Nike Q3 Performance And Its Implications For Foot Locker's Near-Term Prospects

Table of Contents

Nike's Q3 Earnings Report: A Deep Dive

Nike's Q3 earnings report provides vital insights into the overall health of the athletic footwear market and the effectiveness of Nike's strategies. Analyzing key performance indicators is crucial to understanding the implications for its retail partners.

Key Performance Indicators

Nike's Q3 results (replace with actual figures once available) will reveal crucial data points. We'll be looking closely at:

- Revenue: A significant increase/decrease compared to Q3 of the previous year and analyst predictions will signal overall market demand and the success of new product launches.

- Earnings Per Share (EPS): This metric indicates profitability and the efficiency of Nike's operations. A strong EPS suggests healthy margins and effective cost management.

- Gross Margin: Changes in gross margin reveal insights into pricing strategies, manufacturing costs, and the impact of supply chain improvements.

- Inventory Levels: Managing inventory effectively is crucial. High inventory levels might suggest slower sales or potential markdowns, while low inventory could indicate strong demand.

(Insert actual Nike Q3 data here and analyze it against expectations and previous quarters. For example: "Nike reported revenue of X billion, exceeding analyst expectations of Y billion by Z%. This growth was primarily driven by strong performance in the North American market and the success of the new Air Max line.")

Analysis of Nike's Direct-to-Consumer Strategy

Nike's robust direct-to-consumer (DTC) strategy, encompassing its app, website, and owned retail stores, is a major factor influencing its overall performance and, consequently, its wholesale partners.

- App Engagement & Online Sales: High engagement and online sales indicate strong brand loyalty and the success of digital marketing strategies.

- Owned Store Performance: The performance of Nike's retail stores provides valuable data on consumer preferences and buying habits.

Increased DTC sales can sometimes lead to reduced wholesale allocations to partners like Foot Locker, impacting their revenue streams. Analyzing the balance between DTC and wholesale growth is critical.

Supply Chain and Inventory Management

Navigating supply chain challenges and efficiently managing inventory are key to Nike's success.

- Improved Logistics: Efficient logistics and streamlined supply chains are crucial for meeting consumer demand.

- Inventory Optimization: Effective inventory management prevents excess stock and associated markdowns while ensuring sufficient supply to meet demand.

Nike's progress in these areas directly impacts its ability to consistently supply Foot Locker with popular products. Improved efficiency could lead to increased wholesale shipments and stronger partnerships.

Implications for Foot Locker's Near-Term Prospects

Nike's Q3 performance directly impacts Foot Locker's near-term prospects, as Nike products constitute a significant portion of Foot Locker's inventory.

Impact on Wholesale Revenue

Foot Locker's wholesale revenue heavily relies on Nike products. Nike's Q3 results will dictate:

- Wholesale Allocations: Changes in Nike's wholesale pricing strategies or product allocation directly affect Foot Locker's ability to stock popular items.

- Historical Correlation: Analyzing the historical correlation between Nike's sales and Foot Locker's performance provides a crucial predictive framework.

A strong Nike Q3 could translate into increased wholesale revenue for Foot Locker, while weaker performance might indicate challenges.

Foot Locker's Diversification Strategy

To mitigate the risk associated with its reliance on Nike, Foot Locker is actively diversifying its product portfolio.

- Alternative Brands: Foot Locker's strategy includes collaborations with and the stocking of various athletic footwear brands.

- Risk Mitigation: This diversification strategy lessens the impact of fluctuations in Nike's performance on Foot Locker's overall financial health.

The success of Foot Locker's diversification efforts will be a crucial factor in its ability to weather potential downturns in Nike's performance.

Macroeconomic Factors and Consumer Spending

Macroeconomic factors significantly impact consumer spending habits and consequently influence both Nike and Foot Locker's performance.

- Inflation and Interest Rates: High inflation and interest rates can reduce consumer discretionary spending, impacting sales of athletic footwear.

- Consumer Confidence: Overall consumer confidence levels greatly influence purchasing decisions.

Understanding the interplay between macroeconomic factors and consumer behavior is critical in predicting future performance for both companies.

Conclusion

Nike's Q3 performance serves as a powerful indicator for Foot Locker's near-term prospects. A strong Nike Q3, characterized by robust sales, efficient supply chains, and effective DTC strategies, bodes well for Foot Locker's wholesale revenue. However, macroeconomic conditions and Foot Locker's ability to diversify its product portfolio are also crucial factors to consider. Analyzing Nike's Q4 results will provide further insights into the trajectory of both companies. Stay informed about future developments in the athletic footwear market and the relationship between Nike and Foot Locker by subscribing to our newsletter and following us on social media for updates on Nike's future impact and Foot Locker's prospects related to Nike.

Featured Posts

-

Senators Vs Maple Leafs Live Stream April 22nd 2025 Watch Game 2 Online

May 16, 2025

Senators Vs Maple Leafs Live Stream April 22nd 2025 Watch Game 2 Online

May 16, 2025 -

Opening Day 2025 The Projected Return Of Jacob Wilson And Max Muncy

May 16, 2025

Opening Day 2025 The Projected Return Of Jacob Wilson And Max Muncy

May 16, 2025 -

The Downfall Of The King Of Davos Exploring His Reigns End

May 16, 2025

The Downfall Of The King Of Davos Exploring His Reigns End

May 16, 2025 -

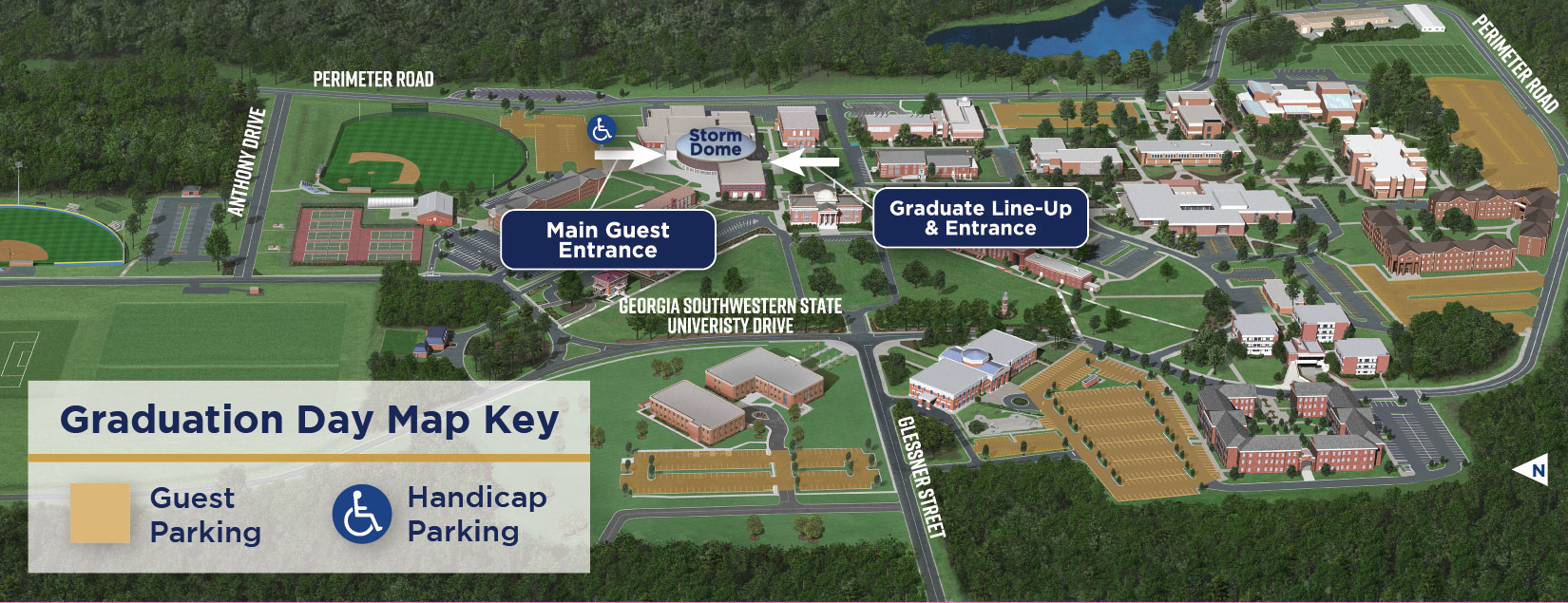

Individual In Custody Gsw Campus Receives All Clear

May 16, 2025

Individual In Custody Gsw Campus Receives All Clear

May 16, 2025 -

Padres Defiance Blocking The Dodgers Master Plan

May 16, 2025

Padres Defiance Blocking The Dodgers Master Plan

May 16, 2025