Nike's Revenue: Worst Performance In Five Years?

Table of Contents

Analyzing Nike's Recent Financial Reports

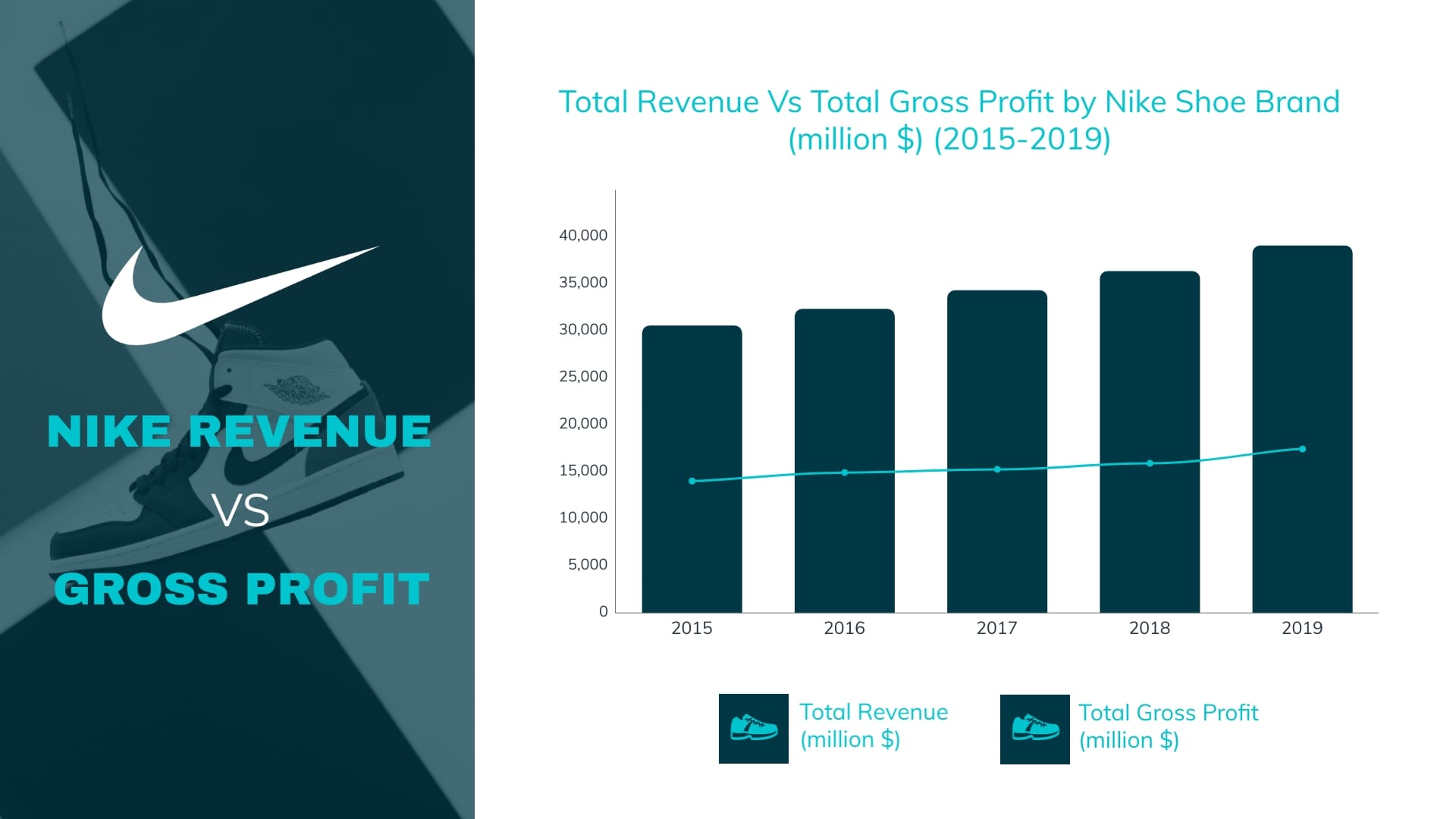

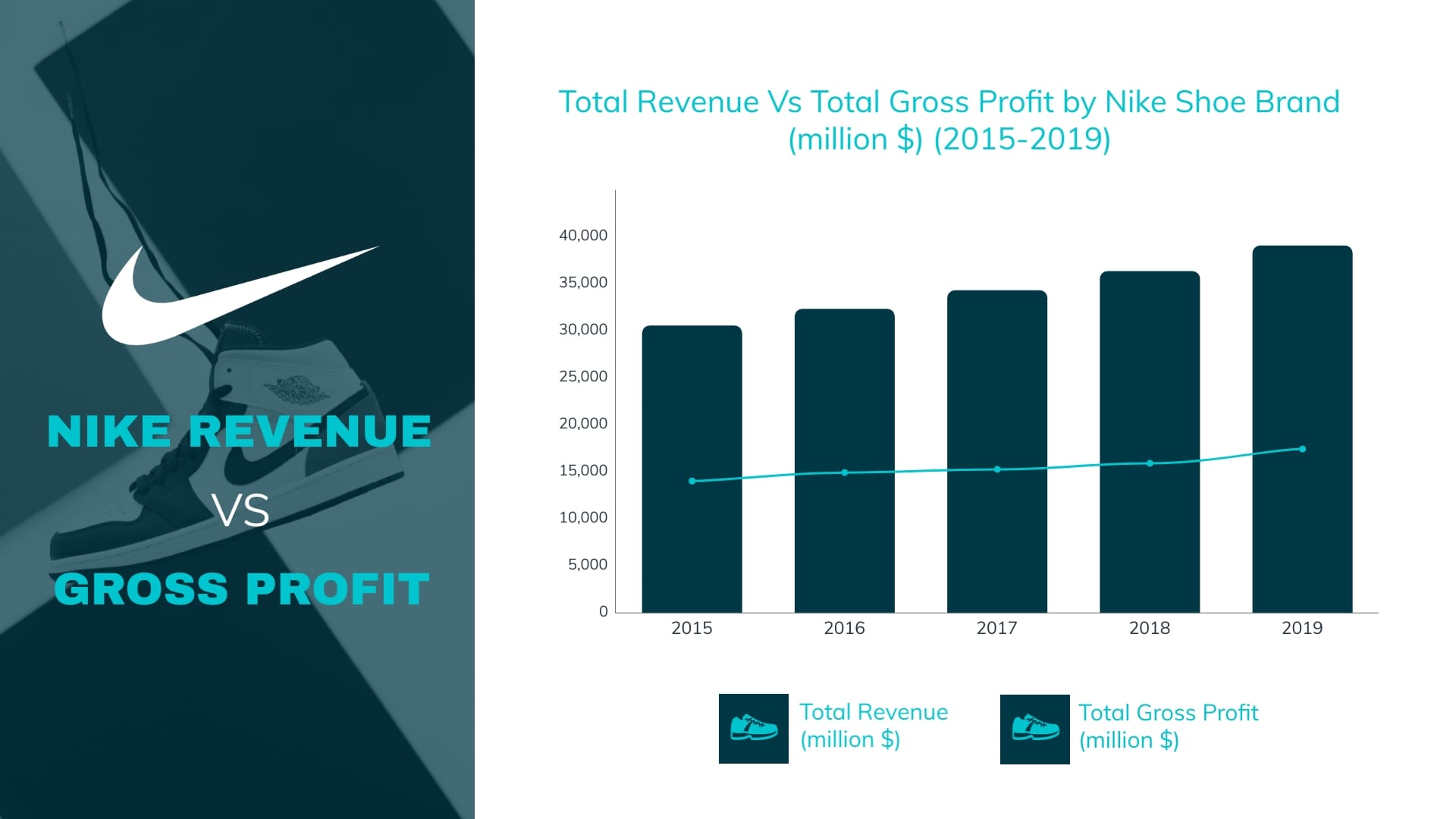

Understanding Nike's current situation requires a close look at its financial statements. Analyzing key metrics like revenue, net income, and earnings per share, compared year-over-year, reveals the extent of the challenges. While precise figures require referencing official Nike financial reports and press releases, a general trend of declining revenue and potentially shrinking profit margins has been observed.

- Year-over-year comparison: A comparison of Nike's revenue figures from the past five years readily highlights the current downturn. Specific quarterly reports will illuminate which periods witnessed the steepest drops in Nike sales.

- Quarterly earnings analysis: Examining individual quarters reveals whether the decline is consistent or if specific periods experienced disproportionately larger setbacks. This granular view is crucial in identifying potential triggers for the fluctuations in Nike's earnings.

- Profit margin fluctuations: A critical aspect of financial health is analyzing the profit margins. Decreasing profit margins, even with stable or slightly declining revenue, indicate a concerning trend suggesting increased costs or reduced pricing power.

Visual representations, like charts and graphs depicting these figures, would significantly enhance understanding and provide a clear picture of Nike's financial performance trajectory.

Key Factors Contributing to the Revenue Decline

The decline in Nike's revenue is likely a confluence of several internal and external factors. Understanding these intertwined issues is crucial for evaluating the company's long-term prospects and its ability to navigate the current challenges.

- Supply chain disruptions: Global supply chain issues continue to impact many industries, including athletic apparel. Delays in production, increased shipping costs, and material shortages undoubtedly contributed to Nike's revenue challenges and hampered its ability to meet market demands.

- Inflation and consumer spending: Rising inflation has reduced consumer spending power globally. Consumers, facing higher prices for essential goods, may be cutting back on discretionary spending, impacting the demand for premium athletic apparel like Nike products.

- Competition in the sportswear industry: Nike faces intense competition from brands like Adidas, Under Armour, and emerging players. Aggressive marketing campaigns, innovative product launches, and competitive pricing strategies from rivals put pressure on Nike's market share and revenue.

- Macroeconomic factors: A global economic slowdown or recessionary environment significantly influences consumer behavior, potentially leading to decreased spending on non-essential items such as athletic apparel.

The Impact of Changing Consumer Preferences

Beyond macroeconomic factors, evolving consumer preferences also play a role. The modern consumer is increasingly conscious of sustainability, ethical sourcing, and unique styles.

- Demand for sustainable products: Consumers are showing a growing preference for brands committed to sustainable practices, including eco-friendly materials and ethical manufacturing processes. Nike needs to adapt its production and marketing to align with this increasing demand for sustainable athletic apparel.

- Ethical sourcing concerns: Consumers are more discerning about where and how products are made. Concerns about labor practices and environmental impact in the supply chain influence purchasing decisions.

- Shifting fashion trends: Athletic apparel is increasingly influenced by fashion trends. Nike's ability to stay ahead of these trends and adapt its product offerings is crucial for maintaining sales and attracting younger demographics.

Nike's Strategies to Recover Revenue

Nike is actively implementing various strategies to address the revenue decline and regain its position in the market. The success of these strategies will largely determine the brand's future trajectory.

- Direct-to-consumer (DTC) strategy: Expanding the DTC model—selling directly to consumers through online channels and owned retail stores—allows Nike to control pricing, improve brand messaging, and gather valuable consumer data. This reduces reliance on third-party retailers.

- Marketing campaigns and brand building: Nike continues to invest heavily in marketing campaigns and brand building initiatives to solidify its position in the consumer's mind and foster brand loyalty. The effectiveness of these campaigns in driving sales is essential.

- Product innovation and new product launches: Regular introduction of innovative products with improved technology, enhanced design, and appealing aesthetics is paramount to maintaining market share and attracting new consumers.

Conclusion

Nike's recent revenue performance indicates a challenging period for the brand. The decline is attributable to a complex interplay of external factors like inflation, supply chain disruptions, and macroeconomic conditions, as well as internal factors such as competition and the need to adapt to changing consumer preferences. Nike's strategic response, focusing on its DTC strategy, impactful marketing, and product innovation, will determine its ability to recover and maintain its dominant position in the sportswear industry. Stay tuned for updates on Nike's revenue and the brand's efforts to regain its footing in the athletic apparel sector. Further research into the impact of macroeconomic factors on the athletic apparel industry is also encouraged to gain a comprehensive understanding of the current challenges and future outlook.

Featured Posts

-

Ciri Khas Batu Yaman Habasyi Identifikasi Dan Pemeriksaan Keaslian

May 06, 2025

Ciri Khas Batu Yaman Habasyi Identifikasi Dan Pemeriksaan Keaslian

May 06, 2025 -

Demi Moores 1991 Body Paint Photoshoot Inspiration For Pooja Bhatts Bold Look

May 06, 2025

Demi Moores 1991 Body Paint Photoshoot Inspiration For Pooja Bhatts Bold Look

May 06, 2025 -

Patrick Schwarzeneggers Classic Bronco Effortless Cool In La

May 06, 2025

Patrick Schwarzeneggers Classic Bronco Effortless Cool In La

May 06, 2025 -

Priyanka Chopras Miss World Two Piece Controversy Madhu Chopra Reveals All

May 06, 2025

Priyanka Chopras Miss World Two Piece Controversy Madhu Chopra Reveals All

May 06, 2025 -

Betty Gilpins Oh Mary Broadway Run A List Farewell With Jennifer Lopez Meryl Streep And More

May 06, 2025

Betty Gilpins Oh Mary Broadway Run A List Farewell With Jennifer Lopez Meryl Streep And More

May 06, 2025