Ontario's $14.6 Billion Deficit: Tariff Impacts And Economic Outlook

Table of Contents

The Impact of Tariffs on Ontario's Economy

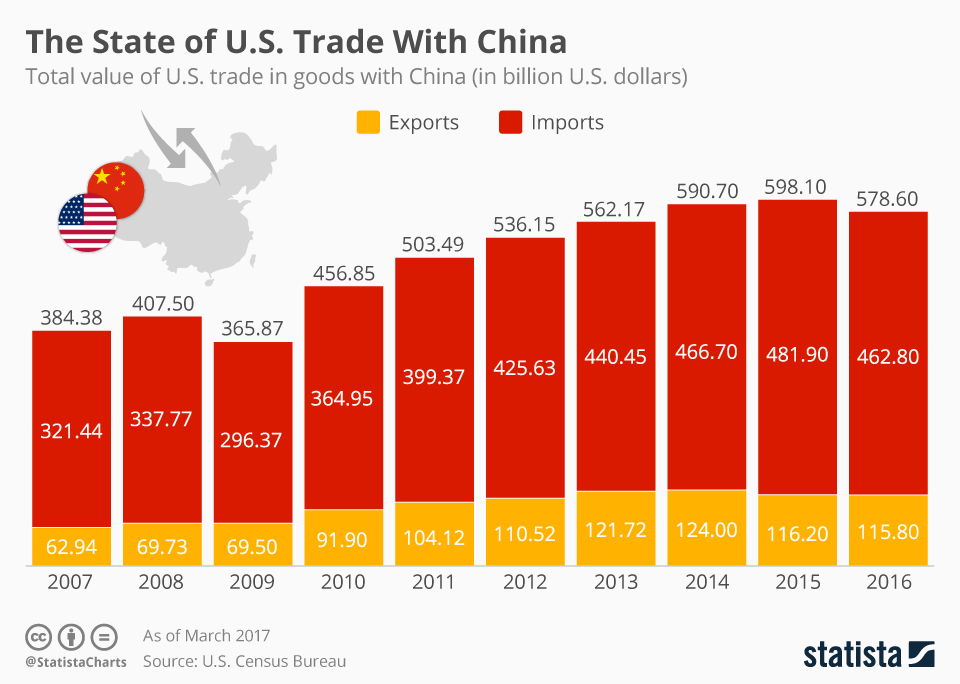

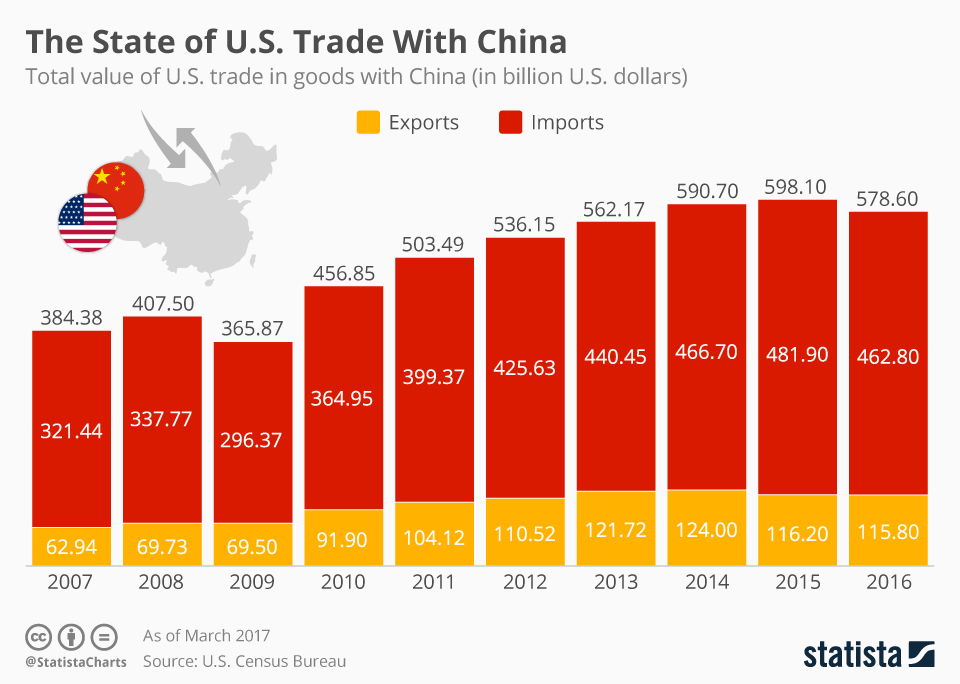

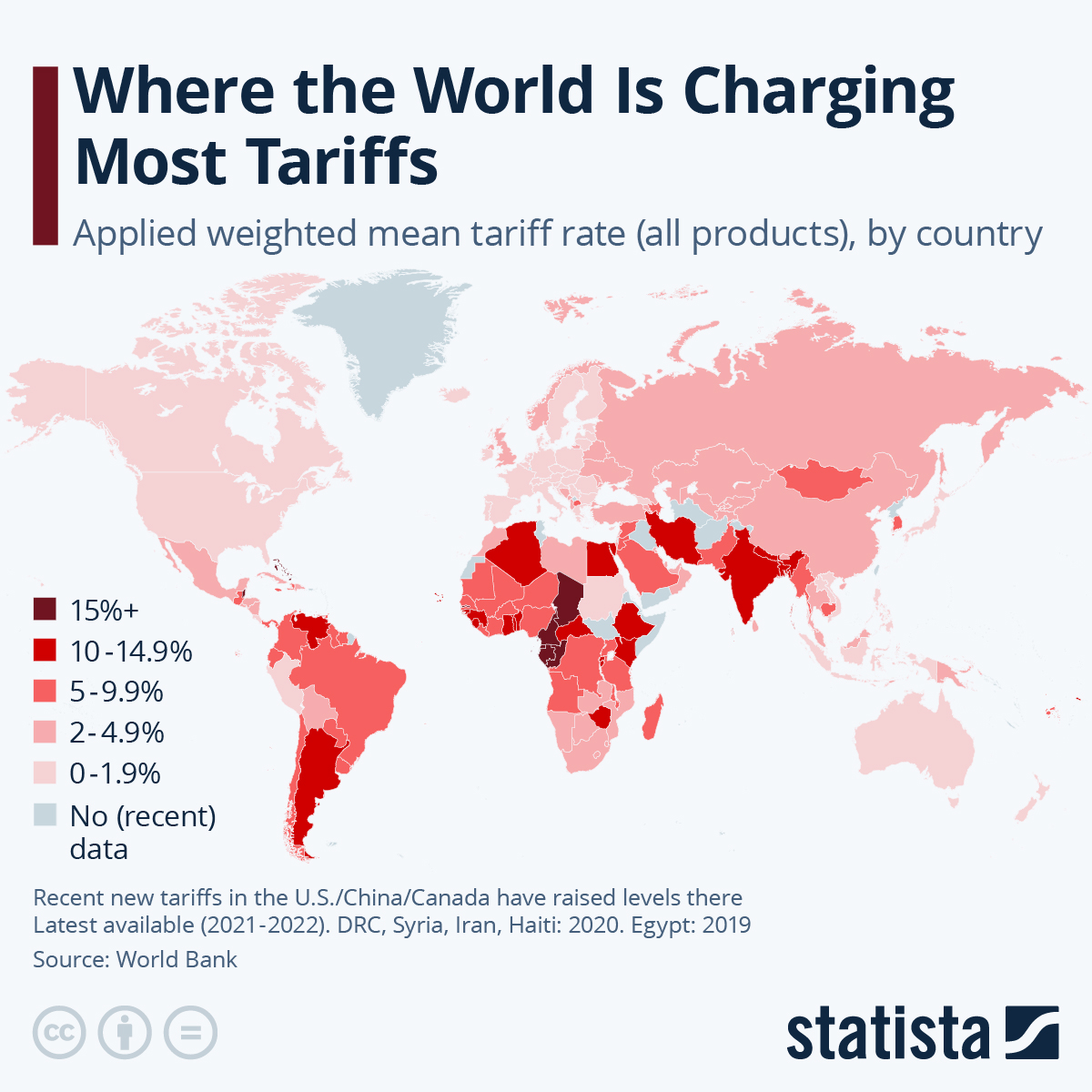

Tariffs, essentially taxes on imported goods, significantly impact Ontario's economy, influencing both import and export prices. Increased tariffs lead to higher import costs for businesses, reducing their competitiveness and potentially squeezing profit margins. Consumers also bear the brunt, facing higher prices for goods and services. This, in turn, can stifle consumer spending and overall economic growth.

Specific sectors in Ontario are disproportionately affected by tariffs. The manufacturing and automotive industries, for example, are particularly vulnerable.

- Steel Tariffs: Increased steel tariffs directly impact manufacturers reliant on steel imports for production, leading to higher production costs and potentially job losses.

- Lumber Tariffs: The construction industry, a significant contributor to Ontario's economy, faces challenges due to lumber tariffs, increasing the cost of building materials and slowing down construction projects.

- Automotive Tariffs: The automotive sector, a cornerstone of the Ontario economy, is highly sensitive to tariffs on parts and finished vehicles, impacting both production and employment.

The ripple effect of these tariff-related price increases is substantial. Higher prices contribute to inflation, eroding purchasing power and reducing consumer confidence. This creates a negative feedback loop, impacting businesses, employment levels, and overall economic growth. The complexities of global trade wars and resulting supply chain disruption further exacerbate these challenges for Ontario businesses struggling with increased import costs and restricted export markets.

Analyzing the $14.6 Billion Deficit: Key Contributing Factors Beyond Tariffs

While tariffs significantly impact the Ontario economy, the $14.6 billion fiscal deficit is a multifaceted problem stemming from various contributing factors.

- Government Spending: Increased government spending on social programs, healthcare, and infrastructure projects, while essential, contributes to the deficit if not balanced by sufficient revenue generation. According to the 2023 Ontario Budget, [cite source here], X% of the deficit is attributable to increased spending in [specific area].

- Reduced Tax Revenue: Economic slowdowns or changes in tax policies can lead to reduced tax revenue, widening the gap between government spending and income. Data from [cite source here] shows a Y% decrease in tax revenue compared to the previous year.

- Economic Slowdown: Periods of economic slowdown, such as the one experienced during the COVID-19 pandemic, naturally reduce tax revenue and increase demand for social support programs, contributing to an increased provincial debt.

The interplay of these factors creates a complex challenge. Understanding the relationship between government spending, tax revenue, and economic growth is crucial for developing effective strategies to address the Ontario budget deficit and improve the overall economic health of the province.

The Economic Outlook for Ontario: Short-Term and Long-Term Projections

The current Ontario deficit, combined with the ongoing impact of tariffs, casts a shadow on the province's short-term and long-term economic outlook.

Short-term forecasts suggest moderate economic growth, but the rate of job creation may be hampered by the ongoing challenges. Consumer confidence remains fragile due to inflationary pressures.

Long-term implications are more uncertain. Sustained tariff pressures and a large fiscal deficit could negatively affect the province's economic stability.

- Scenario 1 (Positive): Effective government policies addressing the deficit and mitigating tariff impacts lead to sustained economic growth, improved job creation, and increased investor confidence.

- Scenario 2 (Negative): Failure to address the deficit and continued tariff pressures could result in slower economic growth, higher unemployment, and reduced investor confidence, potentially leading to a credit downgrade.

These scenarios highlight the importance of proactive and strategic policy responses to ensure the long-term fiscal sustainability of Ontario.

Potential Mitigation Strategies and Policy Recommendations

Addressing the Ontario deficit and mitigating the impact of tariffs requires a multi-pronged approach involving strategic government intervention.

- Fiscal Responsibility Measures: Implementing measures to control government spending while ensuring essential social programs are maintained.

- Investment in Key Sectors: Strategic investments in sectors with high growth potential, creating jobs and stimulating economic activity.

- Trade Diversification Strategies: Reducing reliance on specific trade partners by diversifying export markets and developing new trade relationships.

- Negotiating Better Trade Agreements: Actively pursuing and negotiating favorable trade agreements to reduce tariff barriers and improve access to international markets.

The effectiveness of these strategies hinges on their careful implementation and consideration of potential economic consequences. A well-coordinated approach incorporating economic stimulus measures targeted at specific sectors could significantly contribute to GDP growth and boost the job market.

Conclusion: Understanding and Addressing Ontario's $14.6 Billion Deficit

Ontario's $14.6 billion deficit is a significant concern, driven by a complex interplay of factors. Tariffs play a crucial role, impacting businesses and consumers across several key sectors. Other contributing factors include government spending, reduced tax revenue, and economic slowdowns. The long-term consequences could be severe if left unaddressed. Proactive policy responses, including fiscal responsibility, strategic investments, and trade diversification, are essential to mitigate the negative impacts and secure a sustainable economic future for Ontario.

To effectively address the Ontario deficit, we need informed public discourse and advocacy for policies that promote fiscal policy reform, stimulate economic growth, and ensure the long-term wellbeing of the province. We encourage readers to stay informed about the ongoing situation, engage in public discussions, and advocate for policies that address Ontario’s economic challenges effectively and sustainably. Further research into Ontario's economic policy and Canada's trade relations is recommended for a deeper understanding of this critical issue.

Featured Posts

-

Canada Us Trade Update Near Elimination Of Tariffs And Impact On Specific Industries

May 17, 2025

Canada Us Trade Update Near Elimination Of Tariffs And Impact On Specific Industries

May 17, 2025 -

Reta Nba Teisejo Klaida Lemia Pistons Ir Knicks Pralaimejima

May 17, 2025

Reta Nba Teisejo Klaida Lemia Pistons Ir Knicks Pralaimejima

May 17, 2025 -

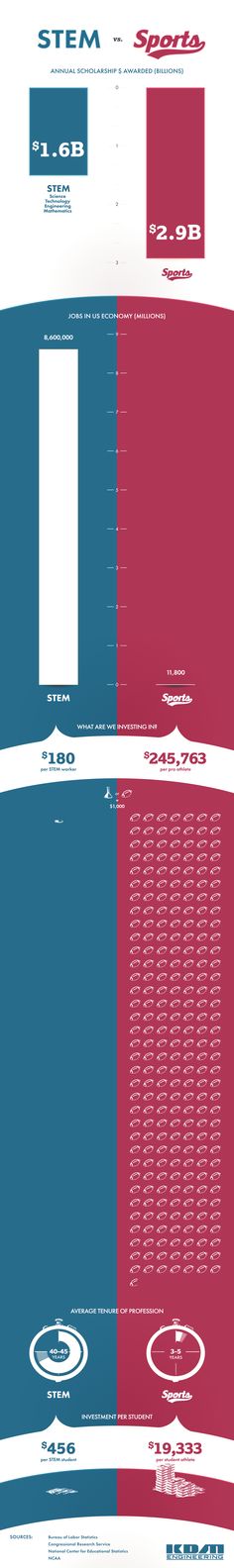

How Local Students Can Win Stem Scholarships

May 17, 2025

How Local Students Can Win Stem Scholarships

May 17, 2025 -

Trumps Student Loan Plan The Black Communitys Response

May 17, 2025

Trumps Student Loan Plan The Black Communitys Response

May 17, 2025 -

Chrisean Rock Interview Angel Reese Addresses Public Criticism

May 17, 2025

Chrisean Rock Interview Angel Reese Addresses Public Criticism

May 17, 2025

Latest Posts

-

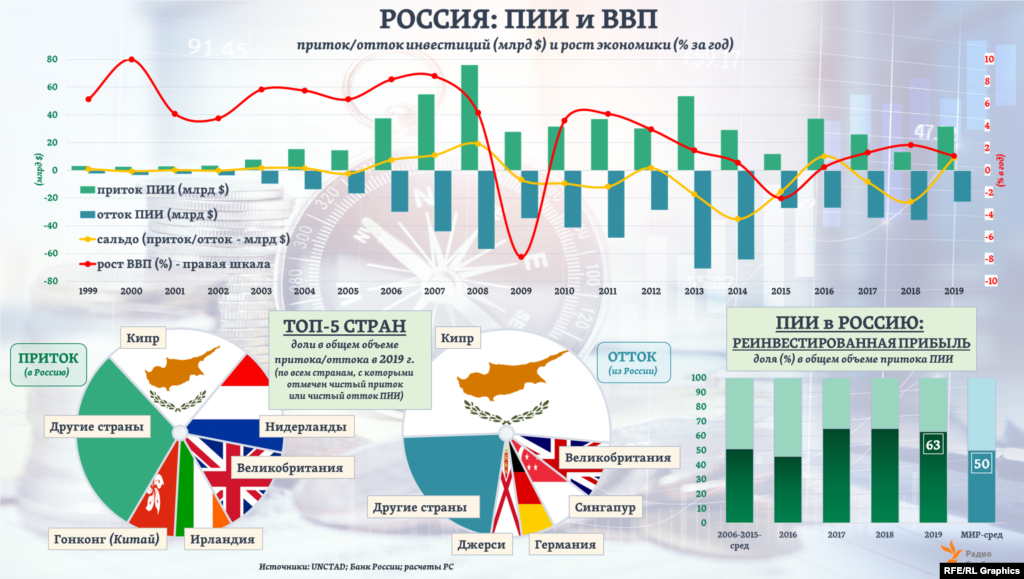

Rossiya V Troyke Veduschikh Investorov Uzbekistana

May 17, 2025

Rossiya V Troyke Veduschikh Investorov Uzbekistana

May 17, 2025 -

Investigacion Del Esquema Ponzi De Koriun Inversiones Como Funciono

May 17, 2025

Investigacion Del Esquema Ponzi De Koriun Inversiones Como Funciono

May 17, 2025 -

Uzbekistan Rossiya Sredi Krupneyshikh Inostrannykh Investorov

May 17, 2025

Uzbekistan Rossiya Sredi Krupneyshikh Inostrannykh Investorov

May 17, 2025 -

Entendiendo El Esquema Ponzi De Koriun Inversiones Victimas Y Consecuencias

May 17, 2025

Entendiendo El Esquema Ponzi De Koriun Inversiones Victimas Y Consecuencias

May 17, 2025 -

Investitsii Rossii V Uzbekistane Strana Voshla V Troyku Liderov

May 17, 2025

Investitsii Rossii V Uzbekistane Strana Voshla V Troyku Liderov

May 17, 2025