Norway's Nicolai Tangen And The Impact Of Trump's Tariffs

Table of Contents

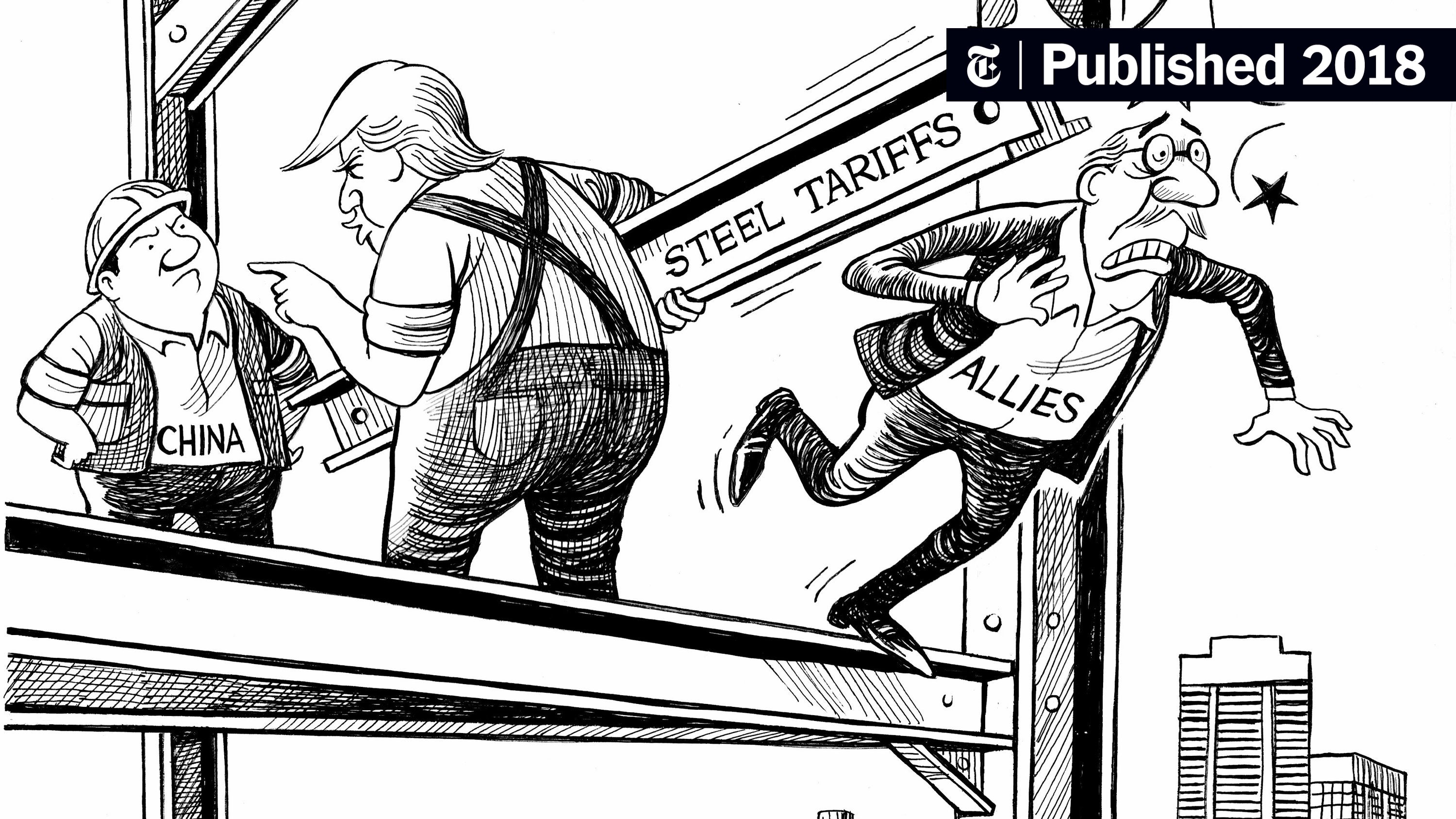

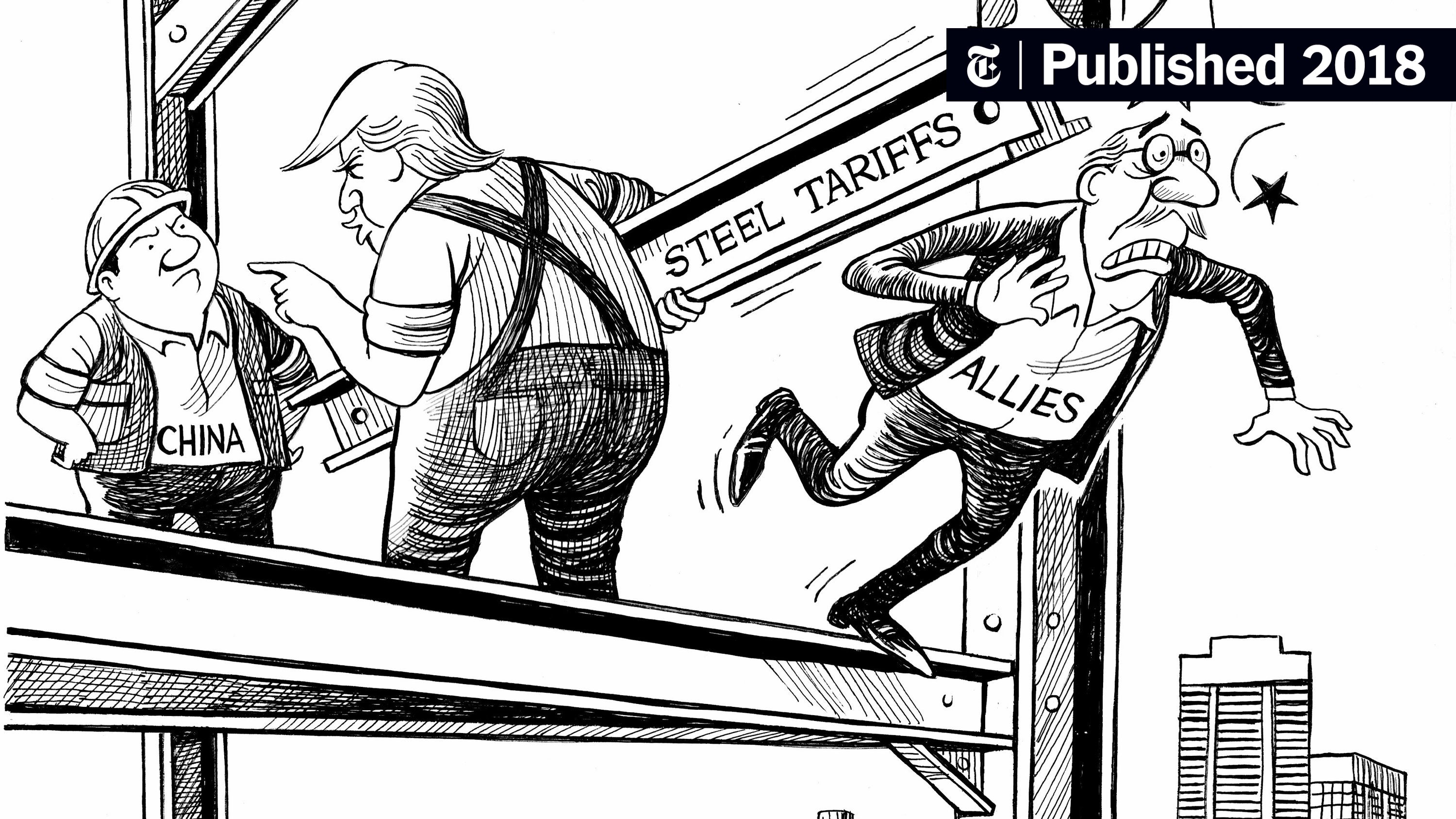

Trump's Tariffs: A Global Economic Disruption

Trump's trade protectionist policies, characterized by significant tariffs on imported goods, created a considerable disruption in global markets. These policies, aimed at protecting American industries, sparked retaliatory measures from other countries, escalating trade tensions and uncertainty. Specific tariffs targeted sectors like steel, aluminum, and technology, triggering ripple effects across the global economy.

- Impact on Specific Industries: The steel and aluminum tariffs, for example, directly impacted manufacturers reliant on imported materials, raising costs and potentially hindering competitiveness. Technology tariffs further strained already tense US-China trade relations.

- Increased Trade Tensions and Retaliatory Measures: The imposition of tariffs often led to retaliatory measures from affected countries, creating a cycle of escalating trade disputes. This uncertainty made accurate economic forecasting extremely challenging.

- Uncertainty and Volatility in Global Financial Markets: The resulting uncertainty fueled volatility in global financial markets, making investment decisions significantly more complex and risky for institutions like NBIM.

NBIM's Investment Strategy Under Nicolai Tangen and the Tariff Challenges

Prior to the implementation of Trump's tariffs, NBIM followed a broadly diversified investment strategy, aiming for long-term growth while managing risk. However, the increased market volatility necessitated a reassessment and adaptation of this strategy under Tangen's leadership. The fund had to navigate the complexities of a global landscape marked by protectionism and unpredictability.

- Diversification Strategies: NBIM likely enhanced its diversification strategies, spreading investments across a wider range of asset classes, geographies, and sectors to mitigate the impact of any single tariff-related shock.

- Changes in Asset Allocation: The fund might have shifted its asset allocation, potentially reducing exposure to sectors particularly vulnerable to tariffs while increasing investment in more resilient areas. This could have included a re-evaluation of geographical investment focus.

- Potential Shifts in Geographical Investment Focus: Given the trade tensions, NBIM might have adjusted its geographical focus, potentially reducing exposure to regions heavily impacted by trade disputes or increasing investment in regions less affected by the tariffs.

Specific Examples of NBIM's Response to Tariffs

While NBIM’s investment decisions are largely confidential, we can infer potential responses based on public statements and general market trends. For example, if a specific company heavily reliant on US imports faced significant challenges due to tariffs, NBIM might have adjusted its holdings in that company's stock.

- Examples of Specific Companies or Sectors Affected: Analysis of NBIM’s portfolio might reveal shifts away from companies heavily reliant on sectors directly affected by tariffs, like manufacturing reliant on imported steel.

- Analysis of NBIM’s Financial Performance: While direct causal links are difficult to establish, analyzing NBIM's financial performance during this period could provide insights into the overall impact of tariffs on its portfolio.

- Potential Legal Challenges or Lobbying Efforts: Although unlikely to be directly involved in legal challenges, NBIM might have indirectly influenced policy through engagement with governmental organizations or industry bodies.

The Long-Term Impact on NBIM and Norway's Economy

The long-term effects of Trump's tariffs on NBIM and Norway's economy are complex and multifaceted. The increased market volatility undoubtedly influenced portfolio returns, while the broader global economic slowdown might have had spillover effects on Norway's GDP.

- Long-term Implications for Portfolio Returns: The tariffs' overall impact on NBIM’s long-term returns is difficult to isolate, but the increased market volatility almost certainly introduced additional risk and potentially reduced overall returns compared to a more stable global trade environment.

- Effects on Norway's GDP and Overall Financial Stability: Norway's economy, heavily reliant on exports, might have felt the indirect consequences of reduced global trade and economic slowdown caused by the tariffs.

- Potential Reforms or Policy Adjustments: The experience may have prompted Norway to reassess its own trade policies and economic diversification strategies.

Conclusion: Nicolai Tangen's Stewardship in a Time of Tariff Uncertainty

Nicolai Tangen's leadership at NBIM during the period of Trump's tariffs presented significant challenges. Navigating the increased market volatility required strategic adaptation, diversification, and a careful assessment of global economic trends. The long-term effects on NBIM's portfolio and the Norwegian economy are still unfolding, but the experience underscores the importance of flexible and responsive investment strategies in a globalized world susceptible to protectionist trade policies. How will Nicolai Tangen and NBIM continue to adapt to future global trade fluctuations? This question remains a key focus for the future of this crucial sovereign wealth fund.

Featured Posts

-

Frantsiya Reformy I Referendum Klyuchevye Zayavleniya Premera

May 04, 2025

Frantsiya Reformy I Referendum Klyuchevye Zayavleniya Premera

May 04, 2025 -

The Count Of Monte Cristo A Review Of Alexandre Dumass Masterpiece

May 04, 2025

The Count Of Monte Cristo A Review Of Alexandre Dumass Masterpiece

May 04, 2025 -

Miami Gp Verstappens New Role As A Father

May 04, 2025

Miami Gp Verstappens New Role As A Father

May 04, 2025 -

Childs Death Leads To Cult Groups Imprisonment

May 04, 2025

Childs Death Leads To Cult Groups Imprisonment

May 04, 2025 -

The Trump Tariffs Nicolai Tangens Investment Strategy

May 04, 2025

The Trump Tariffs Nicolai Tangens Investment Strategy

May 04, 2025