Options Trading Strategies: Capitalizing On The AUD/NZD Exchange Rate Differential

Table of Contents

Understanding the AUD/NZD Exchange Rate Dynamics

The AUD/NZD exchange rate, like any currency pair, is influenced by a complex interplay of economic and political factors. Understanding these dynamics is crucial for successful options trading.

Factors Influencing AUD/NZD Volatility:

Several key factors contribute to the volatility of the AUD/NZD exchange rate:

- Interest Rate Differentials: Differences in interest rates between Australia and New Zealand significantly impact the pair. Higher interest rates in one country attract foreign investment, increasing demand for its currency.

- Economic Data Releases: Key economic indicators like GDP growth, inflation rates, employment figures, and consumer confidence from both countries directly influence the AUD/NZD. Strong economic data typically boosts the currency of the respective country.

- Commodity Prices: Australia is a major exporter of commodities like gold and agricultural products. Fluctuations in global commodity prices directly affect the Australian dollar and, consequently, the AUD/NZD.

- Political Stability: Political uncertainty or instability in either Australia or New Zealand can negatively impact investor confidence and lead to currency fluctuations.

- Global Economic Events: Major global events like recessions, geopolitical tensions, and changes in global trade policies can create volatility across all currency pairs, including the AUD/NZD.

Understanding how these factors interact and their potential impact on the AUD/NZD is vital for developing effective options trading strategies.

Analyzing Charts and Identifying Trading Opportunities:

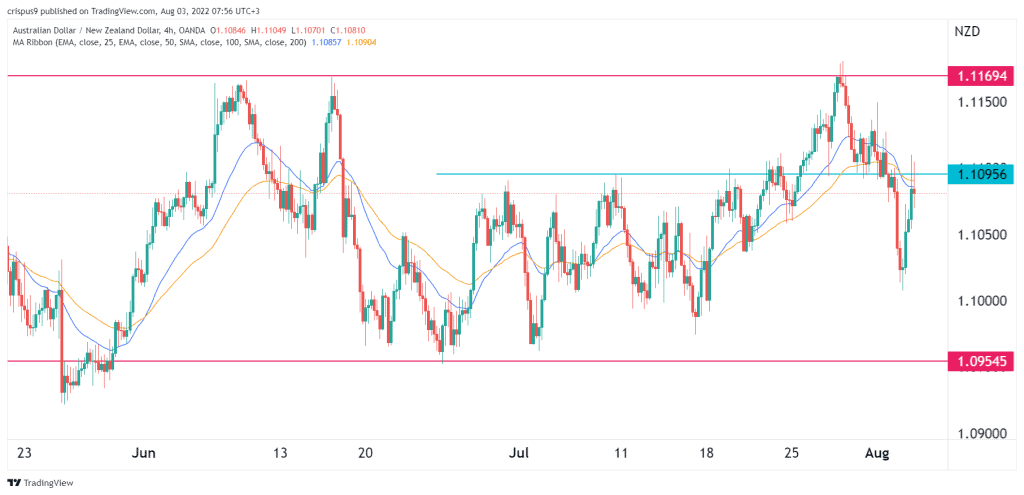

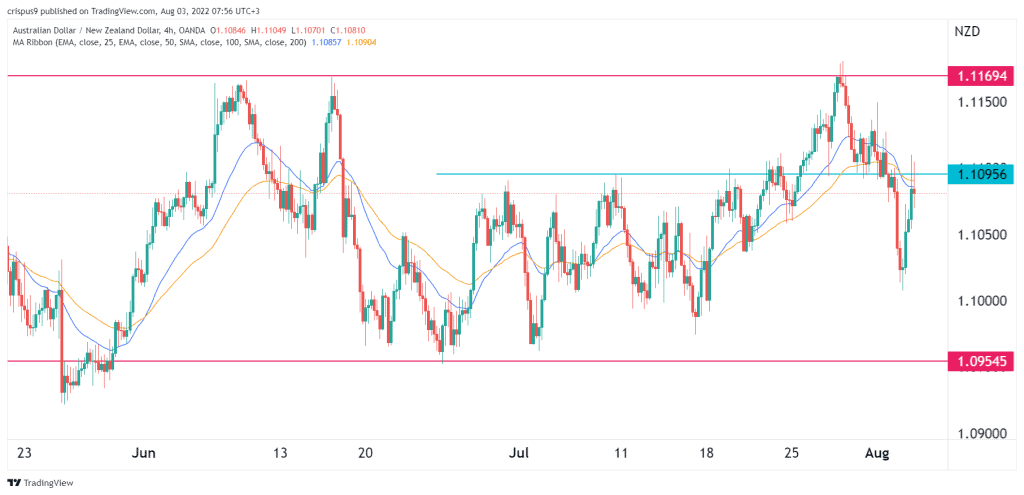

Technical analysis is a crucial tool for identifying potential trading opportunities in the AUD/NZD forex market. By studying price charts and employing various indicators, traders can predict future price movements and strategically position themselves for profit.

- Technical Analysis Indicators: Tools such as moving averages (e.g., 50-day, 200-day), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can help identify trends, momentum shifts, and potential overbought or oversold conditions.

- Chart Patterns: Recognizing chart patterns like head and shoulders, triangles, and double tops/bottoms can provide insights into potential price reversals or continuations.

- Support and Resistance Levels: Identifying these levels, which represent areas where price has historically struggled to break through, can help traders determine potential entry and exit points for their options trades.

Remember, risk management is paramount. Never invest more than you can afford to lose, and always use stop-loss orders to limit potential losses.

Popular Options Strategies for the AUD/NZD Pair

Several options strategies can be effectively employed to capitalize on AUD/NZD price movements. The choice of strategy depends heavily on your market outlook and risk tolerance.

Long Straddles and Strangles:

- Definition: A long straddle involves simultaneously buying a call and a put option with the same strike price and expiration date. A long strangle is similar, but uses different strike prices (one above and one below the current market price).

- Risk-Reward Profile: High risk, high reward. Profits are maximized in highly volatile markets where the price moves significantly in either direction.

- Suitable Market Conditions: High implied volatility is key for success.

- Example Trade Setup: Buy one AUD/NZD call option and one AUD/NZD put option with the same expiration date.

Bullish and Bearish Spreads:

- Definition: Bullish spreads profit from upward price movements, while bearish spreads profit from downward movements. These involve buying one option and selling another with a different strike price.

- Risk-Reward Profile: Lower risk than straddles/strangles, but also lower potential profit.

- Suitable Market Conditions: Directional bias is needed. Bullish spreads are suitable when expecting price to rise; bearish spreads, when expecting it to fall.

- Example Trade Setup (Bullish): Buy one AUD/NZD call option at a lower strike price and sell one at a higher strike price with the same expiration date.

Covered Calls and Protective Puts:

- Definition: A covered call involves selling a call option on an underlying asset you already own. A protective put involves buying a put option to protect against potential losses on an existing position.

- Risk-Reward Profile: Limited risk, limited reward. These strategies are primarily used for hedging.

- Suitable Market Conditions: Neutral to slightly bullish (covered calls) or bearish (protective puts).

- Example Trade Setup (Covered Call): If you own AUD/NZD, sell a call option with a strike price above the current market price.

Risk Management and Money Management in AUD/NZD Options Trading

Successful options trading requires a disciplined approach to risk and money management.

Defining Your Risk Tolerance:

- Importance of Stop-Loss Orders: Always use stop-loss orders to limit potential losses on your trades.

- Position Sizing: Never risk more than a small percentage of your trading capital on any single trade.

- Diversification: Diversify your portfolio across multiple trades and asset classes to reduce overall risk.

Understanding your risk tolerance and implementing appropriate risk management strategies are critical for long-term success.

Monitoring and Adjusting Your Positions:

- Regular Monitoring: Regularly monitor your open positions and the market conditions.

- Adapting Strategies: Be prepared to adjust your strategies based on changes in market conditions.

- Cutting Losses Early: Don't be afraid to cut your losses early if a trade is not going as planned.

Conclusion

Capitalizing on the AUD/NZD exchange rate differential through options trading requires a well-rounded understanding of market dynamics, a strategic approach to selecting options strategies, and disciplined risk management. We’ve explored several popular options trading strategies, including long straddles/strangles, bullish/bearish spreads, and covered calls/protective puts. Remember, technical analysis, choosing the right strategy based on market conditions, and consistent risk management are crucial for success.

Key Takeaways:

- Mastering technical analysis is essential for identifying trading opportunities.

- Select options strategies appropriate for your market outlook and risk tolerance.

- Implement strict risk management practices to protect your capital.

Ready to leverage the potential of the AUD/NZD market? Start refining your options trading strategies today. Explore further resources on AUD/NZD options trading and begin building your profitable trading plan.

Featured Posts

-

Hollywood Strike Impacts Understanding The Actors And Writers Walkout

May 06, 2025

Hollywood Strike Impacts Understanding The Actors And Writers Walkout

May 06, 2025 -

Analyzing The Musical Collaboration Leon Thomas And Halle Baileys Rather Be Alone

May 06, 2025

Analyzing The Musical Collaboration Leon Thomas And Halle Baileys Rather Be Alone

May 06, 2025 -

Sabrina Carpenter In Fortnite Release Date Speculation

May 06, 2025

Sabrina Carpenter In Fortnite Release Date Speculation

May 06, 2025 -

Thlyl Ndae Alhjylan Mn Ajl Ymn Bla Dmae

May 06, 2025

Thlyl Ndae Alhjylan Mn Ajl Ymn Bla Dmae

May 06, 2025 -

Mindy Kalings Shows A Deep Dive Into Fascinating Female Characters

May 06, 2025

Mindy Kalings Shows A Deep Dive Into Fascinating Female Characters

May 06, 2025