New Bitcoin High: US Regulatory Developments Play A Key Role

Table of Contents

The SEC's Increasing Scrutiny of Cryptocurrencies and its Effect on Bitcoin Price

The Securities and Exchange Commission (SEC) is increasingly scrutinizing the cryptocurrency market, and its actions significantly impact Bitcoin's price. This heightened regulatory focus stems from concerns about investor protection, market manipulation, and the classification of various crypto assets as securities.

- Specific lawsuits against crypto companies: The SEC's lawsuits against major players like Ripple Labs and Binance have created uncertainty and volatility in the market. These legal battles highlight the regulatory grey areas surrounding cryptocurrencies and leave investors unsure about the legal status of various assets.

- Impact of SEC rulings on investor confidence: Negative rulings or enforcement actions can erode investor confidence, leading to sell-offs and price declines. Conversely, positive developments or clearer regulatory guidance can boost confidence and drive price increases.

- Effect on Bitcoin trading volume and volatility: SEC actions often result in increased trading volume as investors react to the news, leading to heightened price volatility in both the short-term and long-term. This volatility can be both an opportunity and a risk for Bitcoin investors.

The SEC's future actions remain a significant variable influencing Bitcoin's price. Further crackdowns or a more lenient approach will significantly shape the market's trajectory.

Proposed US Legislation and its Potential to Shape the Future of Bitcoin

The US Congress is actively considering various bills and proposals aimed at regulating the cryptocurrency industry. These legislative efforts aim to bring greater clarity and structure to the market but also pose potential challenges for Bitcoin's future.

- Potential positive and negative impacts on Bitcoin's market: Well-designed legislation could boost investor confidence and facilitate institutional adoption, potentially driving Bitcoin's price higher. Conversely, overly restrictive regulations could stifle innovation and hinder growth, leading to lower prices.

- Discussion of the potential for increased clarity and legal framework: Clearer legal definitions of cryptocurrencies and their regulatory frameworks are essential for fostering investor trust and reducing uncertainty. This would allow businesses to operate with greater certainty and attract further investment.

- Potential challenges for Bitcoin adoption under different regulatory scenarios: Different regulatory approaches could have drastically different consequences for Bitcoin's adoption. A highly restrictive environment could limit access and hamper growth, while a supportive environment could pave the way for widespread acceptance.

The Role of Institutional Investors and Regulatory Clarity

Institutional investors, such as hedge funds and pension funds, are increasingly interested in Bitcoin but remain cautious due to regulatory uncertainty. Regulatory clarity is crucial for attracting significant institutional investment.

- Risk assessment and regulatory compliance requirements: Institutional investors have strict regulatory compliance requirements. The lack of clear regulatory frameworks increases their risk assessment and makes them hesitant to allocate substantial funds to Bitcoin.

- The impact of clear legal frameworks on investment decisions: Clear and consistent legal frameworks significantly influence investment decisions. A predictable regulatory environment reduces risk and makes Bitcoin a more attractive asset for institutional investors.

- The correlation between regulatory certainty and institutional capital inflow: A strong positive correlation exists between regulatory certainty and the inflow of institutional capital into the cryptocurrency market. Increased regulatory clarity tends to reduce uncertainty and encourage institutional investment.

Bitcoin's Price Volatility and the Regulatory Landscape

US regulatory uncertainty is a major driver of Bitcoin's price volatility. Regulatory announcements, whether positive or negative, often trigger significant price swings.

- How regulatory news influences market sentiment and price swings: Positive regulatory news tends to generate bullish sentiment and price increases, while negative news can spark sell-offs and price declines.

- Discussion of potential market manipulation and its prevention through regulation: Appropriate regulation can help prevent market manipulation and enhance the integrity of the Bitcoin market. Clear rules and oversight are crucial for maintaining investor trust.

- Long-term implications of regulatory actions on Bitcoin's price stability: Long-term regulatory actions aimed at providing clarity and stability can contribute to a more mature and less volatile Bitcoin market.

Conclusion: Navigating the Future of Bitcoin with US Regulatory Developments

The relationship between US regulatory developments and Bitcoin's price is complex but undeniable. Recent price highs are influenced by several factors, but the impact of regulatory actions on investor sentiment and institutional participation cannot be ignored. Understanding these developments is crucial for navigating the future of Bitcoin. To effectively manage your Bitcoin investments, stay updated on US Bitcoin regulations, follow US regulatory changes impacting Bitcoin, and learn more about the impact of US regulatory developments on Bitcoin prices. For further reading, explore resources from the SEC and relevant Congressional committees.

Featured Posts

-

Bbc Radio 1 Big Weekend 2025 Sefton Park Ticket Application Guide

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Sefton Park Ticket Application Guide

May 24, 2025 -

Kyle Walkers Night Out Explaining The Photos With Mystery Women Amidst Annie Kilner Split

May 24, 2025

Kyle Walkers Night Out Explaining The Photos With Mystery Women Amidst Annie Kilner Split

May 24, 2025 -

Microsofts Email Filter Blocks Palestine Employee Backlash Explained

May 24, 2025

Microsofts Email Filter Blocks Palestine Employee Backlash Explained

May 24, 2025 -

Securing Bbc Radio 1 Big Weekend Tickets A Step By Step Guide

May 24, 2025

Securing Bbc Radio 1 Big Weekend Tickets A Step By Step Guide

May 24, 2025 -

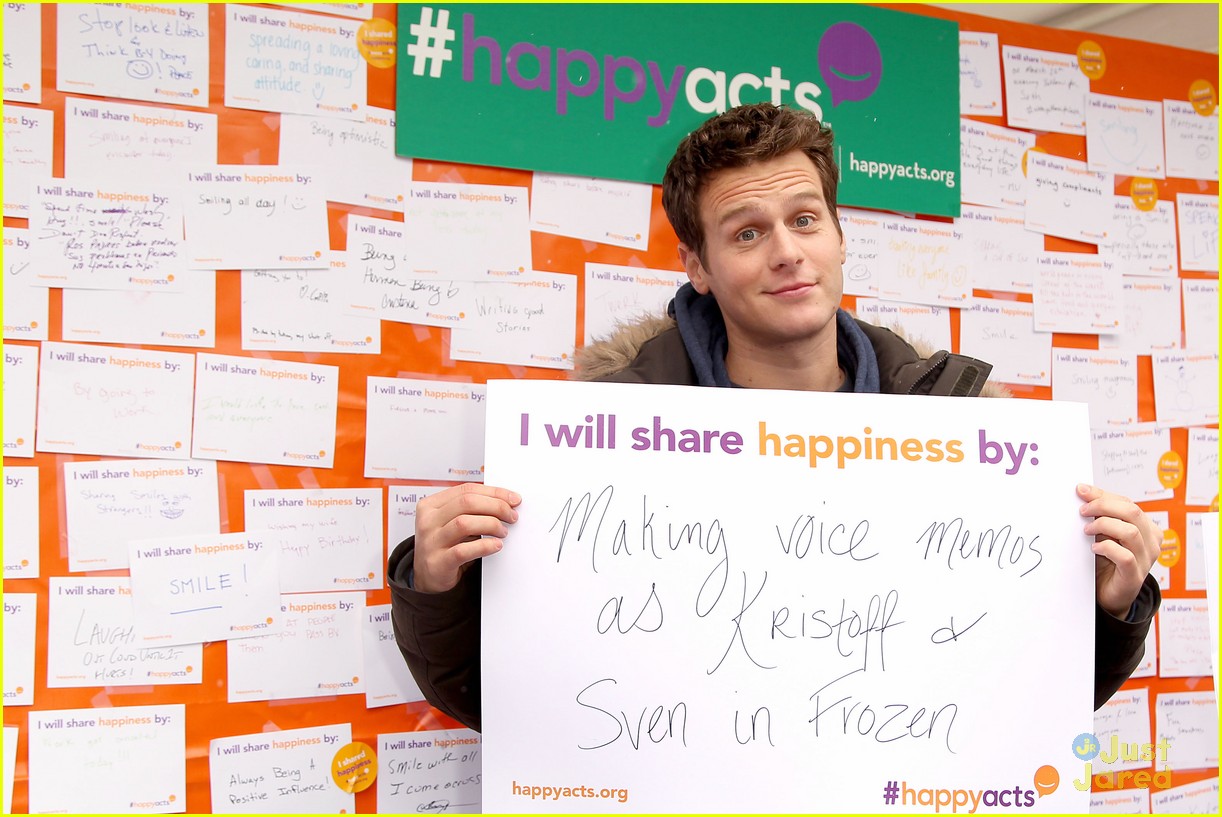

Jonathan Groffs Just In Time Opening A Star Studded Affair

May 24, 2025

Jonathan Groffs Just In Time Opening A Star Studded Affair

May 24, 2025

Latest Posts

-

Instinct Magazine Interview Jonathan Groff On Asexuality

May 24, 2025

Instinct Magazine Interview Jonathan Groff On Asexuality

May 24, 2025 -

Jonathan Groff Opening Up About His Asexuality

May 24, 2025

Jonathan Groff Opening Up About His Asexuality

May 24, 2025 -

Just In Time Musical Review Groffs Performance And The 60s Vibe

May 24, 2025

Just In Time Musical Review Groffs Performance And The 60s Vibe

May 24, 2025 -

Jonathan Groffs Just In Time A 1960s Era Musical Triumph

May 24, 2025

Jonathan Groffs Just In Time A 1960s Era Musical Triumph

May 24, 2025 -

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 24, 2025

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 24, 2025