Network18 Media & Investments Stock Price: Live NSE/BSE Data, Technical Analysis (April 21, 2025)

Table of Contents

Live NSE/BSE Data for Network18 Media & Investments

Real-time data from the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE) is essential for making informed decisions about the Network18 Media & Investments stock price. Accessing reliable, live data allows investors to monitor price fluctuations and react accordingly. Several reputable websites and financial apps provide this information; however, always ensure the source's reliability before making investment decisions.

Key data points to monitor include:

- Opening Price: The price at which the stock begins trading each day.

- Closing Price: The final price of the stock at the end of the trading day.

- High: The highest price the stock reached during the day.

- Low: The lowest price the stock reached during the day.

- Volume: The number of shares traded. High volume often indicates significant market interest.

- Percentage Change: The daily change in the stock price, expressed as a percentage.

Stock tickers, such as those found on financial websites and trading platforms, provide real-time updates on the Network18 Media & Investments stock price, making it easier to track price movements.

- Where to find live NSE data for Network18 Media & Investments: [Insert Links to Reputable Sources - e.g., NSE India website, leading financial portals].

- Where to find live BSE data for Network18 Media & Investments: [Insert Links to Reputable Sources - e.g., BSE India website, leading financial portals].

- Key metrics to watch in real-time: Opening price, closing price, high, low, volume, and percentage change.

Technical Analysis of Network18 Media & Investments Stock

Technical analysis uses past market data—such as price and volume—to predict future price movements. This involves studying charts and using various indicators to identify potential buying or selling opportunities. While not a guarantee of future performance, technical analysis can provide valuable insights into the Network18 Media & Investments stock's momentum and potential trends.

Several indicators can be used:

- Moving Averages: These smooth out price fluctuations and help identify trends. For example, a 50-day moving average crossing above a 200-day moving average is often seen as a bullish signal.

- RSI (Relative Strength Index): This measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): This identifies changes in the strength, direction, momentum, and duration of a trend.

Interpreting these indicators requires practice and understanding. Chart patterns, such as head and shoulders or triangles, can also offer additional insights into potential price movements.

- Key technical indicators for Network18 Media & Investments analysis: Moving averages, RSI, MACD.

- Interpretation of common chart patterns: Requires specialized knowledge and careful study of historical data.

- Importance of understanding chart analysis for informed investment decisions: Provides valuable insights alongside fundamental analysis.

Factors Influencing Network18 Media & Investments Stock Price

The Network18 Media & Investments stock price is influenced by a complex interplay of macroeconomic, company-specific, industry-specific, and investor sentiment factors.

Macroeconomic Factors:

- Interest Rates: Changes in interest rates affect borrowing costs and overall economic activity, impacting investor sentiment and stock prices.

- Inflation: High inflation can erode purchasing power and affect consumer spending, potentially impacting the media industry's advertising revenue.

- Economic Growth: Strong economic growth generally leads to increased consumer spending and advertising budgets, positively impacting media companies.

Company-Specific Factors:

- Earnings Reports: Strong earnings reports generally lead to positive price movements, while weak earnings can lead to declines.

- New Product Launches: Successful new product launches can boost revenue and market share, driving stock prices higher.

- Mergers & Acquisitions: Strategic acquisitions can expand market reach and revenue streams.

- Management Changes: Changes in leadership can impact investor confidence and the company's future direction.

Industry-Specific Factors:

- Advertising Revenue Trends: Changes in advertising spending patterns within the media industry directly affect the performance of media companies like Network18 Media & Investments.

- Competition: Competition from other media companies and digital platforms can impact market share and profitability.

- Regulatory Changes: Changes in government regulations or policies can significantly impact the media industry.

Investor Sentiment: Overall market sentiment and investor confidence play a significant role in shaping stock prices. Positive sentiment can lead to higher prices, while negative sentiment can cause declines.

- Impact of economic conditions on Network18 Media & Investments stock: Economic downturns can reduce advertising spending, negatively affecting the stock price.

- Influence of company performance on stock prices: Strong financial performance typically leads to higher stock prices.

- Effect of industry trends on Network18 Media & Investments: Changes in media consumption habits impact the company's revenue and profitability.

Conclusion: Making Informed Decisions about Network18 Media & Investments Stock

Understanding the Network18 Media & Investments stock price requires monitoring live NSE/BSE data, performing technical analysis, and carefully considering the various factors that influence its performance. By combining these approaches, investors can develop a more comprehensive understanding of the stock's potential and make informed investment decisions. Remember that past performance is not indicative of future results, and all investments carry risk.

Stay updated on the latest Network18 Media & Investments stock price movements to optimize your investment strategies. Regularly review the data and adjust your approach as market conditions evolve. Continuously monitor the Network18 Media & Investments stock price for the best investment opportunities.

Featured Posts

-

Activision Blizzard Acquisition Ftcs Appeal And The Future Of Gaming

May 17, 2025

Activision Blizzard Acquisition Ftcs Appeal And The Future Of Gaming

May 17, 2025 -

Understanding Tony Bennetts Musical Style And Influence

May 17, 2025

Understanding Tony Bennetts Musical Style And Influence

May 17, 2025 -

Three Star Wars Andor Episodes Streaming Free On You Tube

May 17, 2025

Three Star Wars Andor Episodes Streaming Free On You Tube

May 17, 2025 -

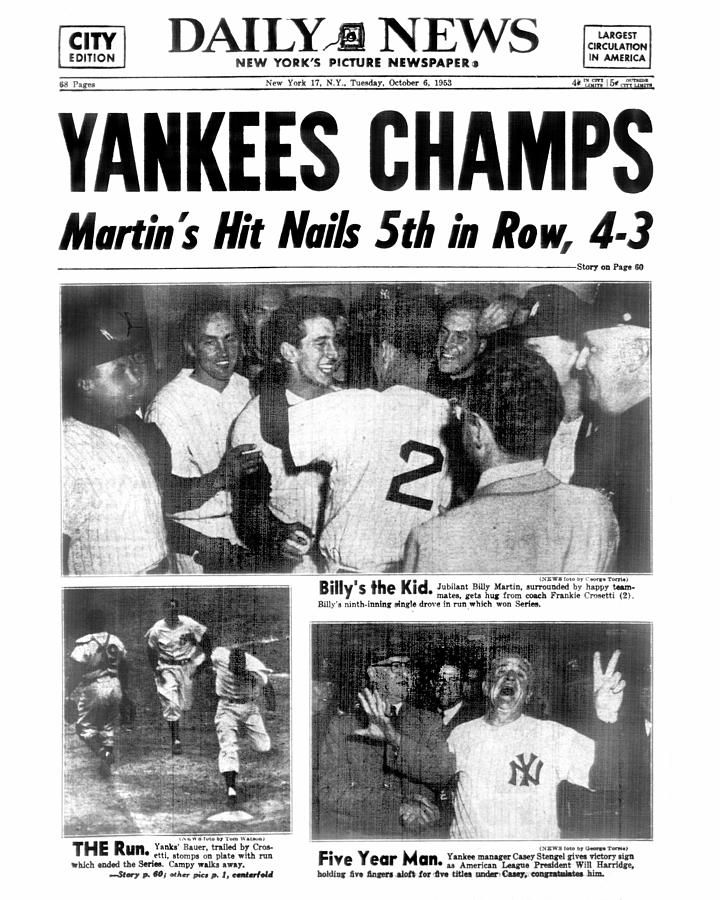

Accessing Past Issues New York Daily News May 2025

May 17, 2025

Accessing Past Issues New York Daily News May 2025

May 17, 2025 -

Exclusive Knicks Fans Bold Petition To Replace Lady Liberty With Jalen Brunson

May 17, 2025

Exclusive Knicks Fans Bold Petition To Replace Lady Liberty With Jalen Brunson

May 17, 2025