News Corp: Undervalued And Underappreciated? Analyzing Its Current Market Position

Table of Contents

News Corp's Diversified Portfolio: A Strength Often Overlooked

News Corp's success hinges on its diversified portfolio, a crucial strength often overlooked by market analysts. This diversification mitigates the risks associated with relying on single revenue streams, a common vulnerability in the volatile media industry.

The Power of Diversification in a Changing Media Landscape

- Dow Jones: This iconic financial news provider remains a cornerstone of News Corp's portfolio, generating consistent revenue streams despite the challenges facing traditional print media. Its digital transformation efforts contribute to its resilience.

- News UK: This division, encompassing prominent British newspapers like The Sun and The Times, showcases News Corp's ability to adapt to evolving media consumption habits, balancing print circulation with robust digital offerings.

- HarperCollins Publishers: This major book publishing house provides a relatively stable revenue stream, less susceptible to the rapid shifts seen in the news media sector. Its diverse catalog and successful author partnerships contribute to its ongoing success.

This strategic diversification across various media segments offers a buffer against economic downturns and shifts in consumer preferences. A portfolio analysis reveals the resilience of each segment, indicating a robust foundation for future growth.

Digital Real Estate: A Hidden Growth Engine

REA Group, a significant component of News Corp's portfolio, is a leading digital real estate business, primarily operating in Australia. Its contribution to News Corp's overall profitability is substantial and growing.

- Market Trends: The global digital real estate market continues to expand rapidly, fueled by technological advancements and evolving consumer behavior.

- News Corp's Position: REA Group holds a dominant market share in Australia, establishing a strong foundation for future expansion into new geographical markets and service offerings.

- Growth Prospects: REA Group's growth prospects are closely tied to the continuing digitization of the real estate industry, suggesting a powerful engine for long-term growth within the News Corp portfolio.

Analyzing News Corp's Financial Performance and Valuation Metrics

A thorough assessment of News Corp's financial performance is crucial in determining its true valuation. By examining key financial indicators and comparing them to industry peers, we can gain a clearer understanding of its market position.

Evaluating Key Financial Indicators

- Revenue Growth: Examining News Corp's revenue growth over time reveals trends and patterns that inform projections for future performance.

- Profit Margins: Analysis of profit margins helps gauge efficiency and profitability across different segments of the business.

- Debt Levels: Assessing debt-to-equity ratios provides insights into the company's financial health and risk profile.

- Free Cash Flow: Analyzing free cash flow is critical in determining the company’s ability to generate cash for reinvestment, acquisitions, or shareholder returns. A comparison to industry peers allows for a better understanding of News Corp's relative performance. (Charts and graphs would be included here in a full article.)

Assessing Market Valuation and Potential Upside

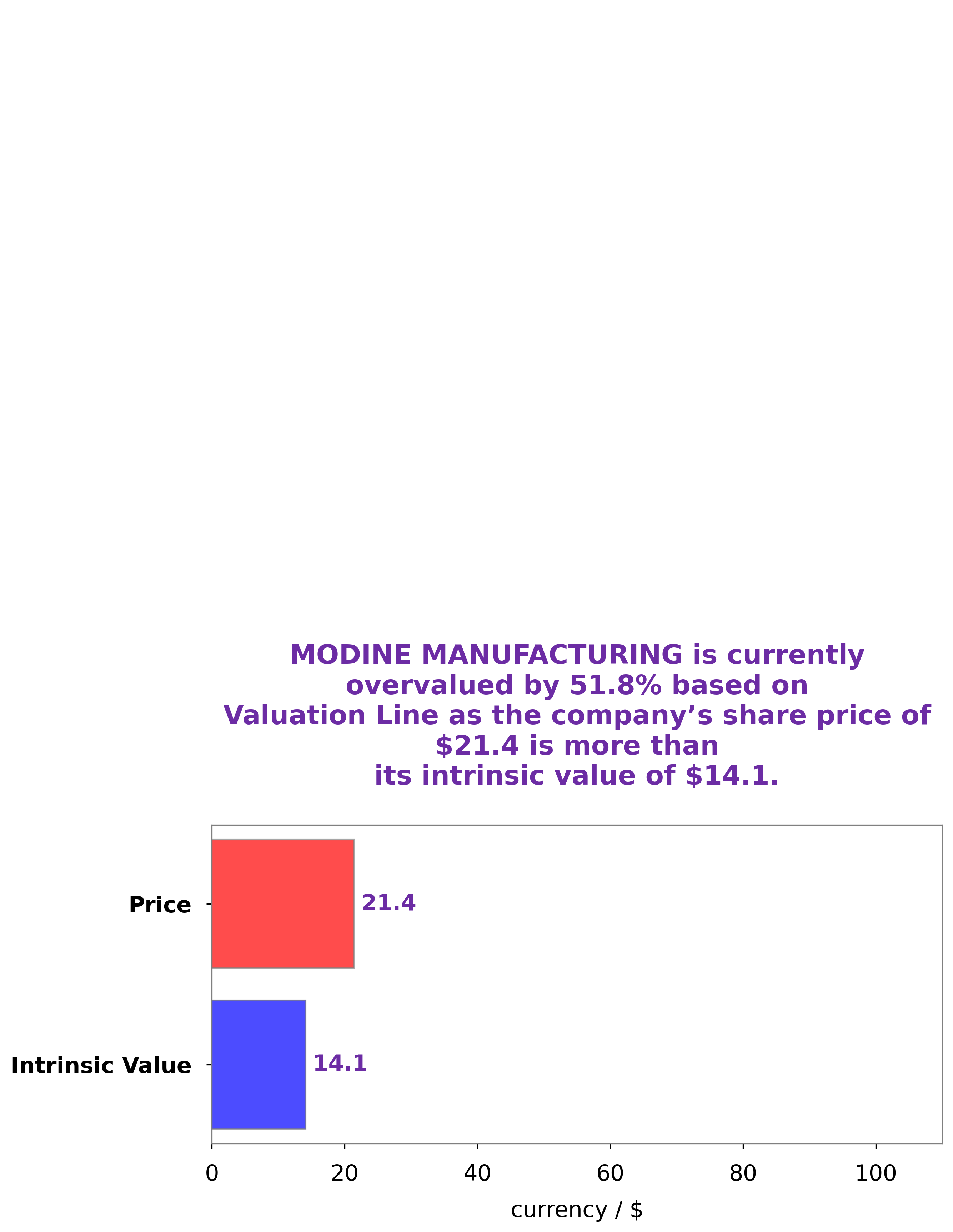

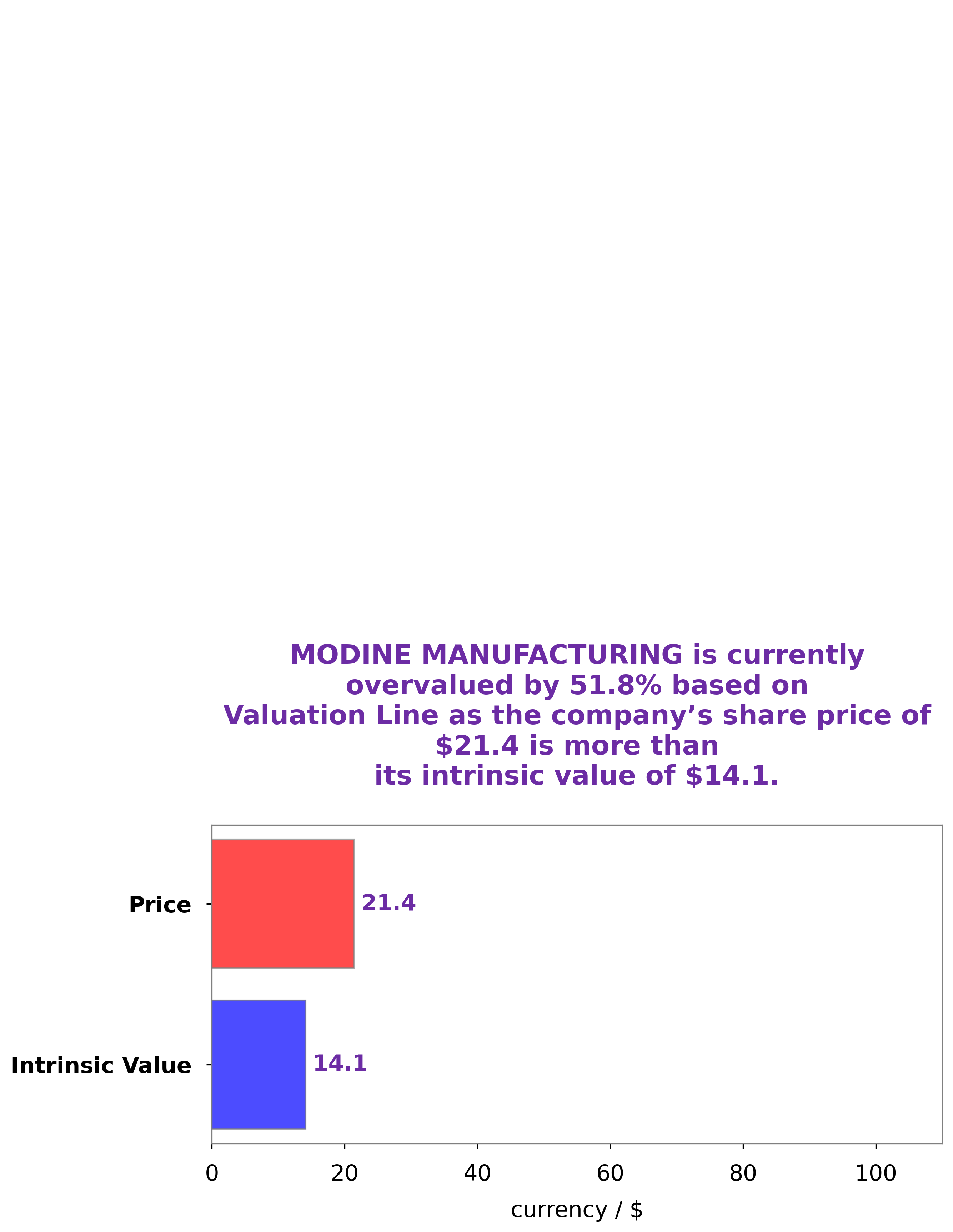

News Corp's current market capitalization needs to be compared to its intrinsic value to determine if it's truly undervalued.

- Intrinsic Value: Estimating News Corp's intrinsic value through discounted cash flow analysis or other valuation methods is crucial for determining potential upside.

- Stock Price Catalysts: Potential catalysts for stock price appreciation include successful acquisitions, strategic partnerships, cost-cutting initiatives, and improving market sentiment.

- Risk Assessment: It is crucial to acknowledge potential risks that could impact the valuation, such as unforeseen economic downturns or changes in regulatory environments.

Addressing Concerns and Potential Risks

While News Corp shows significant potential, acknowledging industry challenges and potential risks is crucial for a balanced assessment.

Challenges in the Media Industry

The media industry faces numerous challenges:

- Declining Print Readership: The shift towards digital media continues to impact print circulation revenues. News Corp is actively diversifying into digital platforms to mitigate this risk.

- Digital Competition: Intense competition from digital platforms requires constant innovation and adaptation to maintain market share.

- Evolving Media Consumption Habits: Understanding and adapting to evolving consumer preferences is vital for long-term success.

News Corp's strategic response involves investing in digital platforms, expanding its content offerings, and focusing on audience engagement.

Geopolitical and Economic Risks

External factors can also impact News Corp's performance:

- Economic Downturns: Global economic instability can affect advertising revenue and consumer spending.

- Regulatory Changes: Regulatory changes in various markets can impact News Corp's operations and profitability.

- Political Instability: Political instability in key markets can create uncertainty and disrupt business operations.

Conclusion: Is News Corp Truly Undervalued? A Call to Action

Our analysis suggests that News Corp's diversified portfolio, strong performance in key segments (particularly digital real estate), and potential for future growth may not be fully reflected in its current market valuation. While significant challenges exist within the media industry, News Corp's strategic initiatives demonstrate a proactive approach to adapting to a changing landscape. While further investigation is always recommended, the evidence presented suggests that News Corp's current market position may not fully reflect its potential. Therefore, we encourage investors to conduct their own thorough due diligence and consider whether News Corp warrants a closer look as a potentially undervalued investment opportunity. Consider News Corp investment as part of a well-diversified portfolio.

Featured Posts

-

The Kyle Walker Annie Kilner Dispute Poisoning Accusations Investigated

May 24, 2025

The Kyle Walker Annie Kilner Dispute Poisoning Accusations Investigated

May 24, 2025 -

Mamma Mia A Collectors Guide To The New Ferrari Hot Wheels Sets

May 24, 2025

Mamma Mia A Collectors Guide To The New Ferrari Hot Wheels Sets

May 24, 2025 -

September Debut For Demnas Gucci Collection Amidst Kering Sales Drop

May 24, 2025

September Debut For Demnas Gucci Collection Amidst Kering Sales Drop

May 24, 2025 -

2024 Philips Annual General Meeting What You Need To Know

May 24, 2025

2024 Philips Annual General Meeting What You Need To Know

May 24, 2025 -

Ot Evroviziya Do Dnes Neveroyatnata Transformatsiya Na Konchita Vurst

May 24, 2025

Ot Evroviziya Do Dnes Neveroyatnata Transformatsiya Na Konchita Vurst

May 24, 2025

Latest Posts

-

England Airpark And Alexandria International Airports Ae Xplore Campaign Boosting Local And Global Travel

May 24, 2025

England Airpark And Alexandria International Airports Ae Xplore Campaign Boosting Local And Global Travel

May 24, 2025 -

Fly Local Explore Global England Airpark And Alexandria International Airports New Ae Xplore Campaign

May 24, 2025

Fly Local Explore Global England Airpark And Alexandria International Airports New Ae Xplore Campaign

May 24, 2025 -

Camunda Con 2025 Amsterdam Driving Business Value Through Orchestrated Ai And Automation

May 24, 2025

Camunda Con 2025 Amsterdam Driving Business Value Through Orchestrated Ai And Automation

May 24, 2025 -

Ae Xplore Global Campaign Launches Connecting England Airpark And Alexandria International Airport

May 24, 2025

Ae Xplore Global Campaign Launches Connecting England Airpark And Alexandria International Airport

May 24, 2025 -

Amsterdams Camunda Con 2025 How Orchestration Boosts Ai And Automation Investments

May 24, 2025

Amsterdams Camunda Con 2025 How Orchestration Boosts Ai And Automation Investments

May 24, 2025