Novo Nordisk's Stumble: Analyzing Ozempic's Position In The Weight-Loss Market

Table of Contents

Novo Nordisk's Ozempic has revolutionized the weight-loss market. Its active ingredient, semaglutide, a GLP-1 receptor agonist, has proven remarkably effective, catapulting Novo Nordisk to a position of market dominance. However, recent challenges, including increased competition and pricing concerns, raise questions about the long-term sustainability of Ozempic's reign. This analysis delves into Ozempic's current market position, exploring its strengths, weaknesses, and the strategic landscape that shapes its future.

Ozempic's Market Dominance and its Mechanisms

The GLP-1 Receptor Agonist Advantage

Ozempic's success stems from its mechanism of action as a GLP-1 receptor agonist. This class of medication works by mimicking the effects of glucagon-like peptide-1, a naturally occurring hormone that regulates appetite and glucose metabolism. By binding to GLP-1 receptors in the brain, semaglutide promotes satiety, leading to reduced food intake and weight loss.

- Efficacy: Numerous clinical trials have demonstrated Ozempic's significant efficacy in promoting weight loss in individuals with obesity and type 2 diabetes.

- FDA Approval: Ozempic is approved by the FDA for both type 2 diabetes management and chronic weight management in adults with obesity or overweight with at least one weight-related comorbidity.

Previous Market Success Factors

Ozempic's initial triumph wasn't solely due to its pharmacological properties. Several factors contributed to its rapid market penetration:

- Strong Clinical Trial Data: Robust and consistent clinical trial results showcased Ozempic's superior efficacy compared to other weight-loss treatments.

- Effective Marketing: Novo Nordisk implemented a highly successful marketing campaign that effectively communicated Ozempic's benefits to both healthcare professionals and the public.

- Physician Adoption: Wide acceptance and adoption by healthcare providers further fueled Ozempic's popularity.

- High Demand & Limited Supply: Initially, high demand coupled with limited supply created a scarcity, leading to a premium price point and reinforcing the perception of its effectiveness.

Emerging Challenges to Ozempic's Market Leadership

Increased Competition

The weight-loss medication market has become increasingly crowded. New competitors and their products, such as Wegovy (also semaglutide, but a higher dose) and Mounjaro (tirzepatide), are posing significant challenges to Ozempic's market share.

- Wegovy: A higher-dose semaglutide formulation offering greater weight loss potential.

- Mounjaro: A dual GLP-1 and GIP receptor agonist showing promising results in weight loss studies.

- Other Competitors: Several other pharmaceutical companies are developing and launching competing GLP-1 receptor agonists and other weight-loss medications, increasing the competitive pressure.

Pricing and Accessibility Concerns

Ozempic's high cost is a major barrier to accessibility for many patients. This poses significant challenges for widespread adoption and long-term market sustainability.

- Insurance Coverage: Varying levels of insurance coverage for Ozempic create discrepancies in patient access.

- Affordability: The high price point makes Ozempic unaffordable for many individuals, limiting its reach and potentially impacting market share.

- Government Regulations: Potential government regulations and pricing policies could further impact Ozempic's availability and affordability.

Side Effects and Safety Concerns

While generally well-tolerated, Ozempic, like other GLP-1 receptor agonists, carries potential side effects. These can impact patient perception and market acceptance.

- Common Side Effects: Nausea, vomiting, diarrhea, constipation, and abdominal pain are among the reported side effects.

- Severity: While usually mild to moderate, side effects can be severe in some cases.

- Long-Term Safety: Ongoing long-term safety studies are crucial for addressing concerns about potential long-term side effects.

Novo Nordisk's Strategic Response and Future Outlook

Strategies to Maintain Market Share

Novo Nordisk is actively pursuing various strategies to maintain its market leadership:

- Improved Supply Chain Management: Addressing past supply chain issues to ensure adequate product availability.

- Innovative Marketing: Adapting marketing strategies to highlight Ozempic's advantages over competitors and address patient concerns.

- Portfolio Diversification: Expanding its portfolio with new formulations, indications, or related products.

- New Formulations or Indications: Exploring and developing new formulations or indications for semaglutide to broaden its application.

Long-Term Projections for Ozempic

The future of Ozempic in the weight-loss market is complex and influenced by several factors:

- Competitive Landscape: The intensity of competition will significantly impact Ozempic's market share.

- Regulatory Environment: Government regulations on pricing and approvals will play a crucial role.

- Technological Advancements: The emergence of new weight-loss treatments could disrupt the market.

- Patent Expiration: The eventual expiration of Ozempic's patent will lead to the entry of generic competitors, affecting pricing and market share.

Conclusion:

Ozempic's success has been remarkable, but the weight-loss market is dynamic and competitive. While its efficacy and strong initial market penetration are undeniable, challenges related to competition, pricing, accessibility, and side effects necessitate proactive strategies from Novo Nordisk. The long-term success of Ozempic will depend on the company's ability to navigate this complex landscape and adapt to the evolving needs of the market. Stay informed on the evolving landscape of Ozempic and the future of weight-loss medications. Further research into GLP-1 receptor agonists and their role in obesity management is encouraged.

Featured Posts

-

Kein Volek Mehr Bei Den Augsburger Panthern Auswirkungen Auf Die Kommende Saison

May 30, 2025

Kein Volek Mehr Bei Den Augsburger Panthern Auswirkungen Auf Die Kommende Saison

May 30, 2025 -

Btss 7 Moment Trailer A Glimpse Into The Groups Future And Potential Solo Releases

May 30, 2025

Btss 7 Moment Trailer A Glimpse Into The Groups Future And Potential Solo Releases

May 30, 2025 -

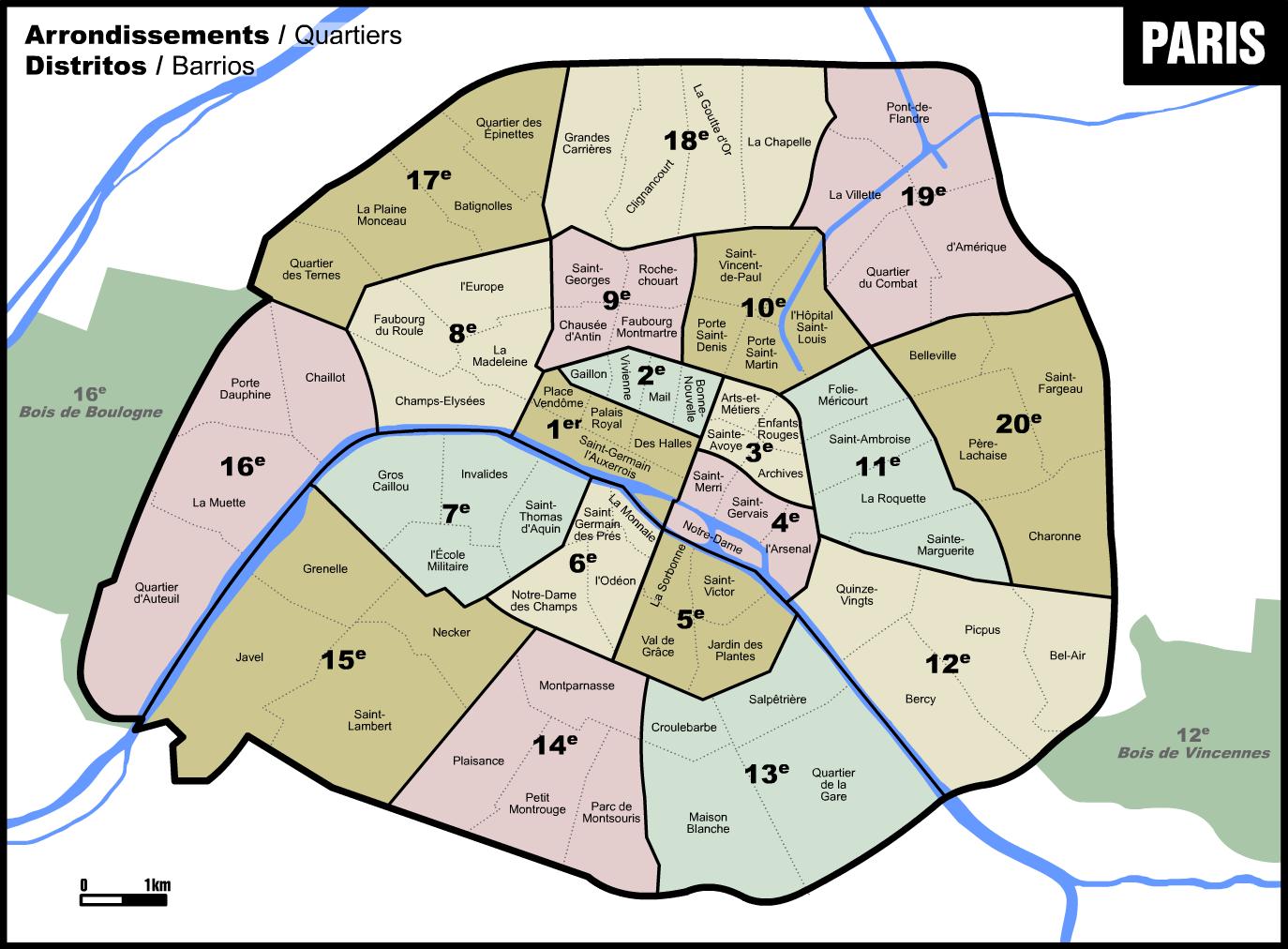

The Best Neighborhoods In Paris A Locals Perspective

May 30, 2025

The Best Neighborhoods In Paris A Locals Perspective

May 30, 2025 -

Rajinikanth Recognizes Ilaiyaraajas London Symphony Achievement

May 30, 2025

Rajinikanth Recognizes Ilaiyaraajas London Symphony Achievement

May 30, 2025 -

Chinas Economic Slowdown How It Affects Nvidias Growth Projections

May 30, 2025

Chinas Economic Slowdown How It Affects Nvidias Growth Projections

May 30, 2025