Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF: A Comprehensive Overview

Table of Contents

What is the NAV and How is it Calculated for the Amundi Dow Jones Industrial Average UCITS ETF?

The Net Asset Value (NAV) of an ETF like the Amundi Dow Jones Industrial Average UCITS ETF represents the value of its underlying assets per share. It's calculated daily, usually at the close of the market. This calculation involves several key components:

- Market Value of Holdings: The primary component is the total market value of all the stocks comprising the Dow Jones Industrial Average that the ETF holds. This is determined by multiplying the number of shares owned by the ETF in each company by the closing price of each share.

- Liabilities: This includes any outstanding debts or obligations the ETF has.

- Expenses: Management fees, administrative costs, and other expenses are deducted from the total value of assets.

The fund manager, Amundi, plays a vital role in accurately determining the NAV by ensuring the correct valuation of all assets and liabilities. It's crucial to understand the difference between NAV and market price. While the NAV represents the intrinsic value, the market price is the price at which the ETF is currently trading on the exchange. These can differ slightly due to supply and demand fluctuations, creating a potential tracking error. Understanding this difference is key for savvy ETF investors. The formula is essentially: NAV = (Total Asset Value - Liabilities - Expenses) / Number of Outstanding Shares. This Amundi ETF NAV calculation is performed daily to reflect the current value of your investment.

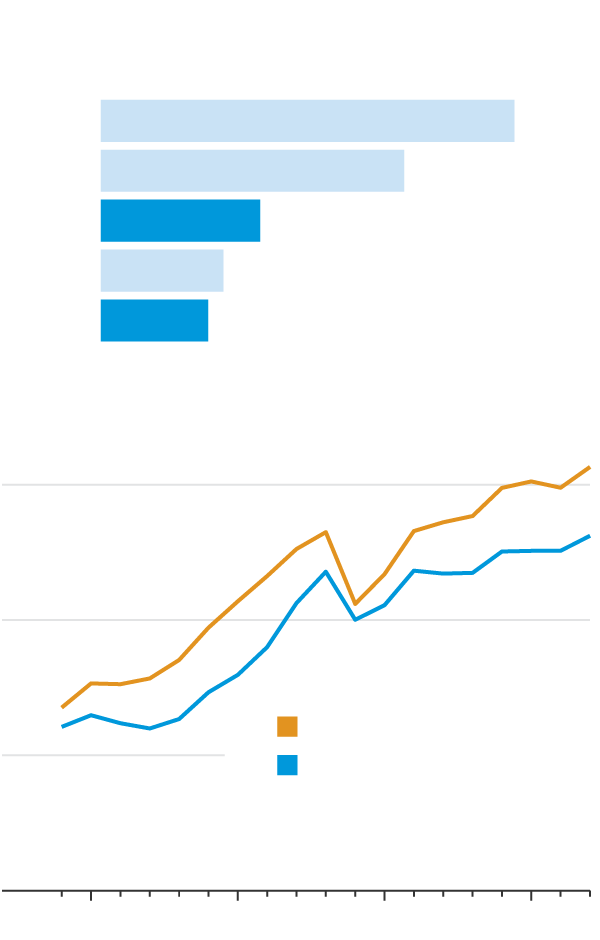

Factors Influencing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors can significantly impact the Amundi ETF NAV:

- Market Fluctuations: The Dow Jones Industrial Average's performance directly influences the ETF's NAV. Positive market movements generally lead to an increase in NAV, while negative movements result in a decrease. This NAV fluctuation is a direct reflection of market volatility.

- Currency Exchange Rates: Since the underlying assets are primarily US-based, currency exchange rate fluctuations between the USD and the investor's currency can impact the NAV, especially for non-USD investors. This represents a potential currency risk.

- Dividends and Corporate Actions: Dividends paid by the companies within the Dow Jones Industrial Average are generally reinvested into the ETF, increasing the NAV. Corporate actions such as stock splits or mergers can also influence the NAV. Understanding the dividend impact is essential for long-term investors.

- Management Fees and Expenses: The ETF's expense ratio, including management fees and other expenses, reduces the NAV over time. These are deducted from the total asset value during the daily NAV calculation.

How to Access the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Finding the daily Amundi ETF NAV data is relatively straightforward. Investors can typically access this information through several channels:

- Amundi's Website: The official Amundi website usually provides daily NAV updates for its ETFs.

- Financial News Sources: Many reputable financial news websites and portals publish ETF NAV data, including that of the Amundi Dow Jones Industrial Average UCITS ETF.

- Brokerage Platforms: Most brokerage platforms provide real-time or near real-time NAV information for the ETFs held within an investor's portfolio.

The NAV is typically published at the end of each trading day. However, there might be occasional delays in reporting, which are usually communicated by the data providers. These delays can temporarily impact the accuracy of the reported Amundi ETF NAV.

Importance of Monitoring the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Regularly monitoring the Amundi Dow Jones Industrial Average UCITS ETF NAV is crucial for informed investment decisions:

- Tracking Investment Performance: Monitoring the NAV allows investors to track the performance of their investment over time, providing insights into their portfolio's growth or decline. This is essential for assessing the effectiveness of your investment strategy.

- Buy/Sell Signals: While not the sole determinant, changes in NAV can provide signals for potential buying or selling opportunities, allowing investors to adjust their portfolio according to their risk tolerance and financial goals. Understanding the relationship between NAV changes and market movements can improve your investment performance.

By understanding and utilizing the data provided by the NAV, investors can effectively manage their investments in the Amundi Dow Jones Industrial Average UCITS ETF.

Conclusion: Making Informed Decisions with Amundi Dow Jones Industrial Average UCITS ETF NAV Data

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is fundamental to successful ETF investing. Regularly checking the NAV allows investors to track their investment performance, make informed decisions, and manage their portfolio effectively. By utilizing the information presented in this article, investors can gain a better understanding of this important metric and improve their portfolio management skills. Stay informed about the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF and make informed investment decisions today!

Featured Posts

-

Picture This Prime Video Every Song Featured In The Soundtrack

May 24, 2025

Picture This Prime Video Every Song Featured In The Soundtrack

May 24, 2025 -

European Shares Rise On Trump Tariff Hint Lvmh Dips

May 24, 2025

European Shares Rise On Trump Tariff Hint Lvmh Dips

May 24, 2025 -

F1 Technika A Koezuton Egyedi Porsche Modell Bemutatasa

May 24, 2025

F1 Technika A Koezuton Egyedi Porsche Modell Bemutatasa

May 24, 2025 -

Planning Your Country Escape Location Lifestyle And Logistics

May 24, 2025

Planning Your Country Escape Location Lifestyle And Logistics

May 24, 2025 -

80 Millio Forintos Extrak Ezen A Porsche 911 Esen

May 24, 2025

80 Millio Forintos Extrak Ezen A Porsche 911 Esen

May 24, 2025

Latest Posts

-

Relx Succes Ondanks Economische Tegenwind De Rol Van Ai In De Groei

May 24, 2025

Relx Succes Ondanks Economische Tegenwind De Rol Van Ai In De Groei

May 24, 2025 -

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 24, 2025

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 24, 2025 -

Ai Stuwt Relx Groei Ondanks Zwakke Economie Voorspellingen Tot 2025

May 24, 2025

Ai Stuwt Relx Groei Ondanks Zwakke Economie Voorspellingen Tot 2025

May 24, 2025 -

Amsterdam Stock Market Aex Index Hits 1 Year Low After 4 Fall

May 24, 2025

Amsterdam Stock Market Aex Index Hits 1 Year Low After 4 Fall

May 24, 2025 -

Relx Sterke Financiele Resultaten Ondanks Economische Uitdagingen Dankzij Ai

May 24, 2025

Relx Sterke Financiele Resultaten Ondanks Economische Uitdagingen Dankzij Ai

May 24, 2025