Omada Health's US IPO: Andreessen Horowitz-Backed Telehealth Company Goes Public

Table of Contents

Omada Health's Business Model and Market Position

Omada Health's core offering revolves around comprehensive chronic disease management programs delivered via a user-friendly telehealth platform. Their programs focus on personalized interventions for individuals with conditions like type 2 diabetes and hypertension. The company's target market includes patients seeking effective remote healthcare solutions and employers looking to improve employee wellness programs and reduce healthcare costs.

Omada Health enjoys a competitive advantage due to its:

-

Personalized Approach: Tailored programs adapted to individual needs and progress.

-

Strong Clinical Evidence: Proven efficacy demonstrated through rigorous clinical trials and published research.

-

Established Partnerships: Collaborations with leading healthcare providers and payers enhance reach and credibility.

-

Successful Track Record: Omada Health boasts a strong track record in helping patients effectively manage chronic conditions, leading to improved health outcomes and reduced healthcare utilization. Their programs leverage digital tools, remote monitoring, and personalized coaching to improve patient engagement and adherence.

-

Key Partnerships: Collaborations with major health insurance providers and employers provide access to a vast patient population, accelerating Omada Health's growth and solidifying their market position within the telehealth solutions landscape.

-

Market Share and Expansion: Omada Health holds a substantial market share in the digital chronic disease management space, with significant potential for future expansion into new therapeutic areas and global markets. Their proven platform and scalable business model provide a strong foundation for continued growth.

-

Keywords: Omada Health platform, chronic disease management, telehealth solutions, digital health market

Details of the Omada Health IPO

The Omada Health IPO details, including the exact date, number of shares offered, and final price range, will be announced closer to the offering. However, early indications suggest a substantial capital raise, positioning the company for significant expansion. Leading underwriters will manage the process, guiding Omada Health through its stock market debut.

The proceeds from the Omada Health IPO will primarily be used to:

-

Expand its platform's capabilities: Adding new features and functionalities to enhance the user experience and broaden the range of conditions managed.

-

Accelerate research and development: Investing in new technologies and clinical trials to further improve the effectiveness of its programs.

-

Fuel strategic acquisitions: Exploring opportunities to acquire complementary businesses and technologies to expand market reach.

-

Specific IPO Data: Once the IPO details are released, investors can find precise figures on the total amount of capital raised, the number of shares offered, and the final pricing.

-

Stock Ticker Symbol: The stock ticker symbol will be announced closer to the IPO date, facilitating easy tracking of Omada Health stock performance.

-

Post-IPO Valuation: The post-IPO valuation will reflect investor sentiment and expectations for the company's future growth and profitability within the competitive digital health market.

-

Keywords: Omada Health stock, IPO details, initial public offering, stock market debut

Andreessen Horowitz's Role and Impact

Andreessen Horowitz has been a significant investor in Omada Health, providing crucial funding throughout various stages of its development. Their investment has been instrumental in shaping Omada Health's trajectory, fostering its growth, and ultimately enabling this landmark telehealth IPO. The firm's extensive experience in the technology sector and its proven track record in identifying promising companies played a pivotal role in Omada Health's success.

- Investment History: Details regarding the specific funding rounds and investment amounts will be publicly available after the IPO.

- Influence on Growth: Andreessen Horowitz's strategic guidance and network have facilitated access to key partnerships, market expansion opportunities, and crucial expertise that propelled Omada Health's growth.

- Telehealth Investment Strategy: This investment reflects Andreessen Horowitz's larger investment strategy within the telehealth sector, highlighting their conviction in the long-term potential of virtual healthcare solutions.

- Keywords: Andreessen Horowitz portfolio, venture capital investment, telehealth funding, Omada Health investors

Future Outlook and Implications for the Telehealth Industry

Omada Health's IPO holds significant implications for the future of the telehealth industry. It signals the maturation of the telehealth sector and validates the increasing demand for virtual healthcare solutions. The success of the Omada Health IPO is likely to attract further investment in the sector and encourage other telehealth companies to pursue similar paths.

- Increased Competition: The successful Omada Health IPO might lead to increased competition, spurring innovation and further improvements in telehealth technologies and service offerings.

- Regulatory Impact: The IPO might influence future regulatory frameworks and healthcare policies, shaping how telehealth services are integrated into the broader healthcare system.

- Industry Dynamics: Omada Health's success will likely reshape the dynamics within the healthcare industry, accelerating the transition towards virtual care delivery models.

- Keywords: telehealth future, digital health trends, healthcare innovation, Omada Health outlook

Conclusion

The Omada Health IPO marks a pivotal moment for the telehealth industry, showcasing the immense potential of digital healthcare solutions and the growing investor confidence in this sector. The Andreessen Horowitz investment has played a crucial role in Omada Health's success, underscoring the strategic importance of venture capital in driving innovation in healthcare. This successful telehealth IPO will likely inspire further investment and drive innovation in the years to come.

To stay informed about Omada Health's stock performance and its continued impact on the telehealth landscape, follow Omada Health's stock, track the Omada Health IPO, and consider learning more about investing in telehealth. Stay tuned for further updates and analyses regarding this groundbreaking event in the digital health market.

Featured Posts

-

Ufc 315 Betting Odds Mm Amania Coms Weekend Preview And Picks

May 11, 2025

Ufc 315 Betting Odds Mm Amania Coms Weekend Preview And Picks

May 11, 2025 -

Analyzing The Chicago Bulls And New York Knicks Injury Situations

May 11, 2025

Analyzing The Chicago Bulls And New York Knicks Injury Situations

May 11, 2025 -

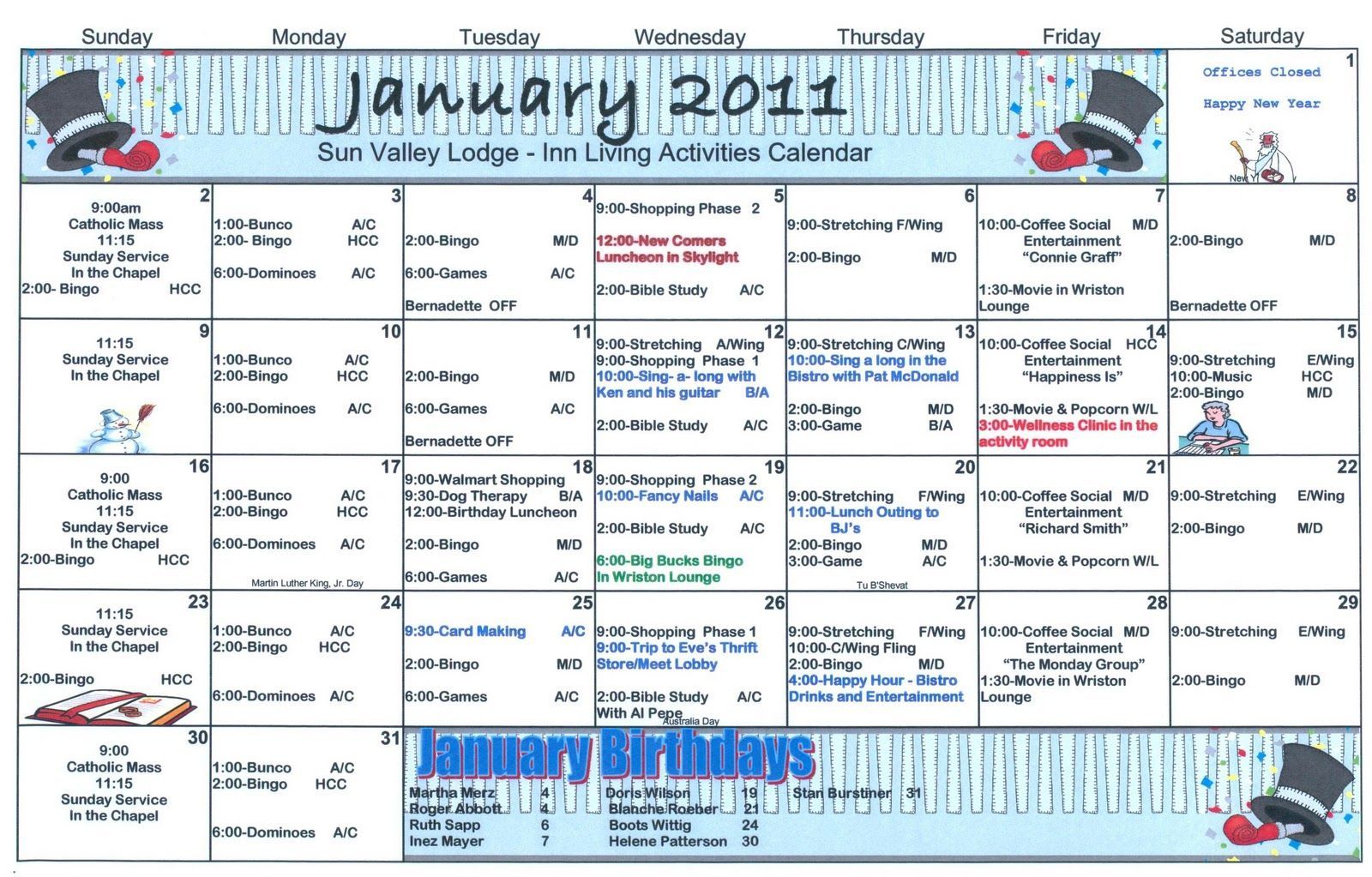

Your Guide To Senior Trips A Monthly Activity Calendar

May 11, 2025

Your Guide To Senior Trips A Monthly Activity Calendar

May 11, 2025 -

Quand C Est L Heure C Est Mueller Analyse Du Match Bayern Inter Milan C1 Quarts

May 11, 2025

Quand C Est L Heure C Est Mueller Analyse Du Match Bayern Inter Milan C1 Quarts

May 11, 2025 -

Le Clash Chantal Ladesou Ines Reg Verites Sur Leur Collaboration A Mask Singer

May 11, 2025

Le Clash Chantal Ladesou Ines Reg Verites Sur Leur Collaboration A Mask Singer

May 11, 2025