Palantir Alternatives: 2 Stock Predictions For Superior Returns (3-Year Outlook)

Table of Contents

Investing in the technology sector can be lucrative, but it also carries significant risk. Palantir, while a prominent player in big data analytics and government contracting, presents a high valuation and considerable dependence on a specific client base. This creates a degree of uncertainty for investors. This article will explore compelling Palantir alternatives, focusing on two promising companies with superior return potential over the next three years: Snowflake (SNOW) and Datadog (DDOG). We'll analyze their market positions, growth trajectories, and financial strength to assess their viability as robust investment options.

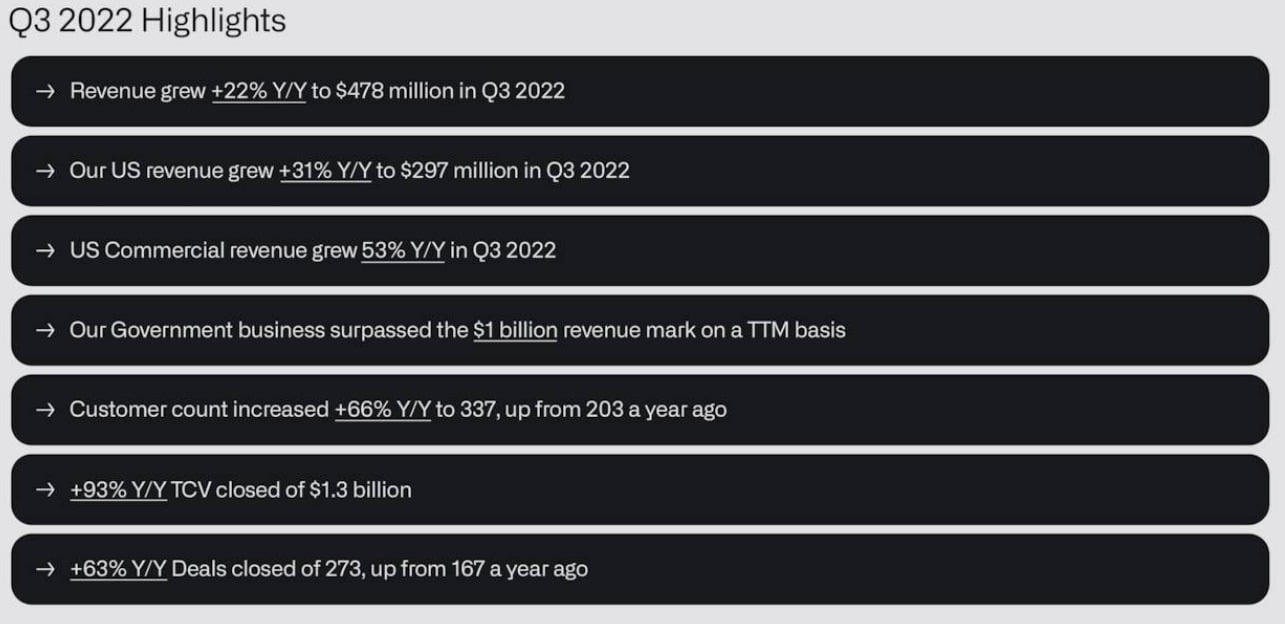

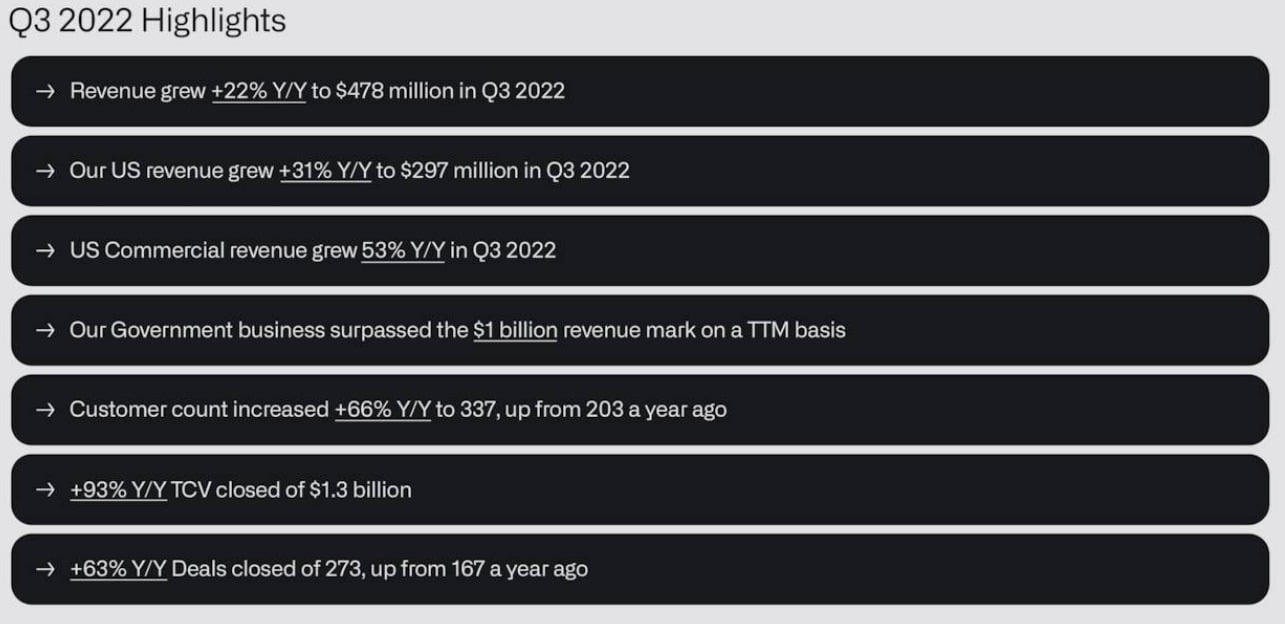

Main Point 1: Analyzing Company A – A Deep Dive into Snowflake & its Growth Potential

H2: Snowflake: A Robust Alternative to Palantir's Big Data Analytics

Snowflake is a cloud-based data warehousing and analytics company offering a unique service model that separates compute and storage. This innovative approach provides scalability and cost efficiency, a key differentiator from traditional data warehousing solutions and even Palantir's offerings. Snowflake's core business focuses on providing a platform for organizations to store, process, and analyze massive datasets.

H3: Competitive Advantages of Snowflake:

- Superior Scalability and Performance: Snowflake's cloud-based architecture allows for virtually unlimited scalability, enabling businesses to handle rapidly growing data volumes with ease. This contrasts with Palantir's on-premise solutions, which can be less adaptable to scaling needs.

- Ease of Use and Integration: Snowflake boasts a user-friendly interface and robust integration capabilities, making it accessible to a wider range of users and systems. This broadens its market reach significantly.

- Strong Market Position: Snowflake holds a leading position in the cloud data warehouse market, experiencing rapid customer acquisition and significant revenue growth. Its strong partnerships further expand its market reach.

- Data Sharing Capabilities: Snowflake's secure data sharing features enable organizations to collaborate on data analysis seamlessly, enhancing collaboration and decision-making capabilities.

H3: 3-Year Growth Prediction for Snowflake:

Based on Snowflake's current growth trajectory, its strong market position, and the increasing demand for cloud-based data analytics solutions, we predict a Compound Annual Growth Rate (CAGR) of 30-35% over the next three years. This prediction is supported by industry analysts' reports indicating continued high demand for cloud-based data platforms. However, potential risks include increased competition and the potential for economic slowdown affecting customer spending.

[Insert a chart or graph visualizing the predicted growth here]

Main Point 2: Exploring Company B – Datadog's Strategic Positioning for Long-Term Returns

H2: Datadog: A Diversified Approach to Data-Driven Solutions

Datadog offers a comprehensive monitoring and analytics platform for cloud-scale applications. Unlike Palantir's focus on highly specialized government and enterprise solutions, Datadog caters to a broader market of businesses leveraging cloud infrastructure. Its business model centers around providing real-time monitoring, analytics, and security for various cloud services and applications.

H3: Market Differentiation and Investment Highlights for Datadog:

- Comprehensive Monitoring Capabilities: Datadog provides a unified platform for monitoring various aspects of cloud infrastructure, applications, and security, offering a single pane of glass view for IT teams.

- Strong Customer Base: Datadog boasts a large and growing customer base across diverse industries, indicating strong market acceptance and adaptability.

- Innovative Technology: Datadog's platform incorporates advanced machine learning and AI capabilities for enhanced insights and proactive alerts, giving it an edge over competitors.

- Strategic Partnerships: Datadog collaborates with major cloud providers and technology partners to ensure seamless integration and expand its reach.

H3: 3-Year Return Outlook for Datadog:

Datadog's diversified approach, strong customer acquisition, and consistent innovation position it for strong growth. We predict a CAGR of 25-30% over the next three years, driven by the expanding market for cloud monitoring and analytics. Potential challenges include competition from established players and the ongoing evolution of cloud technologies.

[Insert a chart or graph visualizing the predicted growth here]

Conclusion: Investing Smartly in Palantir Alternatives for Enhanced Returns

Snowflake and Datadog represent compelling Palantir alternatives, offering significant growth potential and diversification benefits for investors. Snowflake's leading position in the cloud data warehouse market and Datadog's comprehensive monitoring platform provide strong foundations for future success. Our predictions suggest a strong potential for superior returns compared to a concentrated investment in Palantir. Remember, these are predictions based on current market analysis and may not accurately reflect future performance. Before making any investment decisions, conduct thorough due diligence, analyze individual risk tolerance, and consider consulting a financial advisor. Consider diversifying your portfolio with promising Palantir alternatives like Snowflake and Datadog for potentially higher returns in the next three years.

Featured Posts

-

Social Media Censorship X Silences Turkish Mayor Amidst Political Protests

May 09, 2025

Social Media Censorship X Silences Turkish Mayor Amidst Political Protests

May 09, 2025 -

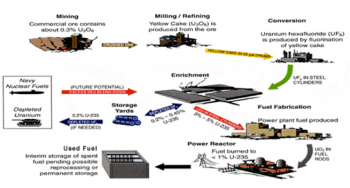

Nuclear Energy Cooperation A French Ministers Proposal For Europe

May 09, 2025

Nuclear Energy Cooperation A French Ministers Proposal For Europe

May 09, 2025 -

Montoya Reveals Predetermined Decision On Doohans F1 Career

May 09, 2025

Montoya Reveals Predetermined Decision On Doohans F1 Career

May 09, 2025 -

Ukraine War Putin Declares Ceasefire For Victory Day

May 09, 2025

Ukraine War Putin Declares Ceasefire For Victory Day

May 09, 2025 -

Edmonton Oilers Favored Betting Odds For Kings Series

May 09, 2025

Edmonton Oilers Favored Betting Odds For Kings Series

May 09, 2025