Nine African Nations Lose PwC: Analysis Of The Senegal, Gabon, And Madagascar Implications

Table of Contents

The Broader Context: PwC's Withdrawal from Nine African Nations

The decision by PwC to withdraw from nine African nations marks a significant shift in the landscape of professional services on the continent. Understanding the reasons behind this withdrawal is crucial to assessing its long-term impact.

Reasons behind the withdrawal:

Several factors may have contributed to PwC's decision. These include:

- Regulatory Changes: Increasingly stringent regulatory requirements in certain African nations may have made operations more complex and costly for PwC. This could involve compliance with new accounting standards, anti-money laundering regulations, and data privacy laws.

- Operational Challenges: Operating in diverse African markets presents logistical and infrastructural hurdles. Challenges such as political instability, unreliable infrastructure, and difficulties in recruiting and retaining skilled staff may have impacted PwC's profitability.

- Strategic Restructuring: PwC's decision might also reflect a broader strategic restructuring within the firm, focusing resources on more profitable or strategically important markets.

Data on the scale of PwC's operations in the affected countries is limited publicly; however, their presence was substantial, particularly in major cities and key economic sectors. This withdrawal will undoubtedly affect the other Big Four firms—Deloitte, Ernst & Young, and KPMG—who may now face increased competition and pressure to fill the void left by PwC.

Senegal: Assessing the Impact of PwC's Departure

The impact of PwC's withdrawal on Senegal's economy is a significant concern. PwC played a substantial role in the Senegalese financial sector, providing auditing services to numerous banks, multinational corporations, and government entities.

Economic Implications:

- Financial Sector Disruption: The departure of PwC could disrupt operations in the financial sector, particularly affecting medium-sized banks and companies relying on PwC’s audit and advisory services.

- Potential Job Losses: The withdrawal may lead to job losses among PwC employees in Senegal, as well as potential indirect job losses in related sectors.

- Attracting New Firms: While challenging, Senegal's proactive approach to attracting foreign investment could attract other international accounting firms to fill the gap left by PwC, boosting competition.

Regulatory Response:

The Senegalese government might respond to PwC's withdrawal by:

- Strengthening local accounting firms: Investing in capacity building for local accounting firms could mitigate the negative impacts.

- Reviewing regulations: The government may review existing regulations to ensure a conducive environment for international accounting firms.

- Engaging with other firms: Proactive engagement with other international firms may help attract replacements for PwC.

Gabon: Analyzing the Implications for Gabonese Businesses

Gabon's economy, heavily reliant on the oil sector, is particularly vulnerable to the repercussions of PwC's withdrawal. PwC's auditing and advisory services played a critical role in ensuring transparency and accountability in the country's business dealings.

Impact on Investment and Development:

- Reduced Transparency: The absence of PwC may lead to decreased transparency and accountability, potentially impacting foreign investment and economic development.

- Oil Sector Vulnerability: The oil sector, a cornerstone of Gabon's economy, relies heavily on robust auditing practices. PwC's withdrawal increases the risk of financial irregularities going undetected.

- Alternative Auditing Firms: While other firms can potentially fill the gap, their capacity to handle the volume of work previously undertaken by PwC remains to be seen.

Challenges for the Gabonese Accounting Profession:

This situation presents both opportunities and challenges for local accounting firms in Gabon.

- Growth Opportunities: Local firms can expand their client base and develop expertise in specialized areas.

- Capacity Building Needs: Significant investment in training and capacity building is crucial to ensure these local firms can effectively replace PwC's services. This includes enhancing technical skills, regulatory knowledge, and international best practices.

Madagascar: Understanding the Consequences for a Developing Economy

Madagascar, with its developing economy, is particularly vulnerable to the implications of PwC's withdrawal. The impact will likely be most acutely felt by small and medium-sized enterprises (SMEs).

Impact on Small and Medium-Sized Enterprises (SMEs):

- Access to Services: SMEs often rely heavily on PwC for affordable auditing and advisory services. The withdrawal limits their access to these vital services.

- Increased Costs: Seeking services from alternative firms may prove more expensive for many SMEs, impacting their financial viability.

- Support Mechanisms: The government needs to establish support mechanisms to help SMEs navigate the challenges resulting from PwC's departure.

Long-term effects on economic growth and stability:

The long-term consequences for Madagascar's economic development are concerning.

- Foreign Investment Risk: The reduced transparency and accountability may deter foreign investment, hindering economic growth.

- Economic Stability: The overall impact on economic stability could be significant, potentially affecting employment and poverty reduction efforts.

- Attracting New Firms: Madagascar needs to implement proactive strategies to attract new international auditing firms and support local capacity building initiatives.

Conclusion: The Lasting Effects of Nine African Nations Losing PwC

The withdrawal of PwC from nine African nations, including Senegal, Gabon, and Madagascar, presents a complex challenge with far-reaching consequences. While the reasons behind the departure are multifaceted, the impact on these nations' economies, business environments, and regulatory frameworks is undeniable. The analysis highlights the need for proactive strategies to mitigate the potential negative consequences. This includes strengthening local accounting capacity, attracting new international firms, and reviewing regulatory frameworks to ensure a conducive environment for business growth. Further research and discussion on the "Nine African Nations Lose PwC" issue are critical to developing effective solutions. We urge readers to engage in further investigation of this developing situation and its implications for sustainable economic growth across the affected nations.

Featured Posts

-

Capital Summertime Ball 2025 Ticket Purchase Everything You Need To Know

Apr 29, 2025

Capital Summertime Ball 2025 Ticket Purchase Everything You Need To Know

Apr 29, 2025 -

A Practical Guide To Getting Capital Summertime Ball 2025 Tickets

Apr 29, 2025

A Practical Guide To Getting Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

Examining The Russian Militarys Activities And Their European Implications

Apr 29, 2025

Examining The Russian Militarys Activities And Their European Implications

Apr 29, 2025 -

Huaweis Exclusive Ai Chip Specifications And Market Implications

Apr 29, 2025

Huaweis Exclusive Ai Chip Specifications And Market Implications

Apr 29, 2025 -

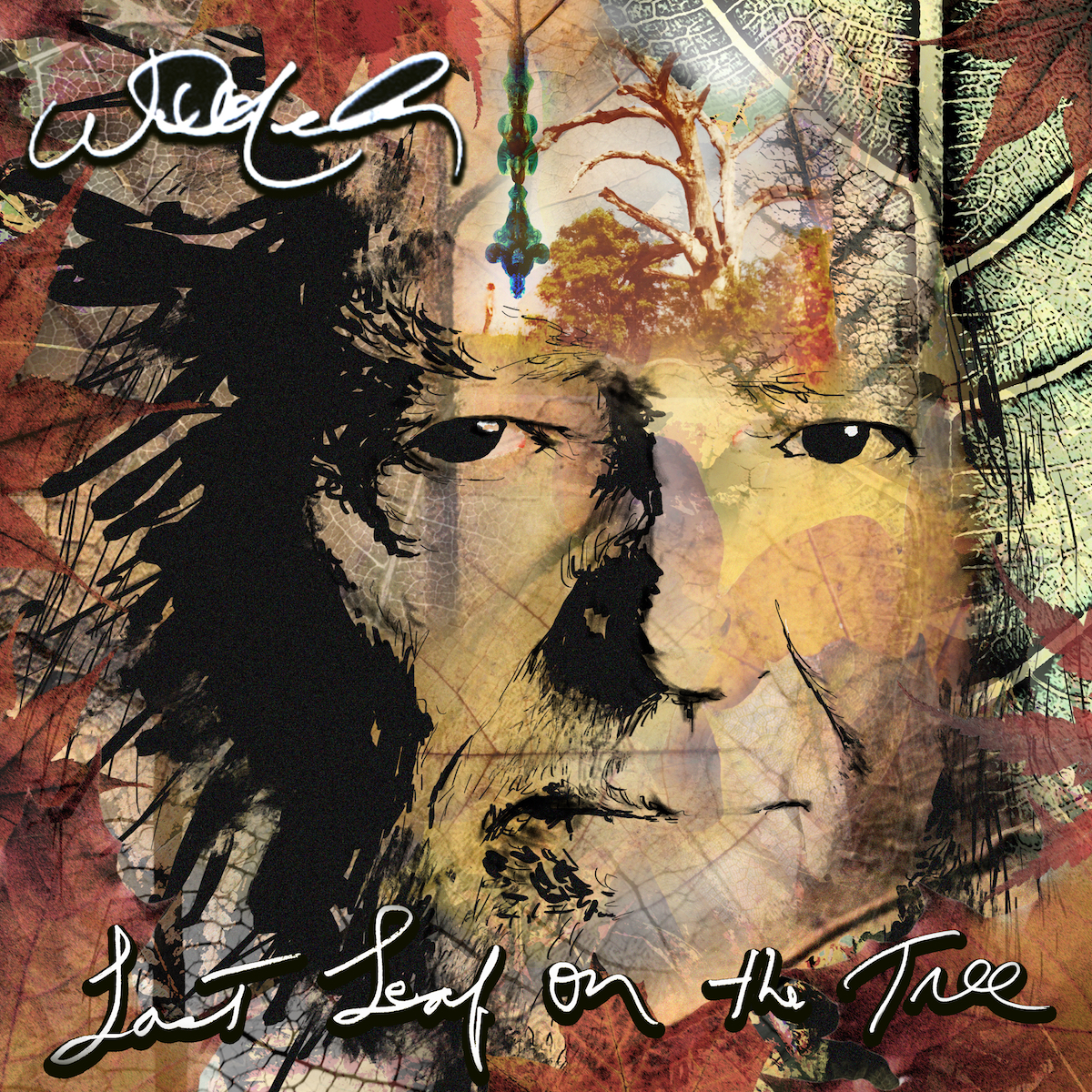

Willie Nelson Announces New Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelson Announces New Album Oh What A Beautiful World

Apr 29, 2025