Nicki Chapman's Escape To The Country: Revealing Her Profitable Property Investment

Table of Contents

Analyzing Nicki Chapman's Property Investment Strategy

While Nicki Chapman hasn't publicly detailed her specific investment portfolio, her association with "Escape to the Country" offers clues about her likely approach. Her expertise in identifying desirable rural properties suggests a focus on:

-

Location, Location, Location: Prime locations, offering both lifestyle appeal and strong rental potential, are likely key criteria. Areas with good infrastructure, schools, and commuting links to larger towns or cities will command higher prices and rental yields.

-

Property Type: Nicki's likely interest lies in a mix of property types, ranging from charming cottages to larger family homes, potentially including those with renovation potential. This diversification offers protection against market fluctuations.

-

Rental Yield: Maximizing rental income is crucial for any successful property investor. Thorough research of local rental markets is essential to ensure a property's potential to generate a solid return.

-

Management: Whether Nicki uses property management companies or self-manages her properties remains unknown. Both have their advantages and disadvantages – professional management frees up time, but self-management allows for more direct control.

Key elements of Nicki Chapman's implied property investment strategy:

- Focus on long-term growth potential: Rural property tends to appreciate in value steadily over time.

- Consideration of renovation and refurbishment opportunities: Adding value through improvements can significantly increase profit margins.

- Diversification of property portfolio: Spreading investments across different locations and property types mitigates risk.

- Thorough due diligence before purchasing: Essential for minimizing costly mistakes and maximizing returns.

The Allure of Rural Property Investment (as seen in "Escape to the Country")

"Escape to the Country" showcases the beauty and tranquility of rural life, and this translates into strong demand for rural properties. Investing in rural properties presents several compelling advantages:

- Capital Appreciation: Rural properties often appreciate in value over the long term, offering significant capital growth.

- Lifestyle Advantages: Owning a rural property offers a lifestyle change, even for purely investment purposes.

However, challenges exist:

- Slower Rental Market: Finding tenants may take longer compared to urban areas.

- Higher Maintenance Costs: Rural properties often require more maintenance due to their age and potential for exposure to the elements.

Specific Benefits of Rural Property Investment:

- Increased demand for rural properties in specific areas: Certain locations are highly sought after, driving up prices.

- Potential for holiday lets and short-term rentals: This can generate higher rental yields than long-term lets.

- Tax advantages for rural property owners (where applicable): Research potential tax benefits associated with rural property ownership in your specific location.

- Importance of understanding local market conditions: Local expertise is vital for successful rural property investment.

Lessons Learned from Nicki Chapman's Success: Practical Tips for Aspiring Property Investors

While we can only speculate about Nicki Chapman’s specific investment techniques, her success implies adherence to core principles of profitable property investment:

- Thorough Market Research: Understanding local market trends is crucial for identifying undervalued properties with high potential.

- Due Diligence is Paramount: Careful vetting of properties, including surveys and legal checks, is essential to avoid costly pitfalls.

- Strategic Financing: Securing suitable financing at competitive rates is vital to maximize returns.

- Build a Strong Team: Working with experienced solicitors, estate agents, and surveyors provides invaluable support.

- Account for Maintenance: Budget for potential repairs and renovations, especially with older rural properties.

- Long-Term Vision: Property investment is a long-term game; patience and a clear strategy are key to success.

Finding Your Own "Escape to the Country": A Step-by-Step Guide

Ready to embark on your own profitable property investment journey? Follow these steps:

- Define Your Investment Goals and Budget: Set realistic goals and determine how much you can afford to invest.

- Search for Suitable Properties: Utilize online property portals, engage estate agents specializing in rural properties, and network within the industry.

- Conduct Thorough Inspections and Valuations: Engage qualified surveyors to assess the property's condition and value accurately.

- Negotiate the Purchase Price: Develop strong negotiation skills to secure a favorable price.

- Complete the Legal and Financial Processes: Ensure all legal and financial aspects of the transaction are handled correctly by professionals.

Conclusion: Unlocking Profitable Property Investment – Your Escape to the Country Awaits

Nicki Chapman's implied success in property investment, particularly in the rural sector, provides valuable insights for aspiring investors. By focusing on thorough research, due diligence, and a long-term perspective, you too can unlock the potential of profitable property investment. Start your journey today by researching rural properties in areas that appeal to you. Remember, the key to successful rural property investment is understanding the market, securing appropriate financing, and having a clear, well-defined investment strategy. Start your search for your own "Escape to the Country" property now! Find profitable property investment opportunities and begin building your portfolio.

Featured Posts

-

Dogecoins Future Elon Musks Involvement

May 25, 2025

Dogecoins Future Elon Musks Involvement

May 25, 2025 -

Analyse Van De Stijgende Kapitaalmarktrentes En De Sterke Euro

May 25, 2025

Analyse Van De Stijgende Kapitaalmarktrentes En De Sterke Euro

May 25, 2025 -

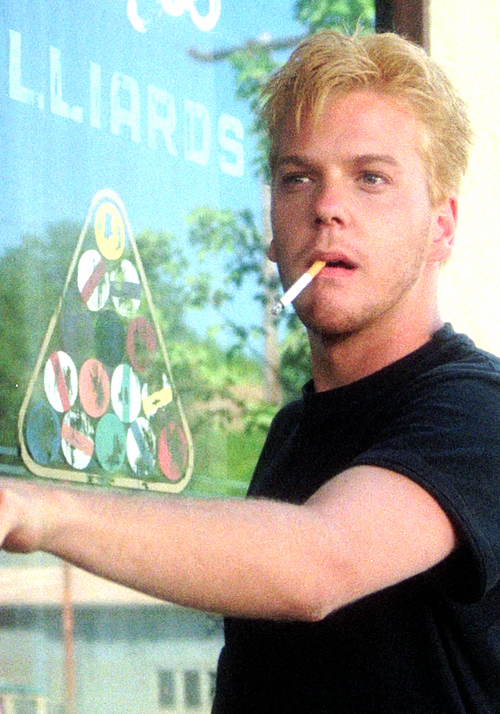

Kiefer Sutherland Casting News Sends Fans Into A Frenzy

May 25, 2025

Kiefer Sutherland Casting News Sends Fans Into A Frenzy

May 25, 2025 -

European Shares React To Trumps Tariff Comments Lvmh Stock Takes A Hit

May 25, 2025

European Shares React To Trumps Tariff Comments Lvmh Stock Takes A Hit

May 25, 2025 -

Mamma Mia A Look At The New Ferrari Hot Wheels Car Sets

May 25, 2025

Mamma Mia A Look At The New Ferrari Hot Wheels Car Sets

May 25, 2025