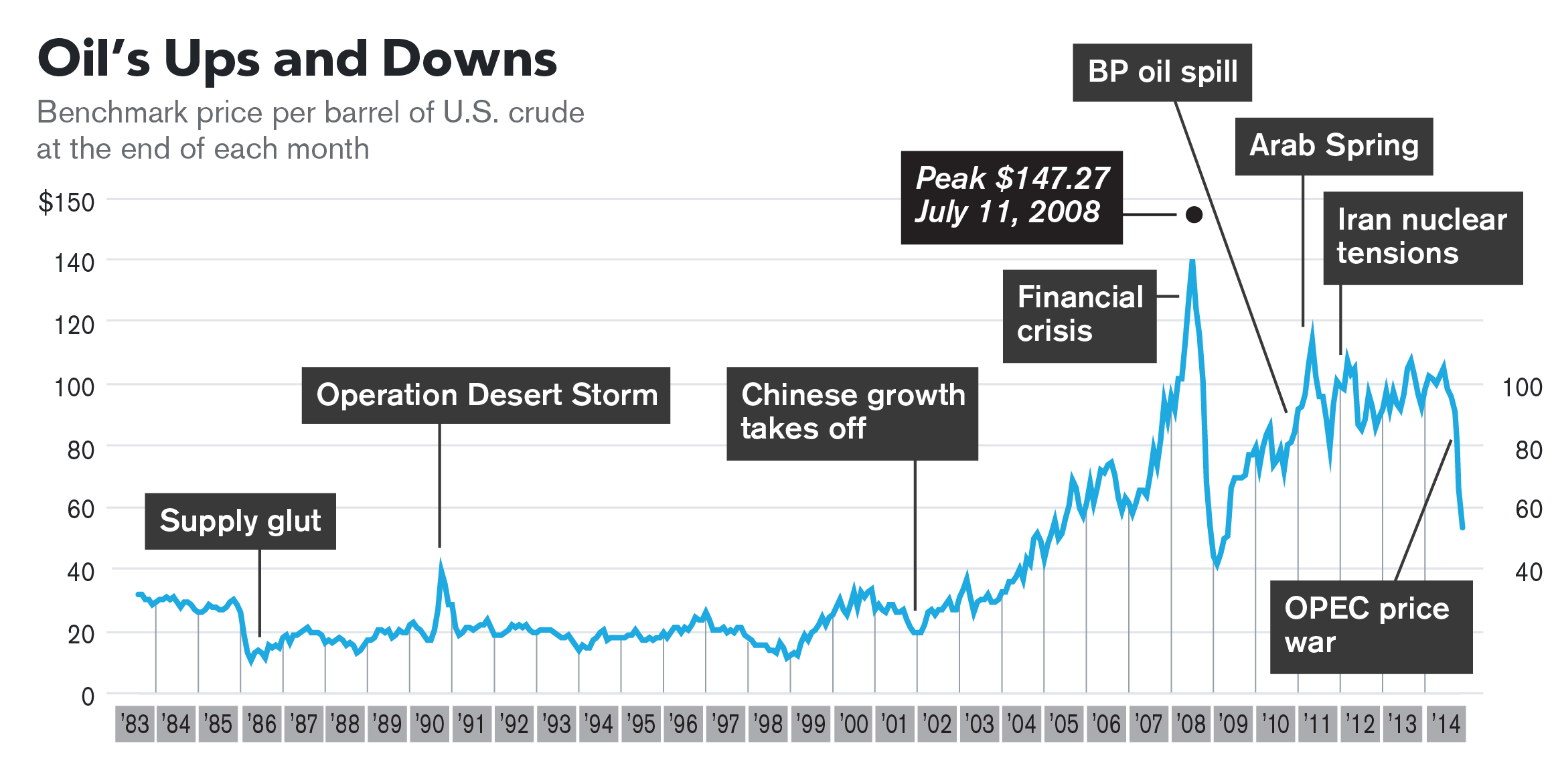

Oil Price News And Analysis For May 16: A Detailed Overview

Table of Contents

Global Crude Oil Price Movements on May 16

Brent Crude Oil Price

On May 16th, Brent crude oil opened at $78.50 per barrel. Throughout the day, the price experienced significant volatility.

- High: $80.20 per barrel

- Low: $77.80 per barrel

- Close: $79.90 per barrel

This represents a 2.5% increase compared to the previous day's closing price, highlighting the impact of the OPEC+ decision. The volatility underscores the market's reaction to the unexpected production cuts and the uncertainty surrounding future supply.

WTI Crude Oil Price

West Texas Intermediate (WTI) crude oil followed a similar trend on May 16th.

- Open: $75.00 per barrel

- High: $76.70 per barrel

- Low: $74.20 per barrel

- Close: $76.50 per barrel

WTI also saw a notable increase of approximately 2% compared to the previous day's close. While mirroring Brent's upward trajectory, the price gap between Brent and WTI remained relatively stable, suggesting a consistent market response to the global production cut announcement.

Impact of Major Trading Events

Several significant trading events contributed to the observed price fluctuations on May 16th.

- OPEC+ Production Cut Announcement: The surprise decision by OPEC+ to deepen production cuts was the primary driver of the price surge. The market interpreted this as a move to tighten supply and support prices.

- API Inventory Report: The American Petroleum Institute (API) released its weekly inventory report, which showed a smaller-than-expected build in crude oil stocks, further bolstering the upward price pressure. This data reinforced the narrative of tightening supply.

- Geopolitical Tensions: Ongoing geopolitical uncertainties in several oil-producing regions contributed to a risk premium in oil prices, adding to the overall upward movement.

Key Factors Influencing Oil Prices on May 16

Geopolitical Factors

Geopolitical instability remains a significant factor influencing oil prices.

- Middle East Tensions: Continued tensions in the Middle East, a key oil-producing region, created uncertainty in the market, pushing prices higher.

- Ukraine Conflict: The ongoing conflict in Ukraine continues to affect energy markets due to sanctions on Russian oil and gas, limiting supply and contributing to higher prices.

Supply and Demand Dynamics

The balance between global oil supply and demand played a crucial role in shaping the price on May 16th.

- OPEC+ Production Cuts: The reduction in OPEC+ production directly reduced the global oil supply, creating a tighter market and driving prices upward.

- Global Oil Demand: Global oil demand remained relatively robust despite concerns about a potential economic slowdown, further contributing to the price increase.

- Inventory Levels: The relatively low inventory levels observed in the API report signaled a tight market and supported higher prices.

Economic Indicators

Macroeconomic indicators also exert influence on oil prices.

- Inflation Concerns: Persistent inflationary pressures in various economies created uncertainty, potentially impacting future oil demand and influencing price levels.

- Interest Rate Hikes: The prospect of further interest rate hikes by central banks to combat inflation might curb economic growth and consequently reduce oil demand. This factor, however, played a less significant role on May 16th than the supply-side influences.

Market Sentiment and Analyst Predictions

Market Sentiment Analysis

Overall market sentiment on May 16th was decidedly bullish. The OPEC+ decision fueled optimism among many investors, anticipating higher prices in the near term.

- Positive Market Commentary: News articles and market reports reflected a generally positive outlook, with many analysts highlighting the potential for further price increases.

- Increased Trading Activity: Increased trading volume indicated high levels of investor participation and confidence in the upward price trend.

Analyst Forecasts

Many energy analysts predicted continued price strength for the coming weeks.

- Short-Term Outlook: Most analysts forecast continued price increases in the short term, driven by tight supply conditions.

- Long-Term Outlook: Long-term predictions varied, with some analysts cautioning about the potential impact of a global economic slowdown on oil demand.

Trading Strategies and Investment Implications

Risk Assessment

Investing in the oil market always carries risks.

- Geopolitical Risks: Geopolitical instability remains a significant risk, potentially causing abrupt price swings.

- Economic Slowdown: A potential global economic slowdown could reduce oil demand, impacting prices negatively.

- OPEC+ Policy Changes: Any changes in OPEC+ production policies could significantly affect oil prices.

Potential Trading Strategies

Based on the analysis of May 16th's data, various trading strategies could be considered. However, remember that this is not financial advice.

- Long Positions: Some investors might consider establishing long positions, betting on continued price increases.

- Hedging Strategies: Hedging strategies may be employed to mitigate potential risks associated with price volatility.

Conclusion: Key Takeaways and Call to Action

May 16th saw a significant increase in oil prices, primarily driven by the unexpected OPEC+ production cut announcement. Market sentiment was strongly bullish, with analysts anticipating further price strength in the short term. However, investors should be mindful of geopolitical risks and the potential impact of an economic slowdown.

Stay informed about daily oil price fluctuations with our comprehensive Oil Price News and Analysis updates. Check back tomorrow for the latest oil price news and insightful analysis.

Featured Posts

-

Rynok Truda Dubaya Perspektivy Dlya Rossiyskikh Spetsialistov

May 17, 2025

Rynok Truda Dubaya Perspektivy Dlya Rossiyskikh Spetsialistov

May 17, 2025 -

Can Eminem Help Secure A Wnba Team For Detroit

May 17, 2025

Can Eminem Help Secure A Wnba Team For Detroit

May 17, 2025 -

Top Rated Crypto Casino Jack Bits Fast Payouts And Top Games

May 17, 2025

Top Rated Crypto Casino Jack Bits Fast Payouts And Top Games

May 17, 2025 -

Bolee 200 Raket I Dronov Podrobnosti Masshtabnoy Ataki Rf Na Ukrainu

May 17, 2025

Bolee 200 Raket I Dronov Podrobnosti Masshtabnoy Ataki Rf Na Ukrainu

May 17, 2025 -

Trumps Multiple Affairs And Sexual Misconduct Accusations His Path To The Presidency

May 17, 2025

Trumps Multiple Affairs And Sexual Misconduct Accusations His Path To The Presidency

May 17, 2025