Ontario Faces $14.6 Billion Deficit: Analysis Of Tariff Effects

Table of Contents

Facing a staggering $14.6 billion deficit, Ontarians are experiencing the consequences through increased taxes, reduced public services, and a slower economy. This significant budget shortfall isn't solely the result of one factor, but the impact of tariffs plays a substantial, often overlooked role. This article will analyze the significant role tariffs play in contributing to Ontario's substantial budget shortfall, examining the direct and indirect economic consequences and exploring potential solutions. We'll delve into the intricacies of the Ontario deficit, the tariff impact, and the crucial need for effective fiscal policy.

<h2>The Direct Impact of Tariffs on Ontario's Revenue</h2>

Tariffs, essentially taxes on imported goods, directly impact Ontario's revenue streams and the health of its economy. They affect import/export businesses within the province significantly. When tariffs increase, the price of imported goods rises, making them less competitive with domestically produced goods. This can lead to several negative consequences:

- Decreased consumer spending: Higher prices on imported goods reduce consumer purchasing power, leading to a decline in overall spending.

- Reduced profitability for businesses: Businesses reliant on imports for production or exports for sales face reduced profitability due to increased costs or decreased demand. This is particularly true for businesses operating in global supply chains.

- Job losses in tariff-affected sectors: Industries heavily reliant on imports or exports, such as the automotive and manufacturing sectors, experience job losses as businesses struggle to compete.

- Examples of specific industries impacted: The automotive industry, for instance, relies heavily on imported parts. Increased tariffs on these parts directly increase manufacturing costs, impacting profitability and potentially leading to plant closures or reduced production. Similarly, the manufacturing sector, which often relies on imported raw materials, is also vulnerable to the negative effects of tariffs.

The Ontario deficit is exacerbated by this loss of revenue stemming from reduced trade and decreased economic activity directly attributable to tariff implementation.

<h2>Indirect Economic Consequences of Tariffs and the Ontario Deficit</h2>

The negative effects of tariffs extend far beyond the immediate impact on import/export businesses. They create a ripple effect across the broader Ontario economy, leading to a range of indirect economic consequences that further contribute to the budget shortfall.

- Impact on the provincial GDP: Reduced consumer spending and business profitability translate into lower overall economic output, directly affecting Ontario's Gross Domestic Product (GDP).

- Decreased tax revenue: Reduced economic activity means less tax revenue for the provincial government, worsening the already significant deficit. This includes decreased income tax revenue, sales tax revenue, and corporate tax revenue.

- Increased unemployment claims and social welfare spending: Job losses in tariff-affected sectors lead to increased unemployment insurance claims and a higher demand for social welfare programs, placing additional strain on the provincial budget.

- Potential implications for credit rating and borrowing costs: A widening deficit can negatively impact Ontario's credit rating, leading to higher borrowing costs for the government, making it more expensive to finance its operations and potentially further exacerbating the fiscal situation.

These indirect effects highlight the systemic nature of the problem and the interconnectedness of the Ontario economy.

<h2>The Role of Provincial Fiscal Policy in Addressing the Deficit</h2>

The Ontario government is tasked with addressing the significant deficit, and its response relies heavily on fiscal policy measures. These include a range of strategies aimed at either increasing revenue or reducing spending. However, the effectiveness of these strategies is subject to ongoing debate.

- Spending cuts and austerity measures: Governments may choose to reduce spending on public services, infrastructure projects, or social programs to lower the deficit. However, these measures can have negative social and economic consequences.

- Tax increases: The government might raise taxes—income tax, sales tax, or other forms of taxation—to generate additional revenue. This can reduce consumer spending and harm economic growth.

- Investment in specific sectors to stimulate growth: Investing in key sectors of the economy can promote job creation and economic growth, indirectly helping to alleviate the deficit. However, effective targeting of investments is crucial.

- Effectiveness of current strategies: The efficacy of existing fiscal policies in addressing the Ontario deficit and the specific impact of tariff-related losses remain a subject of ongoing analysis and discussion.

<h2>Comparing Ontario's Tariff Impact to Other Provinces/Countries</h2>

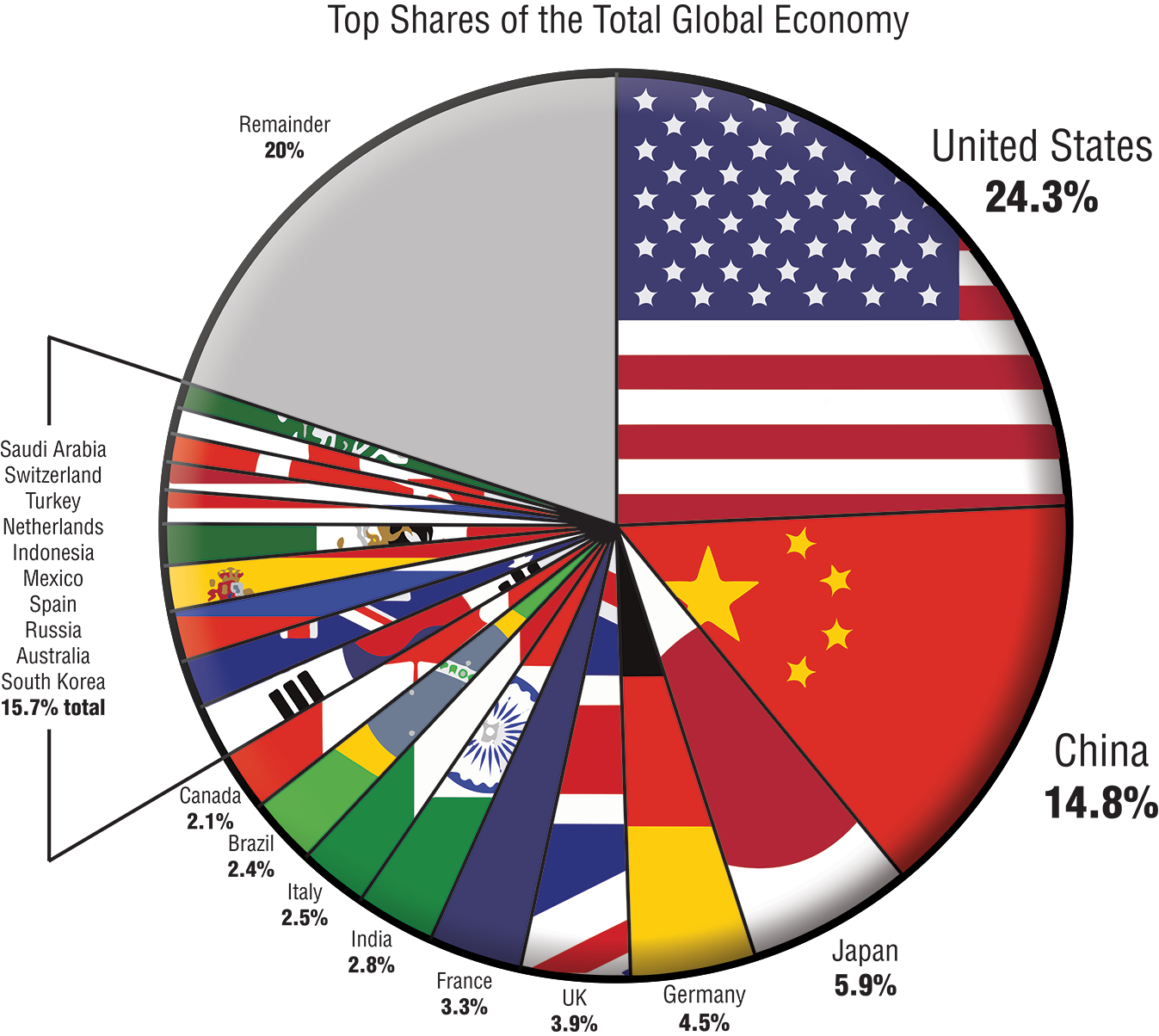

To fully understand the situation in Ontario, it's crucial to compare the impact of tariffs on its economy to other provinces and countries. Different jurisdictions have adopted varying approaches to mitigate the negative effects of tariffs, offering valuable lessons.

- Comparison of tariff rates and their effects in other provinces: Analyzing the tariff rates and their economic effects in other Canadian provinces can reveal relative impacts and potential best practices.

- Examples of successful mitigation strategies in other regions: Examining successful mitigation strategies employed in other regions, both domestically and internationally, can provide valuable insights for Ontario policymakers.

- Lessons learned from international experiences with tariff impacts: International case studies provide a broader context, showing how different countries have responded to similar economic challenges.

<h2>Conclusion: Understanding and Addressing Ontario's Tariff-Related Deficit</h2>

In conclusion, tariffs significantly contribute to Ontario's $14.6 billion deficit. The analysis reveals both direct consequences, such as reduced revenue from trade and job losses, and indirect consequences, including decreased GDP and increased social welfare spending. Understanding the economic impact of tariffs on provincial finances is crucial. Learn more about the impact of tariffs on the Ontario deficit by engaging in the discussion surrounding Ontario’s fiscal policy. Demand responsible solutions to address the Ontario deficit and tariff-related challenges. The future of Ontario's economy depends on developing effective strategies to mitigate the negative impacts of tariffs and implement sound fiscal policies to manage the budget shortfall.

Featured Posts

-

Tvs Jupiter Cng

May 17, 2025

Tvs Jupiter Cng

May 17, 2025 -

Iowa Wrestling Adds D2 National Champion Ben Mc Collum To Coaching Team

May 17, 2025

Iowa Wrestling Adds D2 National Champion Ben Mc Collum To Coaching Team

May 17, 2025 -

Donald Trump And The Presidency Navigating Accusations Of Affairs And Sexual Misconduct

May 17, 2025

Donald Trump And The Presidency Navigating Accusations Of Affairs And Sexual Misconduct

May 17, 2025 -

Is Eminem The Key To A Detroit Wnba Comeback

May 17, 2025

Is Eminem The Key To A Detroit Wnba Comeback

May 17, 2025 -

Find The Best Crypto Casinos In 2025 Compare Bitcoin Casinos With Easy Withdrawals

May 17, 2025

Find The Best Crypto Casinos In 2025 Compare Bitcoin Casinos With Easy Withdrawals

May 17, 2025