Onex Sells 25% WestJet Stake To Foreign Airlines, Recouping Investment

Table of Contents

Details of the WestJet Stake Sale

Onex sold a 25% stake in WestJet Airlines to a group of foreign airlines, the identities of which have not yet been publicly disclosed. While the exact sale price remains undisclosed, sources suggest it represents a substantial return on Onex's initial investment, showcasing a successful exit strategy. This transaction significantly alters WestJet's ownership structure, introducing a substantial level of foreign ownership into the previously largely Canadian-controlled airline.

- Timing: The sale represents a calculated strategic move by Onex, likely timed to capitalize on favorable market conditions and investor sentiment.

- Regulatory Approvals: The transaction likely required significant regulatory approvals from both Canadian and potentially foreign governing bodies, given the implications of foreign investment in a key national infrastructure sector. This process likely involved extensive due diligence and negotiations.

- Future Implications: The influx of foreign investment could lead to changes in WestJet's operational strategy, potentially opening doors to new international routes, partnerships, and code-sharing agreements.

Onex's Investment Strategy and Return

Onex's initial investment in WestJet represented a significant bet on the Canadian airline industry. Their ownership spanned several years, during which they played an active role in shaping WestJet's strategic direction. The successful sale, representing a substantial return on investment (ROI), underscores Onex's expertise in identifying and nurturing high-growth companies.

- Onex's Portfolio: This divestment aligns with Onex's broader investment strategy, focusing on identifying undervalued assets, driving growth, and ultimately realizing significant returns through strategic exits.

- Similar Divestments: Onex has a history of successfully divesting from portfolio companies at opportune moments, maximizing shareholder value and demonstrating a consistent track record of strategic decision-making.

- Financial Benefits: The financial gains from the WestJet stake sale will significantly bolster Onex's financial position, enabling them to pursue further investment opportunities.

Implications for WestJet and the Airline Industry

The sale of the 25% stake has significant implications for WestJet and the wider Canadian airline industry. While the specifics of the foreign airlines' involvement remain unclear, the transaction could spark a wave of international collaborations and potentially reshape WestJet's competitive landscape.

- Potential Collaborations: The foreign airlines may seek synergistic partnerships with WestJet, potentially leading to enhanced flight networks, improved customer loyalty programs, and shared resources.

- Future Growth: Foreign investment could provide WestJet with the capital and expertise needed to accelerate its expansion plans, both domestically and internationally.

- Long-Term Effects: The long-term impact on airfares and flight routes remains to be seen, but increased competition could potentially benefit consumers through lower fares and expanded options.

Analysis of Foreign Airline Involvement

The motivations behind the foreign airlines' acquisition of the WestJet stake likely include gaining access to the Canadian market, potentially leveraging WestJet's existing infrastructure and brand recognition. This move underscores the growing international interest in the Canadian aviation sector.

- Strategic Alliances: We can expect to see new strategic alliances and code-sharing agreements emerge, benefiting both WestJet and the foreign airlines involved.

- Market Expansion: For the foreign airlines, this investment provides a direct route into the lucrative Canadian market, significantly expanding their global reach.

- Global Landscape: The involvement of these foreign airlines will undoubtedly impact the broader global airline landscape, potentially leading to increased competition and shifting alliances within the industry.

Conclusion: The Future of Onex and WestJet After the Stake Sale

Onex's successful sale of its WestJet stake marks a significant milestone for both companies. The transaction demonstrates Onex's sharp investment acumen and positions WestJet for potential growth and transformation. The long-term implications for both Onex's investment strategy and WestJet's future operations remain to be fully realized, but one thing is certain – the deal has profoundly reshaped the Canadian aviation landscape. Stay informed about the latest developments in Onex's investment strategies and WestJet's future by following our blog for further updates on major transactions in the airline industry, including news on "Onex investment news," "WestJet stock," and other key developments in "airline investment strategies."

Featured Posts

-

Holstein Kiels Relegation Battle A Draw Against Mainz Could Decide Fate

May 11, 2025

Holstein Kiels Relegation Battle A Draw Against Mainz Could Decide Fate

May 11, 2025 -

How To Meet Shane Lowry Tips And Strategies

May 11, 2025

How To Meet Shane Lowry Tips And Strategies

May 11, 2025 -

Barber Motorsports Park Colton Hertas Quest For Qualifying And Race Pace

May 11, 2025

Barber Motorsports Park Colton Hertas Quest For Qualifying And Race Pace

May 11, 2025 -

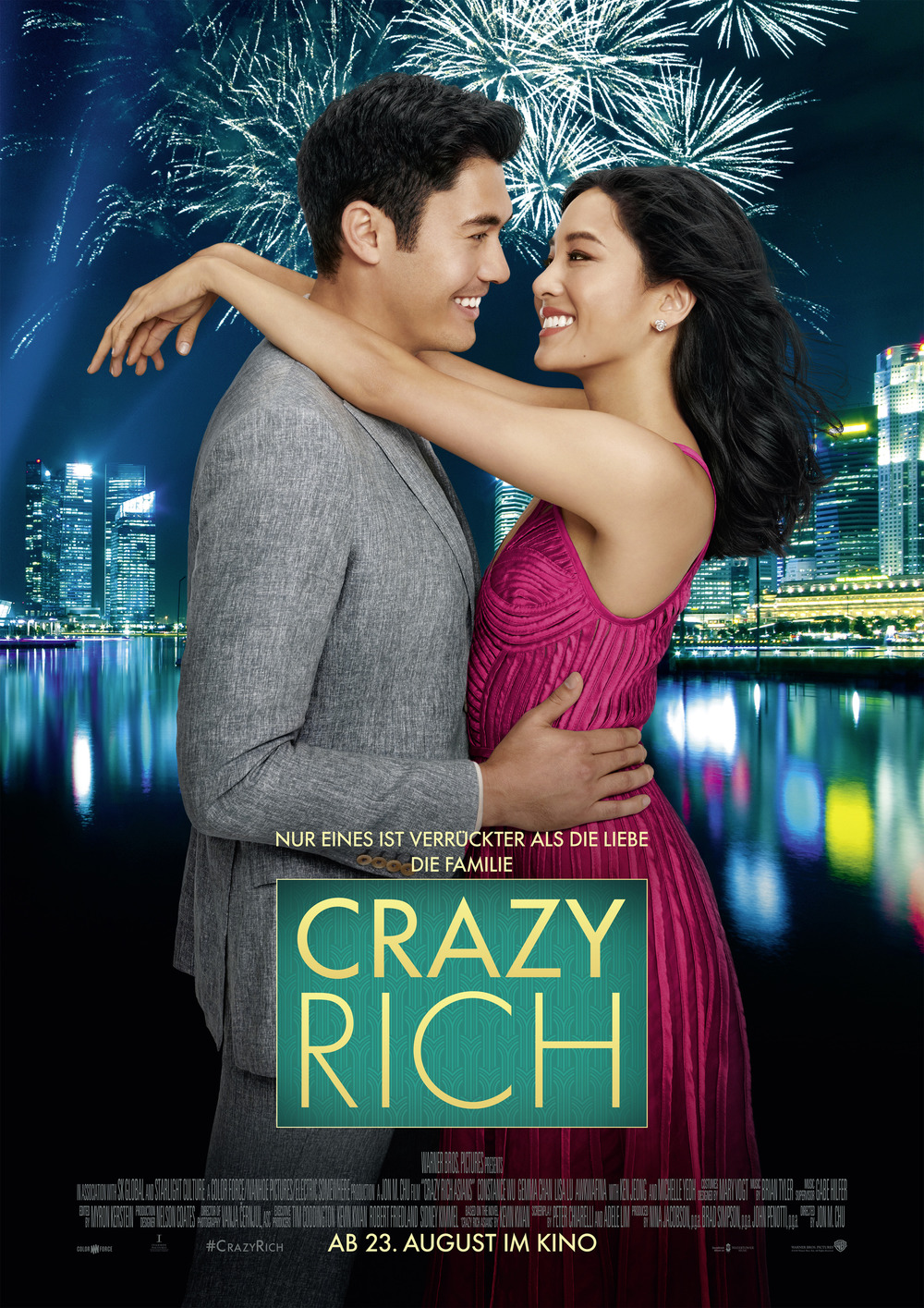

Crazy Rich Asians Adele Lims New Series For Max

May 11, 2025

Crazy Rich Asians Adele Lims New Series For Max

May 11, 2025 -

Indy 500 Field Full Sato Confirms 34th Entry

May 11, 2025

Indy 500 Field Full Sato Confirms 34th Entry

May 11, 2025