Omada Health's US IPO: A Look At The Andreessen Horowitz-Backed Company

Table of Contents

Omada Health, a prominent player in the digital therapeutics space, recently made its highly anticipated US Initial Public Offering (IPO). Backed by the influential venture capital firm Andreessen Horowitz, this IPO marks a significant milestone for both the company and the broader telehealth industry. This article provides a comprehensive analysis of Omada Health's IPO, exploring its business model, market position, the impact of Andreessen Horowitz's investment, and the potential for future growth. We'll also consider the implications for investors interested in Omada Health stock and the future of digital health investing.

Omada Health's Business Model and Market Position

Digital Therapeutics and Chronic Disease Management

Omada Health's core business revolves around providing digital therapeutics solutions for the management of chronic conditions. Their flagship program focuses primarily on type 2 diabetes and hypertension, two prevalent and costly health issues. The program leverages a multi-faceted approach:

- Personalized coaching and support: Certified health coaches work with individuals to create personalized plans tailored to their specific needs and goals.

- Remote monitoring of vital signs: Patients use connected devices to track their blood glucose, blood pressure, and weight, providing valuable data for both the patient and their care team.

- Integration with wearable technology: Omada Health seamlessly integrates with popular wearable devices, enhancing data collection and engagement.

- Emphasis on behavioral change and lifestyle modification: The program isn't just about medication management; it emphasizes sustainable lifestyle changes through education, support, and behavior modification techniques. This holistic approach is a key differentiator in the digital therapeutics market.

Competitive Landscape and Market Share

Omada Health operates in a rapidly growing but competitive market. Key competitors include companies offering similar digital therapeutics solutions for chronic disease management, as well as established telehealth providers. However, Omada Health's unique selling propositions (USPs) include:

- Strong clinical evidence: The effectiveness of Omada Health's programs is backed by robust clinical data demonstrating improved health outcomes.

- Established payer relationships: Securing reimbursement from insurance providers is crucial in the healthcare sector, and Omada Health has made significant strides in this area.

- Scalable platform: Their technology platform allows for efficient delivery of care to a large patient population.

The market for digital therapeutics is projected to experience significant growth in the coming years, driven by factors like rising healthcare costs, an aging population, and increased adoption of technology in healthcare. Omada Health is well-positioned to capitalize on this growth, but maintaining its competitive edge will be crucial.

Revenue Streams and Financial Performance

Prior to the IPO, Omada Health generated revenue primarily through contracts with employers, health plans, and other healthcare organizations. Their financial performance leading up to the IPO showed a clear growth trajectory, though profitability remained a key focus for the company. Key financial metrics to watch for investors include:

- Revenue growth rate: Sustained growth in revenue is essential for long-term success.

- Customer acquisition cost (CAC): The cost of acquiring new customers is a critical factor influencing profitability.

- Customer lifetime value (CLTV): Understanding the long-term value of each customer is crucial for assessing the sustainability of the business model.

The Andreessen Horowitz Investment and its Significance

Andreessen Horowitz's Role and Influence

Andreessen Horowitz (a16z), a prominent venture capital firm known for its investments in high-growth technology companies, played a significant role in Omada Health's development. Their investment provided not only crucial capital but also valuable strategic guidance and access to a vast network of industry connections. The details of the investment amount and stages are available in public filings associated with the Omada Health IPO.

Impact on IPO Valuation and Investor Confidence

Andreessen Horowitz's backing significantly enhanced Omada Health's credibility and attracted investor interest. The association with a reputable VC firm like a16z provided:

- Increased investor confidence: a16z's due diligence and investment decision signaled a vote of confidence in Omada Health's potential.

- Higher IPO valuation: The backing likely contributed to a higher valuation during the IPO process compared to what might have been achieved without such a prominent investor.

- Access to resources: Beyond capital, a16z provides access to a network of mentors, advisors, and potential strategic partners, further accelerating Omada Health's growth.

IPO Details and Future Outlook

IPO Pricing and Market Reaction

The Omada Health IPO involved the offering of a specific number of shares at a certain price per share. The market's initial reaction to the IPO, reflected in the stock price's performance on its first day of trading and subsequent days, is crucial in evaluating the success of the offering. Analyzing this market reaction requires monitoring of Omada Health's stock price and trading volume.

Growth Projections and Potential Risks

Omada Health's future growth prospects are promising, given the increasing demand for digital health solutions. However, potential challenges and risks exist:

- Regulatory hurdles: Navigating the regulatory landscape for telehealth and digital therapeutics is crucial for continued operation.

- Competition: The market is becoming increasingly competitive, requiring continuous innovation and differentiation.

- Reimbursement rates: Securing favorable reimbursement rates from payers is essential for financial sustainability.

- Data security and privacy: Protecting sensitive patient data is paramount in the healthcare industry.

Conclusion:

Omada Health's IPO represents a significant event in the digital therapeutics space. The company's strong business model, backed by the influential Andreessen Horowitz, positions it for potential growth within a rapidly expanding market. However, investors should carefully consider the inherent risks associated with the telehealth industry and Omada Health's reliance on technology, regulatory approval, and securing payer relationships. The success of the Omada Health IPO, as measured by the long-term performance of its stock, will depend on its ability to execute its strategy effectively and navigate the challenges ahead. Stay informed about the Omada Health stock price and the unfolding developments in this dynamic sector. Learn more about the Omada Health IPO and the future of telehealth by [link to relevant resource or further reading]. Consider the implications of this Omada Health IPO for the future of healthcare investing.

Featured Posts

-

Technical Skill Development Program For Transgenders In Punjab

May 10, 2025

Technical Skill Development Program For Transgenders In Punjab

May 10, 2025 -

Upcoming Trade Agreement Trumps Plans For Britain Revealed

May 10, 2025

Upcoming Trade Agreement Trumps Plans For Britain Revealed

May 10, 2025 -

Pam Bondi And The Epstein Client List A Timeline Of Events

May 10, 2025

Pam Bondi And The Epstein Client List A Timeline Of Events

May 10, 2025 -

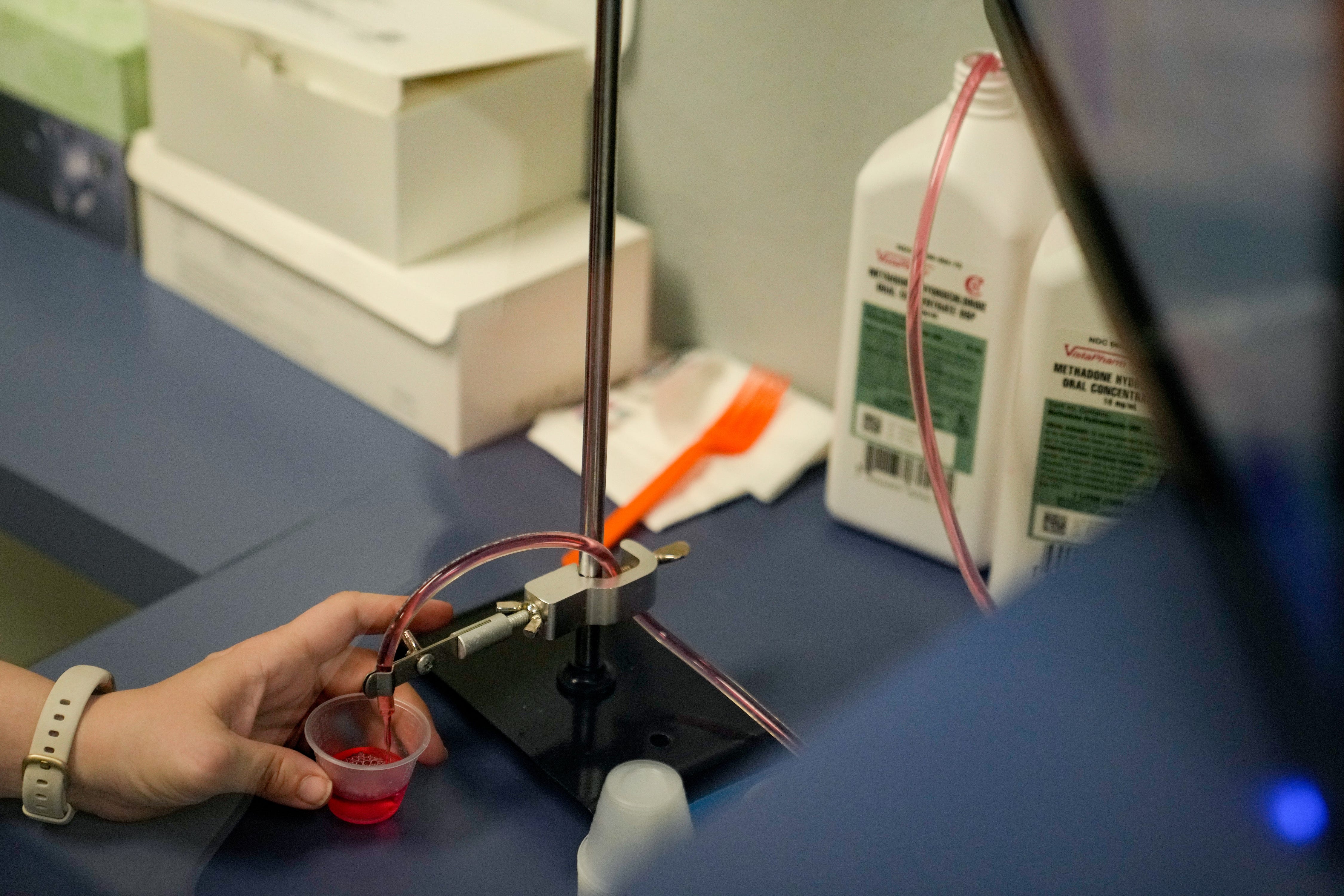

Attorney General Uses Prop Fentanyl To Illustrate Drug Crisis

May 10, 2025

Attorney General Uses Prop Fentanyl To Illustrate Drug Crisis

May 10, 2025 -

A Hilarious Farce St Albert Dinner Theatres Latest Production

May 10, 2025

A Hilarious Farce St Albert Dinner Theatres Latest Production

May 10, 2025