Oil Prices Surge: Airlines Face A Turbulent Future

Table of Contents

Fuel Costs: The Biggest Headache for Airlines

Rising fuel prices represent the most significant challenge for airlines today. The direct correlation between oil prices and airline operating costs is undeniable; fuel often accounts for 20-40% of an airline's total operating expenses. This makes airlines highly vulnerable to price fluctuations in the global oil market.

Rising Fuel Prices Directly Impact Profitability

- Statistic: For example, if oil prices increase by 20%, a typical airline might see a 5-10% increase in their operating costs, drastically reducing profit margins.

- Examples: Several major airlines have already announced measures to offset these rising costs, including increases in baggage fees and other ancillary charges. Some are also exploring route optimization to reduce fuel consumption.

Hedging Strategies and Their Effectiveness

Many airlines utilize fuel hedging strategies to mitigate the risk of volatile oil prices. These strategies involve purchasing fuel contracts at fixed prices in advance.

- How Hedging Works: Airlines lock in a price for a certain amount of fuel for a specific period. This protects them from price spikes, but it also limits their upside potential if oil prices fall.

- Limitations of Hedging: The effectiveness of hedging depends heavily on the accuracy of price predictions. The current volatility in the oil market is making hedging particularly challenging. If oil prices unexpectedly drop, airlines with hedging contracts can face significant losses.

Impact on Airfares and Passenger Demand

The increased fuel costs will inevitably have a ripple effect throughout the airline industry and on consumers.

Potential for Increased Airfares

Airlines are likely to pass a portion of these increased fuel costs onto consumers by increasing airfares.

- Elasticity of Demand: The extent to which airfares can be raised depends on the elasticity of demand for air travel. While air travel is essential for business and leisure, consumers are sensitive to price increases, particularly for discretionary travel.

- Reduced Passenger Numbers: Higher airfares could lead to a decrease in the number of passengers, especially for price-sensitive travelers. Airlines must carefully balance the need to recover costs with maintaining passenger demand.

Impact on Route Networks and Flight Schedules

To manage rising costs, airlines might adjust their operations in several significant ways.

- Route Consolidation: Airlines may consolidate routes or reduce the frequency of flights on less profitable routes to minimize fuel consumption. This could mean fewer flight options for passengers in certain markets.

- Grounding Less Efficient Aircraft: Older, less fuel-efficient aircraft might be grounded, potentially leading to capacity reductions.

Airlines' Response to the Crisis

Airlines are exploring various strategies to cope with the surge in oil prices.

Cost-Cutting Measures

To offset the impact, many airlines will implement cost-cutting measures.

- Examples: This could involve staff reductions (through voluntary redundancies or hiring freezes), route cuts, and increased ancillary revenue generation (such as charging extra for baggage or seat selection).

- Impact on Morale and Customer Satisfaction: Cost-cutting measures, particularly staff reductions, can negatively impact employee morale and potentially lead to reduced customer service quality.

Investing in Fuel Efficiency

Airlines are also focusing on long-term strategies to enhance fuel efficiency and reduce their dependence on fluctuating oil prices.

- Fuel-Efficient Aircraft: Investing in new, more fuel-efficient aircraft is a crucial long-term strategy to reduce fuel consumption and operational costs.

- Sustainable Aviation Fuels (SAFs): The adoption of SAFs, which are produced from sustainable sources, is another significant area of focus for environmentally conscious airlines aiming to decrease their carbon footprint while lowering fuel costs over time.

Conclusion

The surge in oil prices presents a substantial and sustained challenge to the airline industry. Airlines are facing a turbulent period, needing to make difficult decisions concerning pricing, routes, and operational costs. The impact on consumers is likely to involve potential increases in airfares and potentially reduced flight options. Understanding the complexities of the situation—the interplay between fuel costs, passenger demand, and airline strategies—is critical for navigating the future of air travel. Stay informed about the evolving situation surrounding oil prices surge airlines and its effects on the aviation sector. Continue to follow our news and analysis for the latest updates on how airlines are responding to this crucial issue.

Featured Posts

-

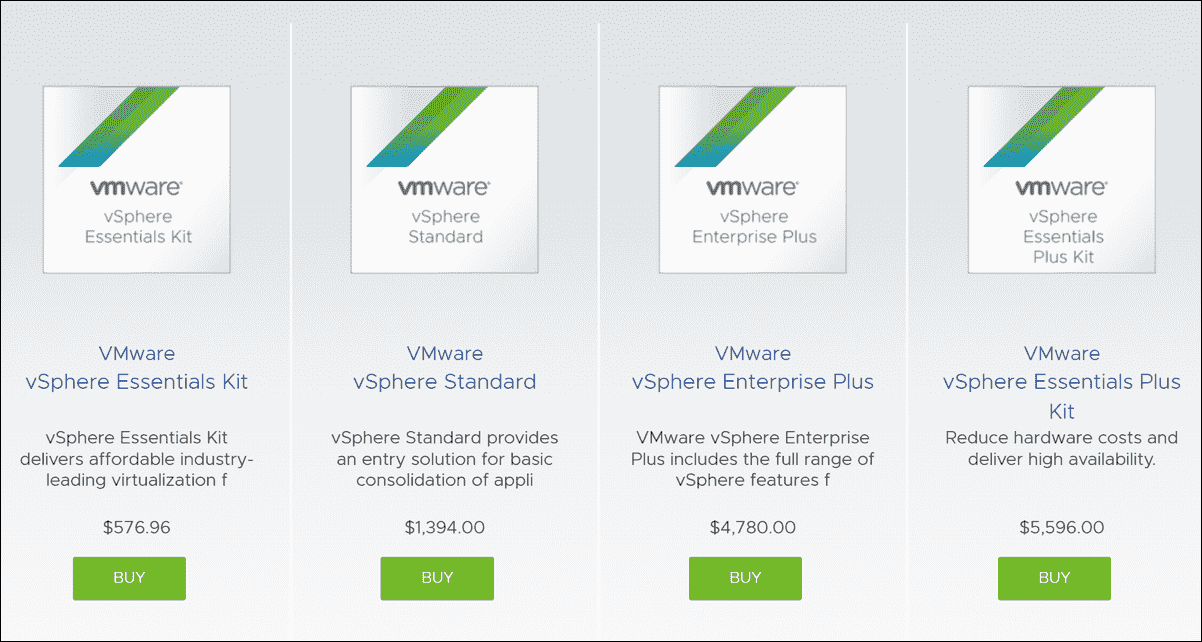

At And T Sounds Alarm Broadcoms Extreme V Mware Price Increase At 1 050

May 04, 2025

At And T Sounds Alarm Broadcoms Extreme V Mware Price Increase At 1 050

May 04, 2025 -

Nigel Farage And The Snp An Unlikely Alliance Ahead Of The Holyrood Election

May 04, 2025

Nigel Farage And The Snp An Unlikely Alliance Ahead Of The Holyrood Election

May 04, 2025 -

Logan County Jail Report Finding Information On Inmates

May 04, 2025

Logan County Jail Report Finding Information On Inmates

May 04, 2025 -

Nigel Farages Reform Uk Faces Rift Ex Deputy Hints At New Party

May 04, 2025

Nigel Farages Reform Uk Faces Rift Ex Deputy Hints At New Party

May 04, 2025 -

Lizzos Weight Loss Journey Diet Exercise And Body Positivity

May 04, 2025

Lizzos Weight Loss Journey Diet Exercise And Body Positivity

May 04, 2025