, and alternative investments, helps mitigate risk and enhance potential returns. A well-diversified portfolio is essential for long-term wealth preservation.

- Considering the impact of inflation on future wealth: Inflation erodes the purchasing power of money over time. A successful succession plan accounts for inflation by implementing strategies to maintain the real value of assets over the long term.

- The role of a financial advisor in guiding the succession plan: A qualified financial advisor plays a crucial role in providing objective guidance, developing personalized investment strategies, and monitoring the performance of the investment portfolio.

- Establishing clear financial goals for each generation: Setting clear, measurable financial goals for each generation helps align investment strategies with individual aspirations and ensures the long-term financial well-being of the family.

Building a Lasting Legacy Beyond Financial Assets

Building a lasting legacy extends beyond mere financial assets. It encompasses family values, traditions, and a shared sense of purpose.

- Defining family values and incorporating them into the succession plan: Family values should be at the heart of the succession plan. Consider how these values can be preserved and passed down through generations, reinforcing family unity and shared identity.

- Establishing family traditions and rituals to maintain family unity: Regular family gatherings, shared experiences, and established traditions strengthen family bonds and create a sense of continuity across generations. This fosters a positive family environment and strengthens intergenerational relationships.

- Exploring charitable giving and philanthropic endeavors: Incorporating charitable giving into the succession plan not only benefits worthy causes but also instills values of social responsibility in future generations.

- Documenting family history and legacy for future generations: Preserving family history through written accounts, photographs, and videos creates a tangible link between generations, fostering a deeper understanding of family heritage and values.

- Facilitating open communication and understanding between generations: Open and honest communication between generations is essential for building strong family relationships and ensuring the smooth transfer of wealth and values.

Conclusion

Effective succession planning for multi-generational wealth requires a holistic approach, encompassing legal, financial, and familial considerations. By addressing these key aspects proactively, families can ensure the smooth transfer of assets, minimize tax liabilities, and cultivate lasting family harmony. A well-structured plan provides peace of mind, ensuring your legacy endures for generations to come.

Don't wait until it's too late. Begin navigating your family's succession planning for multi-generational wealth today. Contact a qualified estate planning attorney and financial advisor to develop a personalized strategy that protects your legacy and secures your family's future.

Featured Posts

-

From Prison To Studio Vybz Kartels Update On Life Family And New Music

May 22, 2025

From Prison To Studio Vybz Kartels Update On Life Family And New Music

May 22, 2025 -

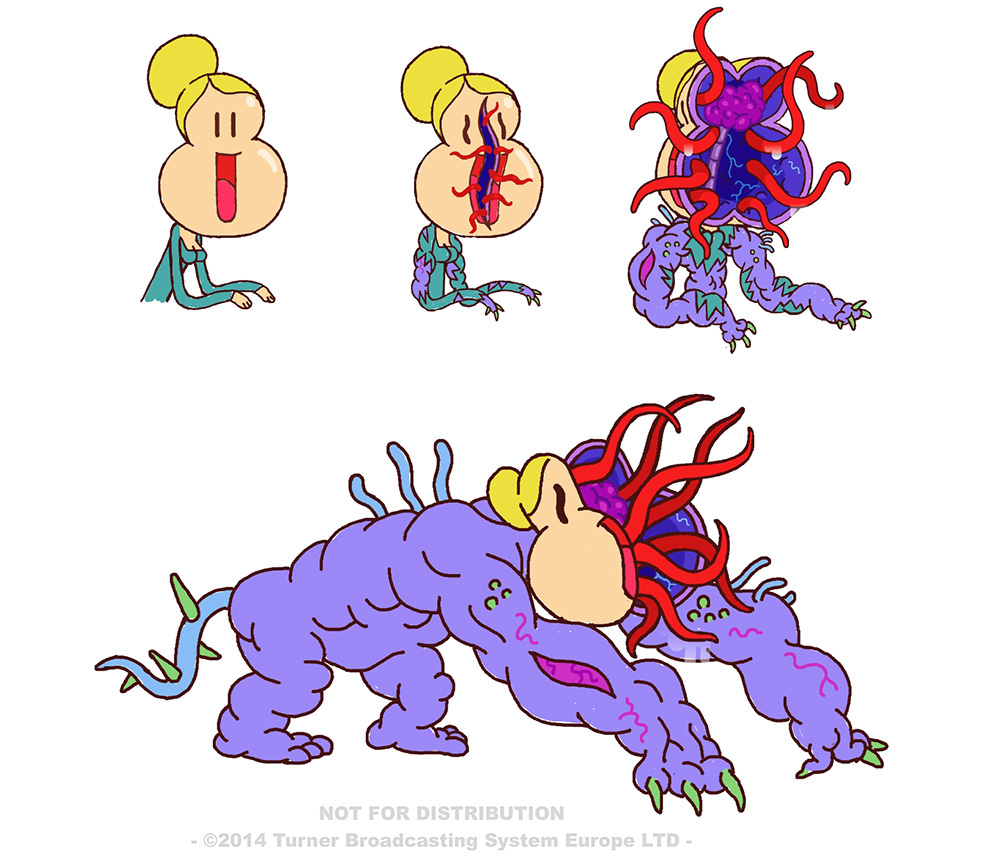

Gumballs Weird And Wonderful World Expands

May 22, 2025

Gumballs Weird And Wonderful World Expands

May 22, 2025 -

Office365 Data Breach Crook Makes Millions Targeting Executive Inboxes

May 22, 2025

Office365 Data Breach Crook Makes Millions Targeting Executive Inboxes

May 22, 2025 -

Vidmova Nato Priynyati Ukrayinu Shlyakh Do Podalshoyi Rosiyskoyi Agresiyi

May 22, 2025

Vidmova Nato Priynyati Ukrayinu Shlyakh Do Podalshoyi Rosiyskoyi Agresiyi

May 22, 2025 -

Dexter Original Sin Steelbook Blu Ray Complete Your Collection

May 22, 2025

Dexter Original Sin Steelbook Blu Ray Complete Your Collection

May 22, 2025