Nippon-U.S. Steel Deal: Trump Administration's Approval And Market Impact

Table of Contents

The Nippon-U.S. Steel Deal: A Deep Dive

Details of the Deal:

The specifics of the Nippon-U.S. Steel deal, while potentially complex and subject to non-disclosure agreements, would typically involve several key aspects. Let's assume, for illustrative purposes, a hypothetical scenario:

- Nature of the Deal: A joint venture combining specific assets and operations of Nippon Steel and U.S. Steel.

- Assets Involved: This could include specific steel mills in the US and Japan, research and development facilities, and particular production lines specializing in certain steel grades. The exact assets would be determined by the specifics of any real agreement.

- Companies Involved: While the primary focus is on Nippon Steel and U.S. Steel, other smaller companies within their respective supply chains could be indirectly affected.

The Trump Administration's Role:

The Trump administration's "America First" policy and its imposition of steel tariffs significantly shaped the landscape within which this deal was negotiated. The administration's review process would likely have focused on:

- National Security Concerns: Whether the deal threatened US national security by potentially diminishing domestic steel production capabilities or increasing reliance on foreign sources.

- Economic Considerations: The administration would assess the deal's impact on US jobs, economic growth, and the overall competitiveness of the American steel industry.

- Key Figures and Statements: Statements from officials like the Commerce Secretary and the President would offer insight into the administration's reasoning behind approving or rejecting the deal. Potential delays would signal concerns needing further investigation.

Antitrust and Regulatory Scrutiny:

The deal would undoubtedly undergo rigorous antitrust scrutiny by relevant authorities, including:

- Review Process: Detailed investigation to ensure the deal doesn't lead to monopolistic practices or stifle competition within the steel industry.

- Potential Challenges: Concerns could arise about reduced competition, higher prices for consumers, and potential job losses in certain sectors.

- Concessions: To secure approval, the companies might have been required to make concessions such as divesting specific assets or altering operational practices to address anti-competitive concerns.

- Final Outcome: The regulatory bodies' final decision would determine whether the deal proceeds as planned, is modified, or ultimately blocked.

Market Impact of the Nippon-U.S. Steel Deal

Impact on Steel Prices:

The Nippon-U.S. Steel Deal, depending on its exact nature, could have significantly impacted steel prices.

- Short-Term Effects: Potentially increased prices due to reduced competition in certain market segments.

- Long-Term Effects: The long-term effect would be complex, potentially leading to either stabilized or fluctuating prices depending on market supply and demand. Analysis would require detailed economic modeling.

- Charts and Graphs: Visual representations of steel price movements before, during, and after the deal's completion would be essential for a thorough analysis. (Note: These would need to be sourced separately).

Impact on Competition:

This aspect is crucial for assessing the deal's consequences.

- Market Concentration: The joint venture might lead to increased market concentration, potentially reducing competition in specific steel product categories.

- Effects on Other Producers: Competitors might face increased pressure, leading to potential consolidation within the industry or increased efforts to innovate and compete.

Impact on Employment:

Job creation and job losses are always central concerns.

- Job Creation: Potential gains in efficiency and economies of scale could lead to job creation in specific areas, such as research and development or management.

- Job Losses: Conversely, plant closures or streamlining of operations might lead to job losses in certain regions. Careful analysis of the deal's specifics is needed to assess the net effect on employment.

Long-Term Implications:

The deal's long-term consequences are far-reaching.

- US Steel Industry Competitiveness: The agreement's success could bolster the competitiveness of the US steel industry on a global scale. Conversely, failure could lead to further decline.

- Strategic Implications: For both Nippon Steel and U.S. Steel, the deal presents a strategic opportunity to enhance their market position and access new technologies or markets.

Conclusion: Assessing the Legacy of the Nippon-U.S. Steel Deal

The Nippon-U.S. Steel Deal, under the scrutiny of the Trump administration, holds significant implications for the global steel market. While the deal's specifics are hypothetical for this analysis, its potential impact on steel prices, competition, and employment underscores the importance of careful regulatory review of such mergers or joint ventures. The long-term consequences depend on the effectiveness of the combined entity and how it adapts to market changes and global competition. We urge readers to share their insights on the Nippon-U.S. Steel Deal and its future effects. Further reading on US-Japan trade relations and global steel market trends is encouraged to gain a more comprehensive understanding.

Featured Posts

-

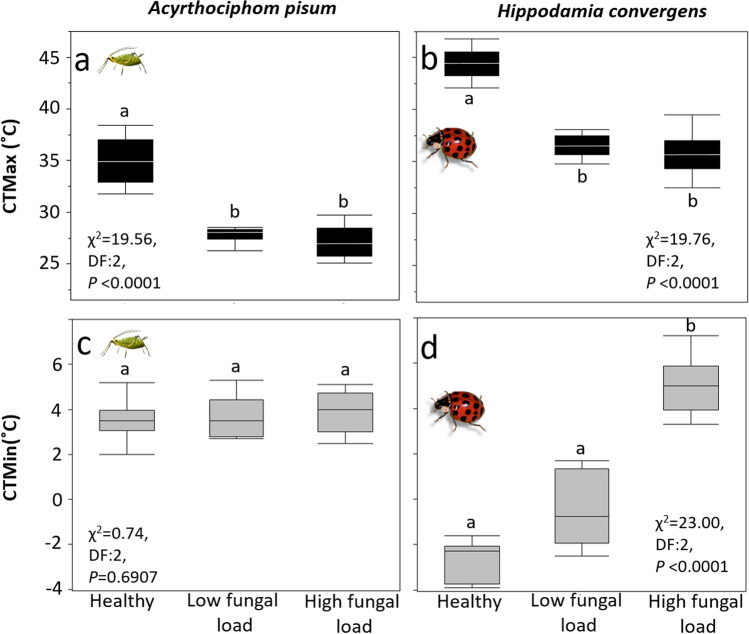

Rising Temperatures And The Increased Risk Of Invasive Fungal Diseases

May 26, 2025

Rising Temperatures And The Increased Risk Of Invasive Fungal Diseases

May 26, 2025 -

The Gregor Robertson Housing Strategy Balancing Affordability And Market Stability

May 26, 2025

The Gregor Robertson Housing Strategy Balancing Affordability And Market Stability

May 26, 2025 -

Canyon Aeroad Mathieu Van Der Poels Custom Ride For Tirreno Adriatico

May 26, 2025

Canyon Aeroad Mathieu Van Der Poels Custom Ride For Tirreno Adriatico

May 26, 2025 -

Alex Eala Targets Strong French Open Debut

May 26, 2025

Alex Eala Targets Strong French Open Debut

May 26, 2025 -

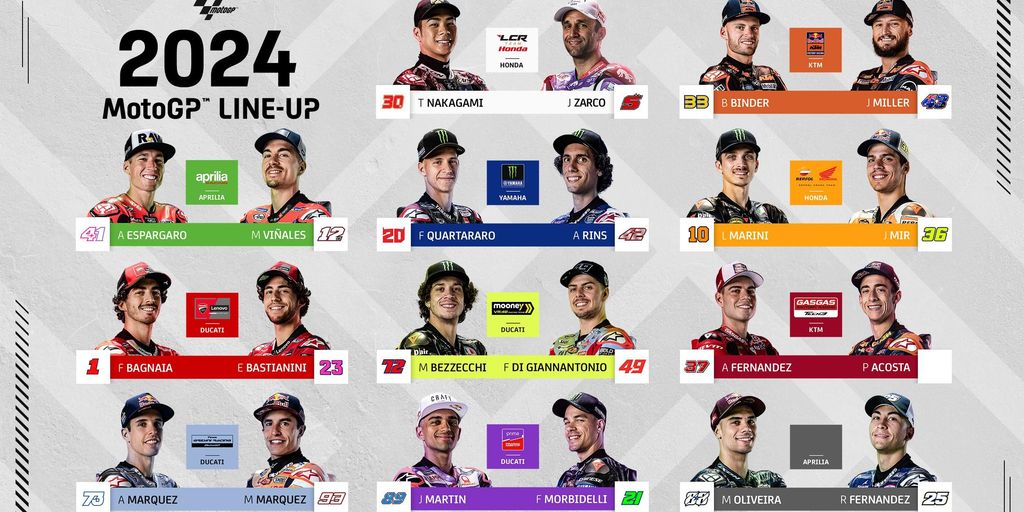

Jadwal Lengkap Moto Gp Inggris 2024 Jangan Lewatkan Keseruannya

May 26, 2025

Jadwal Lengkap Moto Gp Inggris 2024 Jangan Lewatkan Keseruannya

May 26, 2025