New HMRC Approach To Side Hustle Tax: Increased Scrutiny And Enforcement

Table of Contents

Understanding the HMRC's Renewed Focus on Side Hustle Income

HMRC's policy shift towards greater enforcement of side hustle tax regulations reflects a broader effort to close the tax gap and address the growing prevalence of the gig economy. The rise of online platforms and flexible working arrangements has led to a significant increase in individuals engaging in secondary employment, often without fully understanding their tax responsibilities. This has prompted HMRC to implement more proactive measures to ensure fair tax collection.

This increased focus manifests in several ways:

- Increased data sharing with other government agencies: HMRC is collaborating more closely with other departments to access information about individuals' income streams, improving their ability to identify unreported side hustle earnings.

- More proactive use of tax investigations: HMRC is undertaking more targeted investigations into individuals suspected of underdeclaring their side hustle income, leading to a higher likelihood of penalties for non-compliance.

- Targeted campaigns focusing on specific side hustle sectors: HMRC is launching campaigns specifically targeting popular side hustle areas, such as online selling (e.g., through platforms like eBay and Etsy), freelance work, and the sharing economy (e.g., Airbnb).

- Use of AI and data analytics to identify potential tax evasion: Sophisticated algorithms are being used to analyze large datasets, identifying patterns and anomalies that may indicate tax evasion related to side hustle income.

New Reporting Requirements for Side Hustle Income

The reporting requirements for side hustle income vary depending on the nature of the activity and the level of income generated. It's crucial to understand your specific obligations to avoid penalties. For many, this involves self-assessment.

Accurate record-keeping is paramount. This includes meticulously documenting all income and expenses. Failure to do so can lead to significant issues when filing your tax return.

- Importance of registering as self-employed if income exceeds the threshold: If your side hustle income exceeds the annual threshold, you're legally obligated to register as self-employed with HMRC. Failing to do so is a serious offense.

- Regular filing of Self Assessment tax returns: Self-assessment tax returns must be submitted annually, usually by 31 January following the tax year. Late filing incurs penalties.

- Accurate record-keeping of all income and expenses (receipts, invoices): Keep detailed records of every transaction, including receipts for expenses and invoices for income. Digital record-keeping is increasingly common and accepted.

- Understanding the implications of different business structures (sole trader, partnership, limited company): The tax implications differ significantly based on your chosen business structure. Seek professional advice to choose the structure most suitable for your side hustle.

Penalties for Non-Compliance with Side Hustle Tax Regulations

Non-compliance with side hustle tax regulations can result in severe financial penalties. These penalties can escalate depending on the severity and frequency of the offense. HMRC takes non-compliance seriously.

- Late filing penalties: Submitting your Self Assessment return late will automatically incur penalties.

- Accuracy penalties: Inaccuracies in your tax return, such as underreporting income, can also result in significant penalties.

- Interest charges on unpaid tax: You'll be charged interest on any unpaid tax.

- Criminal prosecution in serious cases: In cases of deliberate tax evasion or fraud, criminal prosecution is a possibility, with potentially severe consequences.

Minimizing Your Risk: Best Practices for Side Hustle Tax Compliance

Proactive tax compliance is the best way to avoid penalties and maintain a positive relationship with HMRC.

- Keep detailed and accurate records: Meticulous record-keeping is essential. Use accounting software if necessary.

- File your Self Assessment tax return on time: Plan ahead and submit your return well before the deadline.

- Seek professional advice from an accountant or tax advisor: Professional advice can provide peace of mind and ensure you're fulfilling all your tax obligations correctly.

- Understand your tax obligations for your specific type of side hustle: Tax rules vary depending on your side hustle, so ensure you understand your specific liabilities.

- Use accounting software to track income and expenses: Software can automate many aspects of record-keeping, simplifying the process and reducing the risk of errors.

Conclusion

The new HMRC approach to side hustle tax signifies a significant shift towards increased scrutiny and enforcement. Understanding your tax obligations and adhering to reporting requirements is crucial to avoid penalties. By maintaining accurate records, filing your returns on time, and seeking professional advice when needed, you can minimise your risk and ensure compliance. Don't face the consequences of non-compliance – take control of your side hustle tax today and stay informed about the latest changes affecting your side hustle income. Learn more about staying compliant with the new HMRC approach to side hustle tax and avoid potential issues with HMRC.

Featured Posts

-

La Cruda Verdad La Conversacion Previa Al Regreso De Schumacher A La F1 En 2010

May 20, 2025

La Cruda Verdad La Conversacion Previa Al Regreso De Schumacher A La F1 En 2010

May 20, 2025 -

Robin Roberts Welcomes New Family Member On Gma

May 20, 2025

Robin Roberts Welcomes New Family Member On Gma

May 20, 2025 -

Suki Waterhouses Revealing Met Gala 2025 Outfit Black Tuxedo Dress Details

May 20, 2025

Suki Waterhouses Revealing Met Gala 2025 Outfit Black Tuxedo Dress Details

May 20, 2025 -

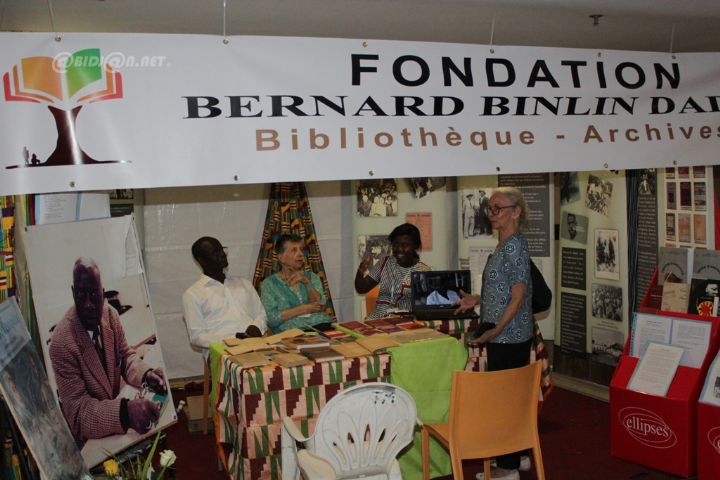

Salon International Du Livre D Abidjan Lancement De La 15eme Edition

May 20, 2025

Salon International Du Livre D Abidjan Lancement De La 15eme Edition

May 20, 2025 -

Tampoy I Marilena Dexetai Epithesi Me Maxairi Sto Epomeno Epeisodio

May 20, 2025

Tampoy I Marilena Dexetai Epithesi Me Maxairi Sto Epomeno Epeisodio

May 20, 2025