One Analyst Predicts Apple At $254: Should You Buy Now?

Table of Contents

The Analyst's Rationale Behind the $254 Apple Stock Prediction

The $254 Apple stock forecast stems from a confluence of factors, according to [Analyst Name/Firm – insert source here]. Their reasoning centers on Apple's continued strength across multiple sectors and anticipates robust future growth. The analyst's Apple stock forecast is built upon the following key pillars:

- Strong iPhone Sales and Market Share: The analyst points to consistently strong iPhone sales, projecting continued growth in the premium smartphone segment, fueled by innovative features and a loyal customer base.

- Expanding Services Revenue: Apple's services ecosystem, including Apple Music, iCloud, and the App Store, is a significant and rapidly expanding revenue stream. The analyst expects this segment to continue its trajectory of impressive growth.

- New Product Launches and Innovation: Anticipated new product launches, like potential augmented reality devices or further advancements in the Apple Watch lineup, are expected to drive sales and attract new customers. This fuels the Apple price target prediction.

- Analyst Track Record: [Analyst Name/Firm] boasts a strong track record of successful Apple stock predictions, lending credibility to this latest forecast. Their past accuracy bolsters confidence in their investment outlook.

Current Market Conditions and Their Impact on Apple Stock

Analyzing the $254 Apple stock prediction requires a keen understanding of the broader market environment. Currently, [Describe the current market condition – bullish, bearish, volatile etc. and provide reasoning]. This overall market sentiment significantly influences Apple stock valuation.

- Interest Rates and Inflation: Rising interest rates and persistent inflation pose challenges for the market, potentially impacting investor confidence and stock prices.

- Geopolitical Factors: Global economic instability and geopolitical events can also create uncertainty and volatility in the stock market, affecting Apple stock performance.

- Competition: Increased competition in the smartphone and tech sector is a potential risk, though Apple's strong brand loyalty offers a significant buffer.

- Supply Chain Disruptions: Although less of a concern than in previous years, potential supply chain disruptions remain a risk factor to be considered in any Apple stock investment decision.

Apple's Financial Performance and Future Growth Prospects

Apple's recent financial reports reveal a picture of [describe overall financial health - strong, stable etc. ]. This financial performance directly impacts the viability of the $254 Apple stock prediction.

- Revenue Growth: Apple has consistently demonstrated robust revenue growth, driven by its diverse product portfolio.

- Earnings Per Share (EPS): Strong EPS growth indicates the company’s profitability and efficiency in generating profits.

- Profit Margins: Apple's high profit margins underscore its pricing power and efficient operations.

- Future Growth Prospects: Apple's extensive research and development efforts and future product plans suggest promising prospects for continued growth. Apple's innovation pipeline positions it well for future market leadership and further revenue growth, solidifying its position as a potential investment.

Alternative Investment Strategies and Risk Assessment

While the $254 Apple stock prediction is tempting, a diversified investment portfolio mitigates risk.

- Diversification: Diversifying your investments across different asset classes (stocks, bonds, real estate) reduces the impact of any single investment's underperformance.

- Risk Tolerance: Consider your personal risk tolerance before committing to any investment, particularly in individual stocks. A higher risk tolerance may make the potential volatility of Apple stock more acceptable.

- Upside and Downside Potential: Investing in Apple stock presents both significant upside potential – as indicated by the $254 price target – and considerable downside risk. Thoroughly weigh both factors.

Conclusion: Should You Buy Apple Stock at the Predicted $254 Price?

The $254 Apple stock prediction is based on compelling factors, such as Apple's strong financial performance, growth in services, and anticipated product launches. However, current market conditions and inherent investment risks must also be considered. The decision to buy Apple stock at any price requires a comprehensive analysis of your financial situation, risk tolerance, and investment goals. Before acting on the $254 Apple stock prediction or any other investment opportunity, conduct thorough research, consult with a qualified financial advisor, and carefully evaluate the potential risks and rewards. Remember, informed investment decisions are key to building a successful financial future.

Featured Posts

-

2024 Philips Annual General Meeting What You Need To Know

May 24, 2025

2024 Philips Annual General Meeting What You Need To Know

May 24, 2025 -

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 24, 2025

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 24, 2025 -

Ecb Faiz Indirimi Avrupa Borsalarinda Karisik Bir Guen

May 24, 2025

Ecb Faiz Indirimi Avrupa Borsalarinda Karisik Bir Guen

May 24, 2025 -

Country Living Is An Escape To The Country Right For You

May 24, 2025

Country Living Is An Escape To The Country Right For You

May 24, 2025 -

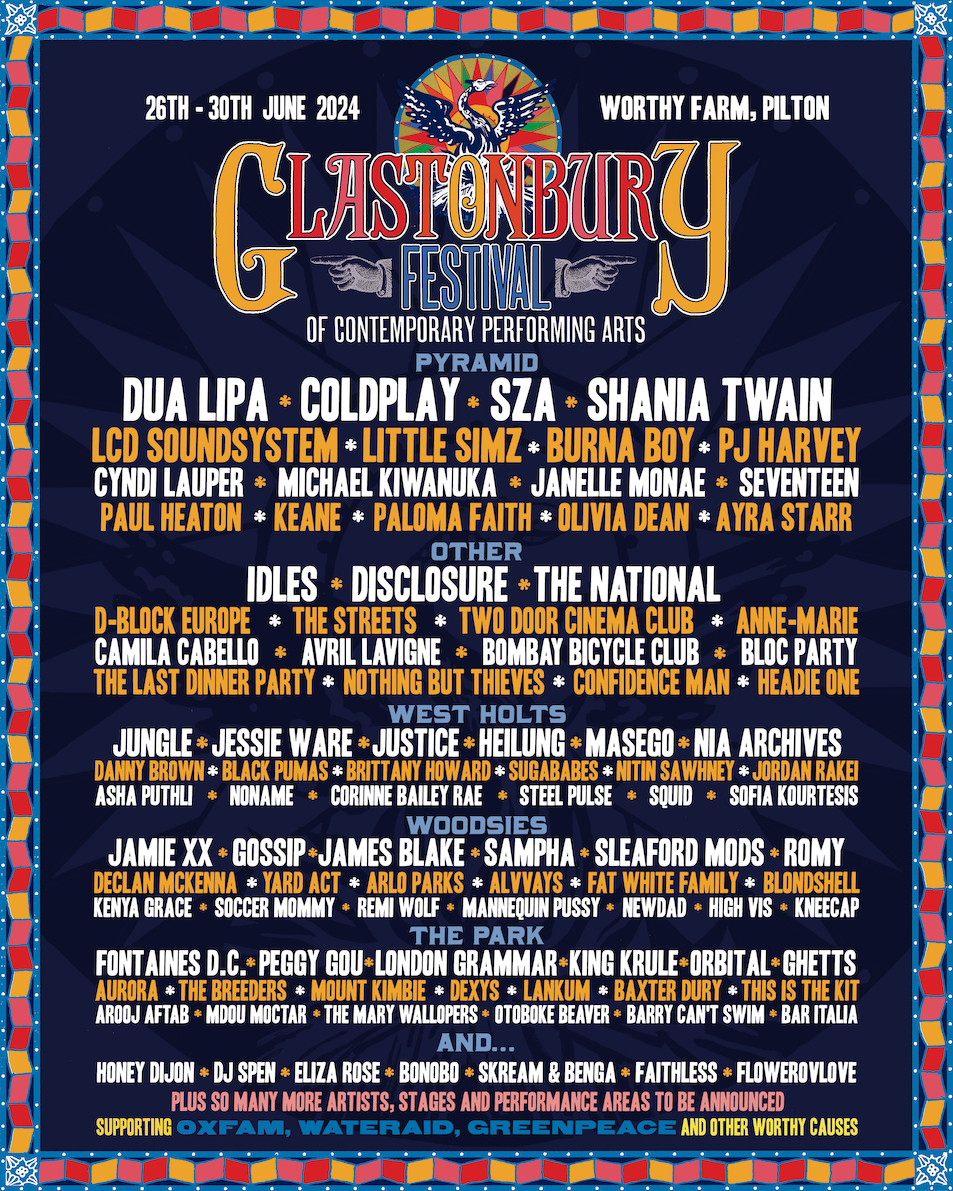

Is This Us Band Playing Glastonbury Social Media Ignites Debate

May 24, 2025

Is This Us Band Playing Glastonbury Social Media Ignites Debate

May 24, 2025

Latest Posts

-

Is A Trump Era Plan To Blame For Newark Airports Air Traffic Control Problems

May 24, 2025

Is A Trump Era Plan To Blame For Newark Airports Air Traffic Control Problems

May 24, 2025 -

Close Calls And Crashes A Visual Analysis Of Airplane Safety Data

May 24, 2025

Close Calls And Crashes A Visual Analysis Of Airplane Safety Data

May 24, 2025 -

Trumps Private Warning Putins Unreadiness To End War Say European Officials

May 24, 2025

Trumps Private Warning Putins Unreadiness To End War Say European Officials

May 24, 2025 -

President Ramaphosas White House Encounter Evaluating Alternative Approaches

May 24, 2025

President Ramaphosas White House Encounter Evaluating Alternative Approaches

May 24, 2025 -

The Terrible Idea Thats Crippling Newark Airport A Look At Trumps Air Traffic Control Plan

May 24, 2025

The Terrible Idea Thats Crippling Newark Airport A Look At Trumps Air Traffic Control Plan

May 24, 2025